Answered step by step

Verified Expert Solution

Question

1 Approved Answer

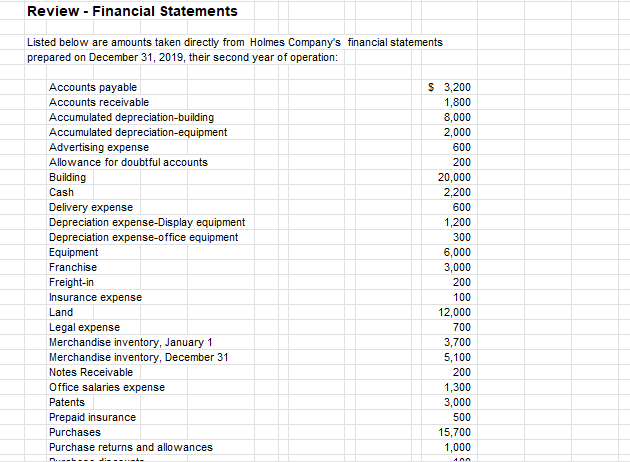

Review - Financial Statements Listed below are amounts taken directly from Holmes Company's financial statements prepared on December 31, 2019, their second year of

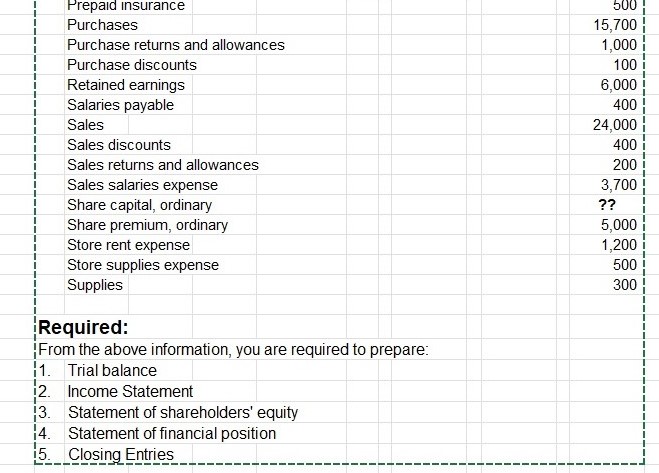

Review - Financial Statements Listed below are amounts taken directly from Holmes Company's financial statements prepared on December 31, 2019, their second year of operation: Accounts payable Accounts receivable Accumulated depreciation-building Accumulated depreciation-equipment Advertising expense Allowance for doubtful accounts Building Cash Delivery expense Depreciation expense-Display equipment Depreciation expense-office equipment Equipment Franchise Freight-in Insurance expense Land Legal expense Merchandise inventory, January 1 Merchandise inventory, December 31 Notes Receivable Office salaries expense Patents Prepaid insurance Purchases Purchase returns and allowances $ 3,200 1,800 8,000 2,000 600 200 20,000 2,200 600 1,200 300 6,000 3,000 200 100 12,000 700 3,700 5,100 200 1,300 3,000 500 15,700 1,000 Prepaid insurance Purchases Purchase returns and allowances Purchase discounts Retained earnings Salaries payable Sales Sales discounts Sales returns and allowances Sales salaries expense Share capital, ordinary Share premium, ordinary Store rent expense Store supplies expense Supplies Required: From the above information, you are required to prepare: 1. Trial balance 2. Income Statement 3. Statement of shareholders' equity 4. Statement of financial position 5. Closing Entries 500 15,700 1,000 100 6,000 400 24,000 400 200 3,700 ?? 5,000 1,200 500 300 I T I L I I

Step by Step Solution

★★★★★

3.23 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Trial Balance Account Debit Credit Cash 2200 Accounts Receivable 1800 Accumulated Depreciation Building 8000 Accumulated Depreciation Equipment 2000 Advertising Expense 600 Allowance for Doubtful Ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started