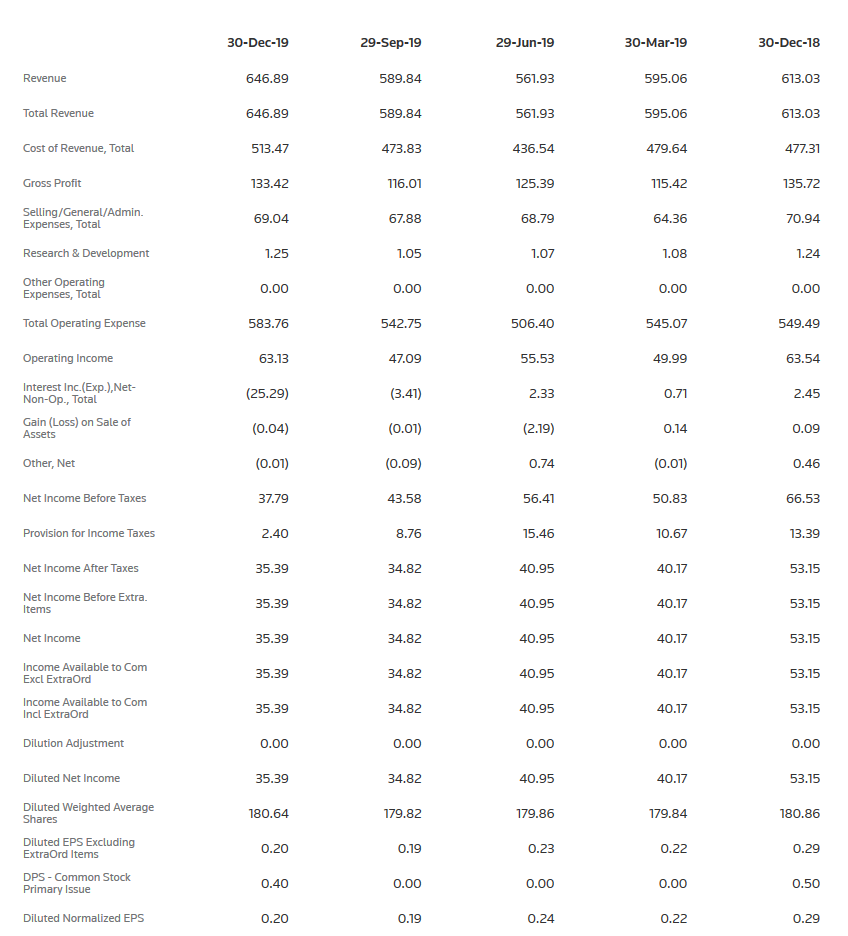

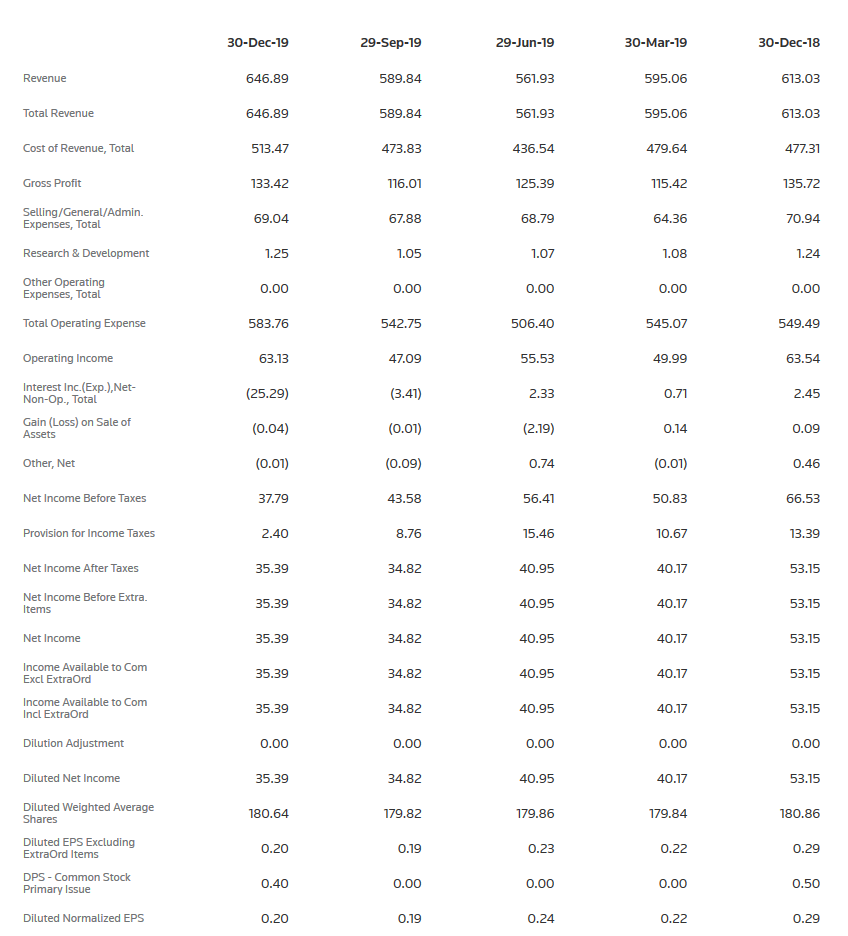

Review the Income Statement below and compute the following:

1 -Financial Ration Analysis. Please calculate the following rations:

- Current Ratio

- Acid Test Ratio

- Debt to Equity Ratio

- Return on Investment Ratio

- Working Capital

2- Using the above ratio results, indicate how well your company rates in a relative sense

3- Provide a synopsis of your conclusions about the relative financial performance and health of your company against industry benchmarks.

30-Dec-19 29-Sep-19 29-Jun-19 30-Mar-19 30-Dec-18 Revenue 646.89 589.84 561.93 595.06 613.03 Total Revenue 646.89 589.84 561.93 595.06 613.03 Cost of Revenue, Total 513.47 473.83 436.54 479.64 477.31 Gross Profit 133.42 116.01 125.39 115.42 135.72 Selling/General/Admin. Expenses, Total 69.04 67.88 68.79 64.36 70.94 Research & Development 1.25 1.05 1.07 1.08 1.24 Other Operating Expenses, Total 0.00 0.00 0.00 0.00 0.00 Total Operating Expense 583.76 542.75 506.40 545.07 549.49 Operating Income 63.13 47.09 55.53 49.99 63.54 Interest Inc.(Exp.), Net- Non-Op., Total (25.29) (3.41) 2.33 0.71 2.45 Gain (Loss) on Sale of Assets (0.04) (0.01) (2.19) 0.14 0.09 Other, Net (0.01) (0.09) 0.74 (0.01) 0.46 Net Income Before Taxes 37.79 43.58 56.41 50.83 66.53 Provision for Income Taxes 2.40 8.76 15.46 10.67 13.39 Net Income After Taxes 35.39 34.82 40.95 40.17 53.15 Net Income Before Extra. Items 35.39 34.82 40.95 40.17 53.15 Net Income 35.39 34.82 40.95 40.17 53.15 Income Available to Com Excl Extraord 35.39 34.82 40.95 40.17 53.15 Income Available to Com Incl Extraord 35.39 34.82 40.95 40.17 53.15 Dilution Adjustment 0.00 0.00 0.00 0.00 0.00 Diluted Net Income 35.39 34.82 40.95 40.17 53.15 Diluted Weighted Average Shares 180.64 179.82 179.86 179.84 180.86 Diluted EPS Excluding ExtraOrd Items 0.20 0.19 0.23 0.22 0.29 DPS - Common Stock Primary Issue 0.40 0.00 0.00 0.00 0.50 Diluted Normalized EPS 0.20 0.19 0.24 0.22 0.29 30-Dec-19 29-Sep-19 29-Jun-19 30-Mar-19 30-Dec-18 Revenue 646.89 589.84 561.93 595.06 613.03 Total Revenue 646.89 589.84 561.93 595.06 613.03 Cost of Revenue, Total 513.47 473.83 436.54 479.64 477.31 Gross Profit 133.42 116.01 125.39 115.42 135.72 Selling/General/Admin. Expenses, Total 69.04 67.88 68.79 64.36 70.94 Research & Development 1.25 1.05 1.07 1.08 1.24 Other Operating Expenses, Total 0.00 0.00 0.00 0.00 0.00 Total Operating Expense 583.76 542.75 506.40 545.07 549.49 Operating Income 63.13 47.09 55.53 49.99 63.54 Interest Inc.(Exp.), Net- Non-Op., Total (25.29) (3.41) 2.33 0.71 2.45 Gain (Loss) on Sale of Assets (0.04) (0.01) (2.19) 0.14 0.09 Other, Net (0.01) (0.09) 0.74 (0.01) 0.46 Net Income Before Taxes 37.79 43.58 56.41 50.83 66.53 Provision for Income Taxes 2.40 8.76 15.46 10.67 13.39 Net Income After Taxes 35.39 34.82 40.95 40.17 53.15 Net Income Before Extra. Items 35.39 34.82 40.95 40.17 53.15 Net Income 35.39 34.82 40.95 40.17 53.15 Income Available to Com Excl Extraord 35.39 34.82 40.95 40.17 53.15 Income Available to Com Incl Extraord 35.39 34.82 40.95 40.17 53.15 Dilution Adjustment 0.00 0.00 0.00 0.00 0.00 Diluted Net Income 35.39 34.82 40.95 40.17 53.15 Diluted Weighted Average Shares 180.64 179.82 179.86 179.84 180.86 Diluted EPS Excluding ExtraOrd Items 0.20 0.19 0.23 0.22 0.29 DPS - Common Stock Primary Issue 0.40 0.00 0.00 0.00 0.50 Diluted Normalized EPS 0.20 0.19 0.24 0.22 0.29