Review the income statement and notes to the financial statement for NextEra company and focus on either sales revenue recognition. Provide some insight on what you find out about how they report these items in accordance with GAAP (look for the principles, assumptions, valuation, etc). Response should be at least 5 sentences. Thank you.

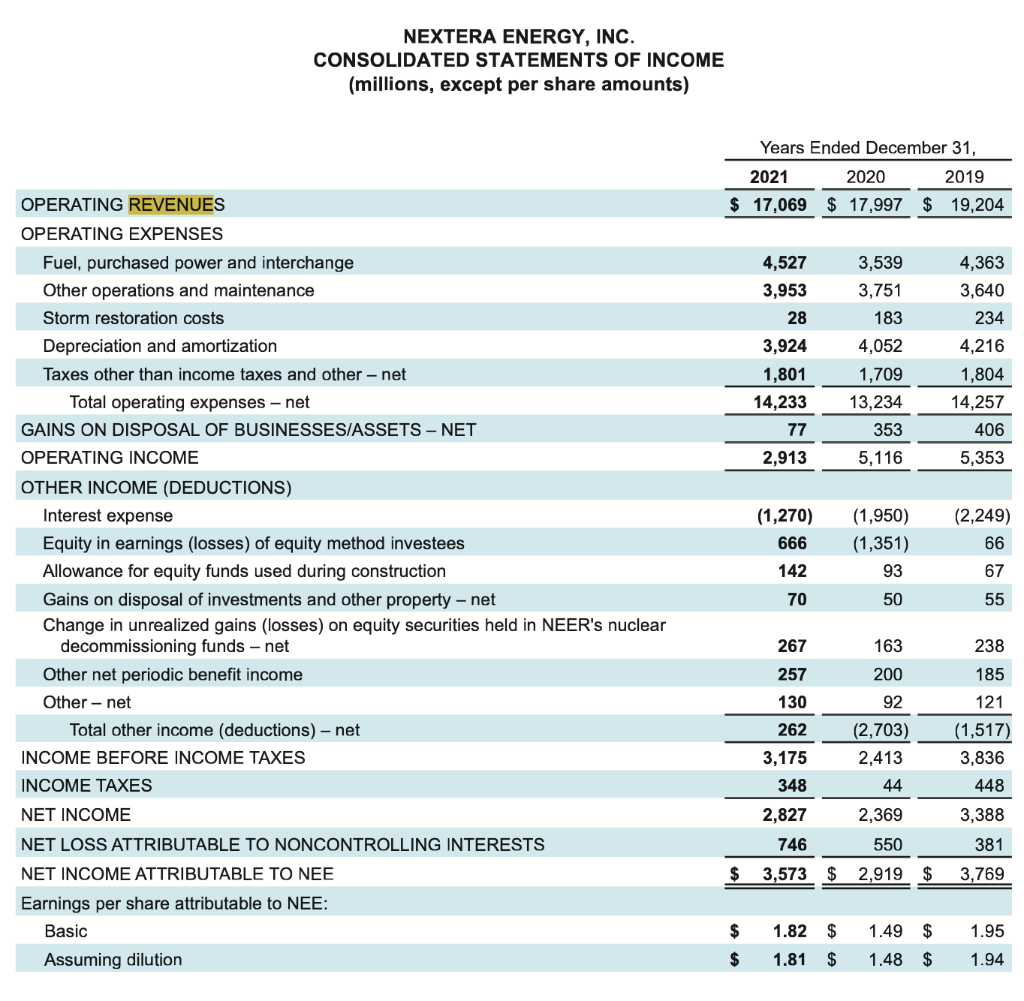

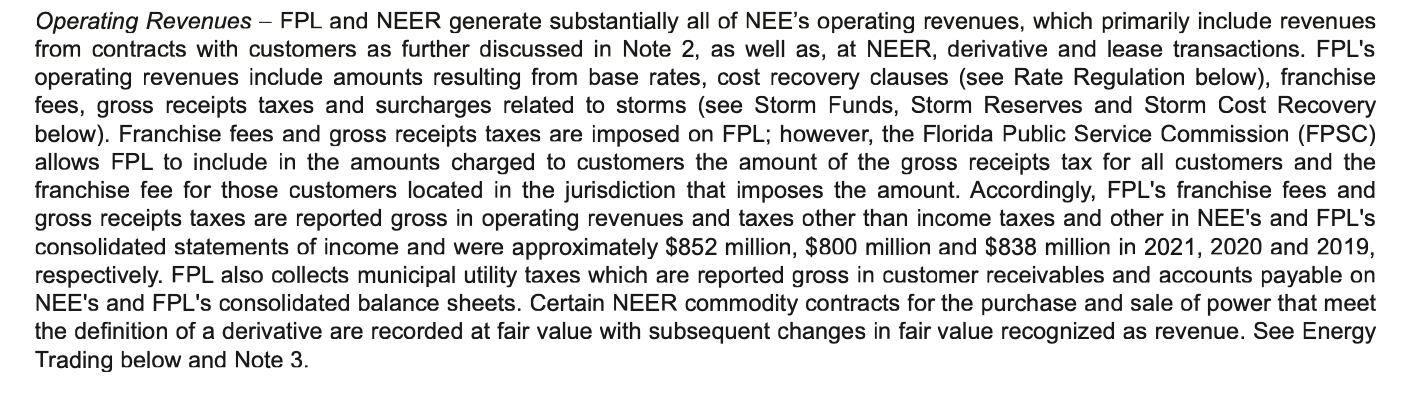

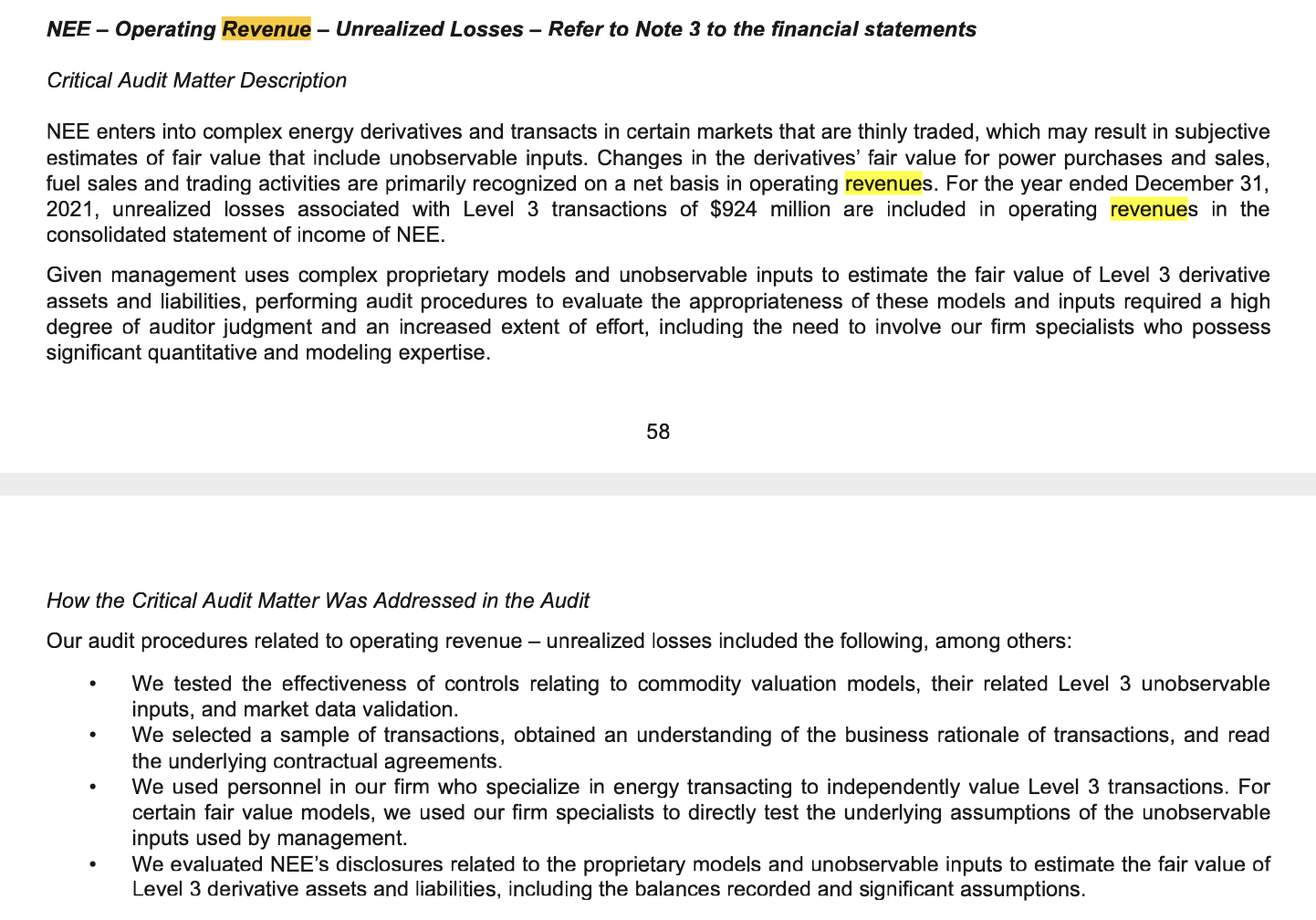

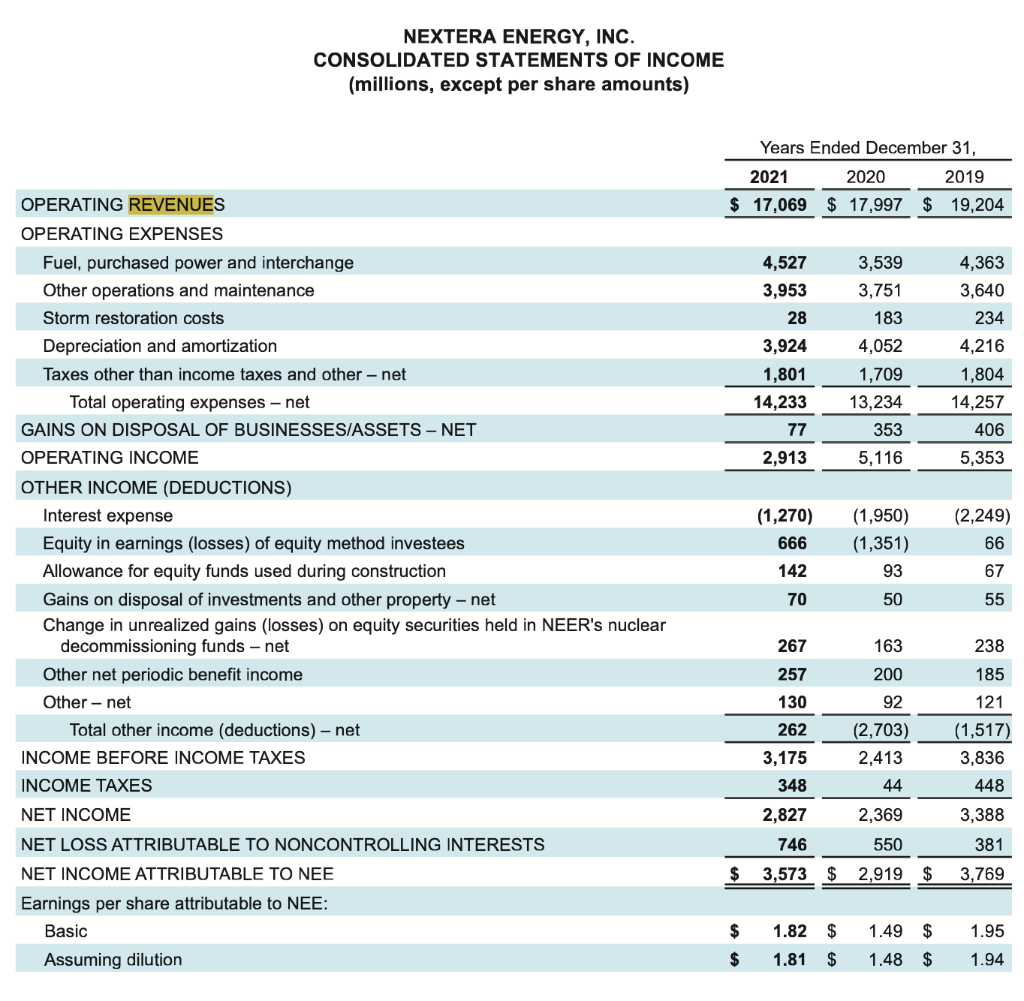

NEXTERA ENERGY, INC. CONSOLIDATED STATEMENTS OF INCOME (millions, except per share amounts) Operating Revenues - FPL and NEER generate substantially all of NEE's operating revenues, which primarily include revenues from contracts with customers as further discussed in Note 2, as well as, at NEER, derivative and lease transactions. FPL's operating revenues include amounts resulting from base rates, cost recovery clauses (see Rate Regulation below), franchise fees, gross receipts taxes and surcharges related to storms (see Storm Funds, Storm Reserves and Storm Cost Recovery below). Franchise fees and gross receipts taxes are imposed on FPL; however, the Florida Public Service Commission (FPSC) allows FPL to include in the amounts charged to customers the amount of the gross receipts tax for all customers and the franchise fee for those customers located in the jurisdiction that imposes the amount. Accordingly, FPL's franchise fees and gross receipts taxes are reported gross in operating revenues and taxes other than income taxes and other in NEE's and FPL's consolidated statements of income and were approximately $852 million, $800 million and $838 million in 2021,2020 and 2019 , respectively. FPL also collects municipal utility taxes which are reported gross in customer receivables and accounts payable on NEE's and FPL's consolidated balance sheets. Certain NEER commodity contracts for the purchase and sale of power that meet the definition of a derivative are recorded at fair value with subsequent changes in fair value recognized as revenue. See Energy Trading below and Note 3 . NEE - Operating Revenue - Unrealized Losses - Refer to Note 3 to the financial statements Critical Audit Matter Description NEE enters into complex energy derivatives and transacts in certain markets that are thinly traded, which may result in subjective estimates of fair value that include unobservable inputs. Changes in the derivatives' fair value for power purchases and sales, fuel sales and trading activities are primarily recognized on a net basis in operating revenues. For the year ended December 31 , 2021, unrealized losses associated with Level 3 transactions of $924 million are included in operating revenues in the consolidated statement of income of NEE. Given management uses complex proprietary models and unobservable inputs to estimate the fair value of Level 3 derivative assets and liabilities, performing audit procedures to evaluate the appropriateness of these models and inputs required a high degree of auditor judgment and an increased extent of effort, including the need to involve our firm specialists who possess significant quantitative and modeling expertise. 58 How the Critical Audit Matter Was Addressed in the Audit Our audit procedures related to operating revenue - unrealized losses included the following, among others: - We tested the effectiveness of controls relating to commodity valuation models, their related Level 3 unobservable inputs, and market data validation. - We selected a sample of transactions, obtained an understanding of the business rationale of transactions, and read the underlying contractual agreements. - We used personnel in our firm who specialize in energy transacting to independently value Level 3 transactions. For certain fair value models, we used our firm specialists to directly test the underlying assumptions of the unobservable inputs used by management. - We evaluated NEE's disclosures related to the proprietary models and unobservable inputs to estimate the fair value of Level 3 derivative assets and liabilities, including the balances recorded and significant assumptions. NEXTERA ENERGY, INC. CONSOLIDATED STATEMENTS OF INCOME (millions, except per share amounts) Operating Revenues - FPL and NEER generate substantially all of NEE's operating revenues, which primarily include revenues from contracts with customers as further discussed in Note 2, as well as, at NEER, derivative and lease transactions. FPL's operating revenues include amounts resulting from base rates, cost recovery clauses (see Rate Regulation below), franchise fees, gross receipts taxes and surcharges related to storms (see Storm Funds, Storm Reserves and Storm Cost Recovery below). Franchise fees and gross receipts taxes are imposed on FPL; however, the Florida Public Service Commission (FPSC) allows FPL to include in the amounts charged to customers the amount of the gross receipts tax for all customers and the franchise fee for those customers located in the jurisdiction that imposes the amount. Accordingly, FPL's franchise fees and gross receipts taxes are reported gross in operating revenues and taxes other than income taxes and other in NEE's and FPL's consolidated statements of income and were approximately $852 million, $800 million and $838 million in 2021,2020 and 2019 , respectively. FPL also collects municipal utility taxes which are reported gross in customer receivables and accounts payable on NEE's and FPL's consolidated balance sheets. Certain NEER commodity contracts for the purchase and sale of power that meet the definition of a derivative are recorded at fair value with subsequent changes in fair value recognized as revenue. See Energy Trading below and Note 3 . NEE - Operating Revenue - Unrealized Losses - Refer to Note 3 to the financial statements Critical Audit Matter Description NEE enters into complex energy derivatives and transacts in certain markets that are thinly traded, which may result in subjective estimates of fair value that include unobservable inputs. Changes in the derivatives' fair value for power purchases and sales, fuel sales and trading activities are primarily recognized on a net basis in operating revenues. For the year ended December 31 , 2021, unrealized losses associated with Level 3 transactions of $924 million are included in operating revenues in the consolidated statement of income of NEE. Given management uses complex proprietary models and unobservable inputs to estimate the fair value of Level 3 derivative assets and liabilities, performing audit procedures to evaluate the appropriateness of these models and inputs required a high degree of auditor judgment and an increased extent of effort, including the need to involve our firm specialists who possess significant quantitative and modeling expertise. 58 How the Critical Audit Matter Was Addressed in the Audit Our audit procedures related to operating revenue - unrealized losses included the following, among others: - We tested the effectiveness of controls relating to commodity valuation models, their related Level 3 unobservable inputs, and market data validation. - We selected a sample of transactions, obtained an understanding of the business rationale of transactions, and read the underlying contractual agreements. - We used personnel in our firm who specialize in energy transacting to independently value Level 3 transactions. For certain fair value models, we used our firm specialists to directly test the underlying assumptions of the unobservable inputs used by management. - We evaluated NEE's disclosures related to the proprietary models and unobservable inputs to estimate the fair value of Level 3 derivative assets and liabilities, including the balances recorded and significant assumptions