Answered step by step

Verified Expert Solution

Question

1 Approved Answer

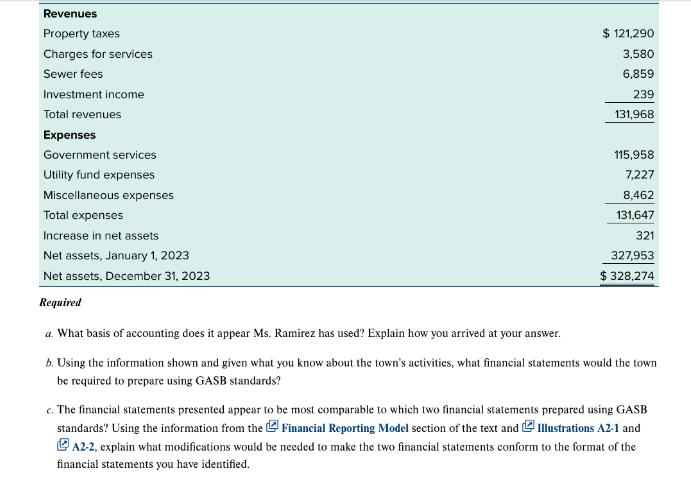

Revenues Property taxes Charges for services Sewer fees Investment income Total revenues Expenses Government services Utility fund expenses Miscellaneous expenses Total expenses Increase in

Revenues Property taxes Charges for services Sewer fees Investment income Total revenues Expenses Government services Utility fund expenses Miscellaneous expenses Total expenses Increase in net assets Net assets, January 1, 2023 Net assets, December 31, 2023 Required a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer. $ 121,290 3,580 6,859 239 131,968 115,958 7,227 8,462 131,647 321 327,953 $ 328,274 b. Using the information shown and given what you know about the town's activities, what financial statements would the town be required to prepare using GASB standards? c. The financial statements presented appear to be most comparable to which two financial statements prepared using GASB standards? Using the information from the Financial Reporting Model section of the text and Illustrations A2-1 and A2-2, explain what modifications would be needed to make the two financial statements conform to the format of the financial statements you have identified.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started