Question

1. Read the accounts receivable narrative (AR.1.1) and review the sales and accounts receivable flowchart (AR.1.2). Review the narrative and flowchart to identify all of

1. Read the accounts receivable narrative (AR.1.1) and review the sales and accounts receivable flowchart (AR.1.2). Review the narrative and flowchart to identify all of the internal control weaknesses for the accounts receivable and sales processes. Provide one or two sentences on why each item identified is a weakness. This question relates to Step 2 of the Garcia and Foster Audit Plan.

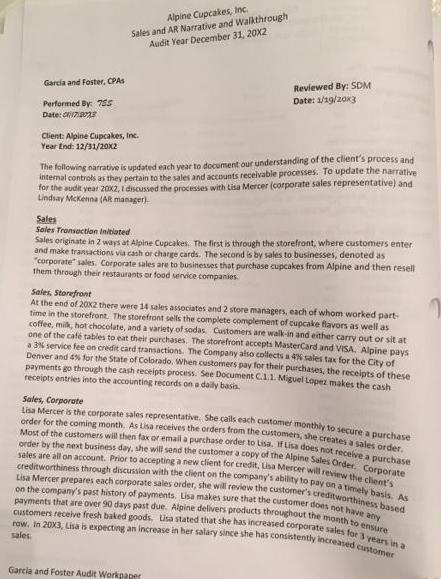

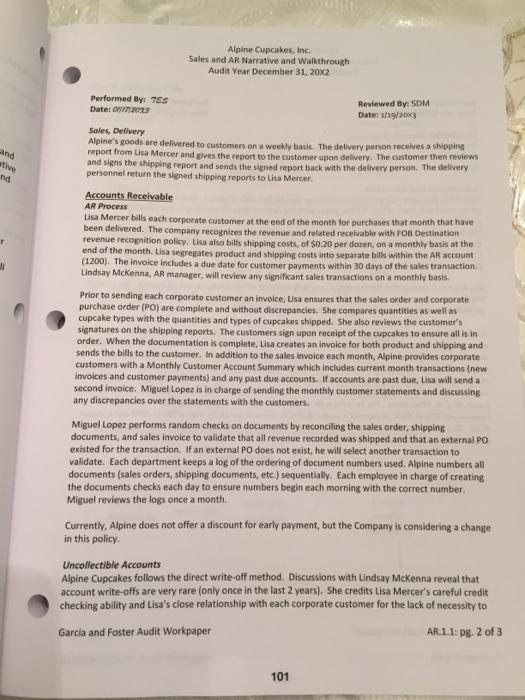

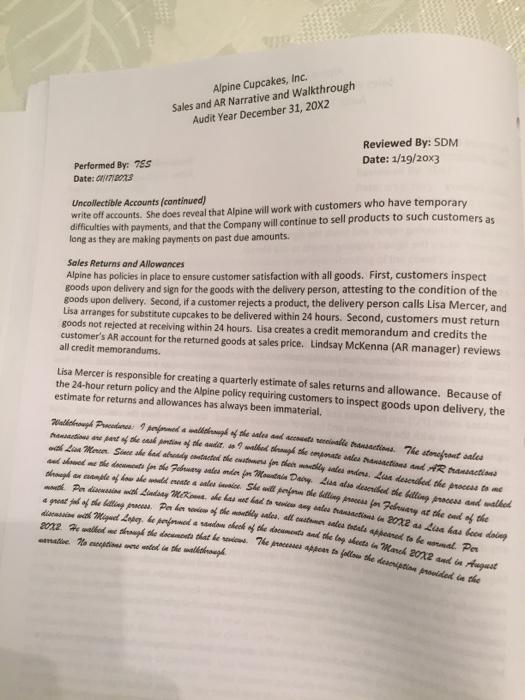

The internal control weaknesses in sales and accounts receivable are the lack of segregation of duties, and Irregular checkups. The lack of segregated duties is the main weakness the Alpine has. Lisa mercer does everything relating to sales right from Receiving a PO from customer to shipping the goods and also performs a lot in accounts receivable controls. The documents are only reviewed once per month which is not okay considering that transactions occur everyday.

2. Based on your review of the account receivable - test of control procedures (workpapers AR.2.1 to AR.2.4), you believe that there were some issues with the audit work performed. You decide to review in detail the auditing procedures from the audit program and the related documentation. You are particularly concerned about their implementation of the attribute sampling procedures—their sample selection process and evaluation of the results. Identify any of the following issues: a. Did they perform all of the steps associated with the audit program? b. Did they perform the steps accurately? If not, then specifically state the nature of the problem and follow up on it to the extent possible with the information given. c. Do you see any other issues or problems with the auditors' work or client documentation?

3. Review the account receivable lead sheet memo and related workpapers (AR.3.1 through AR.3.4). Evaluate the auditor's tick marks, comments and explanations in the memo and on the lead sheet. This question relates to Step 4 of the Garcia and Foster Audit Plan. Identify any of the following issues: a. Did they perform all of the steps associated with the AR.3 audit procedure? b. Did they perform the steps accurately? If not, then specifically state the nature of the problem and follow up on it to the extent possible with the information given. c. Do you see any other issues or problems with the auditors' work or client documentation?

4. You are concerned about the adequacy of the substantive audit work done by Garcia and Foster. You decide to carefully and in detail review the account receivable aging substantive testing (AR.4.1-AR.4.5), account receivable confirmation testing (AR.5.1-AR.5.8), sales cutoff testing (AR.6.1-AR.6.7), and the testing of the allowance for doubtful accounts (AR.7.1). This question relates to Step 4 of the Garcia and Foster Audit Plan. Identify any of the following issues:

a. Did they perform all of the steps associated with the audit program?

b. Did they perform the steps accurately? If not, then specifically state the nature of the problem and follow up on it to the extent possible with the information given. c. Do you see any other issues or problems with the auditors' work or client documentation?

5. After answering the above questions, create a professional memo to the firm's partner (Anna Garcia) summarizing your findings for questions 2, 3, 4 and 5. The memo should be one page or less single-spaced. a. Identify the areas of the audit that need improvements. b. Provide feedback on ways to improve their audit of the account receivable and sales processes. c. Use constructive criticism with the knowledge that someday you could be applying for a job with Garcia and Foster, CPAs.

Review the accounts receivable narrative (AR.1.1) and review the accounts receivable flowchart (AR. 1.2) to identify all of the internal control weaknesses for the accounts receivable and sales processes. Provide one or two sentences on why each item identified is a weakness. This ques

Step by Step Solution

3.44 Rating (189 Votes )

There are 3 Steps involved in it

Step: 1

Memo To Anna Garcia Partner From Assistant Date Date Subject Findings and Recommendations for Improving the Audit of Accounts Receivable and Sales Processes I have reviewed the audit work performed by ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started