Answered step by step

Verified Expert Solution

Question

1 Approved Answer

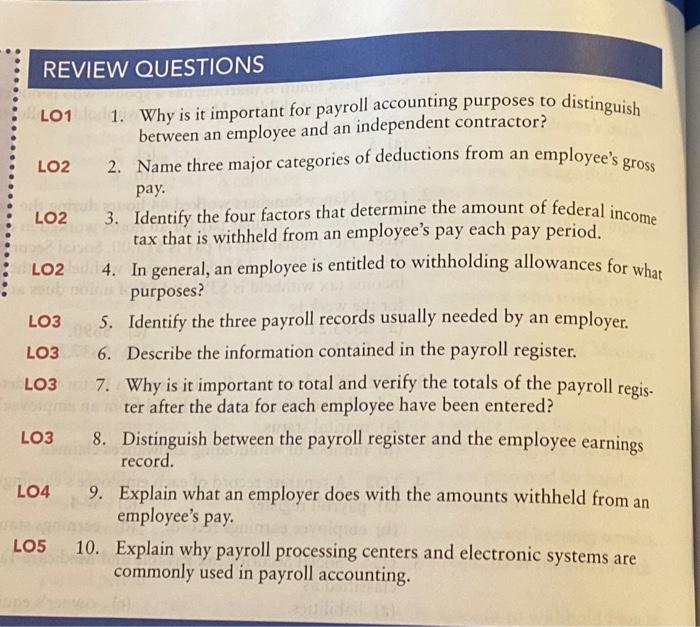

REVIEW QUESTIONS 100 LO1 LO2 LO2 LO2 TIPS 20 1. Why is it important for payroll accounting purposes to between an employee and an independent

REVIEW QUESTIONS 100 LO1 LO2 LO2 LO2 TIPS 20 1. Why is it important for payroll accounting purposes to between an employee and an independent contractor? 2. Name three major categories of deductions from an employee's gross pay. LO3 LO3 LO3 LO37. LO4 distinguish 3. Identify the four factors that determine the amount of federal income tax that is withheld from an employee's pay each pay period. 4. In general, an employee is entitled to withholding allowances for what purposes? 5. Identify the three payroll records usually needed by an employer. 6. Describe the information contained in the payroll register. Why is it important to total and verify the totals of the payroll regis- ter after the data for each employee have been entered? 8. Distinguish between the payroll register and the employee earnings record. 9. Explain what an employer does with the amounts withheld from an employee's pay. LO5 10. Explain why payroll processing centers and electronic systems are commonly used in payroll accounting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started