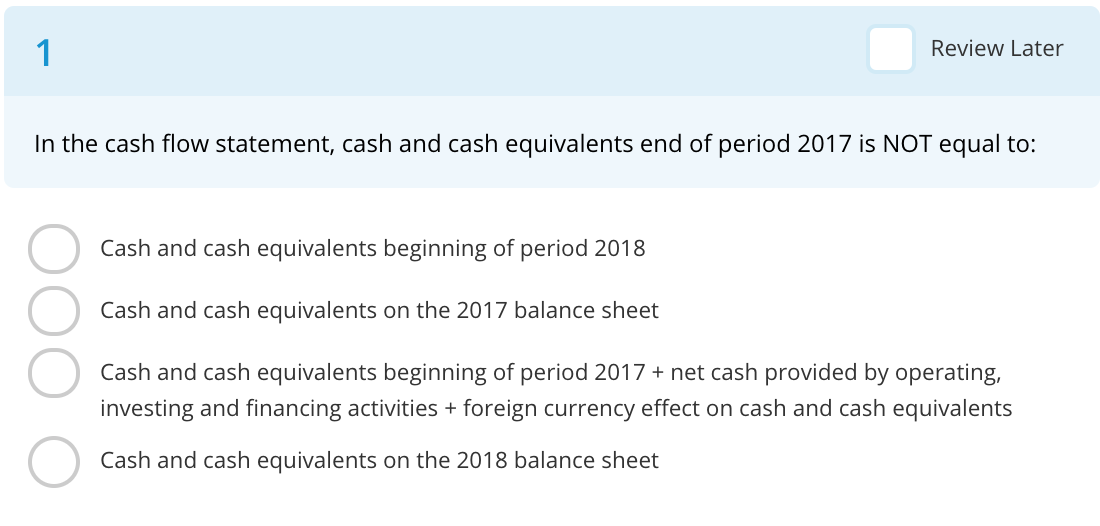

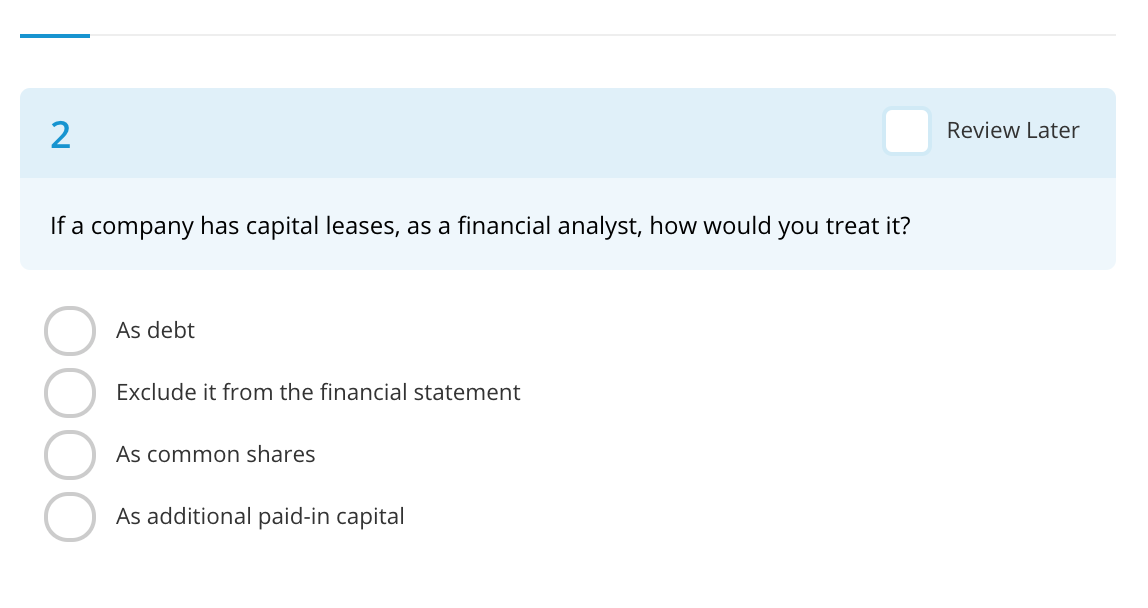

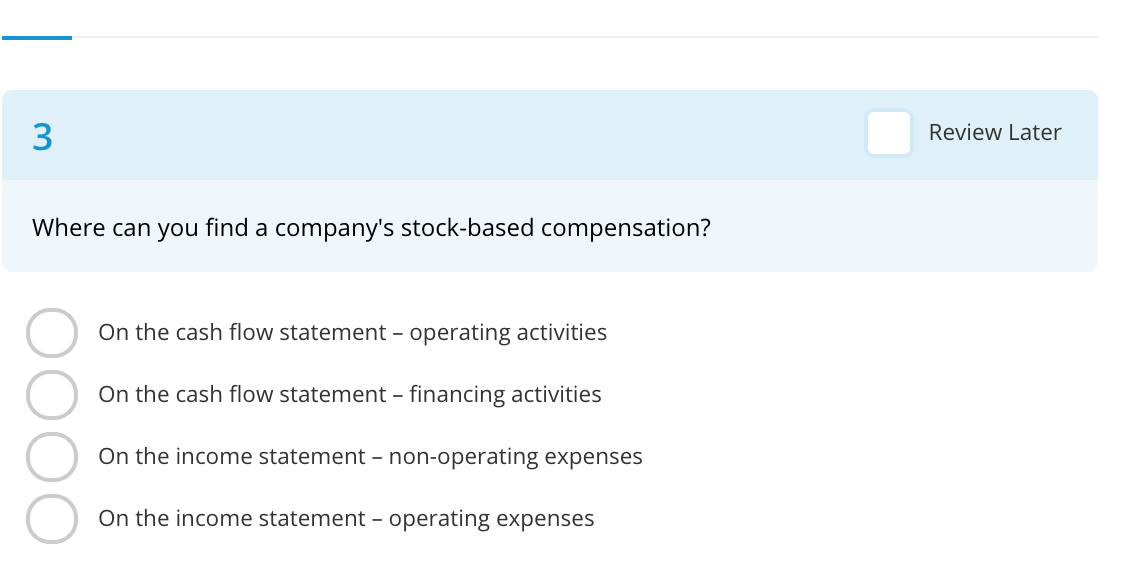

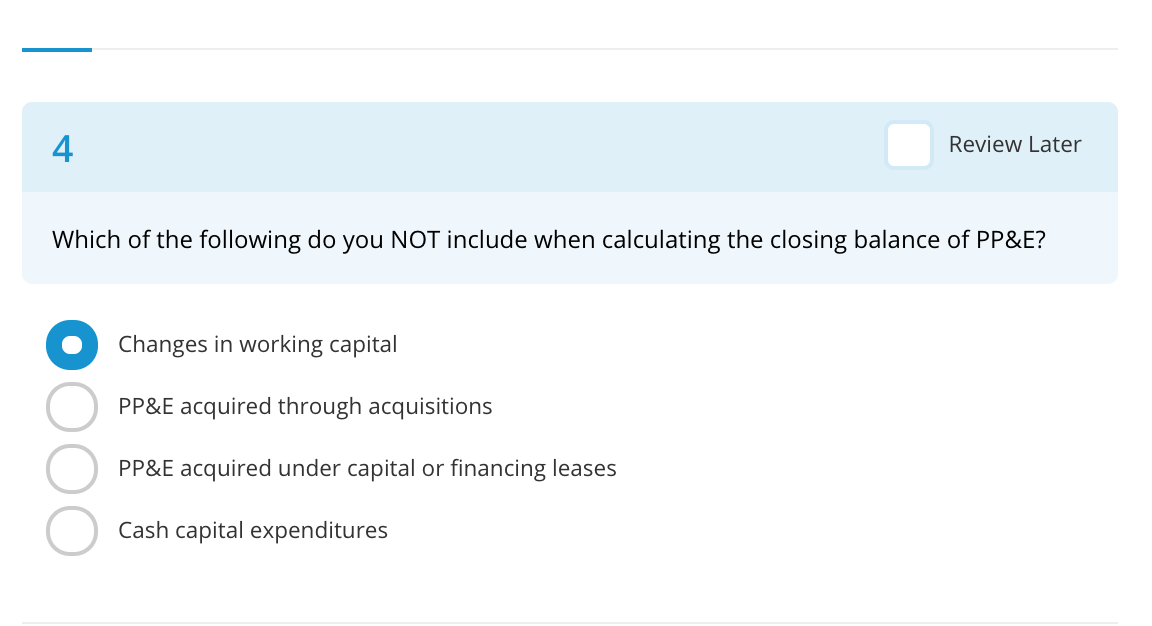

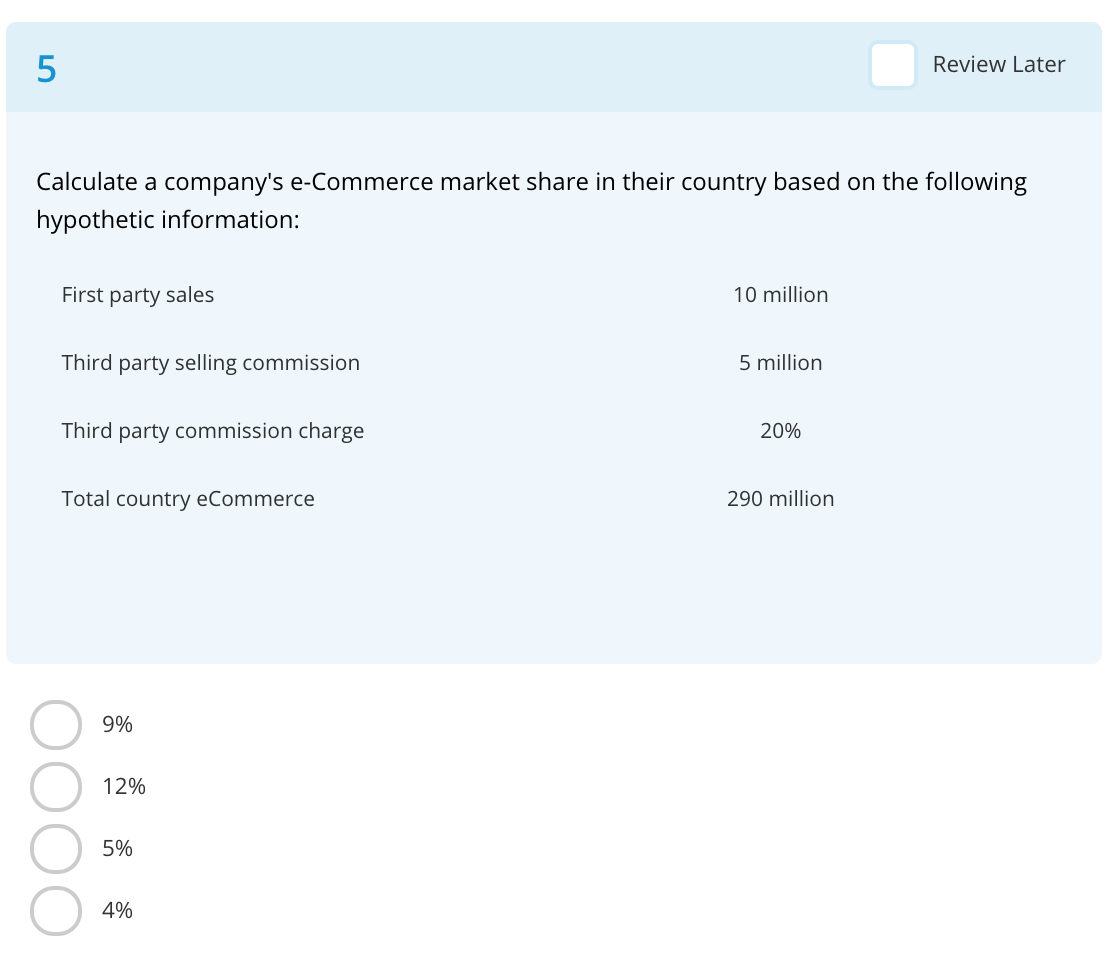

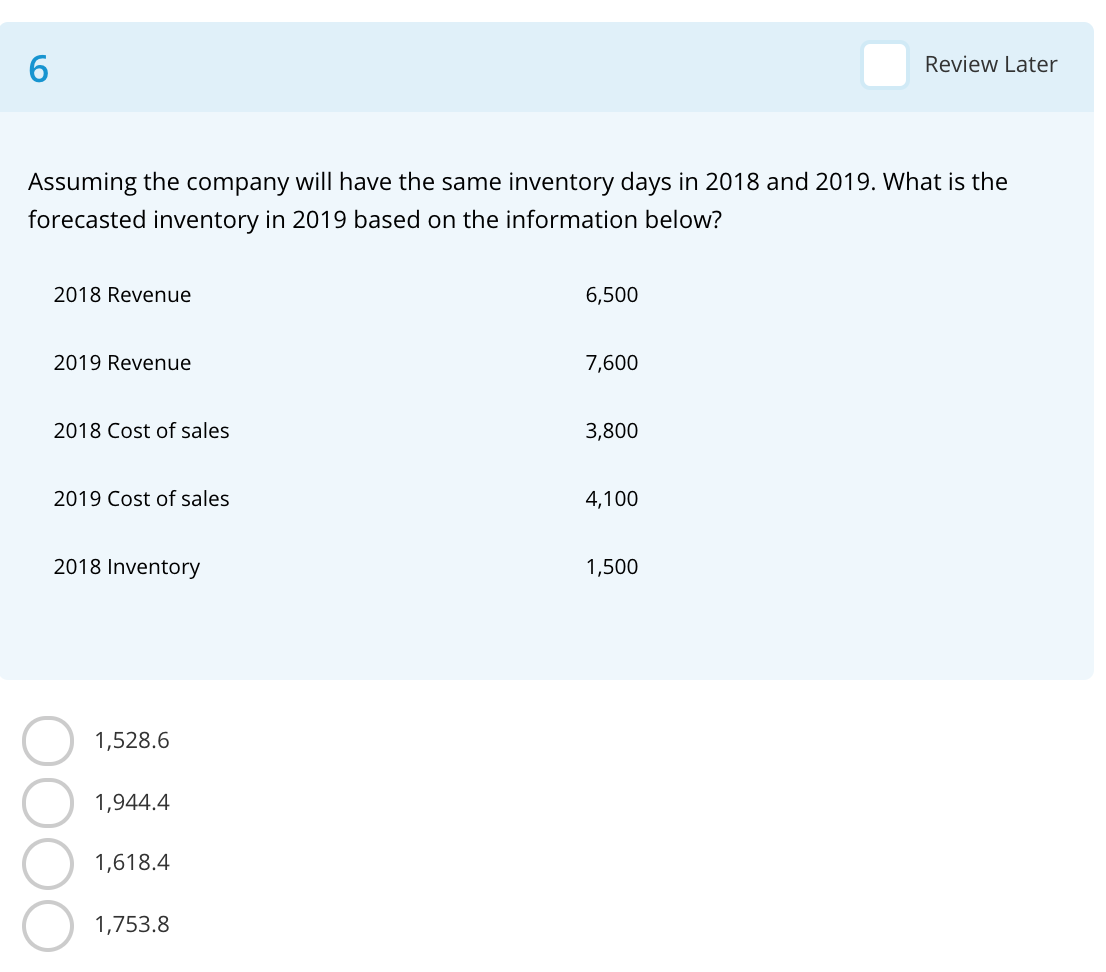

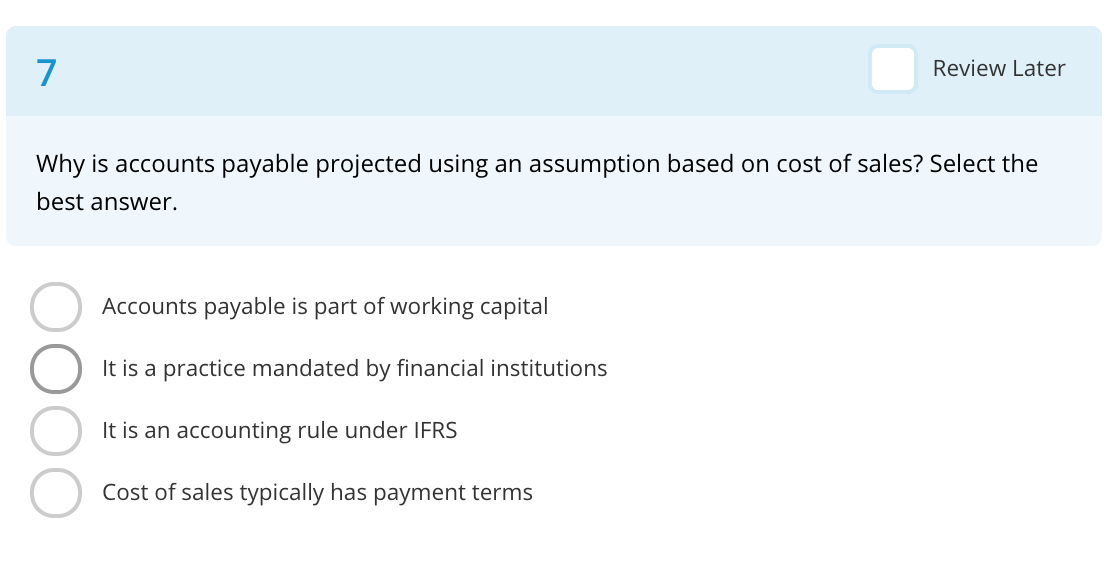

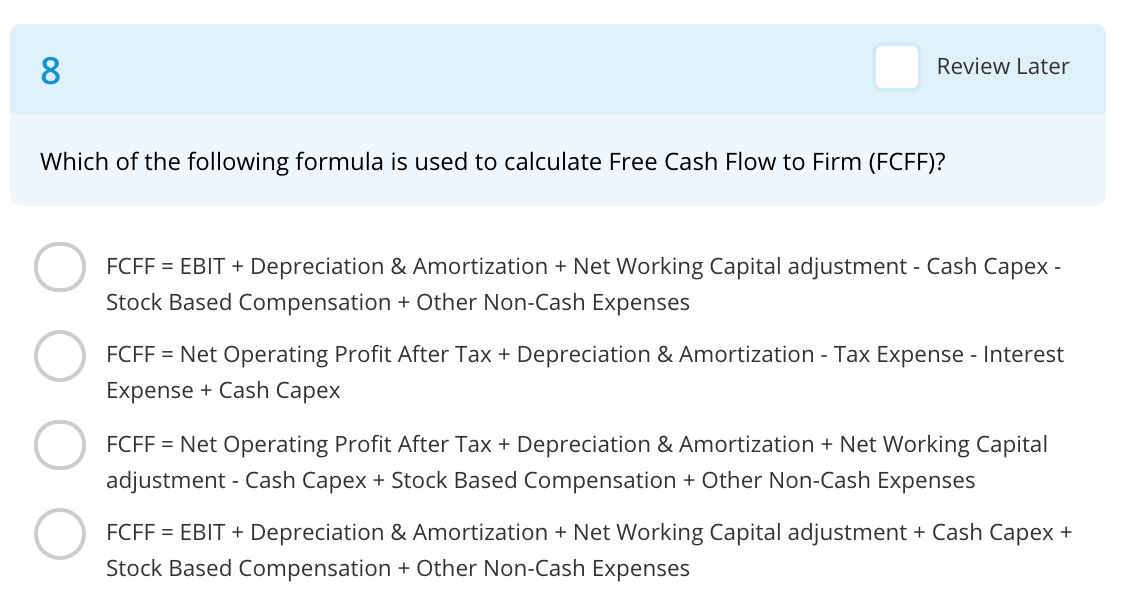

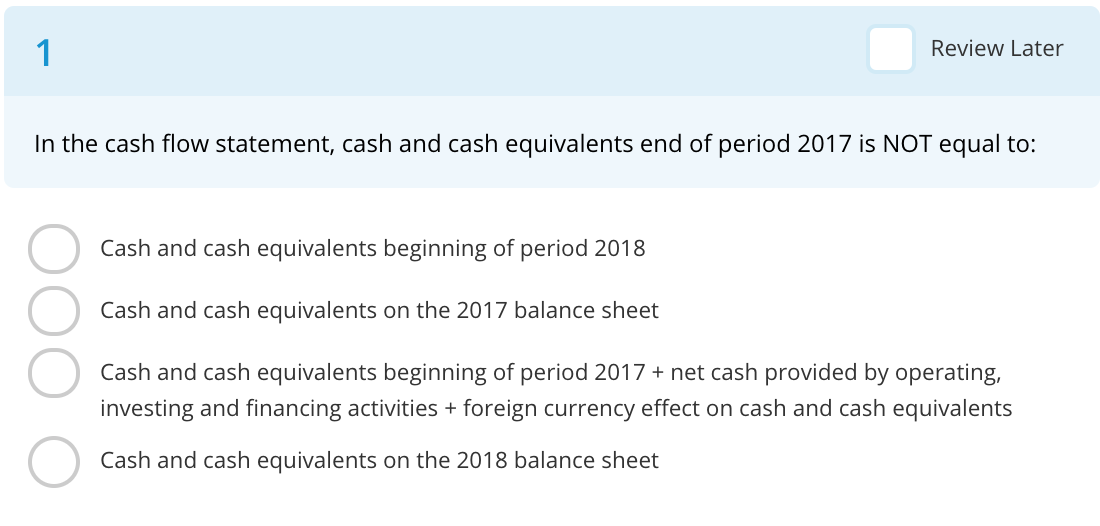

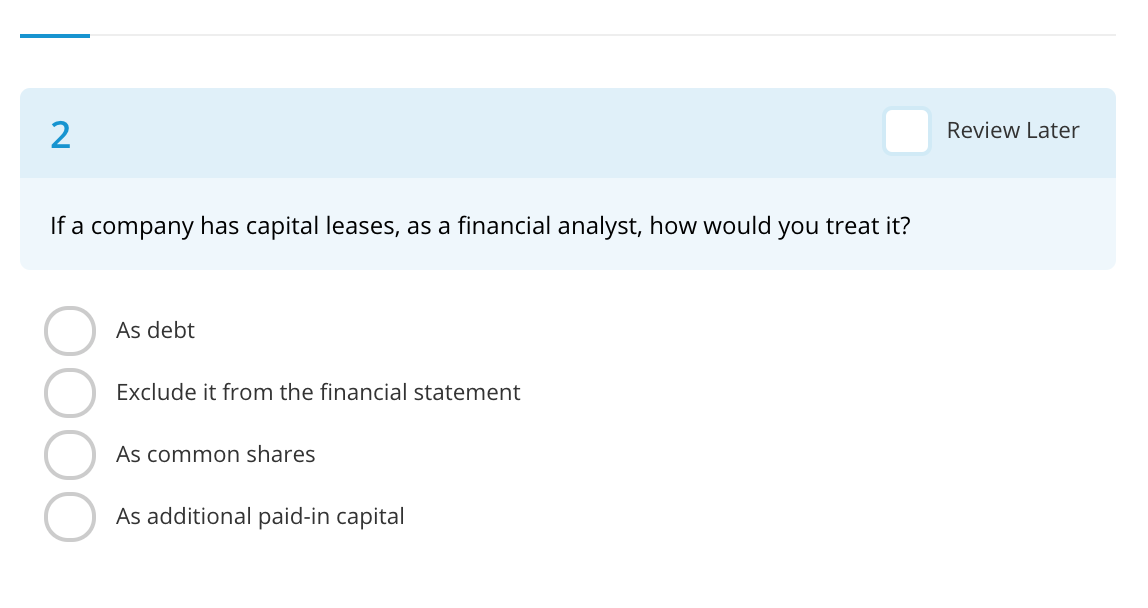

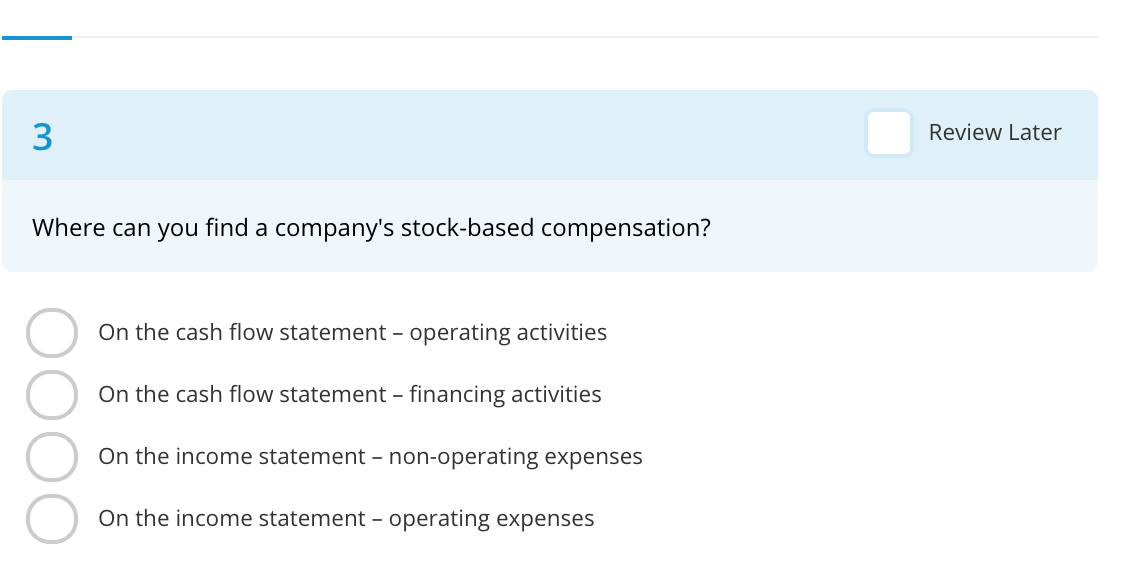

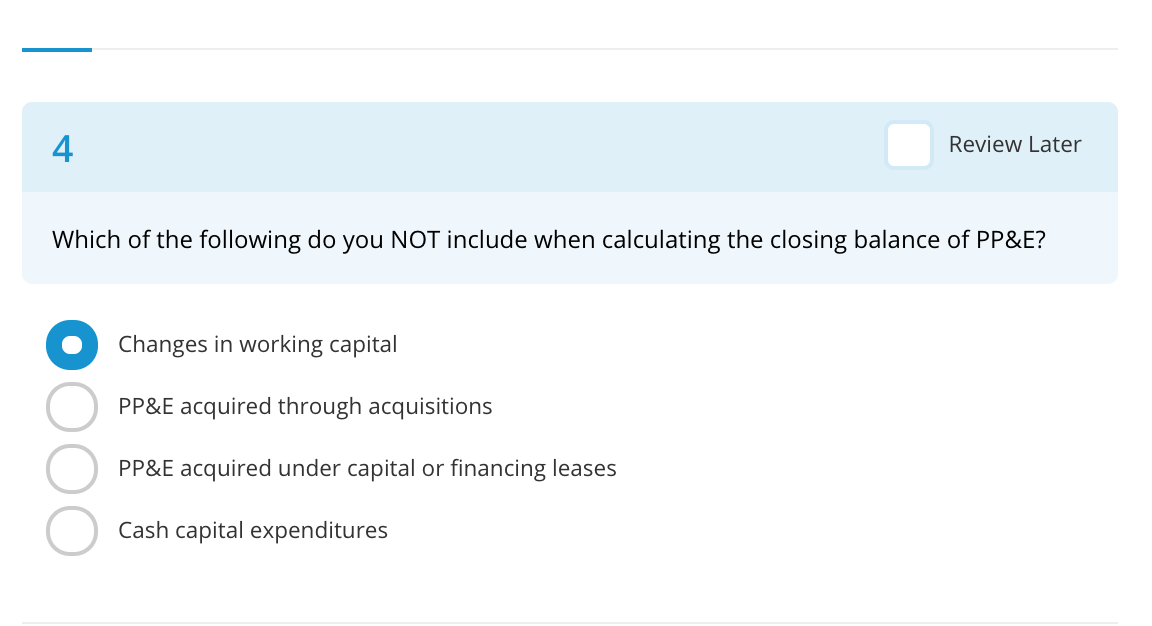

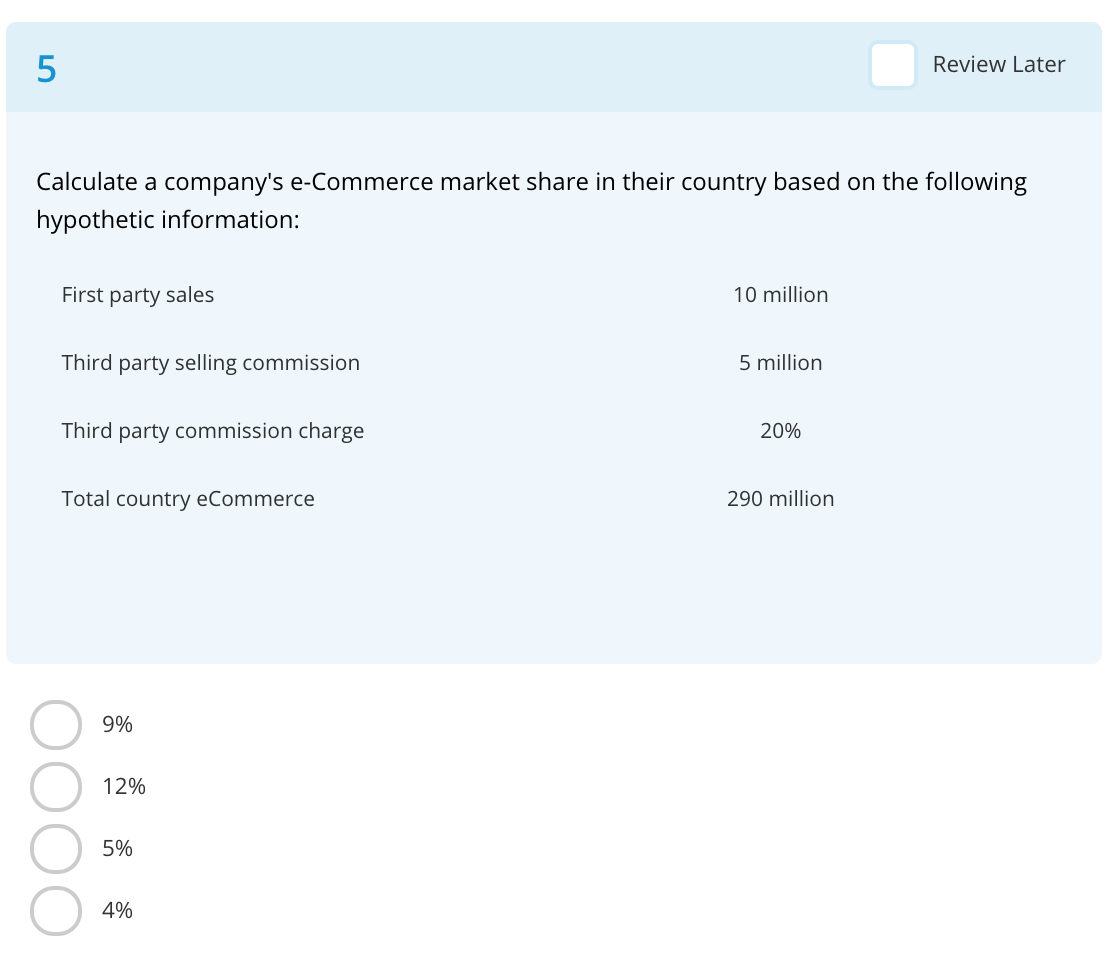

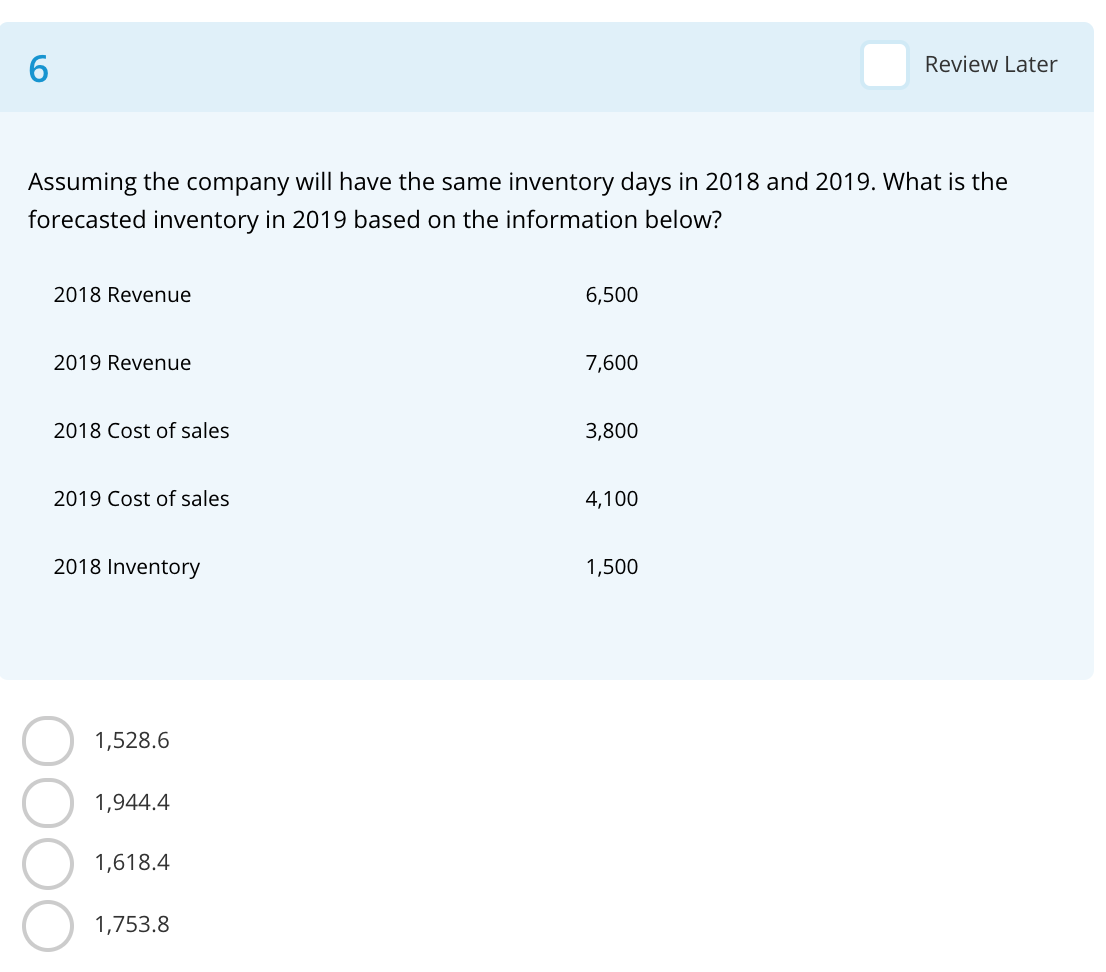

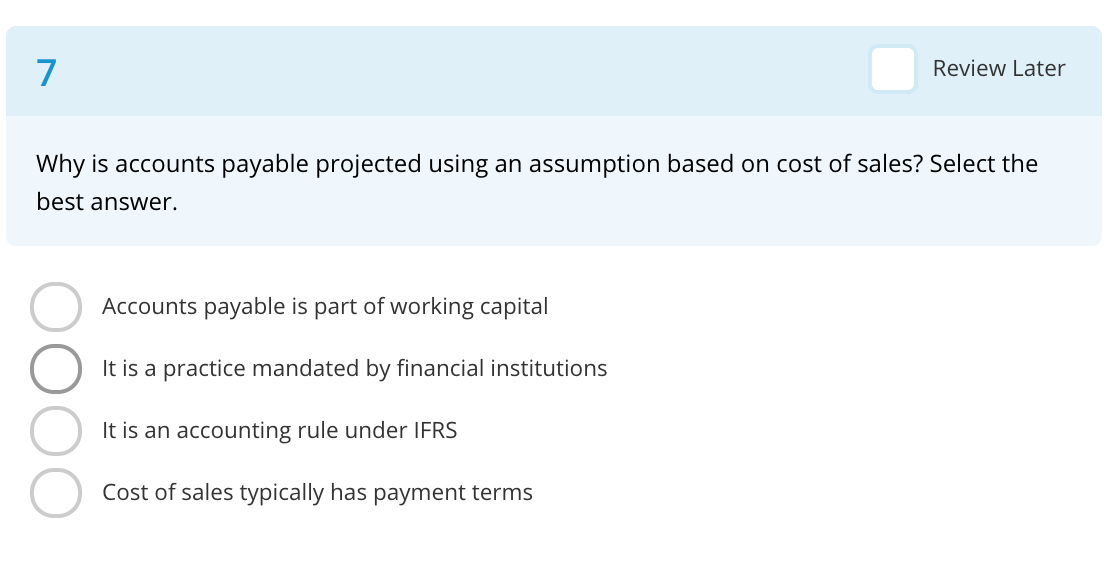

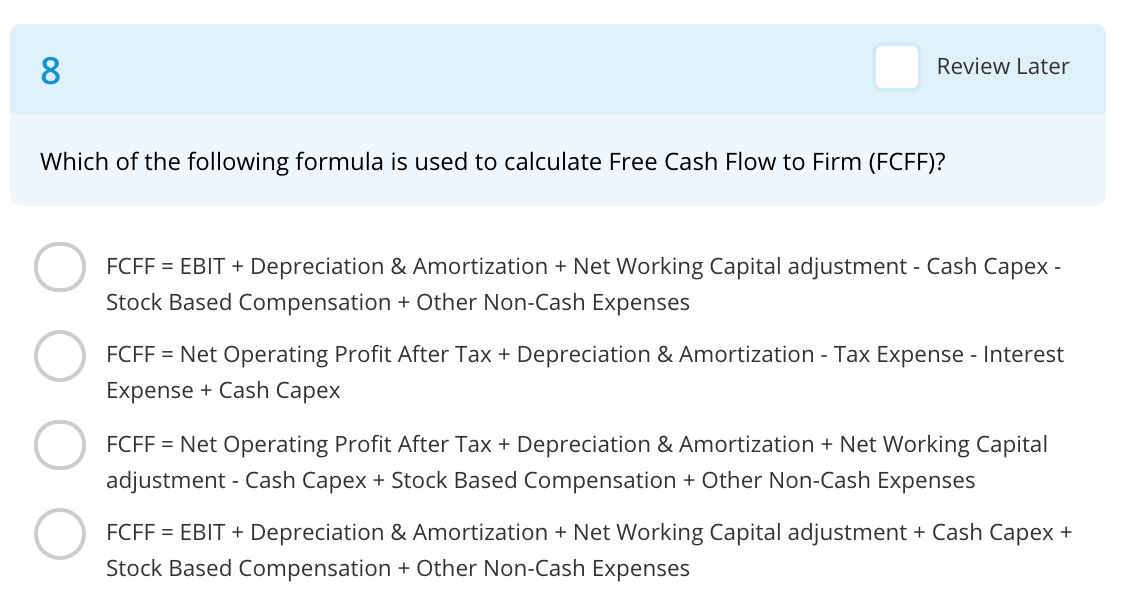

Review Later In the cash flow statement, cash and cash equivalents end of period 2017 is NOT equal to: Cash and cash equivalents beginning of period 2018 Cash and cash equivalents on the 2017 balance sheet Cash and cash equivalents beginning of period 2017 + net cash provided by operating, investing and financing activities + foreign currency effect on cash and cash equivalents Cash and cash equivalents on the 2018 balance sheet Review Later If a company has capital leases, as a financial analyst, how would you treat it? As debt Exclude it from the financial statement As common shares As additional paid-in capital Review Later Where can you find a company's stock-based compensation? On the cash flow statement - operating activities On the cash flow statement - financing activities On the income statement - non-operating expenses On the income statement - operating expenses Review Later Which of the following do you NOT include when calculating the closing balance of PP&E? Changes in working capital PP&E acquired through acquisitions PP&E acquired under capital or financing leases Cash capital expenditures Review Later Calculate a company's e-Commerce market share in their country based on the following hypothetic information: First party sales 10 million Third party selling commission 5 million Third party commission charge 20% Total country eCommerce 290 million 9% 12% 0000 5% 4% Review Later Assuming the company will have the same inventory days in 2018 and 2019. What is the forecasted inventory in 2019 based on the information below? 2018 Revenue 6,500 2019 Revenue 7,600 2018 Cost of sales 3,800 2019 Cost of sales 4,100 2018 Inventory 1,500 1,528.6 1,944.4 1,618.4 1,753.8 Review Later Why is accounts payable projected using an assumption based on cost of sales? Select the best answer. Accounts payable is part of working capital It is a practice mandated by financial institutions OOOO It is an accounting rule under IFRS Cost of sales typically has payment terms Review Later Which of the following formula is used to calculate Free Cash Flow to Firm (FCFF)? FCFF = EBIT + Depreciation & Amortization + Net Working Capital adjustment - Cash Capex - Stock Based Compensation + Other Non-Cash Expenses FCFF = Net Operating Profit After Tax + Depreciation & Amortization - Tax Expense - Interest Expense + Cash Capex FCFF = Net Operating Profit After Tax + Depreciation & Amortization + Net Working Capital adjustment - Cash Capex + Stock Based Compensation + Other Non-Cash Expenses FCFF = EBIT + Depreciation & Amortization + Net Working Capital adjustment + Cash Capex + Stock Based Compensation + Other Non-Cash Expenses