Answered step by step

Verified Expert Solution

Question

1 Approved Answer

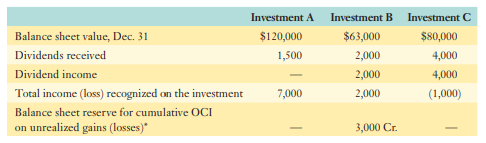

Reversiflex Inc. purchased three equity investments during the year ended December 31, 2012. Required: a. Based on the available information, how did Reversiflex classify each

Reversiflex Inc. purchased three equity investments during the year ended December 31, 2012.

Required:

a. Based on the available information, how did Reversiflex classify each financial asset?

b. Determine the cost of each of the three investments. If it is not possible to do so with the available information, indicate what additional information would be needed.

Investment A $120,000 1,500 Balance sheet value, Dec. 31 Dividends received Dividend income Total income (loss) recognized on the investment Balance sheet reserve for cumulative OCI on unrealized gains (losses)* Investment B $63,000 2,000 2,000 2,000 Investment C $80,000 4,000 4,000 (1,000) 7,000 3,000 Cr. Investment A $120,000 1,500 Balance sheet value, Dec. 31 Dividends received Dividend income Total income (loss) recognized on the investment Balance sheet reserve for cumulative OCI on unrealized gains (losses)* Investment B $63,000 2,000 2,000 2,000 Investment C $80,000 4,000 4,000 (1,000) 7,000 3,000 CrStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started