Question

Review: Amalga Corp. opened for business in November 2020. During November, Amalga purchased 200 items of inventory for $2.00 each ($400 total cost). During

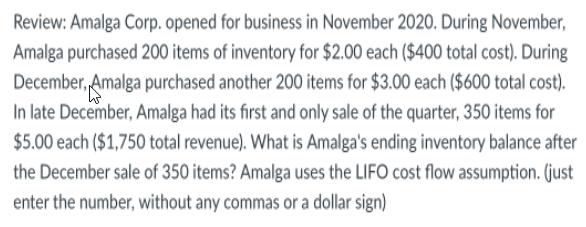

Review: Amalga Corp. opened for business in November 2020. During November, Amalga purchased 200 items of inventory for $2.00 each ($400 total cost). During December, Amalga purchased another 200 items for $3.00 each ($600 total cost). In late December, Amalga had its first and only sale of the quarter, 350 items for $5.00 each ($1,750 total revenue). What is Amalga's ending inventory balance after the December sale of 350 items? Amalga uses the LIFO cost flow assumption. (just enter the number, without any commas or a dollar sign)

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

novemebr purchased 200 items 2 december purchased ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App