- Review the audit risk model assessment and documentation . How should this assessment be altered to correctly reflect the appropriate risk assessment of the firm? How might the documentation of audit risk be improved?

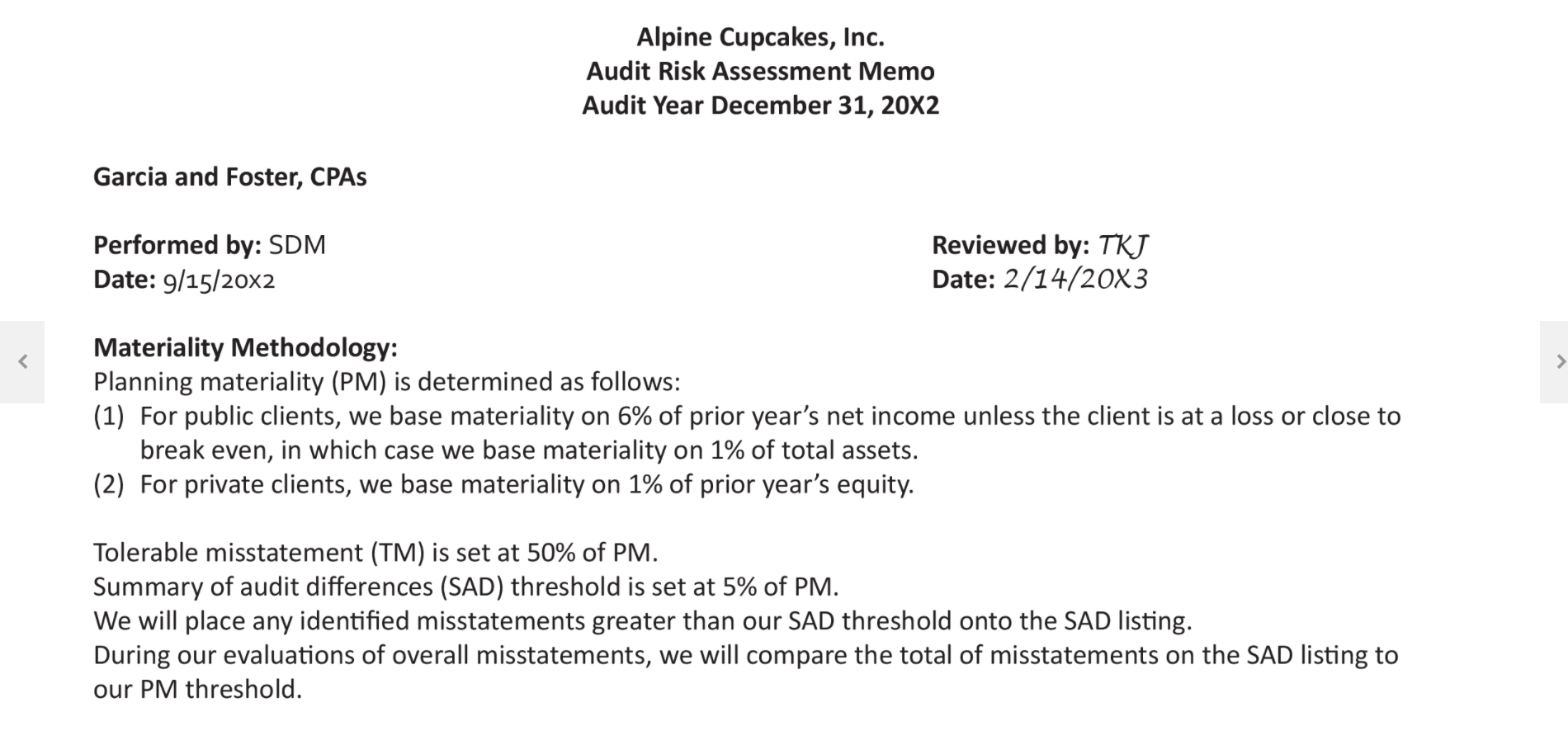

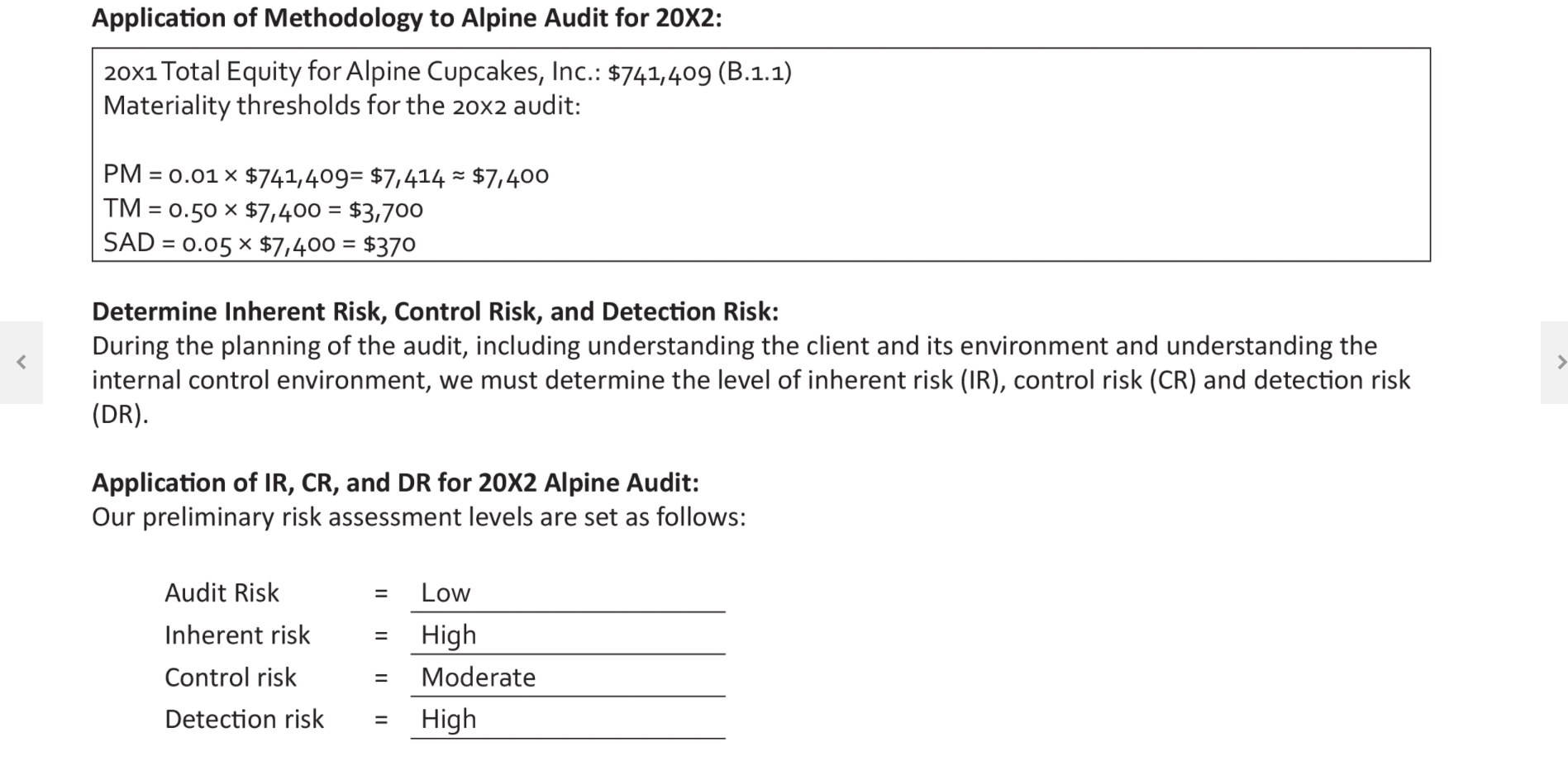

Alpine Cupcakes, Inc. Audit Risk Assessment Memo Audit Year December 31, 20X2 Garcia and Foster, CPAS Performed by: SDM Date: 9/15/20X2 Reviewed by: TKJ Date: 2/14/20X3 Materiality Methodology: Planning materiality (PM) letermined as follows: (1) For public clients, we base materiality on 6% of prior year's net income unless the client is at a loss or close to break even, in which case we base materiality on 1% of total assets. (2) For private clients, we base materiality on 1% of prior year's equity. Tolerable misstatement (TM) is set at 50% of PM. Summary of audit differences (SAD) threshold is set at 5% of PM. We will place any identified misstatements greater than our SAD threshold onto the SAD listing. During our evaluations of overall misstatements, we will compare the total of misstatements on the SAD listing to our PM threshold. Application of Methodology to Alpine Audit for 20x2: 20x1 Total Equity for Alpine Cupcakes, Inc.: $741,409 (B.1.1) Materiality thresholds for the 20x2 audit: PM = 0.01 * $741,409= $7,414 $7,400 TM = 0.50 x $7,400 = $3,700 SAD = 0.05 * $7,400 = $370 Application of IR, CR, and DR for 20x2 Alpine Audit: Our preliminary risk assessment levels are set as follows: = Low Audit Risk Inherent risk Control risk Detection risk High Moderate High = Alpine Cupcakes, Inc. Audit Risk Assessment Memo Audit Year December 31, 20X2 Garcia and Foster, CPAS Performed by: SDM Date: 9/15/20X2 Reviewed by: TKJ Date: 2/14/20X3 Materiality Methodology: Planning materiality (PM) letermined as follows: (1) For public clients, we base materiality on 6% of prior year's net income unless the client is at a loss or close to break even, in which case we base materiality on 1% of total assets. (2) For private clients, we base materiality on 1% of prior year's equity. Tolerable misstatement (TM) is set at 50% of PM. Summary of audit differences (SAD) threshold is set at 5% of PM. We will place any identified misstatements greater than our SAD threshold onto the SAD listing. During our evaluations of overall misstatements, we will compare the total of misstatements on the SAD listing to our PM threshold. Application of Methodology to Alpine Audit for 20x2: 20x1 Total Equity for Alpine Cupcakes, Inc.: $741,409 (B.1.1) Materiality thresholds for the 20x2 audit: PM = 0.01 * $741,409= $7,414 $7,400 TM = 0.50 x $7,400 = $3,700 SAD = 0.05 * $7,400 = $370 Application of IR, CR, and DR for 20x2 Alpine Audit: Our preliminary risk assessment levels are set as follows: = Low Audit Risk Inherent risk Control risk Detection risk High Moderate High =