(Review Questions) Need help figuring out how they got the answers for the last 4 questions (22-25).

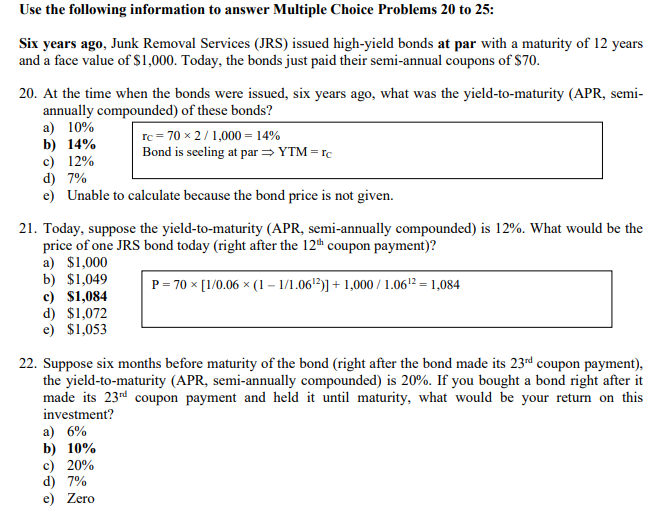

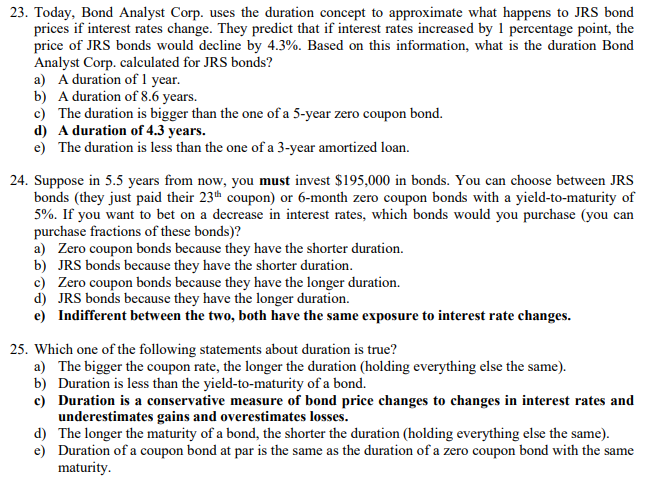

Use the following information to answer Multiple Choice Problems 20 to 25: Six years ago, Junk Removal Services (JRS) issued high-yield bonds at par with a maturity of 12 years and a face value of $1,000. Today, the bonds just paid their semi-annual coupons of $70. 20. At the time when the bonds were issued, six years ago, what was the yield-to-maturity (APR, semi- annually compounded) of these bonds? a) 10% b) 14% re = 70 * 2 / 1,000 = 14% c) 12% Bond is seeling at par = YTM = IC 7% e) Unable to calculate because the bond price is not given. 21. Today, suppose the yield-to-maturity (APR, semi-annually compounded) is 12%. What would be the price of one JRS bond today (right after the 12th coupon payment)? a) $1,000 b) $1,049 P =70 x [1/0.06 * (1 - 1/1.06 2)] + 1,000 / 1.0612 = 1,084 c) $1,084 ) $1,072 e) $1,053 22. Suppose six months before maturity of the bond (right after the bond made its 23"d coupon payment), the yield-to-maturity (APR, semi-annually compounded) is 20%. If you bought a bond right after it made its 23" coupon payment and held it until maturity, what would be your return on this investment? a) 6% b) 10% c) 20% 1 7% e) Zero23. 24. 25. Today. Bond Analyst Corp. uses the duration concept to approximate what happens to IRS bond prices if interest rates change. They predict that if' interest rates increased by 1 percentage point, the price of IRS bonds would decline by 4.3%. Based on this information, what is the duration Bond Analyst Corp. calculated for IRS bonds? a} Adoration of 1 year. b} A duration of 3.15 years. c} The duration is bigger than the one of a Svyear zero coupon bond. d} A duration of 4.3 years. e} The duration is less than the one of a 3year amortized loan. Supmse in 5.5 years from now, you must invest $195,l} in bonds. You can choose between JRS bonds [they just paid their 23* coupon} or vnionth zero coupon bonds with a yield~to~maturity of' 5%. If you want to bet on a decrease in interest rates, which bonds would you purchase {you can purchase fractions of these bonds}? a} Zero coupon bonds because they have the shorter duration. b} JRS bonds because they have the shorter duration. c) Zero coupon bonds because they have the longer duration. d} JRS bonds because they have the longer duration. e} Indifferent between the two, both have the same exposure to interest rate changes. Which one of the following statements about duration is true? a) The bigger the coupon rateI the longer the duration {holding everything else the same}. b) Duration is less than the yieldtomatnrity of a bond. 1:} Duration is a conservative measure of bond price changes to changes in interest rates and underestimates gains and overestimates losses. d) The longer the maturity of a bond, the shorter the duration {holding everything else the same}. e) Duration of a coupon bond at par is the same as the duration of a zero coupon bond with the same maturity