Answered step by step

Verified Expert Solution

Question

1 Approved Answer

G On January 15, KCI paid $700 for employee salaries for work performed in January. H On January 20, KCI sold $3000 of inventory

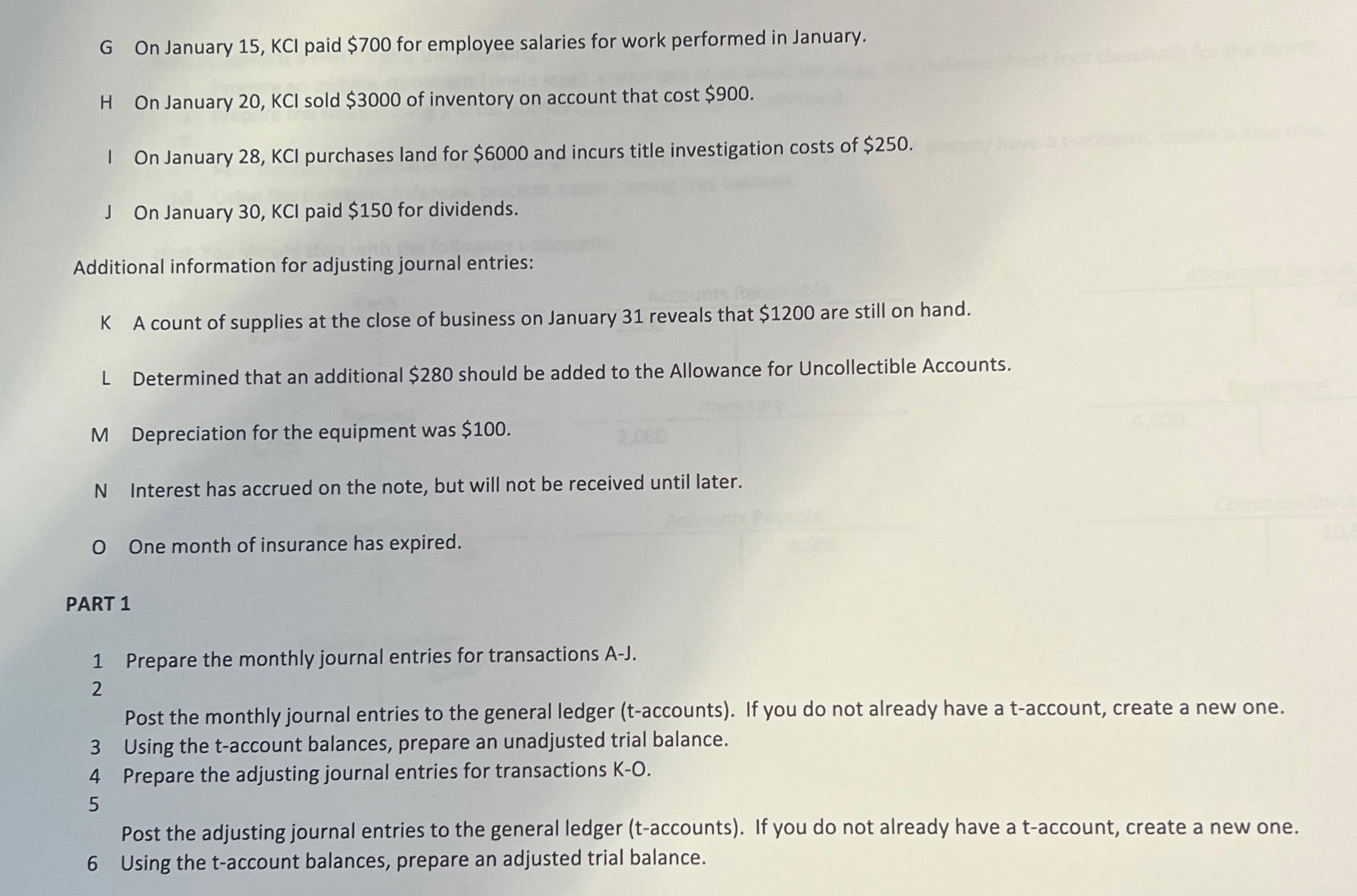

G On January 15, KCI paid $700 for employee salaries for work performed in January. H On January 20, KCI sold $3000 of inventory on account that cost $900. | On January 28, KCI purchases land for $6000 and incurs title investigation costs of $250. J On January 30, KCI paid $150 for dividends. Additional information for adjusting journal entries: K A count of supplies at the close of business on January 31 reveals that $1200 are still on hand. L Determined that an additional $280 should be added to the Allowance for Uncollectible Accounts. M Depreciation for the equipment was $100. N Interest has accrued on the note, but will not be received until later. O One month of insurance has expired. PART 1 1 Prepare the monthly journal entries for transactions A-J. 2 Post the monthly journal entries to the general ledger (t-accounts). If you do not already have a t-account, create a new one. 3 Using the t-account balances, prepare an unadjusted trial balance. 4 Prepare the adjusting journal entries for transactions K-O. 5 Post the adjusting journal entries to the general ledger (t-accounts). If you do not already have a t-account, create a new one. 6 Using the t-account balances, prepare an adjusted trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started