Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review the case study Shrewsberry, herbal product, LTD QUESTIONS 1. Explain the difference in the translation process between the current rate method and the temporal

Review the case study Shrewsberry, herbal product, LTD

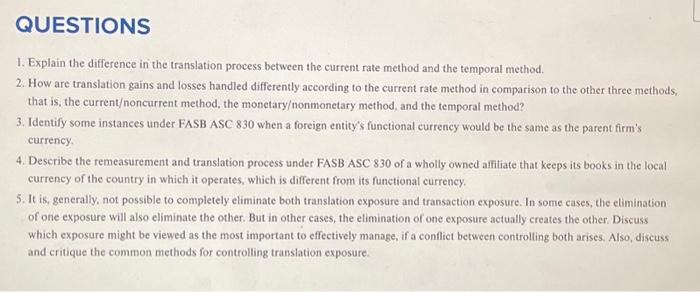

QUESTIONS 1. Explain the difference in the translation process between the current rate method and the temporal method.

2. How are translation gains and losses handled differently according to the current rate method in comparison to the other three methods, that is, the currentoncurrent method, the monetaryonmonetary method, and the temporal method?

3. Identify some instances under FASB ASC 830 when a foreign entity's functional currency would be the same as the parent firm's currency.

4. Describe the remeasurement and translation process under FASB ASC 830 of a wholly owned affiliate that keeps its books in the local currency of the country in which it operates, which is different from its functional currency.

5. It is, generally, not possible to completely eliminate both translation exposure and transaction exposure. In some cases, the elimination of one exposure will also eliminate the other. But in other cases, the elimination of one exposure actually creates the other. Discuss which exposure might be viewed as the most important to effectively manage, if a conflict between controlling both arises. Also, discuss and critique the common methods for controlling translation exposure.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started