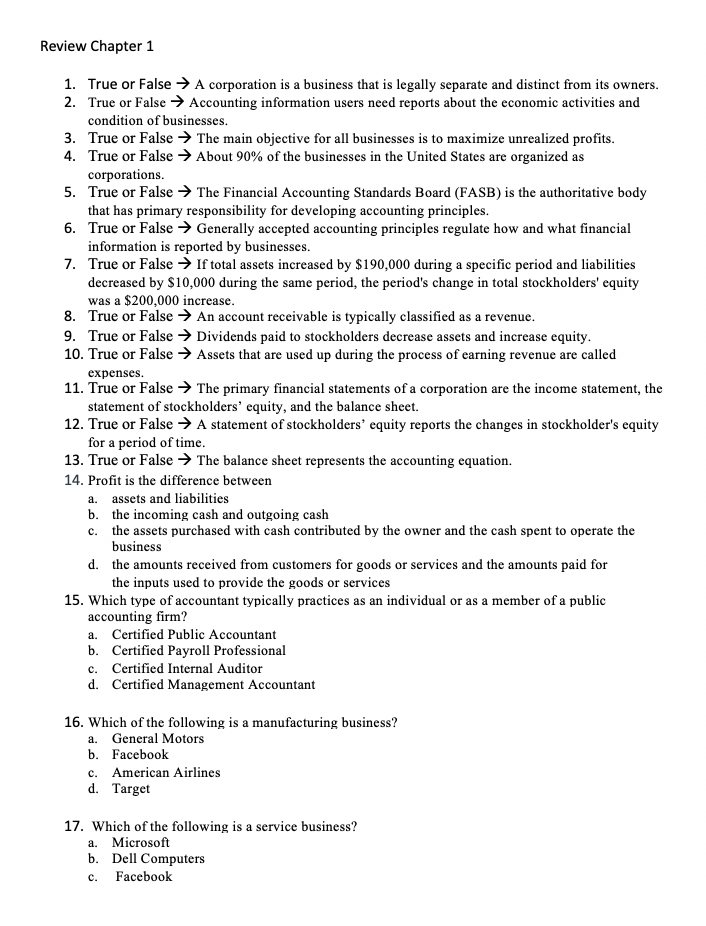

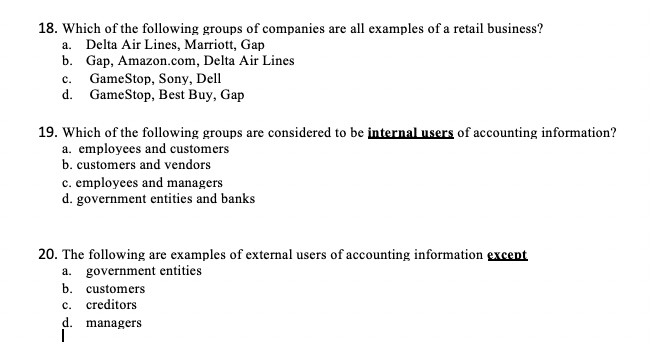

Review Chapter 1 1. True or False A corporation is a business that is legally separate and distinct from its owners. 2. True or False Accounting information users need reports about the economic activities and condition of businesses. 3. True or False The main objective for all businesses is to maximize unrealized profits. 4. True or False About 90% of the businesses in the United States are organized as corporations. 5. True or False The Financial Accounting Standards Board (FASB) is the authoritative body that has primary responsibility for developing accounting principles. 6. True or False Generally accepted accounting principles regulate how and what financial information is reported by businesses. 7. True or False If total assets increased by $190,000 during a specific period and liabilities decreased by $10,000 during the same period, the period's change in total stockholders' equity was a $200,000 increase. 8. True or False An account receivable is typically classified as a revenue. 9. True or False Dividends paid to stockholders decrease assets and increase equity. 10. True or False Assets that are used up during the process of earning revenue are called expenses. 11. True or False The primary financial statements of a corporation are the income statement, the statement of stockholders' equity, and the balance sheet. 12. True or False A statement of stockholders' equity reports the changes in stockholder's equity for a period of time. 13. True or False The balance sheet represents the accounting equation. 14. Profit is the difference between a. assets and liabilities b. the incoming cash and outgoing cash c. the assets purchased with cash contributed by the owner and the cash spent to operate the business d. the amounts received from customers for goods or services and the amounts paid for the inputs used to provide the goods or services 15. Which type of accountant typically practices as an individual or as a member of a public accounting firm? a. Certified Public Accountant b. Certified Payroll Professional c. Certified Internal Auditor d. Certified Management Accountant 16. Which of the following is a manufacturing business? a. General Motors b. Facebook c. American Airlines d. Target 17. Which of the following is a service business? a. Microsoft b. Dell Computers Facebook c. a. 18. Which of the following groups of companies are all examples of a retail business? Delta Air Lines, Marriott, Gap b. Gap, Amazon.com, Delta Air Lines GameStop, Sony, Dell d. GameStop, Best Buy, Gap c. 19. Which of the following groups are considered to be internal users of accounting information? a. employees and customers b. customers and vendors c. employees and managers d. government entities and banks 20. The following are examples of external users of accounting information excent a. government entities b. customers creditors d. managers c