Answered step by step

Verified Expert Solution

Question

1 Approved Answer

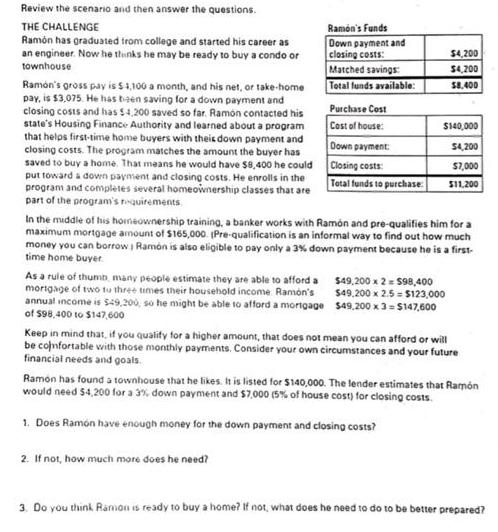

Review the scenario and then answer the questions. THE CHALLENGE Ramn has graduated from college and started his career as an engineer. Now he

Review the scenario and then answer the questions. THE CHALLENGE Ramn has graduated from college and started his career as an engineer. Now he thinks he may be ready to buy a condo or townhouse Ramon's gross pay is $1,100 a month, and his net, or take-home pay, is $3,075. He has been saving for a down payment and closing costs and has $4,200 saved so far. Ramn contacted his state's Housing Finance Authority and learned about a program that helps first-time home buyers with their down payment and closing costs. The program matches the amount the buyer has saved to buy a home. That means he would have $8,400 he could put toward a down payment and closing costs. He enrolls in the program and completes several homeownership classes that are part of the program's requirements Ramon's Funds Down payment and closing costs: Matched savings: Total funds available: As a rule of thumb, many people estimate they are able to afford a mortgage of two to three times their household income Ramon's annual income is $49.,200, so he might be able to afford a mortgage of $98,400 to $147,600 Purchase Cost Cost of house: Down payment: Closing costs: Total funds to purchase: $4,200 $4,200 $8,400 $140,000 $4,200 $7,000 $11,200 In the middle of his homeownership training, a banker works with Ramn and pre-qualifies him for a maximum mortgage amount of $165,000. (Pre-qualification is an informal way to find out how much money you can borrow | Ramon is also eligible to pay only a 3% down payment because he is a first- time home buyer $49,200 x 2 = $98,400 $49,200 x 2.5=$123,000 $49,200 x 3=$147,600 Keep in mind that, if you qualify for a higher amount, that does not mean you can afford or will be confortable with those monthly payments. Consider your own circumstances and your future financial needs and goals. Ramon has found a townhouse that he likes. It is listed for $140,000. The lender estimates that Ramn would need 54,200 for a 3% down payment and $7,000 (5% of house cost) for closing costs. 1. Does Ramon have enough money for the down payment and closing costs? 2. If not, how much more does he need? 3. Do you think Ramon is ready to buy a home? If not, what does he need to do to be better prepared?

Step by Step Solution

★★★★★

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Answer Ansuunt 1 Ramon has found that he likes listed for 140000 The lender est...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started