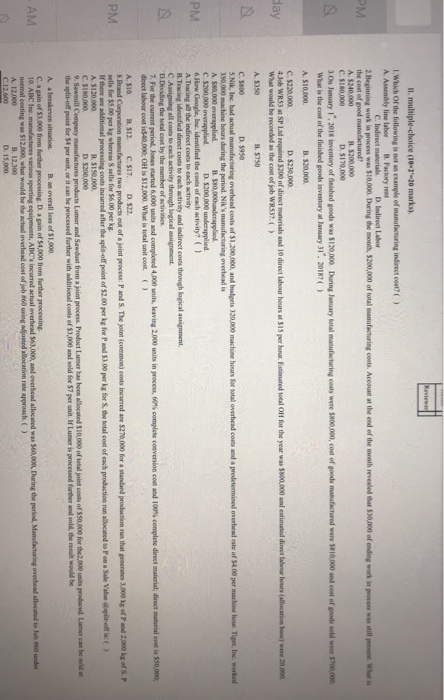

Review PM Hay II. multiple-choice (10320 marks) 1. Which of the following is not an example of manufacturing indirect cost?) A. Asembly line labor B. Factory C. Indirect materials D. Indirect Lahore 2. Beginning work in process was $10,000. During the month, 5200,000 of total manufacturing costs. Account at the end of the month revealed that 50,000 ofending work in process was still pre. What the cost of good manufactured! A $240,000 B. $200.000 C. $180,000 D. 5170,000 3.On January 15 2018 inventory of finished goods was $120.000. During January total manufacturing costs were $800,000.com or goede manufactured were $10,000 and cost of prods sold were $700,000, What is the cost of the finished goods inventory at January 31". 2018 A $10,000 B.520,000 C. $220.000 D. $230.000 4Job WR$3 a SP Lad required $200 of direct materials and 10 direct labour hours at 515 per hour. Estimated total oH for the year was $800,000 and estimated direct labour hours (allocation base) were 20.000 What would be recorded as the cost of job WR337) A 5350 B. 5750 C. 5800 D. 5950 5.Nik, Ine had actual manufacturing overhead costs of $1,200,000, and budgets 320,000 machine hour fortal overhead costs and a predetermined overhead rate of 54.00 per machine hour. Tiger, Inc. worked 350,000 machine hours during the period. Nik's manufacturing overhead is A. $80,000 overapplied B. 580,000 underapplied C. 5200,000 overapplied D. $200.000 underapplied 6. Flow Google, Inc. idewified the costs of each activity ( ) A Tracing all the indirect costs to each activity B.Tracing identified direct costs to each activity and indirect costs through logical assigment Assigning all costs to each activity through logical assignment D. Dividing the total cost by the umber of activities 7. For the current period. Jones tarted 6,000 units and completed 4,000 units, leaving 2.000 units in process, 60% complete conversion cost and 100% complete direct material direct material coat is 550.000, direct labour cost $40,000, OH is $12,000. What is total unit cost () A510 R$12. C. $17. D.522 Brand Corporation manufactures two products out of a joint process and S. The joint common costs incurred are $270.000 for a standard production that generates 3,000 kg of Pund 2.000 kg of SP sells for $5.00 per kg whereas sells for $6.00 per kg. If there are additional processing costs incurred after the split-off point of $2.00 per kg for and $3.00 per kg for S, the total cost of each production run allocated to on Sale Value split B. 150.000 C.SINO,000 D. $200,000 9. Sawmill Company manufactures products Lumer and Sawdust from a joint process. Product Lumer has been allocated 510.000 of total joint costs of 50,000 for the 2.000 units produced Lumer be soldat the split-off point for 54 per unit, or it can be processed further with additional costs of $3,000 and sold for 57 per unit. I Lumeris processed further and sold, the result would be A abakeven situation B. an overall loss of $1,000 Cagain of 3.000 from further processing. D. again of S4,000 from further processing 10. ABC I. manufactures ventes perting equipments, ABC's incurred actual overhead 963.000, and overhead allocated was 60,000, During the period, Manufacturing overhead allocated to do 60 under normal conting was $12.000, what would be the actual overhead cost of jeb 6 using sted allocation rate approach.) A 12.000 B. 12,300 C.12.000 D. 15.000 PM PM AM