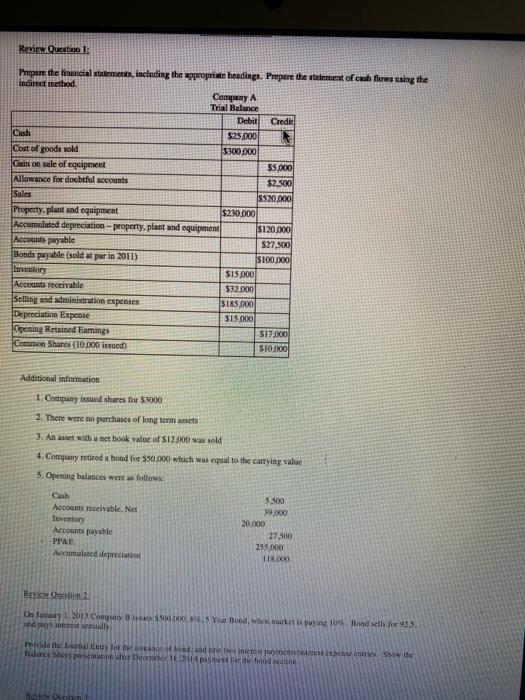

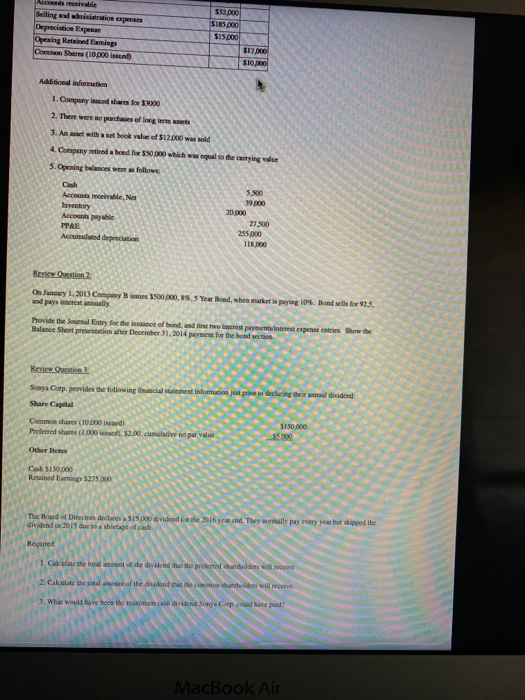

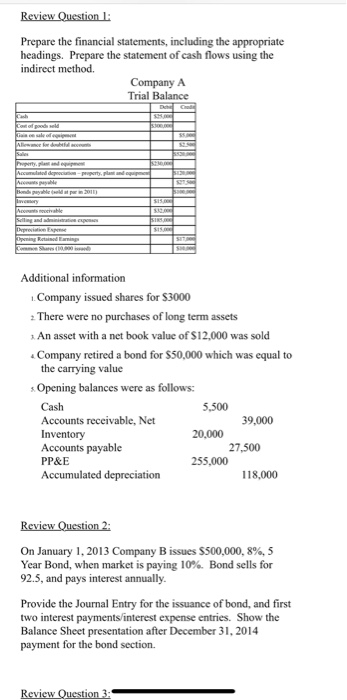

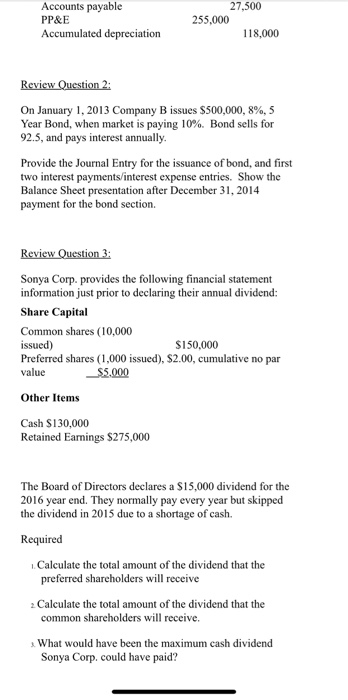

Review Qual: Prepare the finalements, including the appropriate headings. Prepare the statement of cash flows using the Incarncrete Tre Ralance Debit Credit $25 DOO $300.000 Allowance for doceful accounts $2.500 $520.000 Property.plant and equipment $230,000 Accumulated depreciation-property, plant and equipment SI20.000 Accounts payable Bonds payable (sold at par in 2011) SIDO. DOO Inventory ISIS DOO Accounts receivable $32.000 Selling and administration expenses $185.000 Depreciation Expense SI5l Opening Retained Eamings Common Shares (10.000 issued) S1000 Additional information 1. Company issued shares for 53000 2. There were no purchases of long term assets 3. An act with a netbook value of $12.000 was sold 4. Company retired abond for 550.which was equal to the carrying value 5. Opening balances were as follows: Accounts Toeivable.Net Inventory Accounts payable PPAR Accumulated depreciation 39.000 20.000 27.500 255.000 118 CO RO Os , 2003 Com B O , Year Bond, when u sia 105. Bond sells for 233 Pendie Balance Sher presentato D n d wante w i e hond e es, SWIN Arte 532.000 S185 DOO SI5DOO Opening Hotel Bari Common Sheree (10.000 5170 Additional information 1. Company issued for 3300 2. There were to purchases of long term met 3. Ant with a set book value of $12.000 was held 4. Company retired a bed for $30.000 hich was great the carrying value 5. Opening balances were as follows Cash Accounts receivable, Not laventory 20.000 Accomi powie PPAE Accumulated depreciation 5.500 Review Question 2 Onuary 1, 2013 Campy and pays interest anually 3000, 3, 5 Year Bond, she market is paying 10%. Bond 25. Provide the y for the same oben und in two respecterest aspersentries Show Balance Sheet presentation after December 31, 2014 payment for the bond section Review Question 3 Scaya Corp.provides the following financial staten Share Capital Come shares (10.000 ad Preferred shares (1.000 52.00. cumuwie do per value RE The Board of Directions declares a $15.po dividend dividend in 2015 due to a shortage of cash SALE the 2016 yr end. They formally pay every year butski honte de dividend that the pre hureholders will receive 2. C ebel net of the studente che il What would have been the cash dividend Sanya Cepand have pad? Review Question 1: Prepare the financial statements, including the appropriate headings. Prepare the statement of cash flows using the indirect method. Company A Trial Balance Additional information Company issued shares for $3000 2There were no purchases of long term assets An asset with a net book value of $12,000 was sold Company retired a bond for $50,000 which was equal to the carrying value Opening balances were as follows: Cash 5,500 Accounts receivable, Net 39,000 Inventory 20,000 Accounts payable 27,500 PP&E 255,000 Accumulated depreciation 118,000 Review Question 2: On January 1, 2013 Company B issues S500.000,8%, 5 Year Bond, when market is paying 10%. Bond sells for 92.5, and pays interest annually. Provide the Journal Entry for the issuance of bond, and first two interest payments interest expense entries. Show the Balance Sheet presentation after December 31, 2014 payment for the bond section. Review Ouestion 3: Accounts payable PP&E Accumulated depreciation 27,500 255,000 118,000 Review Question 2: On January 1, 2013 Company B issues $500,000, 8%, 5 Year Bond, when market is paying 10%. Bond sells for 92.5, and pays interest annually. Provide the Journal Entry for the issuance of bond, and first two interest payments/interest expense entries. Show the Balance Sheet presentation after December 31, 2014 payment for the bond section. Review Question 3: Sonya Corp. provides the following financial statement information just prior to declaring their annual dividend: Share Capital Common shares (10,000 issued) $150,000 Preferred shares (1,000 issued), $2.00, cumulative no par value _$5.000 Other Items Cash $130,000 Retained Earnings $275,000 The Board of Directors declares a $15,000 dividend for the 2016 year end. They normally pay every year but skipped the dividend in 2015 due to a shortage of cash. Required Calculate the total amount of the dividend that the preferred shareholders will receive 2 Calculate the total amount of the dividend that the common shareholders will receive. What would have been the maximum cash dividend Sonya Corp. could have paid? Review Qual: Prepare the finalements, including the appropriate headings. Prepare the statement of cash flows using the Incarncrete Tre Ralance Debit Credit $25 DOO $300.000 Allowance for doceful accounts $2.500 $520.000 Property.plant and equipment $230,000 Accumulated depreciation-property, plant and equipment SI20.000 Accounts payable Bonds payable (sold at par in 2011) SIDO. DOO Inventory ISIS DOO Accounts receivable $32.000 Selling and administration expenses $185.000 Depreciation Expense SI5l Opening Retained Eamings Common Shares (10.000 issued) S1000 Additional information 1. Company issued shares for 53000 2. There were no purchases of long term assets 3. An act with a netbook value of $12.000 was sold 4. Company retired abond for 550.which was equal to the carrying value 5. Opening balances were as follows: Accounts Toeivable.Net Inventory Accounts payable PPAR Accumulated depreciation 39.000 20.000 27.500 255.000 118 CO RO Os , 2003 Com B O , Year Bond, when u sia 105. Bond sells for 233 Pendie Balance Sher presentato D n d wante w i e hond e es, SWIN Arte 532.000 S185 DOO SI5DOO Opening Hotel Bari Common Sheree (10.000 5170 Additional information 1. Company issued for 3300 2. There were to purchases of long term met 3. Ant with a set book value of $12.000 was held 4. Company retired a bed for $30.000 hich was great the carrying value 5. Opening balances were as follows Cash Accounts receivable, Not laventory 20.000 Accomi powie PPAE Accumulated depreciation 5.500 Review Question 2 Onuary 1, 2013 Campy and pays interest anually 3000, 3, 5 Year Bond, she market is paying 10%. Bond 25. Provide the y for the same oben und in two respecterest aspersentries Show Balance Sheet presentation after December 31, 2014 payment for the bond section Review Question 3 Scaya Corp.provides the following financial staten Share Capital Come shares (10.000 ad Preferred shares (1.000 52.00. cumuwie do per value RE The Board of Directions declares a $15.po dividend dividend in 2015 due to a shortage of cash SALE the 2016 yr end. They formally pay every year butski honte de dividend that the pre hureholders will receive 2. C ebel net of the studente che il What would have been the cash dividend Sanya Cepand have pad? Review Question 1: Prepare the financial statements, including the appropriate headings. Prepare the statement of cash flows using the indirect method. Company A Trial Balance Additional information Company issued shares for $3000 2There were no purchases of long term assets An asset with a net book value of $12,000 was sold Company retired a bond for $50,000 which was equal to the carrying value Opening balances were as follows: Cash 5,500 Accounts receivable, Net 39,000 Inventory 20,000 Accounts payable 27,500 PP&E 255,000 Accumulated depreciation 118,000 Review Question 2: On January 1, 2013 Company B issues S500.000,8%, 5 Year Bond, when market is paying 10%. Bond sells for 92.5, and pays interest annually. Provide the Journal Entry for the issuance of bond, and first two interest payments interest expense entries. Show the Balance Sheet presentation after December 31, 2014 payment for the bond section. Review Ouestion 3: Accounts payable PP&E Accumulated depreciation 27,500 255,000 118,000 Review Question 2: On January 1, 2013 Company B issues $500,000, 8%, 5 Year Bond, when market is paying 10%. Bond sells for 92.5, and pays interest annually. Provide the Journal Entry for the issuance of bond, and first two interest payments/interest expense entries. Show the Balance Sheet presentation after December 31, 2014 payment for the bond section. Review Question 3: Sonya Corp. provides the following financial statement information just prior to declaring their annual dividend: Share Capital Common shares (10,000 issued) $150,000 Preferred shares (1,000 issued), $2.00, cumulative no par value _$5.000 Other Items Cash $130,000 Retained Earnings $275,000 The Board of Directors declares a $15,000 dividend for the 2016 year end. They normally pay every year but skipped the dividend in 2015 due to a shortage of cash. Required Calculate the total amount of the dividend that the preferred shareholders will receive 2 Calculate the total amount of the dividend that the common shareholders will receive. What would have been the maximum cash dividend Sonya Corp. could have paid