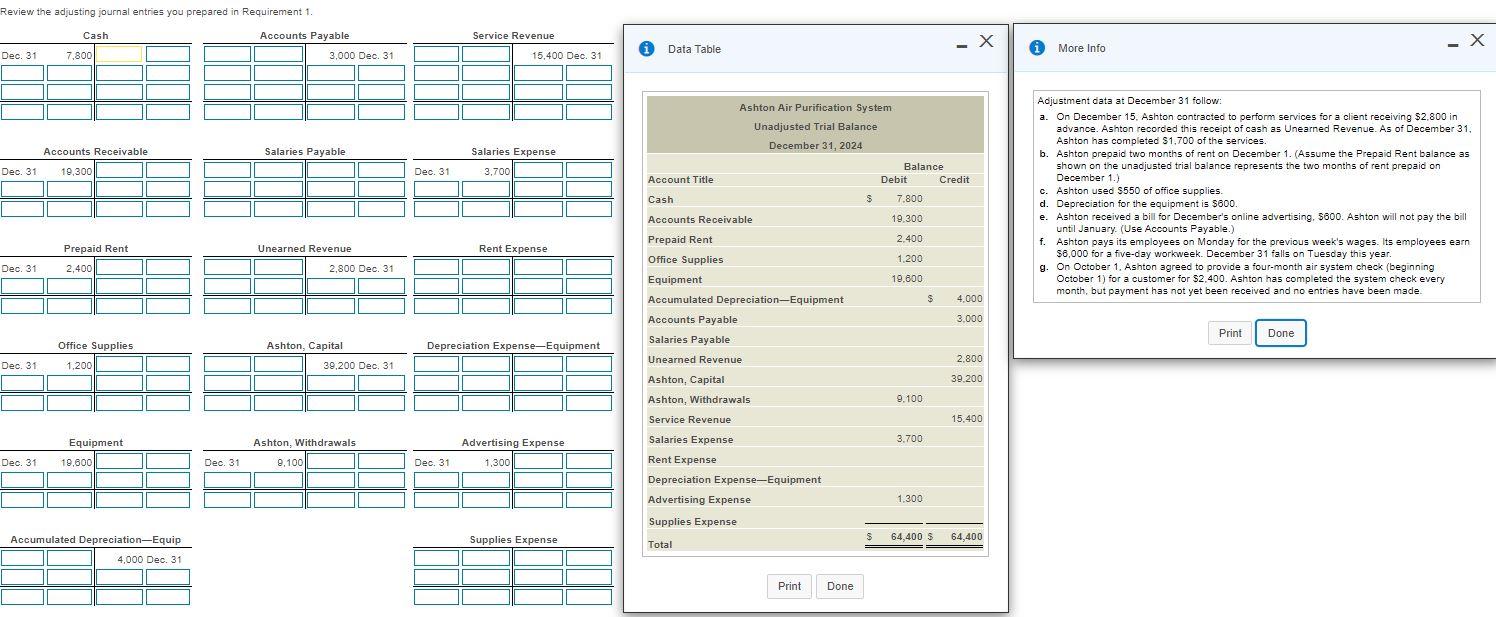

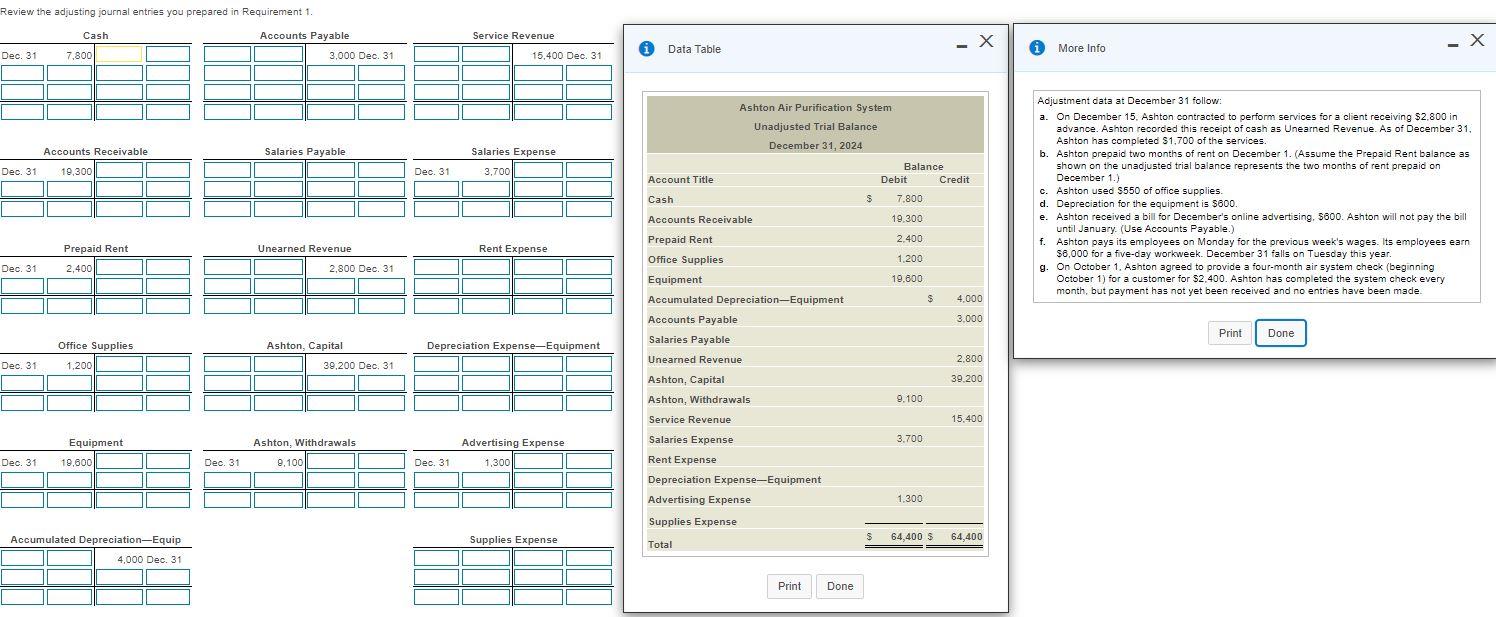

Review the adjusting journal entries you prepared in Requirement 1. Cash Service Revenue Accounts Payable 3,000 Dec. 31 -X - X Data Table More Info Dec. 31 7,800 15,400 Dec. 31 Ashton Air Purification System Unadjusted Trial Balance December 31, 2024 Accounts Receivable Salaries Payable Salaries Expense Dec. 31 19,300 Dec. 31 3,700 Balance Debit Credit Account Title Cash S 7.800 Adjustment data at December 31 follow: a. On December 15. Ashton contracted to perform services for a client receiving $2,800 in advance. Ashton recorded this receipt of cash as Unearned Revenue. As of December 31, Ashton has completed $1,700 of the services. b. Ashton prepaid two months of rent on December 1. (Assume the Prepaid Rent balance as shown on the unadjusted trial balance represents the two months of rent prepaid on December 1.) c. Ashton used $550 of office supplies d. Depreciation for the equipment is $600. e. Ashton received a bill for December's online advertising, 5800. Ashton will not pay the bill until January (Use Accounts Payable.) f. Ashton pays its employees on Monday for the previous week's wages. Its employees earn $8,000 for a five-day workweek. December 31 falls on Tuesday this year. g. On October 1. Ashton agreed to provide a four-month air system check (beginning October 1) for a customer for $2.400. Ashton has completed the system check every month, but payment has not yet been received and no entries have been made. Accounts Receivable 19.300 Prepaid Rent 2.400 Prepaid Rent Unearned Revenue Rent Expense 1,200 Dec. 31 2,400 2,800 Dec. 31 19,600 Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable $ 4,000 3,000 Print Done Office Supplies Depreciation Expense-Equipment Salaries Payable Ashton, Capital 39,200 Dec. 31 2,800 Dec. 31 1,200 Unearned Revenue Ashton, Capital Ashton, Withdrawals 39.200 9.100 Service Revenue 15,400 Equipment Ashton, Withdrawals Advertising Expense 3.700 Dec. 31 19,600 Dec. 31 9,100 Dec. 31 1,300 Salaries Expense Rent Expense Depreciation Expense-Equipment Advertising Expense Supplies Expense 1.300 S Supplies Expense 64,400 S 64,400 Accumulated Depreciation-Equip 4,000 Dec. 31 Total Print Done