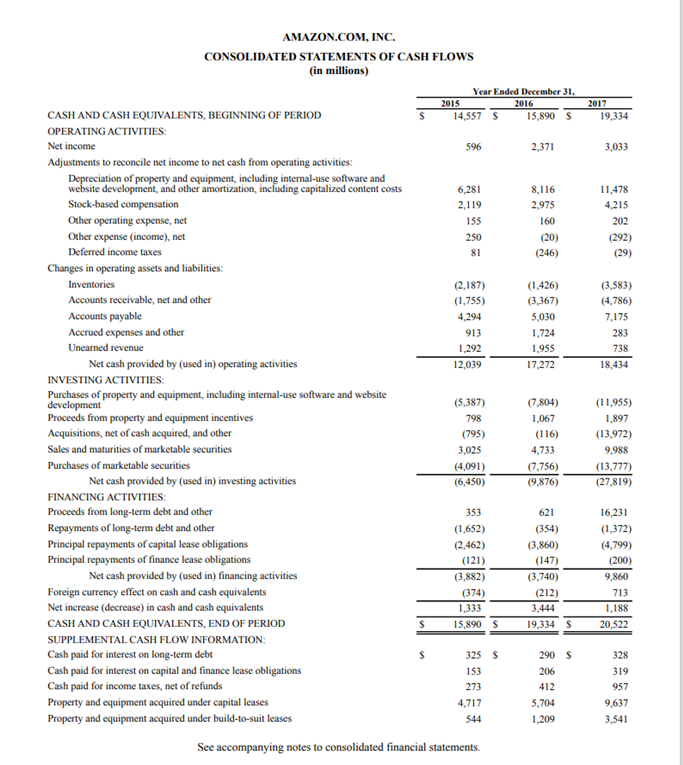

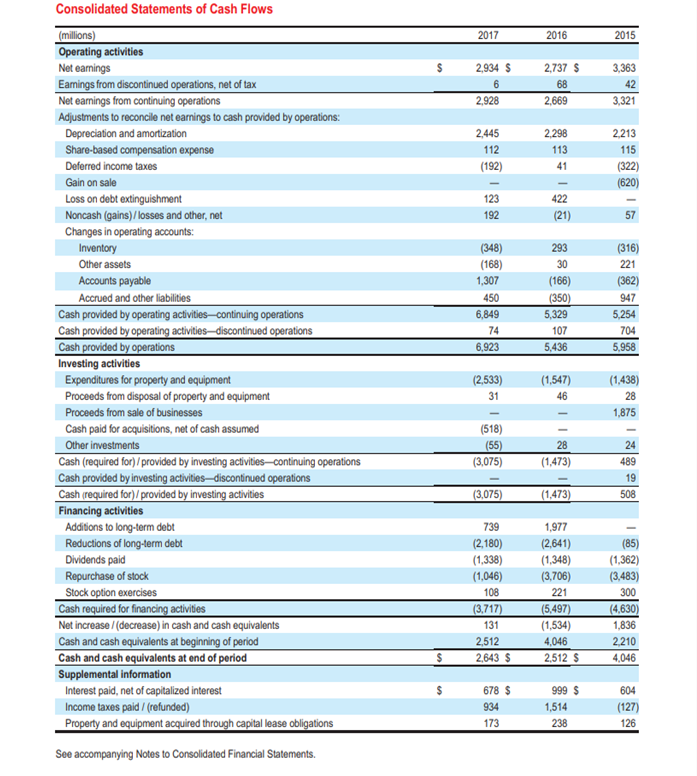

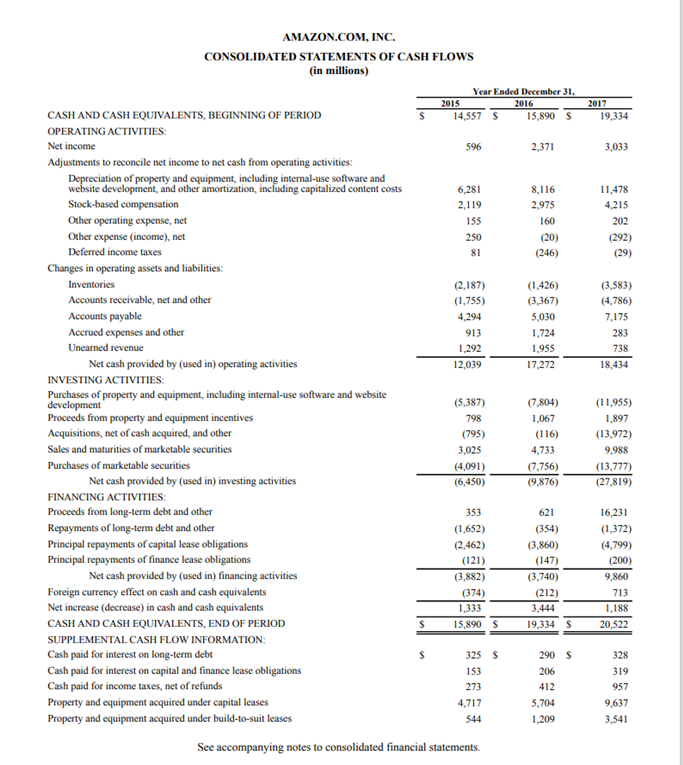

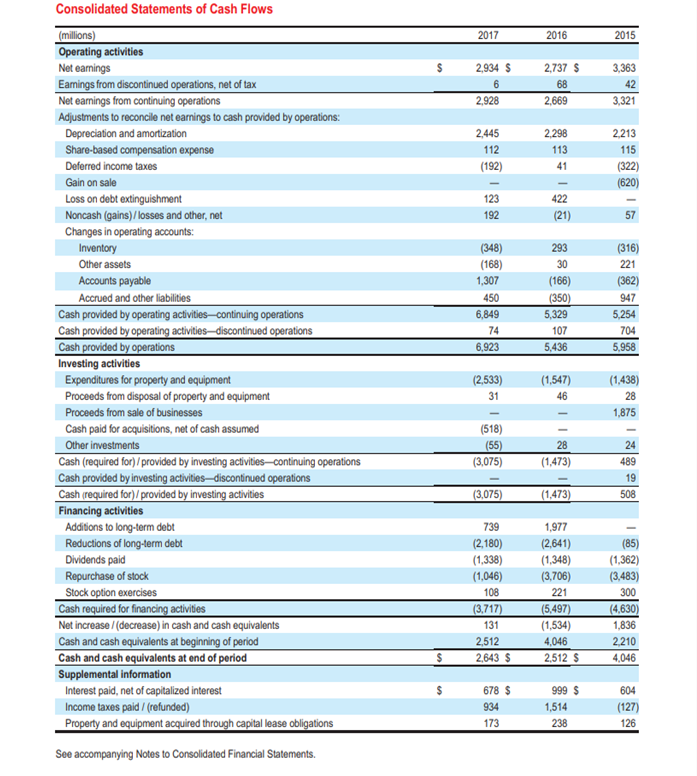

Reviewing the statement of cash flows from 2017 for Amazon and Target, what types of cash flow conclusions can you draw based on the information provided?

Amazon

Target

AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Year Ended December 31, 2015 2016 14,557 $ 15,890 5 2017 19,334 596 2,371 3,033 6,281 2,119 155 250 81 8,116 2.975 160 (20) (246) 11,478 4,215 202 (292) (29) (2,187) (1.755) 4,294 913 (1,426) (3,367) 5,030 1.724 1,955 17,272 (3,583) (4,786) 7,175 283 738 18,434 1,292 12,039 CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation of property and equipment, including internal-use software and website development, and other amortization, including capitalized content costs Stock-based compensation Other operating expense, net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES Purchases of property and equipment, including internal-use software and website development Proceeds from property and equipment incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of capital lease obligations Principal repayments of finance lease obligations Net cash provided by (used in) financing activities Foreign currency effect on cash and cash equivalents Net increase (decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for interest on capital and finance lease obligations Cash paid for income taxes, net of refunds Property and equipment acquired under capital leases Property and equipment acquired under build-to-suit leases (5,387) 798 (795) 3,025 (4,091) (6,450) (7.804) 1,067 (116) 4.733 (7.756) (9,876) (11,955) 1.897 (13,972) 9.988 (13,777) (27,819) 353 (1,652) (2,462) (121) (3,882) (374) 1,333 15,890 $ 621 (354) (3.860) (147) (3,740) (212) 3,444 19,334 S 16,231 (1,372) (4,799) (200) 9,860 713 1.188 20,522 s S 325 S 153 273 4,717 544 290 S 206 412 5,704 1,209 328 319 957 9,637 3,541 See accompanying notes to consolidated financial statements. 2017 2016 2015 $ 2,934 $ 6 2,928 2,737 $ 68 2,669 3,363 42 3,321 2.445 112 (192) 2.298 113 41 2.213 115 (322) (620) 422 123 192 (21) 57 (348) (168) 1,307 450 6,849 74 6,923 293 30 (166) (350) 5,329 (316) 221 (362) 947 107 5,254 704 5,958 5,436 Consolidated Statements of Cash Flows (millions) Operating activities Net earnings Eamings from discontinued operations, net of tax Net earnings from continuing operations Adjustments to reconcile net earnings to cash provided by operations: Depreciation and amortization Share-based compensation expense Deferred income taxes Gain on sale Loss on debt extinguishment Noncash (gains) / losses and other, net Changes in operating accounts: Inventory Other assets Accounts payable Accrued and other liabilities Cash provided by operating activities-continuing operations Cash provided by operating activitiesdiscontinued operations Cash provided by operations Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment Proceeds from sale of businesses Cash paid for acquisitions, net of cash assumed Other investments Cash (required for)/provided by investing activities-continuing operations Cash provided by investing activities discontinued operations Cash (required for) / provided by investing activities Financing activities Additions to long-term debt Reductions of long-term debt Dividends paid Repurchase of stock Stock option exercises Cash required for financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental information Interest paid, net of capitalized interest Income taxes paid /(refunded) Property and equipment acquired through capital lease obligations (2,533) 31 (1,547) 46 (1,438) 28 1,875 (518) (55) (3.075) 28 (1.473) 24 489 19 508 (3.075) (1.473) (85) 739 (2,180) (1,338) (1,046) 108 (3.717) 131 2,512 2,643 $ 1.977 (2,641) (1,348) (3,706) 221 (5.497) (1,534) 4,046 2,512 $ (1,362) (3,483) 300 (4.630) 1,836 2,210 4,046 $ 678 $ 934 173 999 $ 1,514 238 604 (127) 126 See accompanying Notes to Consolidated Financial Statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) Year Ended December 31, 2015 2016 14,557 $ 15,890 5 2017 19,334 596 2,371 3,033 6,281 2,119 155 250 81 8,116 2.975 160 (20) (246) 11,478 4,215 202 (292) (29) (2,187) (1.755) 4,294 913 (1,426) (3,367) 5,030 1.724 1,955 17,272 (3,583) (4,786) 7,175 283 738 18,434 1,292 12,039 CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation of property and equipment, including internal-use software and website development, and other amortization, including capitalized content costs Stock-based compensation Other operating expense, net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES Purchases of property and equipment, including internal-use software and website development Proceeds from property and equipment incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of capital lease obligations Principal repayments of finance lease obligations Net cash provided by (used in) financing activities Foreign currency effect on cash and cash equivalents Net increase (decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for interest on capital and finance lease obligations Cash paid for income taxes, net of refunds Property and equipment acquired under capital leases Property and equipment acquired under build-to-suit leases (5,387) 798 (795) 3,025 (4,091) (6,450) (7.804) 1,067 (116) 4.733 (7.756) (9,876) (11,955) 1.897 (13,972) 9.988 (13,777) (27,819) 353 (1,652) (2,462) (121) (3,882) (374) 1,333 15,890 $ 621 (354) (3.860) (147) (3,740) (212) 3,444 19,334 S 16,231 (1,372) (4,799) (200) 9,860 713 1.188 20,522 s S 325 S 153 273 4,717 544 290 S 206 412 5,704 1,209 328 319 957 9,637 3,541 See accompanying notes to consolidated financial statements. 2017 2016 2015 $ 2,934 $ 6 2,928 2,737 $ 68 2,669 3,363 42 3,321 2.445 112 (192) 2.298 113 41 2.213 115 (322) (620) 422 123 192 (21) 57 (348) (168) 1,307 450 6,849 74 6,923 293 30 (166) (350) 5,329 (316) 221 (362) 947 107 5,254 704 5,958 5,436 Consolidated Statements of Cash Flows (millions) Operating activities Net earnings Eamings from discontinued operations, net of tax Net earnings from continuing operations Adjustments to reconcile net earnings to cash provided by operations: Depreciation and amortization Share-based compensation expense Deferred income taxes Gain on sale Loss on debt extinguishment Noncash (gains) / losses and other, net Changes in operating accounts: Inventory Other assets Accounts payable Accrued and other liabilities Cash provided by operating activities-continuing operations Cash provided by operating activitiesdiscontinued operations Cash provided by operations Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment Proceeds from sale of businesses Cash paid for acquisitions, net of cash assumed Other investments Cash (required for)/provided by investing activities-continuing operations Cash provided by investing activities discontinued operations Cash (required for) / provided by investing activities Financing activities Additions to long-term debt Reductions of long-term debt Dividends paid Repurchase of stock Stock option exercises Cash required for financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental information Interest paid, net of capitalized interest Income taxes paid /(refunded) Property and equipment acquired through capital lease obligations (2,533) 31 (1,547) 46 (1,438) 28 1,875 (518) (55) (3.075) 28 (1.473) 24 489 19 508 (3.075) (1.473) (85) 739 (2,180) (1,338) (1,046) 108 (3.717) 131 2,512 2,643 $ 1.977 (2,641) (1,348) (3,706) 221 (5.497) (1,534) 4,046 2,512 $ (1,362) (3,483) 300 (4.630) 1,836 2,210 4,046 $ 678 $ 934 173 999 $ 1,514 238 604 (127) 126 See accompanying Notes to Consolidated Financial Statements