Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review the list of business transactions during the company's first month of operations in January ( Document attached: ABC LTD: Business Transactions ( January )

Review the list of business transactions during the company's first month of operations in

January Document attached: ABC LTD: Business Transactions January

Review the Company's chart of Accounts Document attached: ABC LTD: Chart of Accounts

Record each transaction with a journal entry using the doubleentry accounting system with

debits and credits. Ensure each entry is detailed and correctly categorizes debits and credits.

ABC LTD Business Transactions January

Started the Business:

January : The owner invested $ in cash to start the business.

Purchased Office Supplies on Account:

January : Bought office supplies on account for $

Provided Services on Credit:

January : Provided design services to a client on credit for $

Received Cash for Services Rendered:

January : The company performed services for cash in the amount of $

Paid Rent Expense:

January : Paid $ in cash for office rent for the month of January.

Bought Equipment on Account:

January : Purchased office equipment on account for $ to be paid within days

Received Payment on Account:

January : Received $ in cash as partial payment from the January th transaction.

Paid Utility Bill:

January : Paid $ in cash for utilities.

Purchased Inventory on Account

January : Purchased inventory for $ on account

Borrowed Money from a Bank:

January : Obtained $ year note payable with an interest rate from the

bank. Payments will be made annually starting in December.

Paid Owner Withdrawals:

January : An owner withdrawal of $ was made.

Accrued Salaries Expense:

January : Accrued $ in salary expenses at the end of the month. Disregard the

calculation of payroll taxes or payroll tax expenses for this transaction.

Depreciation on Equipment:

January : Recorded $ in depreciation for the office equipment.

Closing the Revenue and Expense Accounts:

January : Complete the necessary closing entries for ABC company

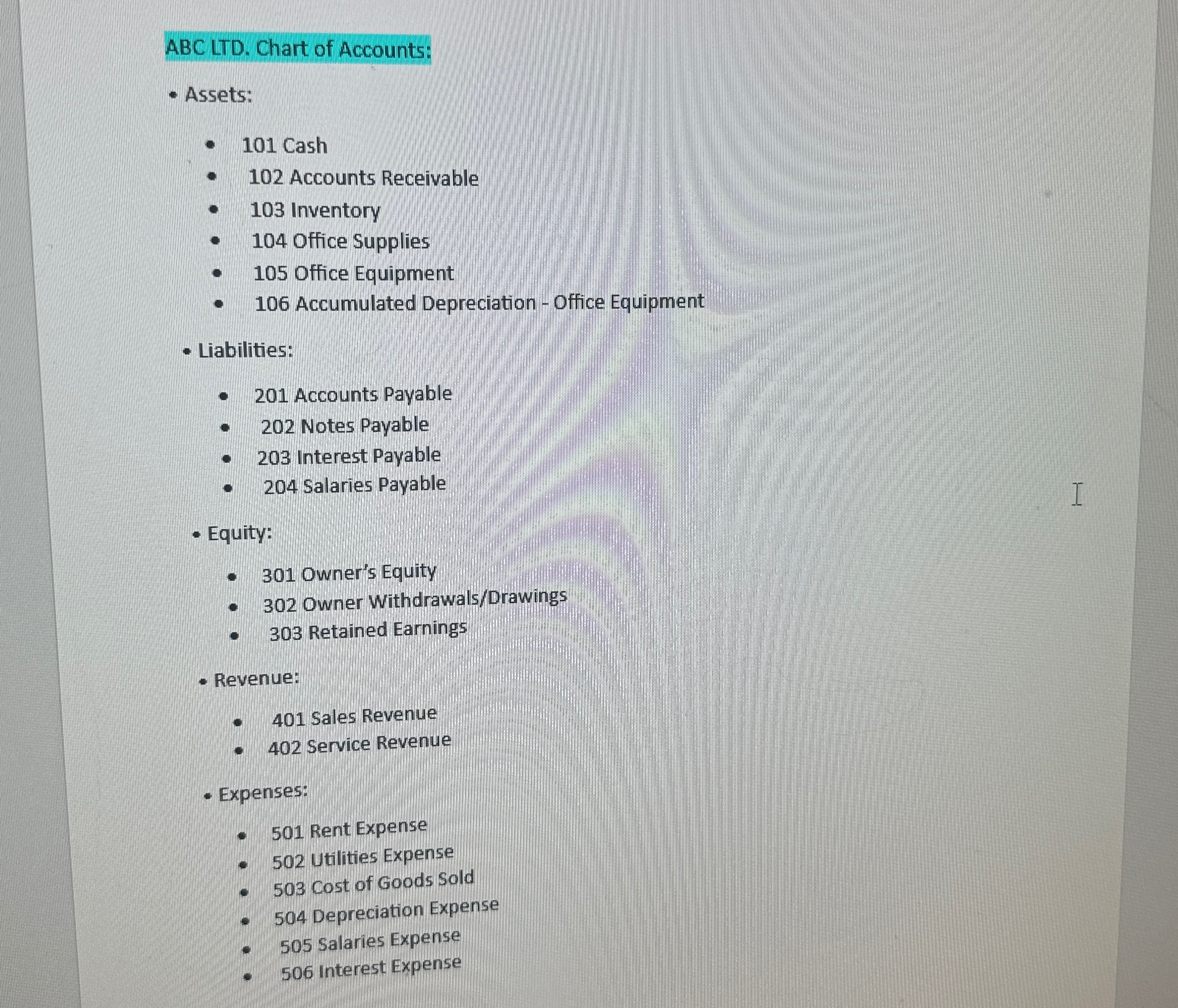

ABC LTD Chart of Accounts:

Assets:

Cash

Accounts Receivable

Inventory

Office Supplies

Office Equipment

Accumulated Depreciation Office Equipment

Liabilities:

Accounts Payable

Notes Payable

Interest Payable

Salaries Payable

Equity:

Owner's Equity

Owner WithdrawalsDrawings

Retained Earnings

Revenue:

Sales Revenue

Service Revenue

Expenses:

Rent Expense

Utilities Expense

Cost of Goods sold

Depreciation Expense

Salaries Expense

Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started