Answered step by step

Verified Expert Solution

Question

1 Approved Answer

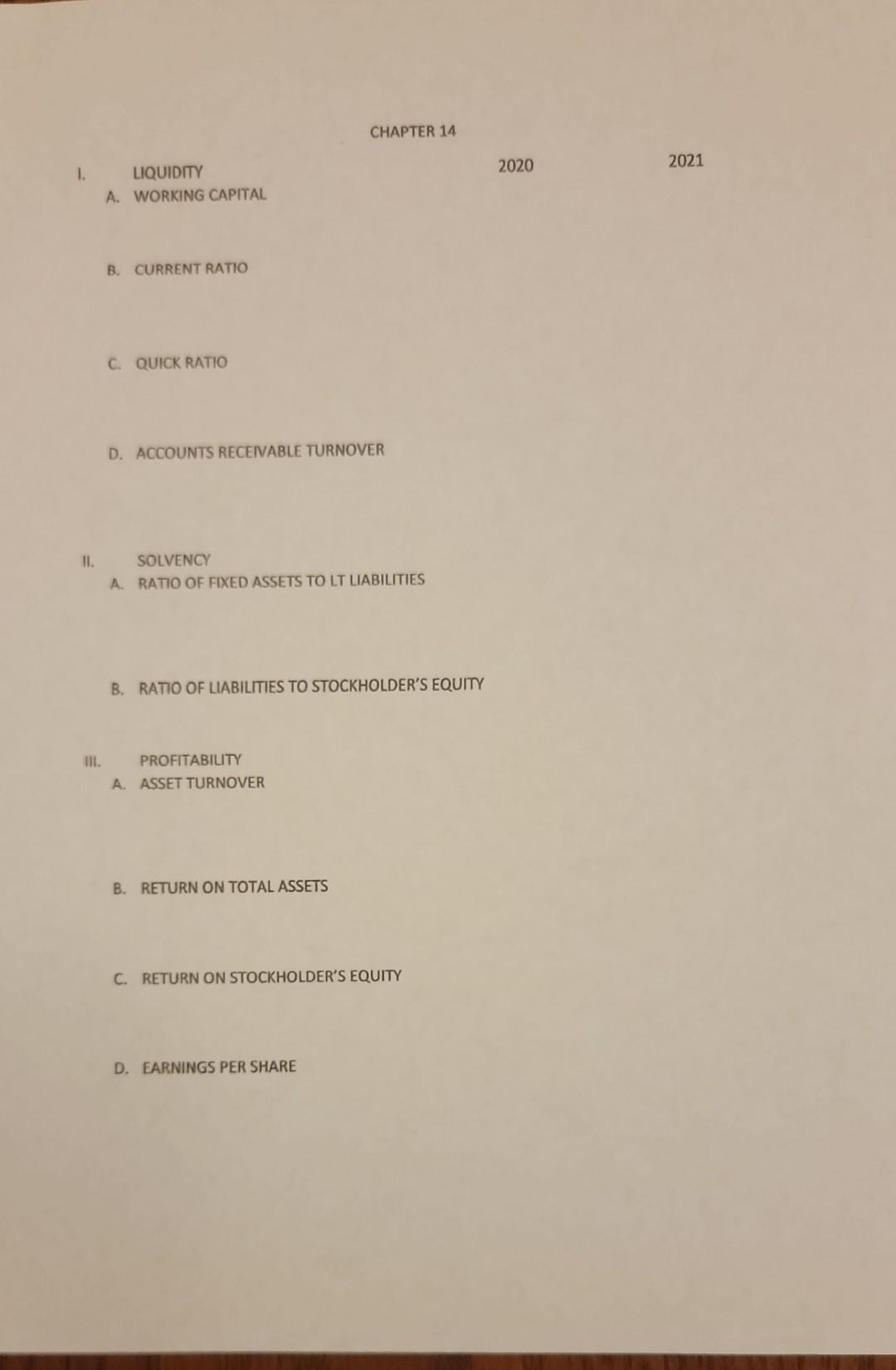

review the financial reports of Apple Inc and prepare the necessary ratio analysis/data analytics of those financials. CHAPTER 14 I. LIQUIDITY 2020 A. WORKING CAPITAL

review the financial reports of Apple Inc and prepare the necessary ratio analysis/data analytics of those financials.

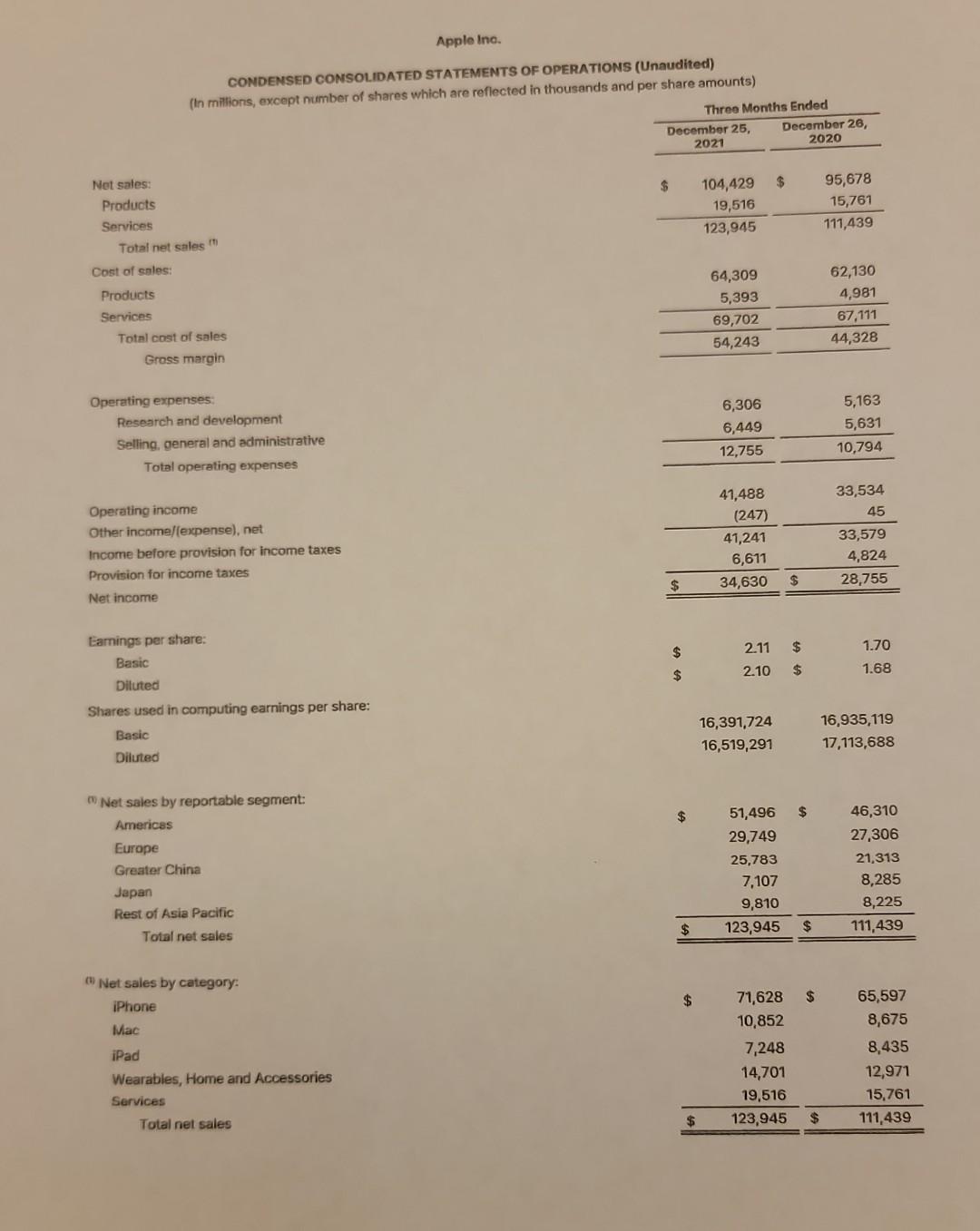

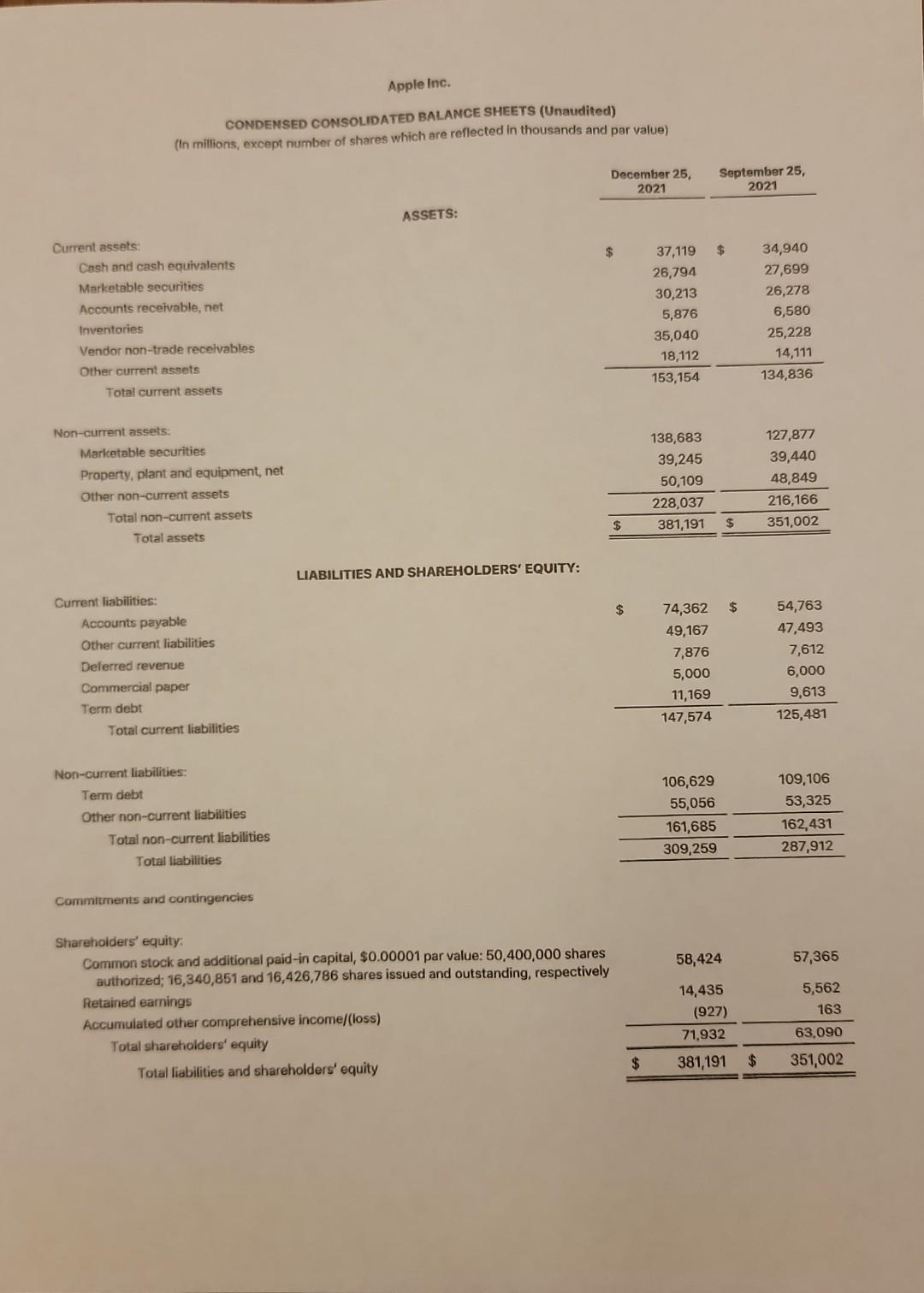

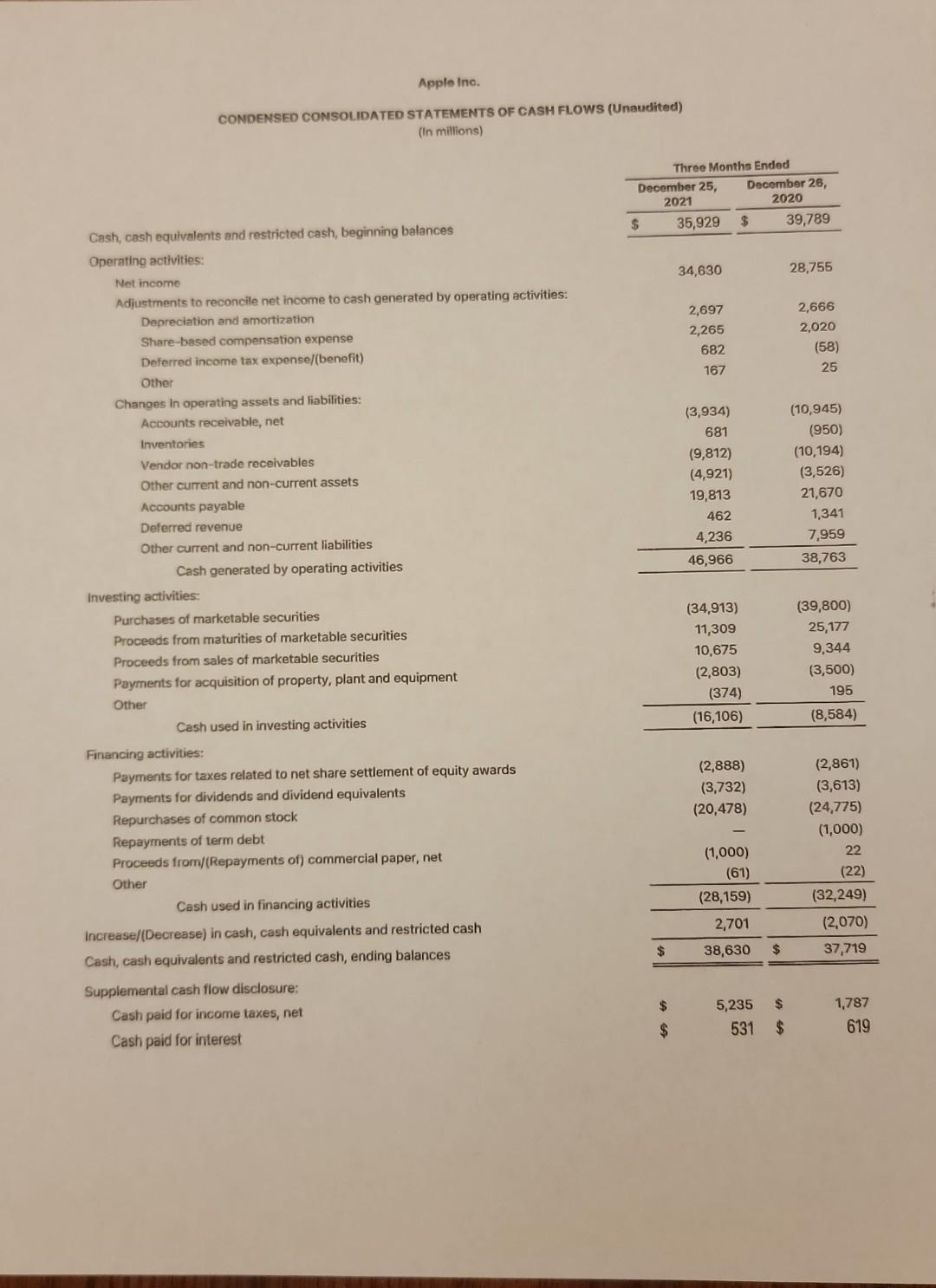

CHAPTER 14 I. LIQUIDITY 2020 A. WORKING CAPITAL B. CURRENT RATIO C. QUICK RATIO D. ACCOUNTS RECENVABLE TURNOVER II. SOLVENCY A. RATIO OF FIXED ASSETS TO LTT LIABILITIES B. RATIO OF LIABILITIES TO STOCKHOLDER'S EQUITY III. PROFITABILITY A. ASSET TURNOVER B. RETURN ON TOTAL ASSETS C. RETURN ON STOCKHOLDER'S EQUITY D. EARININGS PER SHARE Apple Ine. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (th millions, excopt number of shares which are reflected in thousands and per share amounts) Three Months Ended Not sales: Products Services Totai net sales "1) Cost of sales: Products Services Total cost of sales Gross margin \begin{tabular}{rr} 64,309 & 62,130 \\ 5,393 \\ \hline 69,702 \\ \hline 54,243 \\ \hline \end{tabular} Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 16,391,72416,935,119 16,519,29117,113,688 " Net saies by reportable segment: (i) Net sales by category: IPhone Mac iPad Wearables, Home and Accessories Services Total net sales \begin{tabular}{rrr} $1,628 & $ & 65,597 \\ 10,852 & 8,675 \\ 7,248 & 8,435 \\ 14,701 & & 12,971 \\ & 19,516 \\ \cline { 1 - 2 }$123,945 & 15,761 \\ \hline \end{tabular} Apple Inc. Apple Ino. CONDENSED CONSOL.IDATED STATEMENTS OF CASM FLOWS (Unaudited)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started