Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review the attached 2022 financial statements from JB Hi-Fi (notes have been excluded for the purposes of this question). JB Hifi Financial Statements, excluding

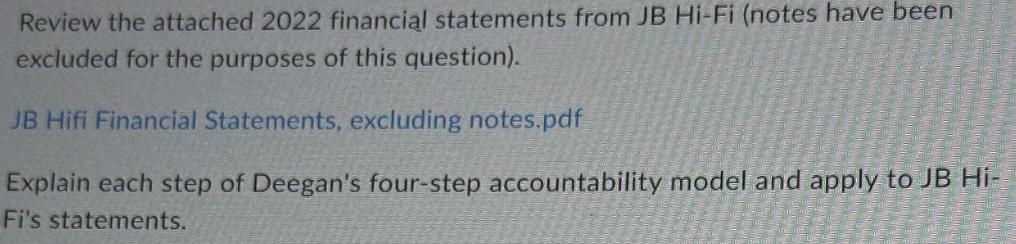

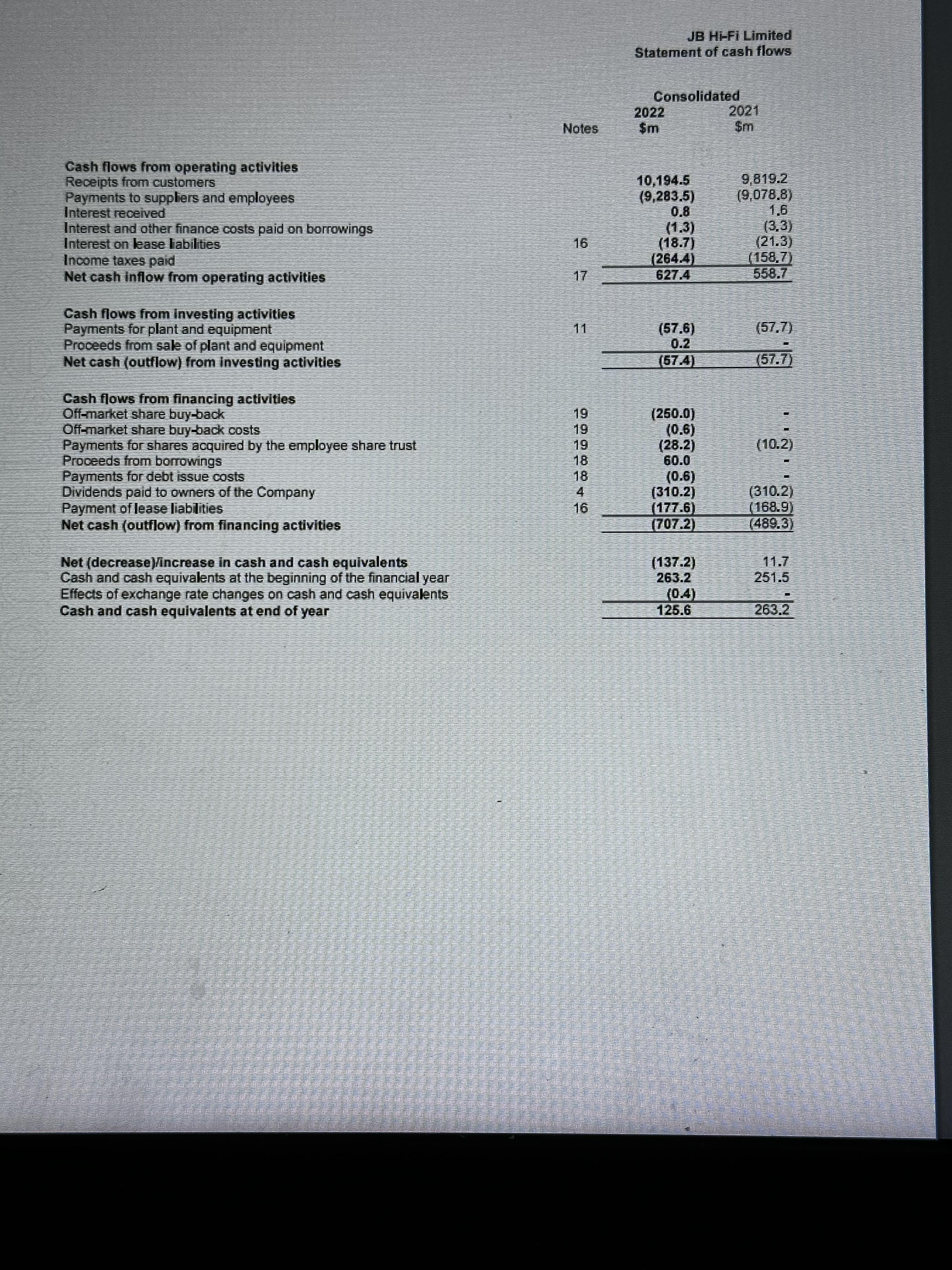

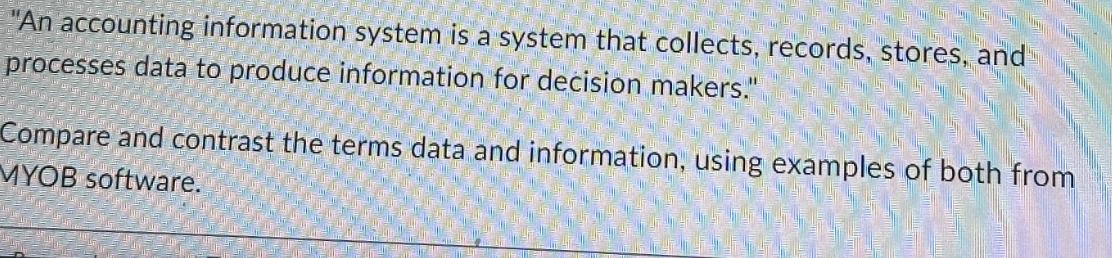

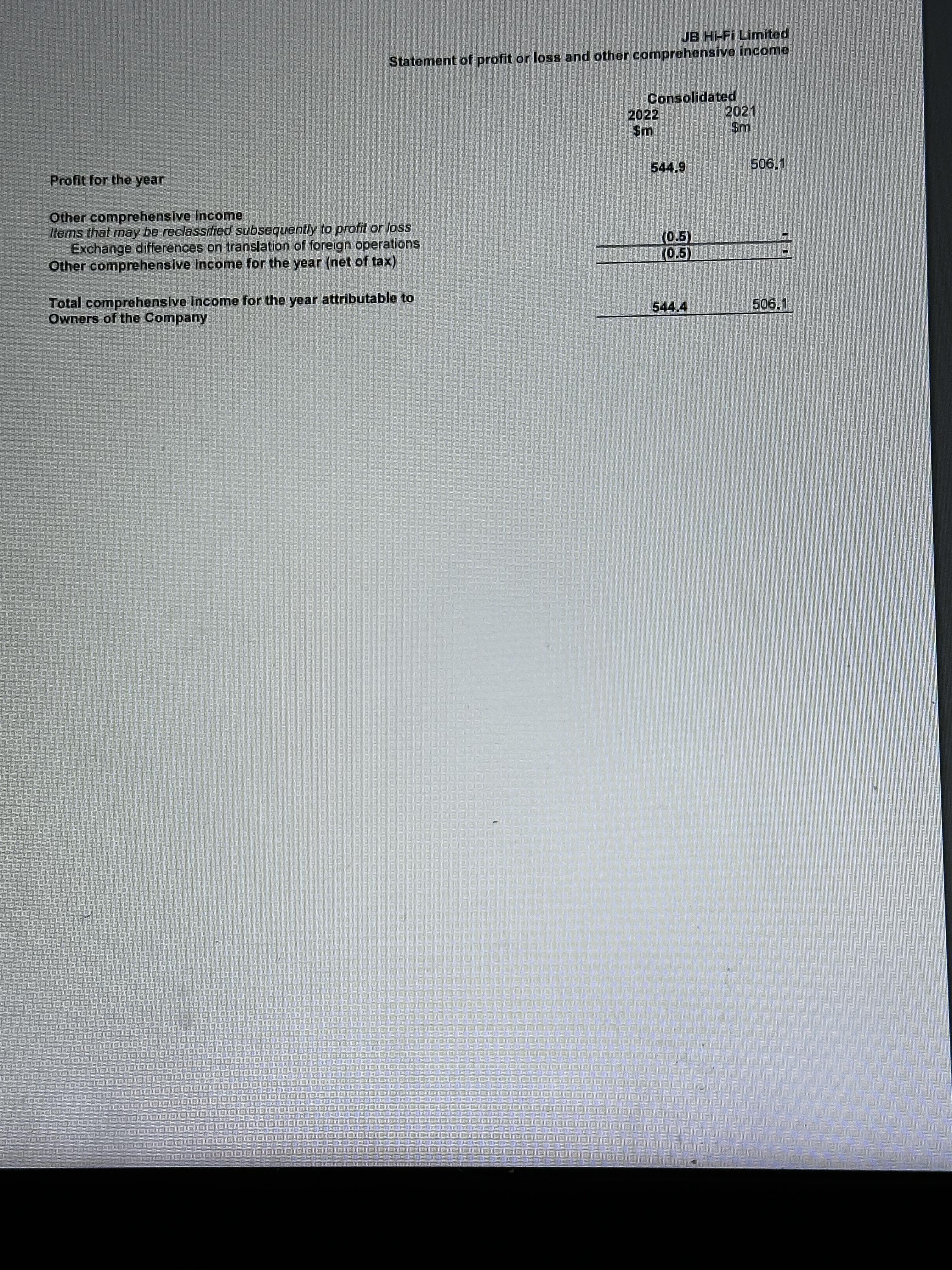

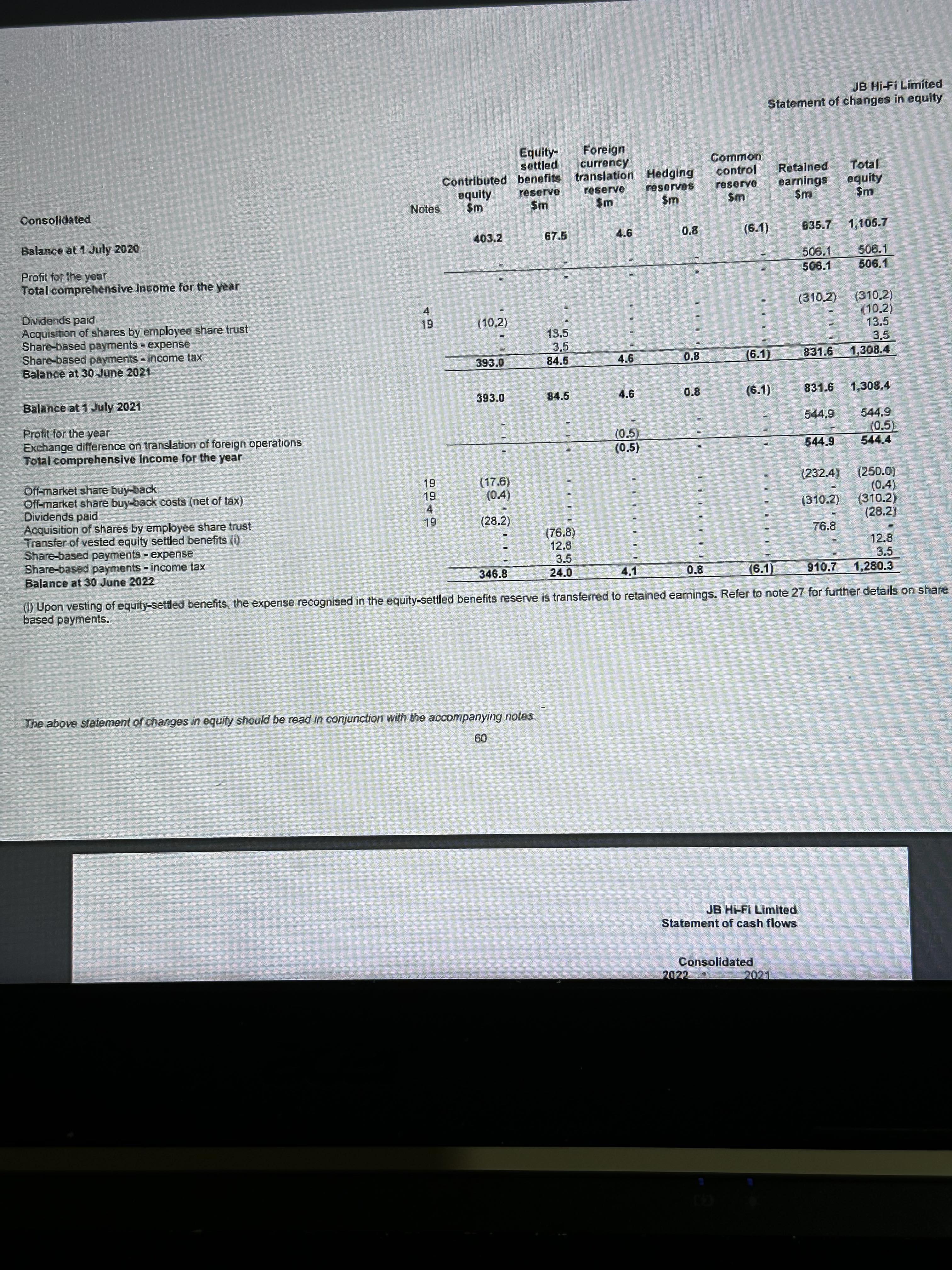

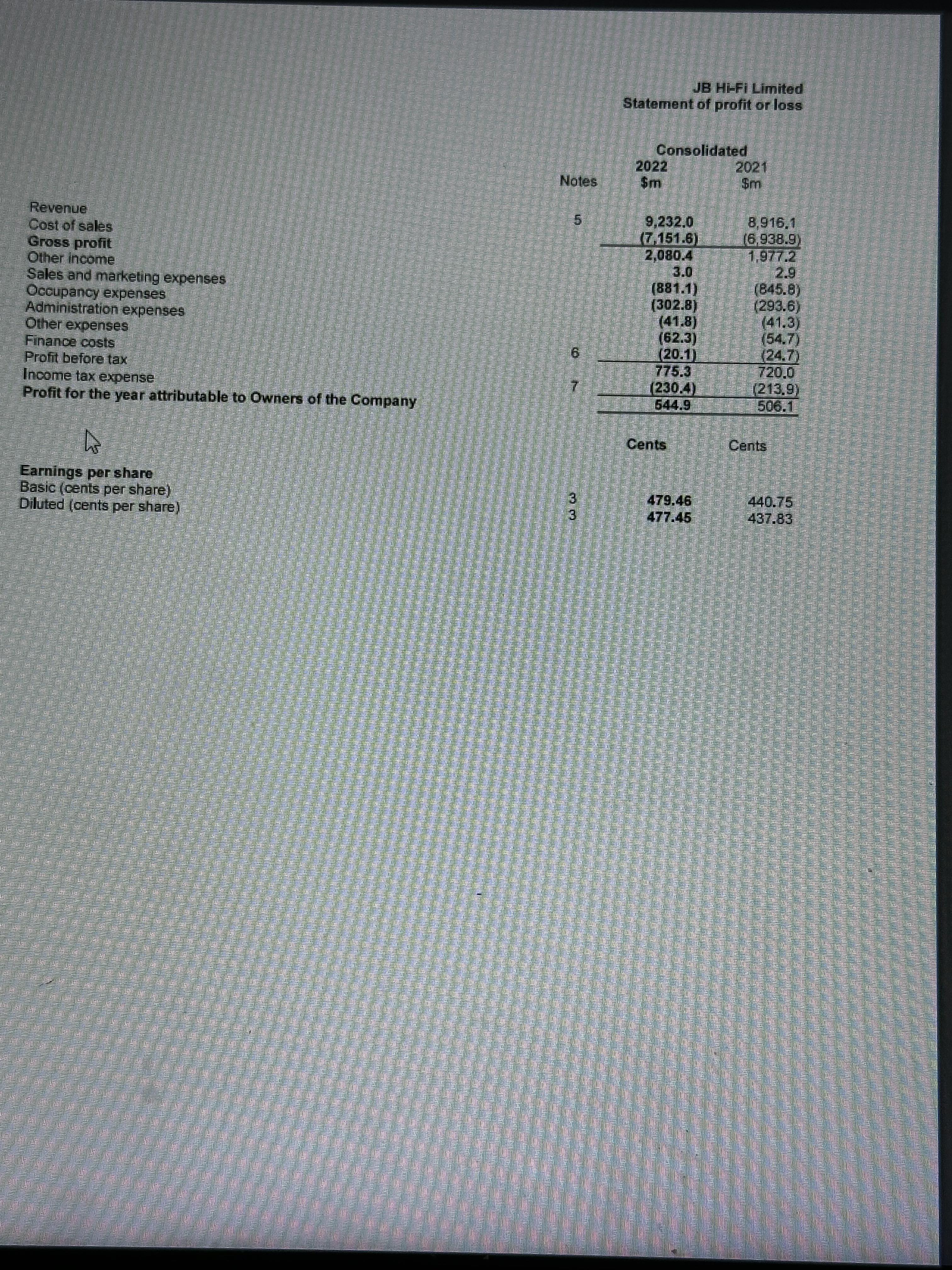

Review the attached 2022 financial statements from JB Hi-Fi (notes have been excluded for the purposes of this question). JB Hifi Financial Statements, excluding notes.pdf Explain each step of Deegan's four-step accountability model and apply to JB Hi- Fi's statements. Cash flows from operating activities Receipts from customers Payments to suppliers and employees Interest received Interest and other finance costs paid on borrowings Interest on lease liabilities Income taxes paid Net cash inflow from operating activities Cash flows from investing activities JB Hi-Fi Limited Statement of cash flows Consolidated 2022 Notes $m 2021 Sm 10,194.5 (9,283.5) 9,819.2 (9,078.8) 0.8 1,6 (1.3) (3,3) 16 (18.7) (21.3) 1264.4) (158,7) 627.4 558.7 Payments for plant and equipment Proceeds from sale of plant and equipment Net cash (outflow) from Investing activities Cash flows from financing activities Off-market share buy-back Off-market share buy-back costs Payments for shares acquired by the employee share trust Proceeds from borrowings Payments for debt issue costs Dividends paid to owners of the Company Payment of lease liabilities Net cash (outflow) from financing activities Net (decrease increase in cash and cash equivalents Cash and cash equivalents at the beginning of the financial year Effects of exchange rate changes on cash and cash equivalents Cash and cash equivalents at end of year 19 61 19 2 2 2 2 2 1 9 4 16 (57.6) (57.7) 0.2 (57.4) (57.7) (250.0) (0.6) (28.2) (10.2) 60.0 (0.6) (310.2) (310.2) (177.61 (168.9) (707.2) (489.3) (137.2) 11.7 263.2 251.5 (0.4) 125.6 263.2 ASSETS JB Hi-Fi Limited Balance sheet Consolidated 2022 Notes $m 2021 Sm Current assets Cash and cash equivalents Trade and other receivables Inventones Other current assets Total current assets Non-current assets Plant and equipment Deferred tax assets Intangible assets 17 125.6 269.2 9 132.6 8 1,135.3 938.8 10 31.2 35.7 1.424.7 1,340.5 11 169.0 169.0 7 30.6 12 1,031.4 1.031.4 Right-of-use assets 16 461.6 536.3 Other non-current assets 10 44.1 39.0 Total non-current assets 1.736.7 1.806.0 Total assets 3,161.4 3,146.5 LIABILITIES Current liabilities Trade and other payables 721.6 668.6 Deferred revenue 14 253.5 212.9 Provisions 15 109.4 105.8 Lease liabilities 16 167.0 167.3 Current tax liabilities 54.8 92,2 Total current liabilities 1,306.3 1.246.5 Non-current liabilities Borrowings 18 Deferred revenue Provisions 15 Lease liabilities 16 59.4 14 94.7 85.0 42.7 42.6 378.0 464.0 Total non-current liabilities 574.8 591.6 Total liabilities 1.881.1 1.838.1 Net assets 1,280.3 1.308.4 EQUITY Contributed equity 19 Reserves 20 346.8 22.8 393.0 83.8 Retained earnings Total equity 910.7 1,280.3 831.6 1,308.4 "An accounting information system is a system that collects, records, stores, and processes data to produce information for decision makers." Compare and contrast the terms data and information, using examples of both from MYOB software. JB Hi-Fi Limited Statement of profit or loss and other comprehensive income Profit for the year Other comprehensive Income Items that may be reclassified subsequently to profit or loss Exchange differences on translation of foreign operations Other comprehensive income for the year (net of tax) Consolidated 2022 $m 2021 Sm 544.9 506.1 (0.5) (0.5) Total comprehensive Income for the year attributable to Owners of the Company 544.4 506.1 JB Hi-Fi Limited Statement of changes in equity Equity- Foreign settled currency Common reserve Contributed benefits translation Hedging equity control Retained Total reserve Consolidated Balance at 1 July 2020 Profit for the year Total comprehensive income for the year Dividends paid Notes $m $m $m reserves Sm reserve earnings equity Sm Sm $m 403.2 67.5 4.6 10.8 (6.1) 635.7 1,105.7 506.1 506.1 506.1 506.1 Acquisition of shares by employee share trust 19 49 (310.2) (310,2) (10,2) (10.2) 13.5 Share-based payments-expense 13.5 3,5 Share-based payments - income tax 3.5 Balance at 30 June 2021 393.0 84.6 4.6 0.8 (6.1) 831.6 1,308.4 Balance at 1 July 2021 393.0 84.5 4.6 0.8 (6.1) 831.6 1,308.4 Profit for the year Exchange difference on translation of foreign operations Total comprehensive income for the year Off-market share buy-back Off-market share buy-back costs (net of tax) Dividends paid Acquisition of shares by employee share trust 544.9 544.9 (0.5) (0.5) (0.5) 544.9 544.4 Transfer of vested equity settled benefits (i) Share-based payments-expense Share-based payments - income tax Balance at 30 June 2022 346.8 19 19 (17.6) (0.4) 4 19 (28.2) (76.8) 12.8 3.5 24.0 4.1 (232.4) (250.0) (0.4) (310.2) (310.2) (28.2) 76.8 12.8 3.5 0.8 (6.1) 910.7 1,280.3 (1) Upon vesting of equity-settled benefits, the expense recognised in the equity-settled benefits reserve is transferred to retained earnings. Refer to note 27 for further details on share based payments. The above statement of changes in equity should be read in conjunction with the accompanying notes 60 JB Hi-Fi Limited Statement of cash flows Consolidated 2022 2021 JB Hi-Fi Limited Statement of profit or loss Consolidated 2022 2021 Notes $m $m Revenue Cost of sales Gross profit 5 9,232.0 8,916,1 (7.151.6) (6,938.9) 2,080.4 Occupancy expenses Other income Sales and marketing expenses Administration expenses Other expenses 3.0 1.977.2 2.9 (881.1) (845.8) [302.8) (293.6) (41.8) (41.3) (62.3) (54.7) Finance costs 6 (20.1) (24.7) Profit before tax 775.3 720.0 Income tax expense 7 (230.4) (213.9) Profit for the year attributable to Owners of the Company 544.9 506.1 D Cents Cents Earnings per share Basic (cents per share) Diluted (cents per share) LETT LET LT LE 1101 3 479.46 440.75 3 477.45 437.83 m

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started