Answered step by step

Verified Expert Solution

Question

1 Approved Answer

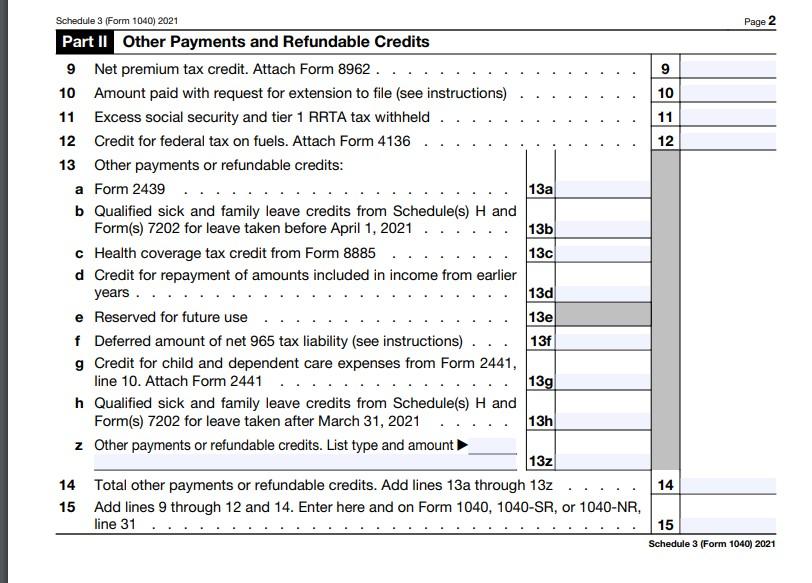

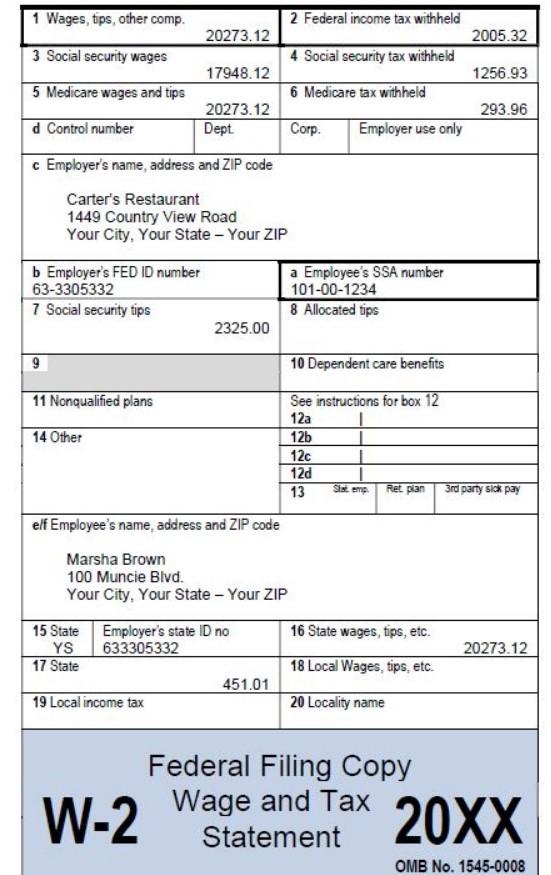

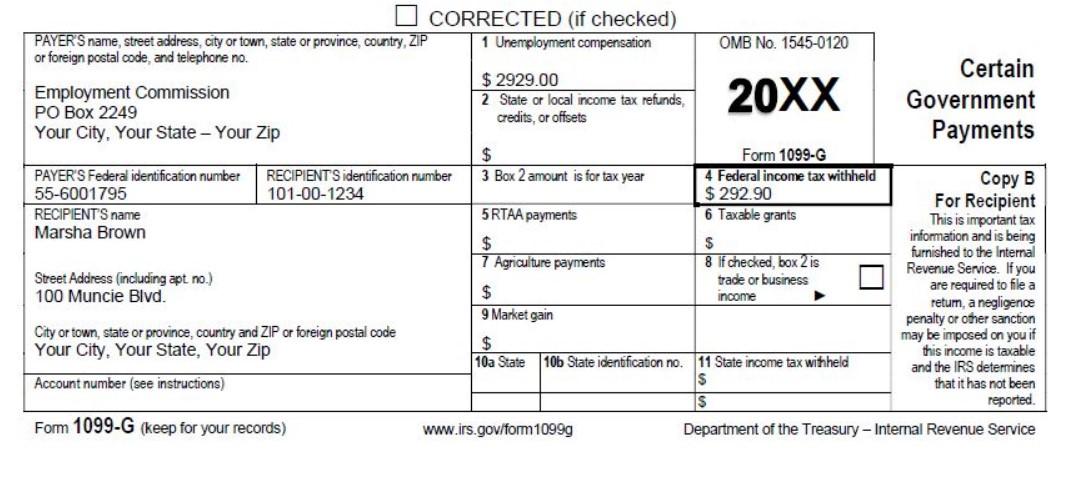

Review the attached tax forms (i.e., W-2 and Form 1099-G) and answer the following questions: What type of income is reported on those tax forms?

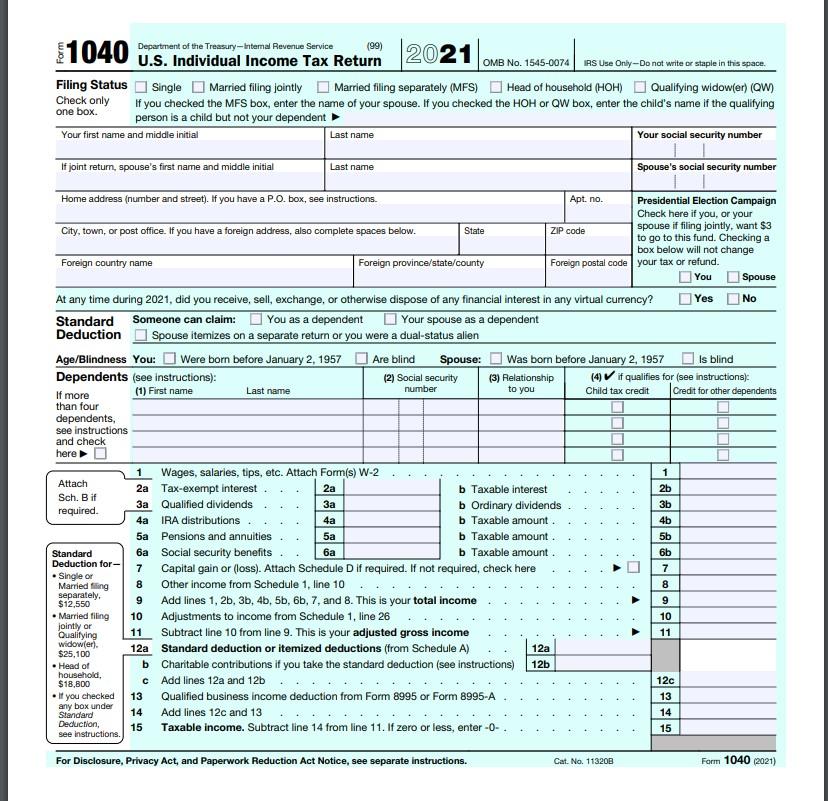

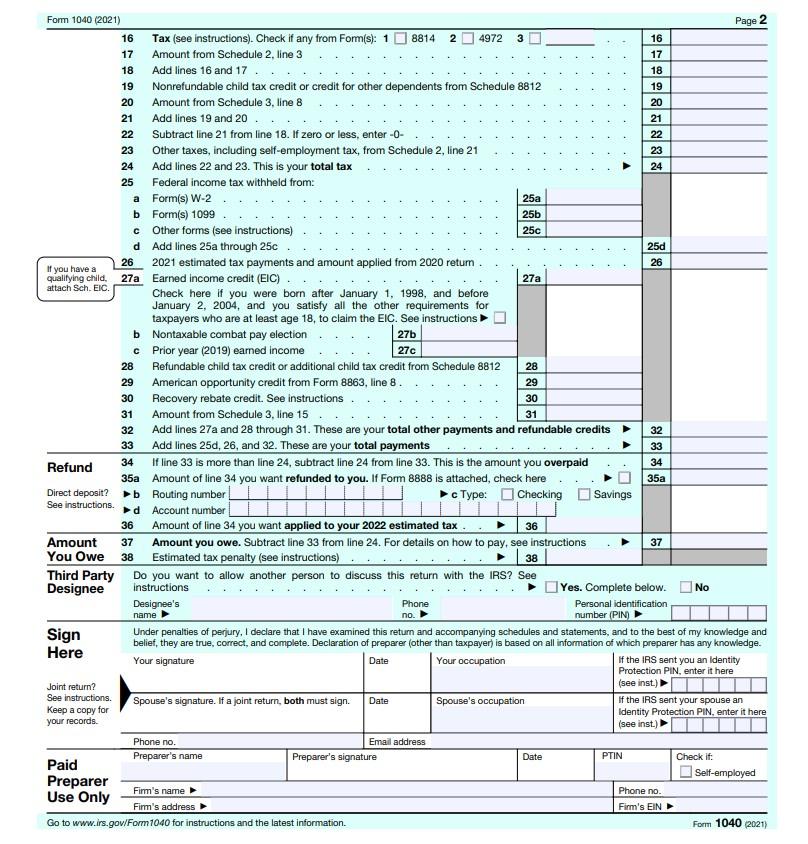

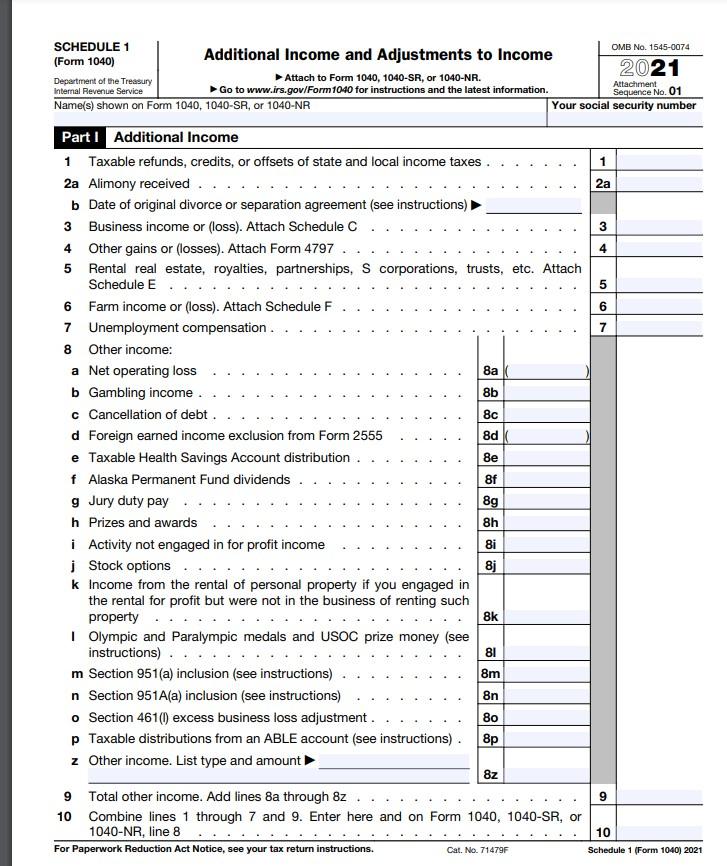

Review the attached tax forms (i.e., W-2 and Form 1099-G) and answer the following questions:

- What type of income is reported on those tax forms?

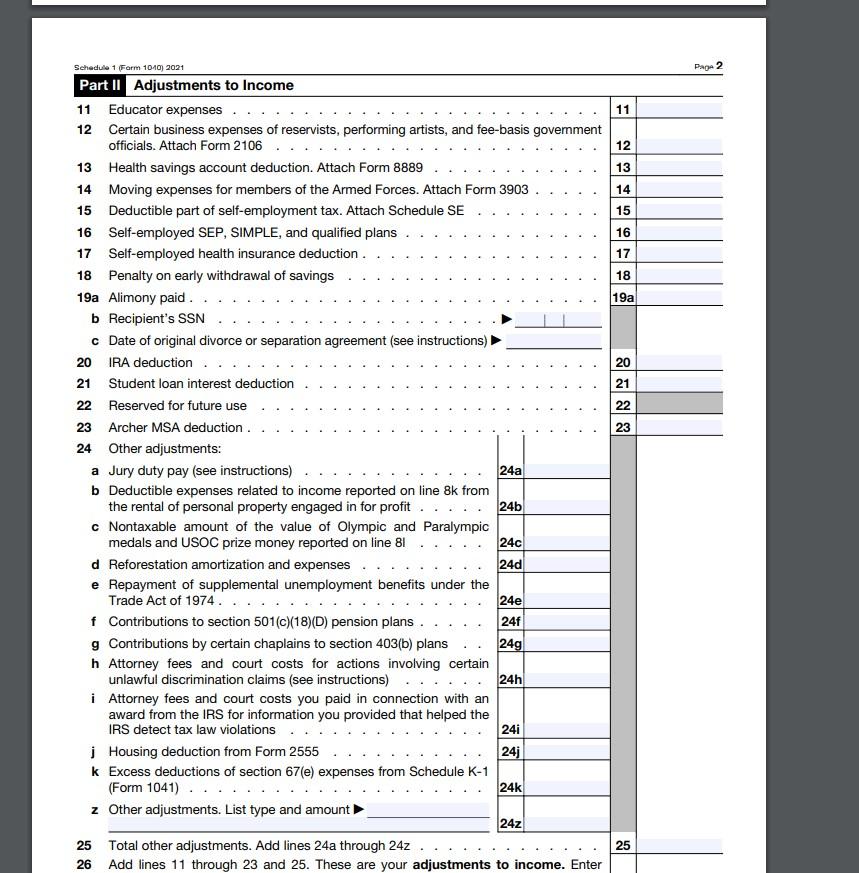

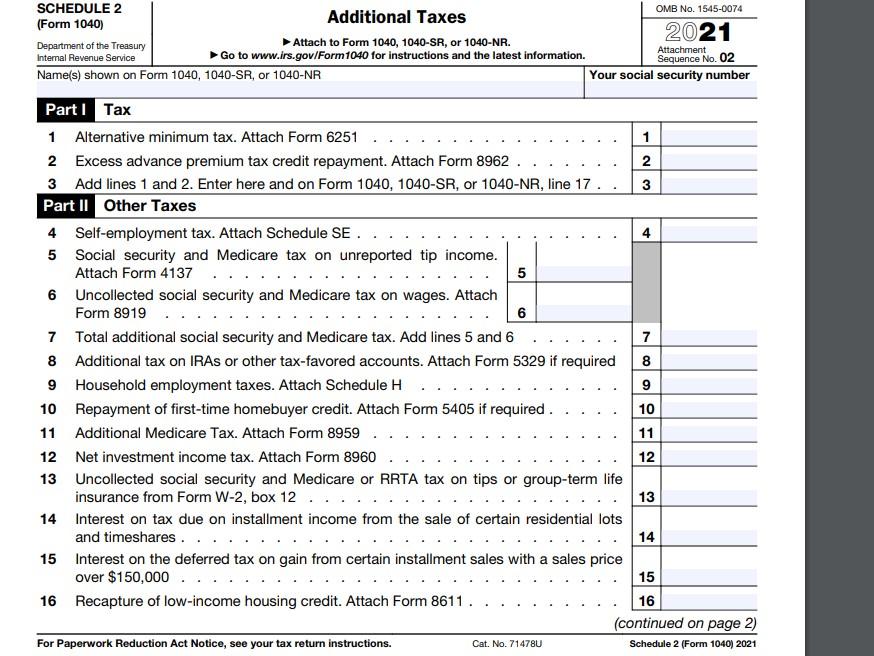

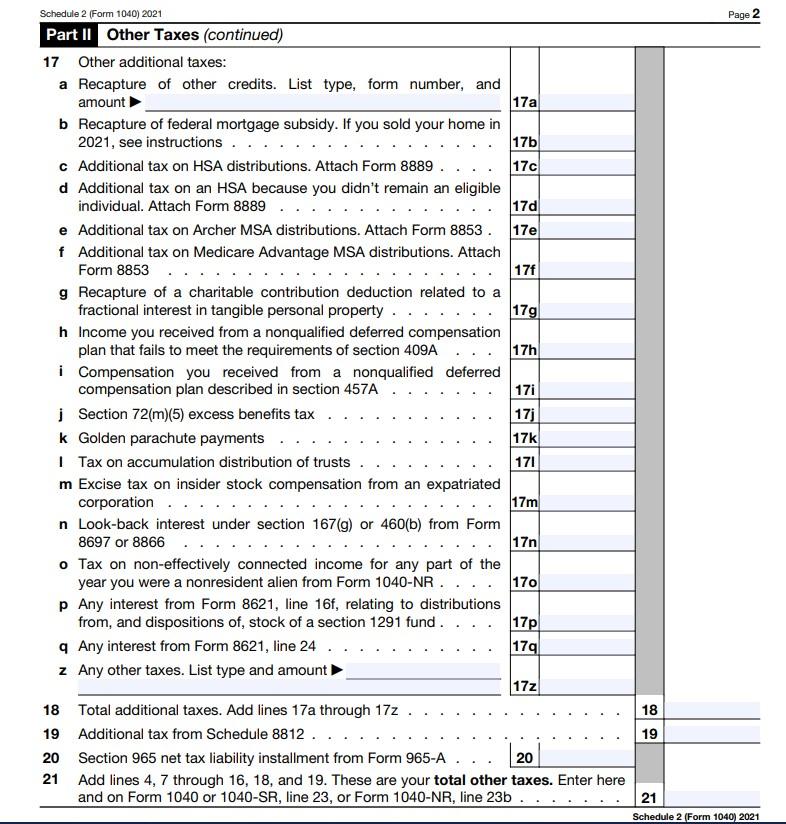

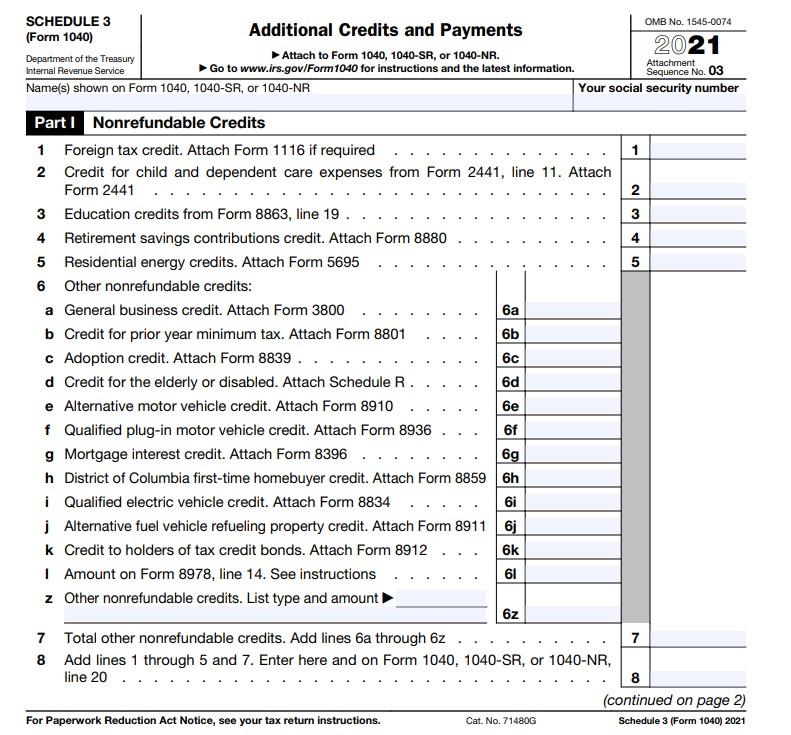

- Where would you report that income? Explain and state the tax form and/or schedule and the line number where the income would be reported. Please review Form 1040 (Links to an external site.) and Schedule 1 (Links to an external site.), Schedule 2 (Links to an external site.), and Schedule 3 (Links to an external site.).

- Is the income FOR AGI or FROM AGI? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started