Answered step by step

Verified Expert Solution

Question

1 Approved Answer

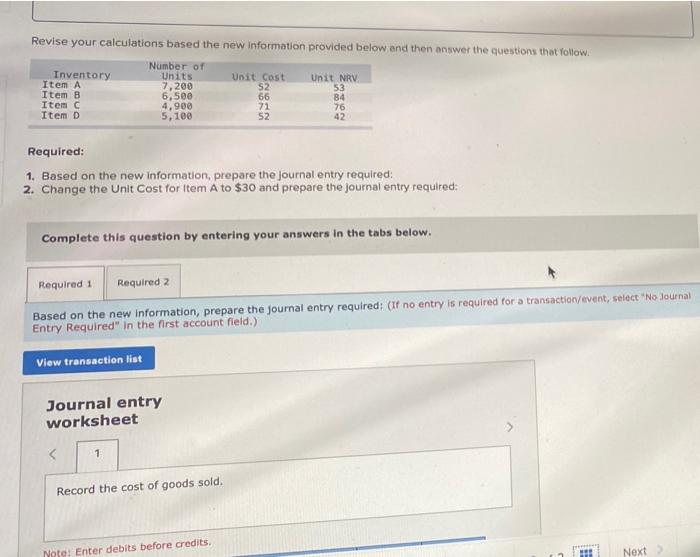

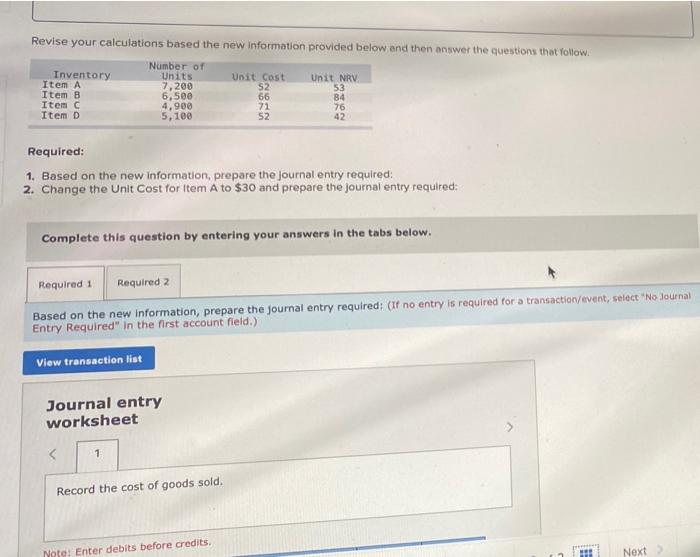

Revise your calculations based ln the new information provided below and then answer the questions that follow. Revise your calculations based the new information provided

Revise your calculations based ln the new information provided below and then answer the questions that follow.

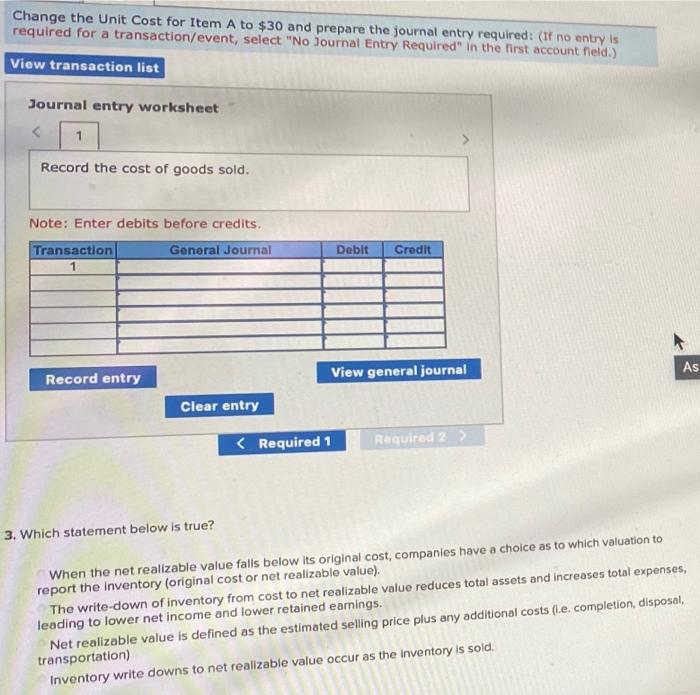

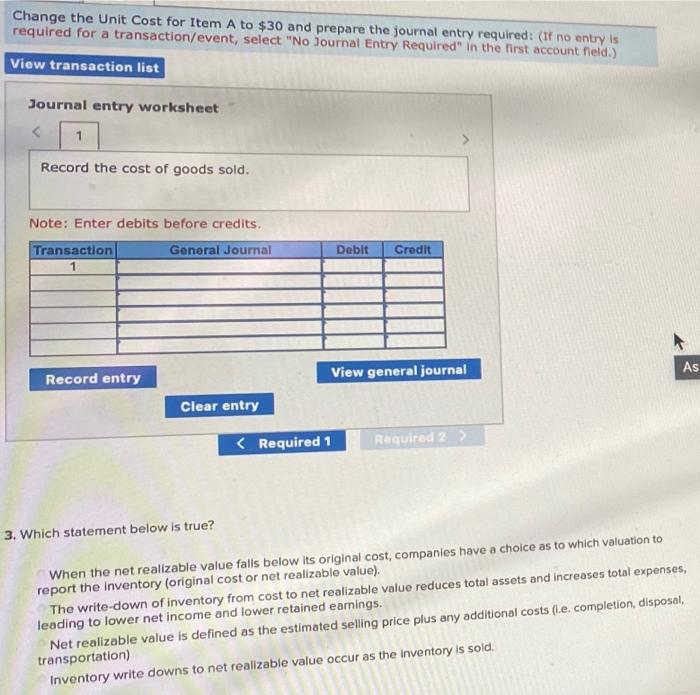

Revise your calculations based the new information provided below and then answer the questions that follow. Inventory. Number of Units 7,200 6,500 Unit Cost Unit NRV Item A Item B Item C 52 53 66 84 4,900 71 76 Item D 5,100 52 42 Required: 1. Based on the new information, prepare the journal entry required: 2. Change the Unit Cost for Item A to $30 and prepare the journal entry required: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on the new information, prepare the journal entry required: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3. Which statement below is true? When the net realizable value falls below its original cost, companies have a choice as to which valuation to report the inventory (original cost or net realizable value). The write-down of inventory from cost to net realizable value reduces total assets and increases total expenses, leading to lower net income and lower retained earnings. Net realizable value is defined as the estimated selling price plus any additional costs (i.e. completion, disposal, transportation) Inventory write downs to net realizable value occur as the inventory is sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started