Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review of the capital market perception of Carlsberg AS in terms of stock price performance and other measures deemed relevant by you the analyst (you

Review of the capital market perception of Carlsberg AS in terms of stock price performance and other measures deemed relevant by you the analyst (you will need to employ research on relevant stock market performance indicators). Please write 2 or 3 paragraphs.

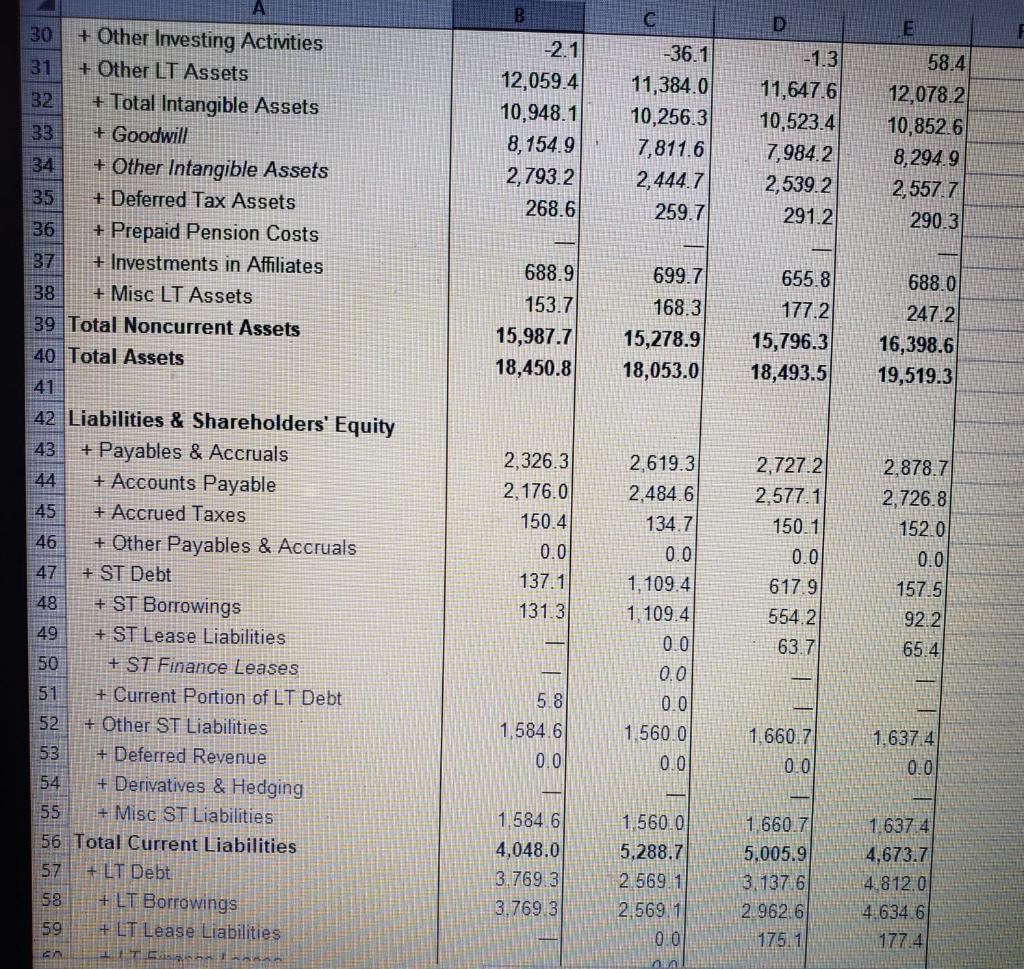

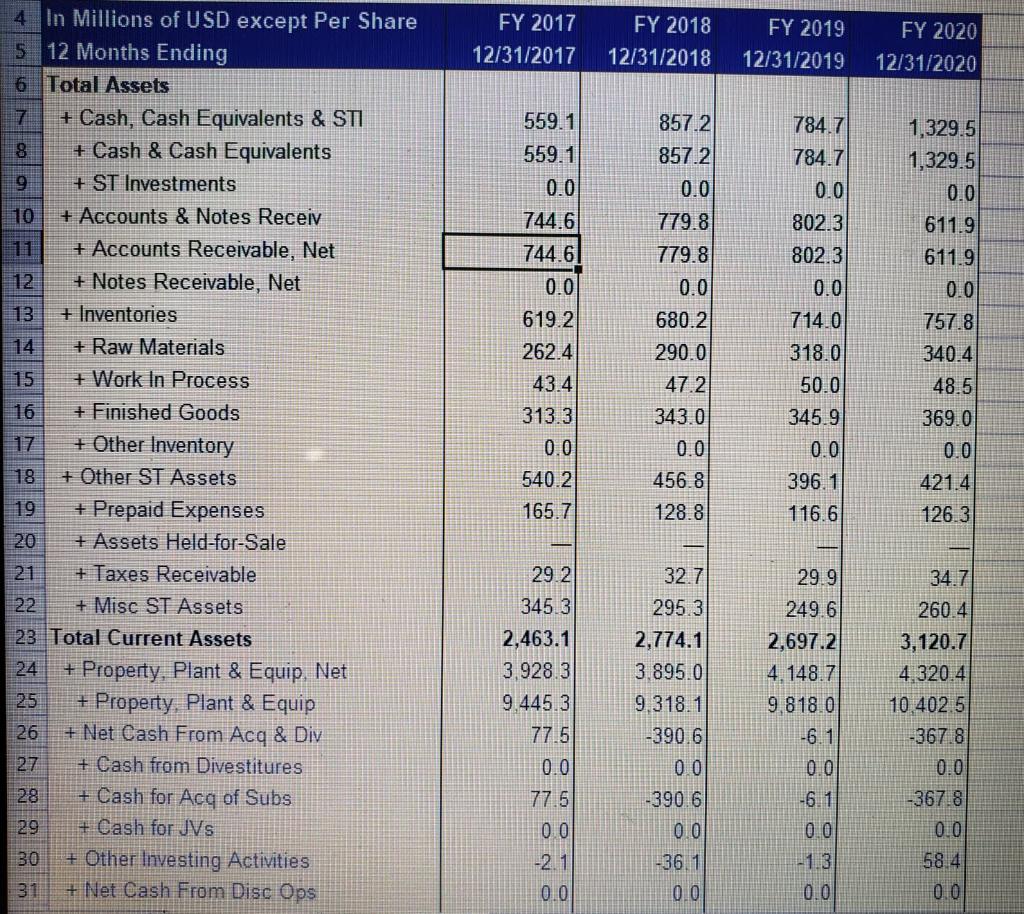

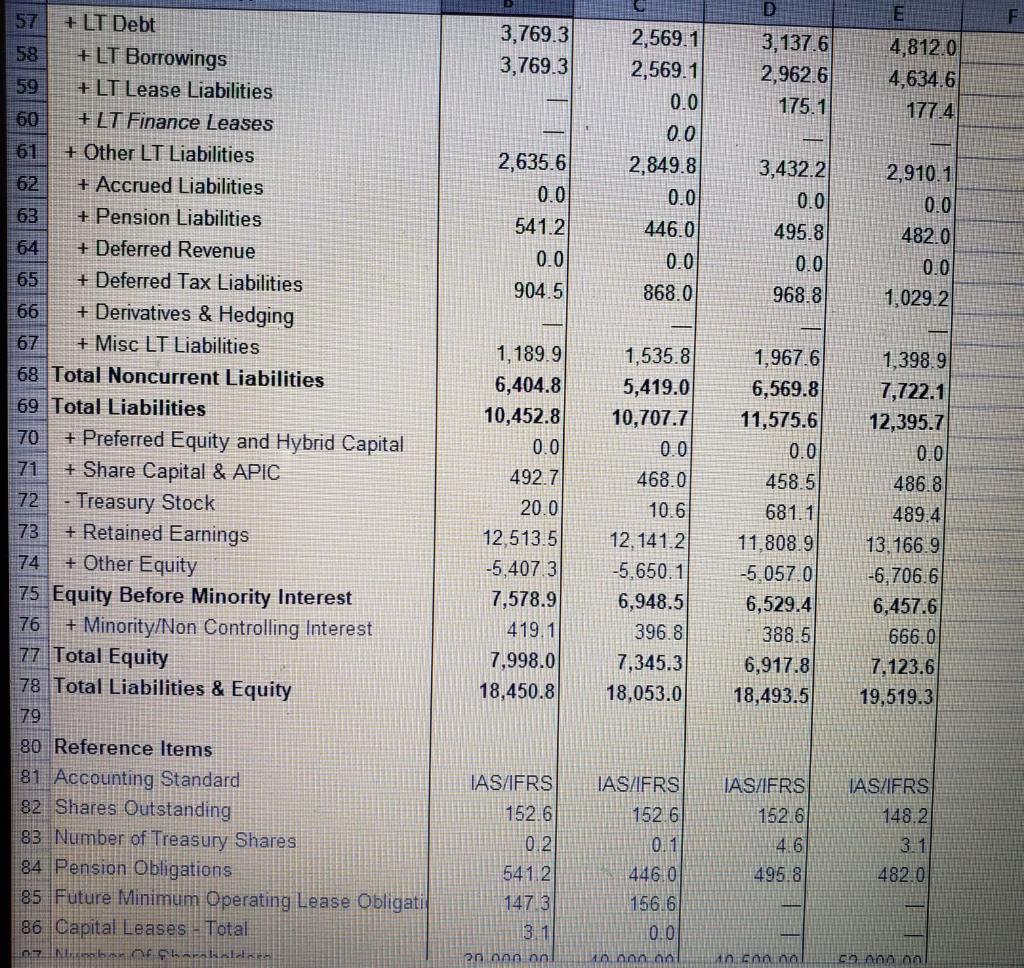

B D E -2.1 12,059.4 10,948.1 8,154.9 2,793.2 268.6 -36.1 11,384.0 10,256.3 7,811.6 2,444.7 259.7 -1.3 11,647.6 10,523.4 7,984.2 2,539.2 291.2 58.4 12,078.2 10,852.6 8,294.9 2,5577 290.3 688.9 153.7 15,987.7 18,450.8 699.7 168.3 15,278.9 18,053.0 655.8 177.2 15,796.3 18,493.5 688.0 247.2 16,398.6 19,519.3 30 + Other Investing Activities 31 + Other LT Assets 32 + Total Intangible Assets 33 + Goodwill 34 + Other Intangible Assets 35 + Deferred Tax Assets 36 + Prepaid Pension Costs 37 + Investments in Affiliates 38 + Misc LT Assets 39 Total Noncurrent Assets 40 Total Assets 41 42 Liabilities & Shareholders' Equity 43 + Payables & Accruals 44 + Accounts Payable 45 + Accrued Taxes 46 + Other Payables & Accruals 47 + ST Debt 48 + ST Borrowings 49 + ST Lease Liabilities 50 + ST Finance Leases 51 + Current Portion of LT Debt 52 + Other ST Liabilities 53 + Deferred Revenue 154 + Derivatives & Hedging 55 + Misc ST Liabilities 56 Total Current Liabilities 57 + LT Debt 58 + LT Borrowings 59 + LT Lease Liabilities FILTER 2,326.3 2,176.0 150.4 0.0 137.1 131.3 2,619.3 2,484.6 134.7 0.0 1,109.4 1.109.4 0.0 0.0 0.0 1.560.0 0.0 2,727.2 2,577.1 150.1 0.0 617.9 554.2 63.7 2,878.7 2,726.8 152.0 0.0 157.5 922 65.4 1 5.8 1,584.6 1.660.7 0.0 0.0 1.6374 0.0 1.584 6 4,048.0 3.769.3 3.769 3 1.560.0 5,288.7 2.569 1 2.569.1 0.0 1 660.7 5.005.9 3.137.6 2 962.6 175.1 1.637 4 4,673.7 4.812.00 4.634 6 177.4 FY 2017 12/31/2017 FY 2018 12/31/2018 FY 2019 12/31/2019 FY 2020 12/31/2020 559.1 559.1 0.0 744.6 744.6 0.0 619.2 262.4 43.4 313.3 4 In Millions of USD except Per Share 5 12 Months Ending 6 Total Assets 7 + Cash, Cash Equivalents & STI 8 + Cash & Cash Equivalents 9 + ST Investments 10 + Accounts & Notes Receiv + Accounts Receivable, Net 12 + Notes Receivable, Net 13 + Inventories 14 + Raw Materials 15 + Work In Process 16 + Finished Goods + Other Inventory 18 + Other ST Assets 19 + Prepaid Expenses 20 + Assets Held-for-Sale 21 + Taxes Receivable 22 + Misc ST Assets 23 Total Current Assets 24 + Property, Plant & Equip. Net + Property. Plant & Equip 26 + Net Cash From Acq & Div 27 + Cash from Divestitures 28 + Cash for Acq of Subs 29 + Cash for JVs 30 + Other Investing Activities 31 + Net Cash From Disc Ops 857.2 857.2 0.0 779.8 779.8 0.0 680.2 290.0 47.2 343.0 0.0 456.8 128.8 784.7 784.7 0.0 802.3 802.3 0.0 714.0 318.0 50.0 345.9 0.0 396.1 116.6 1,329.5 1,329.5 0.0 611.9 611.9 0.0 757.8 340.4 48.5 369.0 0.0 421.4 126.3 0.0 540.2 165.7 29.2 345.3 2,463.1 3.928.3 9.445.3 77.5 0.0 77.5 00 -2.1 0.0 32.7 295.3 2,774.1 3.895.0 9.318.1 -390.6 00 -390.6 0.0 -36.1 0.0 29.9 249.6 2,697.2 4.148.7 9.818.0 -6.1 00 -6.1 0.0 34.7 260.4 3,120.7 4 320.4 10 4025 -367.8 -367.8 0.0 58.4 0.0 0.0 3,769.3 3,769.3 3,137.6 2,962.6 175.1 4,812.0 4,634.6 177.4 2,569.1 2,569.1 0.0 0.0 2,849.8 0.0 446.0 0.0 868.0 3,432.2 2,635.6 0.0 541.2 0.0 904.5 0.0 495.8 0.0 968.8 2,910.1 0.0 482.0 0.0 1,029.2 1,535.8 5,419.0 10,707.7 0.0 57 + LT Debt 58 +LT Borrowings 59 + LT Lease Liabilities 60 +LT Finance Leases 61 + Other LT Liabilities 62 + Accrued Liabilities 63 + Pension Liabilities 64 + Deferred Revenue 65 + Deferred Tax Liabilities 66 + Derivatives & Hedging 67 + Misc LT Liabilities 68 Total Noncurrent Liabilities 69 Total Liabilities 70 + Preferred Equity and Hybrid Capital 71 + Share Capital & APIC 72 - Treasury Stock 73 + Retained Earnings 74 + Other Equity 75 Equity Before Minority Interest 76 + Minority/Non Controlling Interest 77 Total Equity 78 Total Liabilities & Equity 79 80 Reference Items 81 Accounting Standard 82 Shares Outstanding 83 Number of Treasury Shares 84 Pension Obligations 85 Future Minimum Operating Lease Obligati 86 Capital Leases - Total 107 Nanban harakah 468.0 1,189.9 6,404.8 10,452.8 0.0 492.7 20.0 12.513.5 -5.407.3 7,578.9 419.1 7,998.0 18,450.8 10.6 12.141.2 -5.650.1 6,948.5 396.8 7,345.3 18,053.0 1,967.6 6,569.8 11,575.6 0.0 458.5 681.1 11,808.9 -5.057.0 6,529.4 388.5 6.917.8 18,493.5 1,398.9 7,722.1 12,395.7 0.0 486.8 489.4 13.166.9 -6,706.6 6,457.6 666.0 7,123.6 19,519.3 IAS/IFRS 152.6 0.2 541.2 147 3 IAS/IFRS 152.6 0.1 446.0 156.6 10.0 JAS/IERS 152.6 4.6 495.8 TAS FRS 148.2 3.1 482.0 en nonnn ann an na na Anno B D E -2.1 12,059.4 10,948.1 8,154.9 2,793.2 268.6 -36.1 11,384.0 10,256.3 7,811.6 2,444.7 259.7 -1.3 11,647.6 10,523.4 7,984.2 2,539.2 291.2 58.4 12,078.2 10,852.6 8,294.9 2,5577 290.3 688.9 153.7 15,987.7 18,450.8 699.7 168.3 15,278.9 18,053.0 655.8 177.2 15,796.3 18,493.5 688.0 247.2 16,398.6 19,519.3 30 + Other Investing Activities 31 + Other LT Assets 32 + Total Intangible Assets 33 + Goodwill 34 + Other Intangible Assets 35 + Deferred Tax Assets 36 + Prepaid Pension Costs 37 + Investments in Affiliates 38 + Misc LT Assets 39 Total Noncurrent Assets 40 Total Assets 41 42 Liabilities & Shareholders' Equity 43 + Payables & Accruals 44 + Accounts Payable 45 + Accrued Taxes 46 + Other Payables & Accruals 47 + ST Debt 48 + ST Borrowings 49 + ST Lease Liabilities 50 + ST Finance Leases 51 + Current Portion of LT Debt 52 + Other ST Liabilities 53 + Deferred Revenue 154 + Derivatives & Hedging 55 + Misc ST Liabilities 56 Total Current Liabilities 57 + LT Debt 58 + LT Borrowings 59 + LT Lease Liabilities FILTER 2,326.3 2,176.0 150.4 0.0 137.1 131.3 2,619.3 2,484.6 134.7 0.0 1,109.4 1.109.4 0.0 0.0 0.0 1.560.0 0.0 2,727.2 2,577.1 150.1 0.0 617.9 554.2 63.7 2,878.7 2,726.8 152.0 0.0 157.5 922 65.4 1 5.8 1,584.6 1.660.7 0.0 0.0 1.6374 0.0 1.584 6 4,048.0 3.769.3 3.769 3 1.560.0 5,288.7 2.569 1 2.569.1 0.0 1 660.7 5.005.9 3.137.6 2 962.6 175.1 1.637 4 4,673.7 4.812.00 4.634 6 177.4 FY 2017 12/31/2017 FY 2018 12/31/2018 FY 2019 12/31/2019 FY 2020 12/31/2020 559.1 559.1 0.0 744.6 744.6 0.0 619.2 262.4 43.4 313.3 4 In Millions of USD except Per Share 5 12 Months Ending 6 Total Assets 7 + Cash, Cash Equivalents & STI 8 + Cash & Cash Equivalents 9 + ST Investments 10 + Accounts & Notes Receiv + Accounts Receivable, Net 12 + Notes Receivable, Net 13 + Inventories 14 + Raw Materials 15 + Work In Process 16 + Finished Goods + Other Inventory 18 + Other ST Assets 19 + Prepaid Expenses 20 + Assets Held-for-Sale 21 + Taxes Receivable 22 + Misc ST Assets 23 Total Current Assets 24 + Property, Plant & Equip. Net + Property. Plant & Equip 26 + Net Cash From Acq & Div 27 + Cash from Divestitures 28 + Cash for Acq of Subs 29 + Cash for JVs 30 + Other Investing Activities 31 + Net Cash From Disc Ops 857.2 857.2 0.0 779.8 779.8 0.0 680.2 290.0 47.2 343.0 0.0 456.8 128.8 784.7 784.7 0.0 802.3 802.3 0.0 714.0 318.0 50.0 345.9 0.0 396.1 116.6 1,329.5 1,329.5 0.0 611.9 611.9 0.0 757.8 340.4 48.5 369.0 0.0 421.4 126.3 0.0 540.2 165.7 29.2 345.3 2,463.1 3.928.3 9.445.3 77.5 0.0 77.5 00 -2.1 0.0 32.7 295.3 2,774.1 3.895.0 9.318.1 -390.6 00 -390.6 0.0 -36.1 0.0 29.9 249.6 2,697.2 4.148.7 9.818.0 -6.1 00 -6.1 0.0 34.7 260.4 3,120.7 4 320.4 10 4025 -367.8 -367.8 0.0 58.4 0.0 0.0 3,769.3 3,769.3 3,137.6 2,962.6 175.1 4,812.0 4,634.6 177.4 2,569.1 2,569.1 0.0 0.0 2,849.8 0.0 446.0 0.0 868.0 3,432.2 2,635.6 0.0 541.2 0.0 904.5 0.0 495.8 0.0 968.8 2,910.1 0.0 482.0 0.0 1,029.2 1,535.8 5,419.0 10,707.7 0.0 57 + LT Debt 58 +LT Borrowings 59 + LT Lease Liabilities 60 +LT Finance Leases 61 + Other LT Liabilities 62 + Accrued Liabilities 63 + Pension Liabilities 64 + Deferred Revenue 65 + Deferred Tax Liabilities 66 + Derivatives & Hedging 67 + Misc LT Liabilities 68 Total Noncurrent Liabilities 69 Total Liabilities 70 + Preferred Equity and Hybrid Capital 71 + Share Capital & APIC 72 - Treasury Stock 73 + Retained Earnings 74 + Other Equity 75 Equity Before Minority Interest 76 + Minority/Non Controlling Interest 77 Total Equity 78 Total Liabilities & Equity 79 80 Reference Items 81 Accounting Standard 82 Shares Outstanding 83 Number of Treasury Shares 84 Pension Obligations 85 Future Minimum Operating Lease Obligati 86 Capital Leases - Total 107 Nanban harakah 468.0 1,189.9 6,404.8 10,452.8 0.0 492.7 20.0 12.513.5 -5.407.3 7,578.9 419.1 7,998.0 18,450.8 10.6 12.141.2 -5.650.1 6,948.5 396.8 7,345.3 18,053.0 1,967.6 6,569.8 11,575.6 0.0 458.5 681.1 11,808.9 -5.057.0 6,529.4 388.5 6.917.8 18,493.5 1,398.9 7,722.1 12,395.7 0.0 486.8 489.4 13.166.9 -6,706.6 6,457.6 666.0 7,123.6 19,519.3 IAS/IFRS 152.6 0.2 541.2 147 3 IAS/IFRS 152.6 0.1 446.0 156.6 10.0 JAS/IERS 152.6 4.6 495.8 TAS FRS 148.2 3.1 482.0 en nonnn ann an na na Anno

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started