Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review your results below and play again with one of the other scenarios to test and develop your skills further. Real GDP Growth High

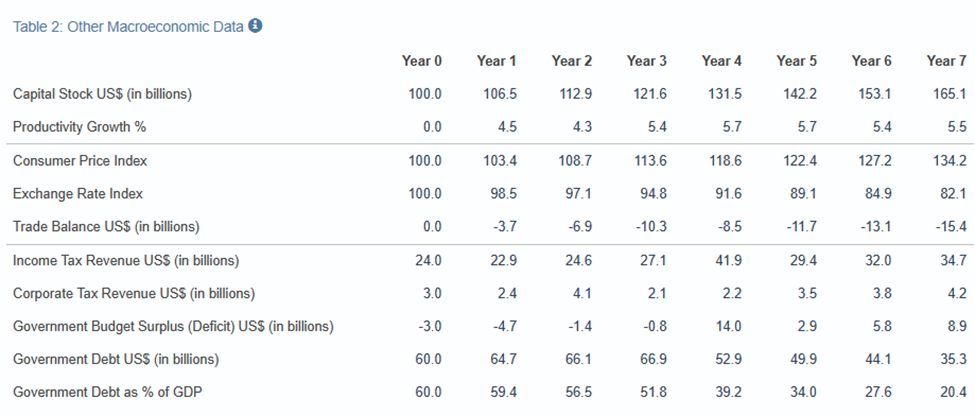

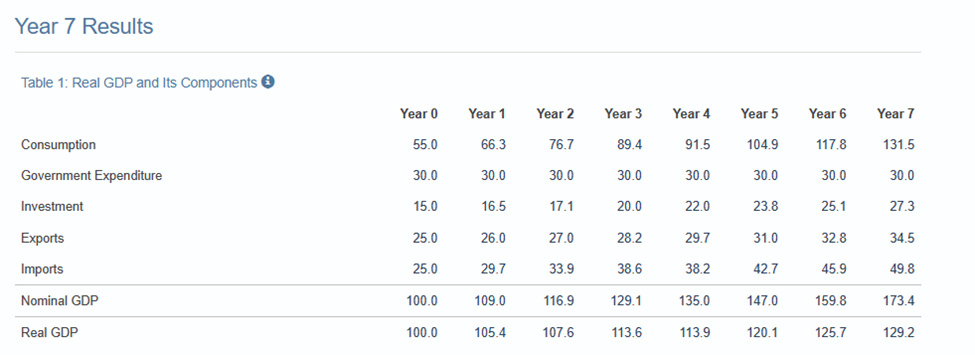

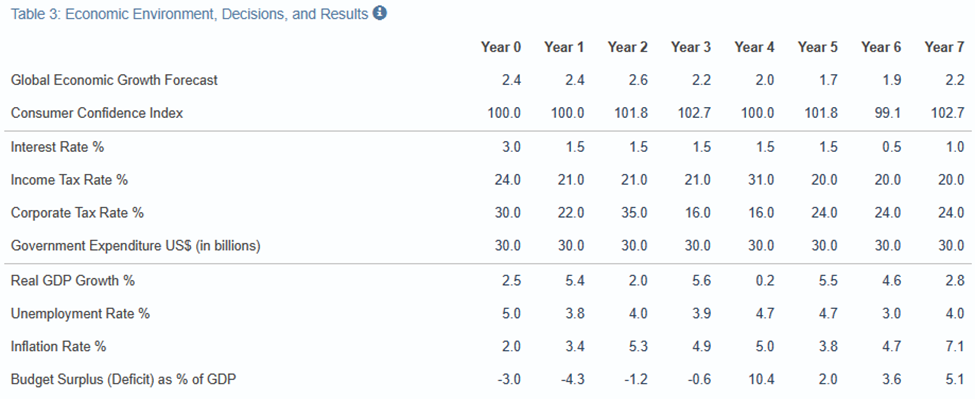

Review your results below and play again with one of the other scenarios to test and develop your skills further. Real GDP Growth High Unemployment Rate Low Approval Rating Feedback from Policy Advisor 10.0 8.0- 6.0 4.0- 20- 0.0- 0 1 2 3 4 5 6 7 Inflation Rate 10.0 High 8.0- 6.0- 4.0- 20- 0.0 01234567 $67 % of labor force 5.0 4.0 3.0 20- 1.0- 0.0 0 1 2 3 4 Budget Surplus (Deficit) % of GDP 15.0- 11.0 7.0- 3.0- -1.0- -5.0 Low L 0 1 2 3 4 5 6 100- 80- 60- 40- 20- T 0 1 2 3 Average Approval Rating High 74 points The economy is growing at a good pace. See if you can identify the policy decisions that have resulted in this level of economic growth. You have kept government expenditure constant in nominal terms. Remember that, if inflation is positive, this amounts to a reduction in government expenditure in real terms (ie. after adjusting for inflation). Inflation is high. See what can be done to reduce inflationary pressures. The government is running a budget surplus. This means there is an opportunity to increase government spending or reduce taxes in order to boost economic growth. Table 2: Other Macroeconomic Data Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Capital Stock US$ (in billions) Productivity Growth % 100.0 106.5 112.9 121.6 131.5 142.2 153.1 165.1 0.0 4.5 4.3 5.4 5.7 5.7 5.4 5.5 Consumer Price Index Exchange Rate Index Trade Balance US$ (in billions) 100.0 103.4 108.7 113.6 118.6 122.4 127.2 134.2 100.0 98.5 97.1 94.8 91.6 89.1 84.9 82.1 0.0 -3.7 -6.9 -10.3 -8.5 -11.7 -13.1 -15.4 Income Tax Revenue US$ (in billions) 24.0 22.9 24.6 27.1 41.9 29.4 32.0 34.7 Corporate Tax Revenue US$ (in billions) 3.0 2.4 4.1 2.1 2.2 3.5 3.8 4.2 Government Budget Surplus (Deficit) US$ (in billions) -3.0 -4.7 -1.4 -0.8 14.0 2.9 5.8 8.9 Government Debt US$ (in billions) 60.0 64.7 66.1 66.9 52.9 49.9 44.1 35.3 Government Debt as % of GDP 60.0 59.4 56.5 51.8 39.2 34.0 27.6 20.4 Year 7 Results Table 1: Real GDP and Its Components Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Consumption 55.0 66.3 76.7 89.4 91.5 104.9 117.8 131.5 Government Expenditure 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0 Investment 15.0 16.5 17.1 20.0 22.0 23.8 25.1 27.3 Exports 25.0 26.0 27.0 28.2 29.7 31.0 32.8 34.5 Imports 25.0 29.7 33.9 38.6 38.2 42.7 45.9 49.8 Nominal GDP 100.0 109.0 116.9 129.1 135.0 147.0 159.8 173.4 Real GDP 100.0 105.4 107.6 113.6 113.9 120.1 125.7 129.2 Table 3: Economic Environment, Decisions, and Results Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Global Economic Growth Forecast 2.4 2.4 2.6 2.2 2.0 1.7 1.9 2.2 Consumer Confidence Index 100.0 100.0 101.8 102.7 100.0 101.8 99.1 102.7 Interest Rate % 3.0 1.5 1.5 1.5 1.5 1.5 0.5 1.0 Income Tax Rate % 24.0 21.0 21.0 21.0 31.0 20.0 20.0 20.0 Corporate Tax Rate % 30.0 22.0 35.0 16.0 16.0 24.0 24.0 24.0 Government Expenditure US$ (in billions) 30.0 30.0 30.0 30.0 30.0 30.0 30.0 30.0 Real GDP Growth % 2.5 5.4 2.0 5.6 0.2 5.5 4.6 2.8 Unemployment Rate % 5.0 3.8 4.0 3.9 4.7 4.7 3.0 4.0 Inflation Rate % 2.0 3.4 5.3 4.9 5.0 3.8 4.7 7.1 Budget Surplus (Deficit) as % of GDP -3.0 -4.3 -1.2 -0.6 10.4 2.0 3.6 5.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started