Answered step by step

Verified Expert Solution

Question

1 Approved Answer

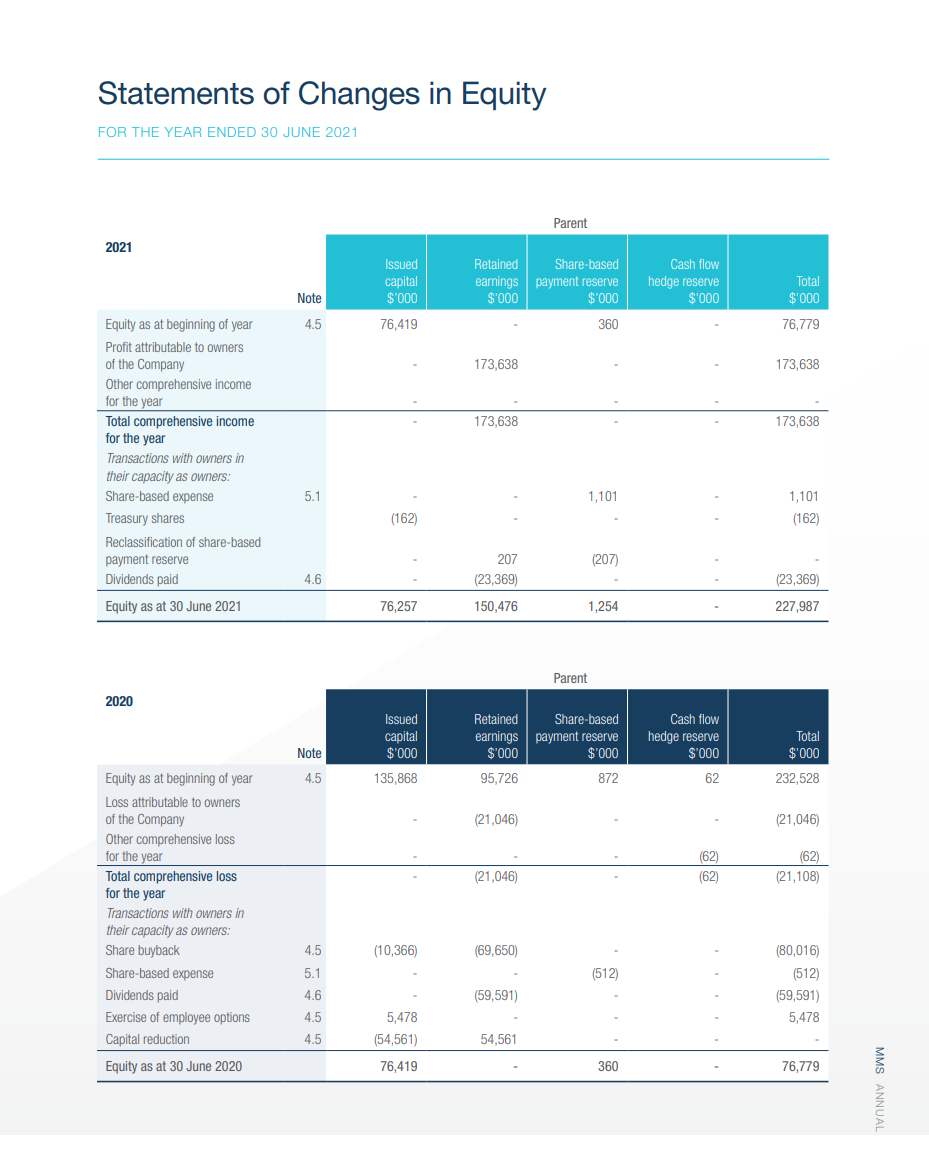

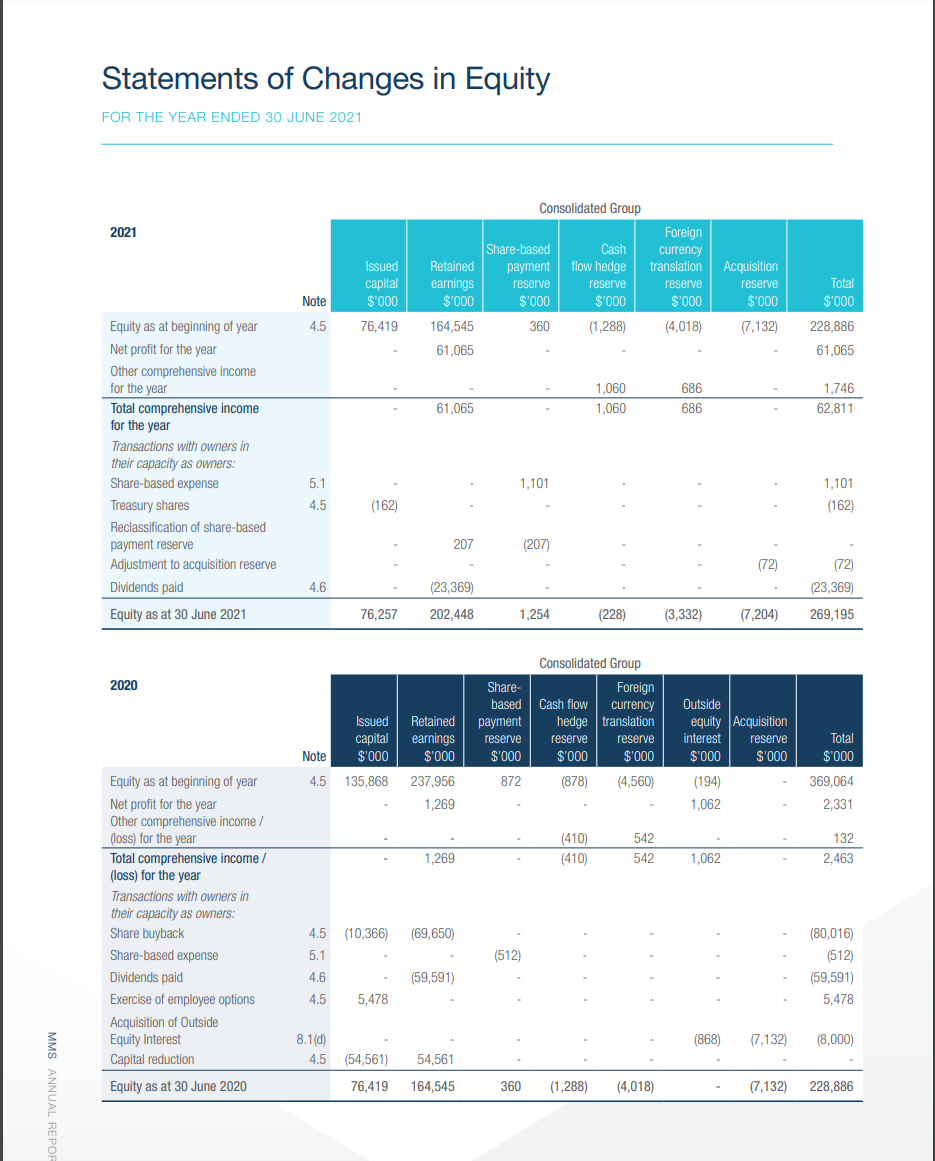

Their disclosure is in compliance with the requirements of relevant accounting standard? Statements of Changes in Equity FOR THE YEAR ENDED 30 JUNE 2021 Parent

Their disclosure is in compliance with the requirements of relevant accounting standard?

Statements of Changes in Equity FOR THE YEAR ENDED 30 JUNE 2021 Parent 2021 Issued capital $'000 Retained Share-based earnings payment reserve $'000 $'000 Cash flow hedge reserve $'000 Total $'000 Note 4.5 76,419 360 76,779 173,638 173,638 173,638 173,638 Equity as at beginning of year Profit attributable to owners of the Company Other comprehensive income for the year Total comprehensive income for the year Transactions with owners in their capacity as owners: Share-based expense Treasury shares Reclassification of share-based payment reserve Dividends paid 5.1 1,101 1,101 (162) (162) (207) 207 (23,369) 4.6 (23,369) 227,987 Equity as at 30 June 2021 76,257 150,476 1,254 Parent 2020 Issued capital $'000 Retained Share-based earnings payment reserve $'000 $'000 95,726 872 Note Cash flow hedge reserve $'000 62 Total $'000 4.5 135,868 232,528 (21,046) (21,046) (62) (62) (62) (21,108) (21,046) Equity as at beginning of year Loss attributable to owners of the Company Other comprehensive loss for the year Total comprehensive loss for the year Transactions with owners in their capacity as owners: Share buyback Share-based expense Dividends paid Exercise of employee options Capital reduction Equity as at 30 June 2020 4.5 (10,366) (69,650) (512) (80,016) (512) (59,591) ) 5,478 5.1 4.6 4.5 4.5 (59,591) 5,478 (54,561) 54,561 76,419 360 76,779 MMS ANNUA Statements of Changes in Equity FOR THE YEAR ENDED 30 JUNE 2021 Consolidated Group 2021 Issued capital $'000 ' 76,419 Retained earnings $'000 Share-based Cash payment flow hedge reserve reserve $'000 $'000 360 (1,288) Foreign currency translation Acquisition reserve reserve $'000 $'000 (4,018) 7,132) Total $'000 Note 4.5 164,545 228,886 61,065 61,065 1,060 1,060 686 686 1,746 62,811 61,065 Equity as at beginning of year Net profit for the year Other comprehensive income for the year Total comprehensive income for the year Transactions with owners in their capacity as owners: Share-based expense Treasury shares Reclassification of share-based payment reserve Adjustment to acquisition reserve Dividends paid Equity as at 30 June 2021 1,101 5.1 4.5 1,101 (162) (162) 207 (207) (72) 4.6 (23,369) (72) (23,369) 269,195 76,257 202,448 1,254 (228) (3,332) (7,204) 2020 Consolidated Group Share- Foreign based Cash flow currency payment hedge translation reserve reserve reserve $'000 $'000 $'000 872 (878) (4,560) Outside equity Acquisition interest reserve $'000 $'000 Issued Retained capital earnings Note $'000 $'000 4.5 135,868 237,956 1,269 Total $'000 369,064 2,331 (194) 1,062 (410) (410) 542 542 132 2,463 1,269 1.062 Equity as at beginning of year Net profit for the year Other comprehensive income / (loss) for the year Total comprehensive income / (loss) for the year Transactions with owners in their capacity as owners: Share buyback Share-based expense Dividends paid Exercise of employee options Acquisition of Outside Equity Interest Capital reduction (69,650) (512) 4.5 (10,366) 5.1 4.6 4.5 5,478 (80,016) (512) (59,591) 5,478 (59,591) (868) 7,132) (8,000) 8.1(d) 4.5 (54,561) 54,561 MMS ANNUAL REPO Equity as at 30 June 2020 76,419 164,545 360 (1,288) (4,018) (7,132) 228,886 Statements of Changes in Equity FOR THE YEAR ENDED 30 JUNE 2021 Parent 2021 Issued capital $'000 Retained Share-based earnings payment reserve $'000 $'000 Cash flow hedge reserve $'000 Total $'000 Note 4.5 76,419 360 76,779 173,638 173,638 173,638 173,638 Equity as at beginning of year Profit attributable to owners of the Company Other comprehensive income for the year Total comprehensive income for the year Transactions with owners in their capacity as owners: Share-based expense Treasury shares Reclassification of share-based payment reserve Dividends paid 5.1 1,101 1,101 (162) (162) (207) 207 (23,369) 4.6 (23,369) 227,987 Equity as at 30 June 2021 76,257 150,476 1,254 Parent 2020 Issued capital $'000 Retained Share-based earnings payment reserve $'000 $'000 95,726 872 Note Cash flow hedge reserve $'000 62 Total $'000 4.5 135,868 232,528 (21,046) (21,046) (62) (62) (62) (21,108) (21,046) Equity as at beginning of year Loss attributable to owners of the Company Other comprehensive loss for the year Total comprehensive loss for the year Transactions with owners in their capacity as owners: Share buyback Share-based expense Dividends paid Exercise of employee options Capital reduction Equity as at 30 June 2020 4.5 (10,366) (69,650) (512) (80,016) (512) (59,591) ) 5,478 5.1 4.6 4.5 4.5 (59,591) 5,478 (54,561) 54,561 76,419 360 76,779 MMS ANNUA Statements of Changes in Equity FOR THE YEAR ENDED 30 JUNE 2021 Consolidated Group 2021 Issued capital $'000 ' 76,419 Retained earnings $'000 Share-based Cash payment flow hedge reserve reserve $'000 $'000 360 (1,288) Foreign currency translation Acquisition reserve reserve $'000 $'000 (4,018) 7,132) Total $'000 Note 4.5 164,545 228,886 61,065 61,065 1,060 1,060 686 686 1,746 62,811 61,065 Equity as at beginning of year Net profit for the year Other comprehensive income for the year Total comprehensive income for the year Transactions with owners in their capacity as owners: Share-based expense Treasury shares Reclassification of share-based payment reserve Adjustment to acquisition reserve Dividends paid Equity as at 30 June 2021 1,101 5.1 4.5 1,101 (162) (162) 207 (207) (72) 4.6 (23,369) (72) (23,369) 269,195 76,257 202,448 1,254 (228) (3,332) (7,204) 2020 Consolidated Group Share- Foreign based Cash flow currency payment hedge translation reserve reserve reserve $'000 $'000 $'000 872 (878) (4,560) Outside equity Acquisition interest reserve $'000 $'000 Issued Retained capital earnings Note $'000 $'000 4.5 135,868 237,956 1,269 Total $'000 369,064 2,331 (194) 1,062 (410) (410) 542 542 132 2,463 1,269 1.062 Equity as at beginning of year Net profit for the year Other comprehensive income / (loss) for the year Total comprehensive income / (loss) for the year Transactions with owners in their capacity as owners: Share buyback Share-based expense Dividends paid Exercise of employee options Acquisition of Outside Equity Interest Capital reduction (69,650) (512) 4.5 (10,366) 5.1 4.6 4.5 5,478 (80,016) (512) (59,591) 5,478 (59,591) (868) 7,132) (8,000) 8.1(d) 4.5 (54,561) 54,561 MMS ANNUAL REPO Equity as at 30 June 2020 76,419 164,545 360 (1,288) (4,018) (7,132) 228,886Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started