Question

REVISED images already. Question 1 Analyse the financial statements and comment on CDLs financial performance over the last two years i.e. 2012 and 2011. In

REVISED images already.

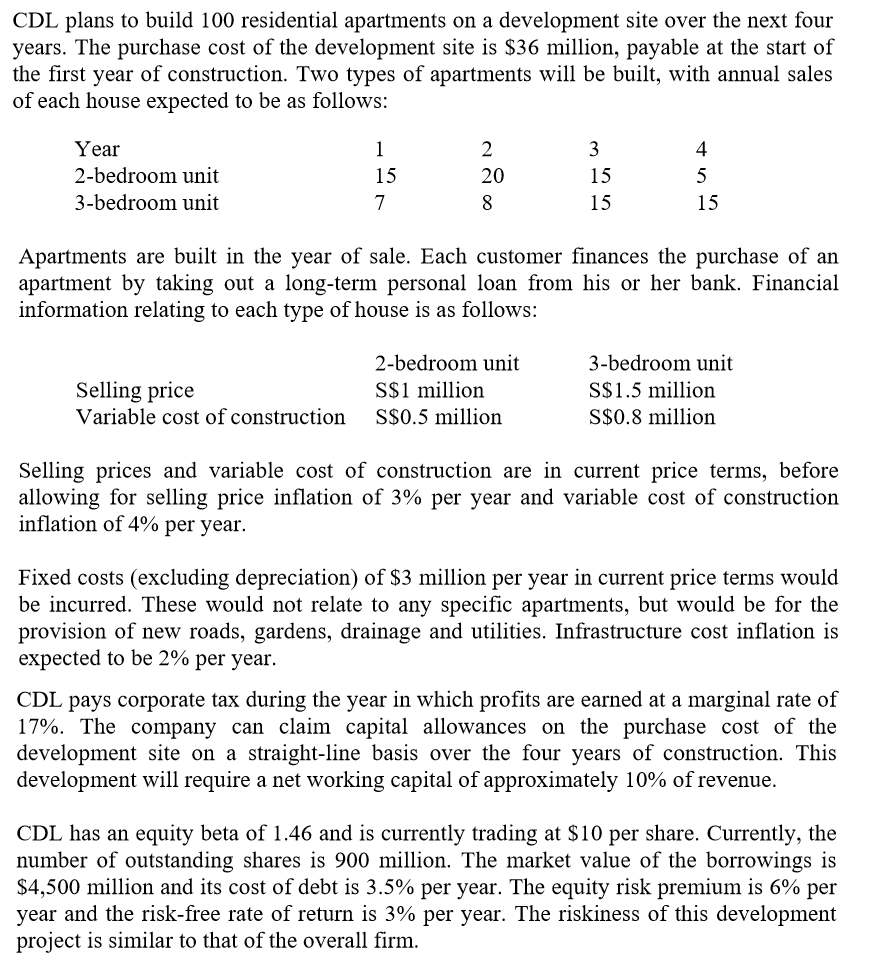

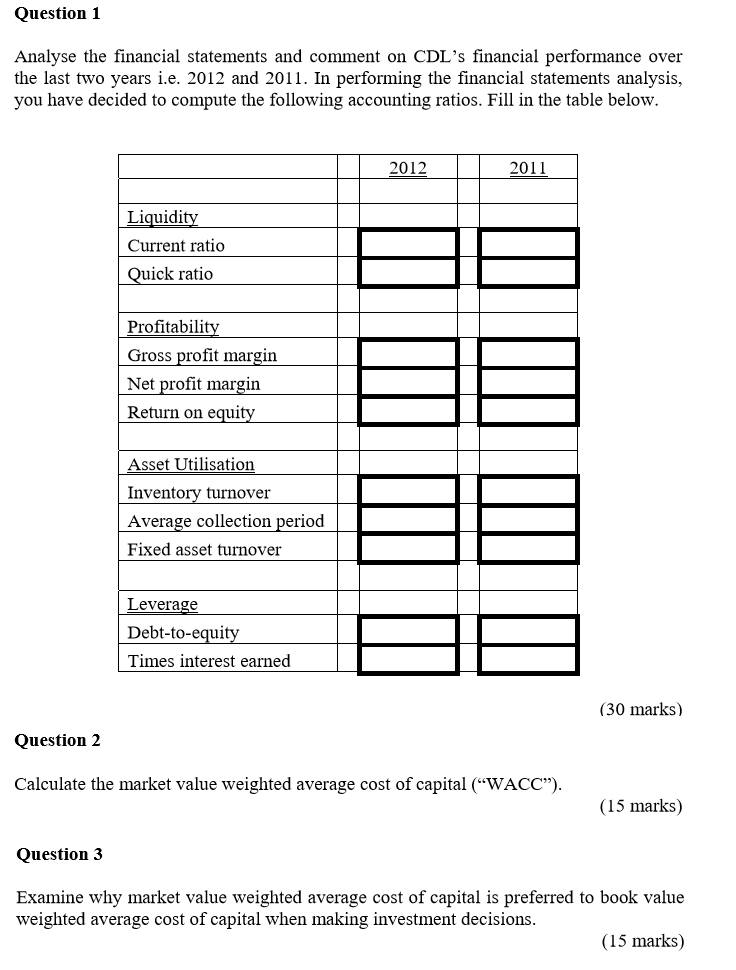

Question 1 Analyse the financial statements and comment on CDLs financial performance over the last two years i.e. 2012 and 2011. In performing the financial statements analysis, you have decided to compute the following accounting ratios. Fill in the table below.

Question 2 Calculate the market value weighted average cost of capital (WACC). (15 marks)

Question 3 Examine why market value weighted average cost of capital is preferred to book value weighted average cost of capital when making investment decisions. (15 marks)

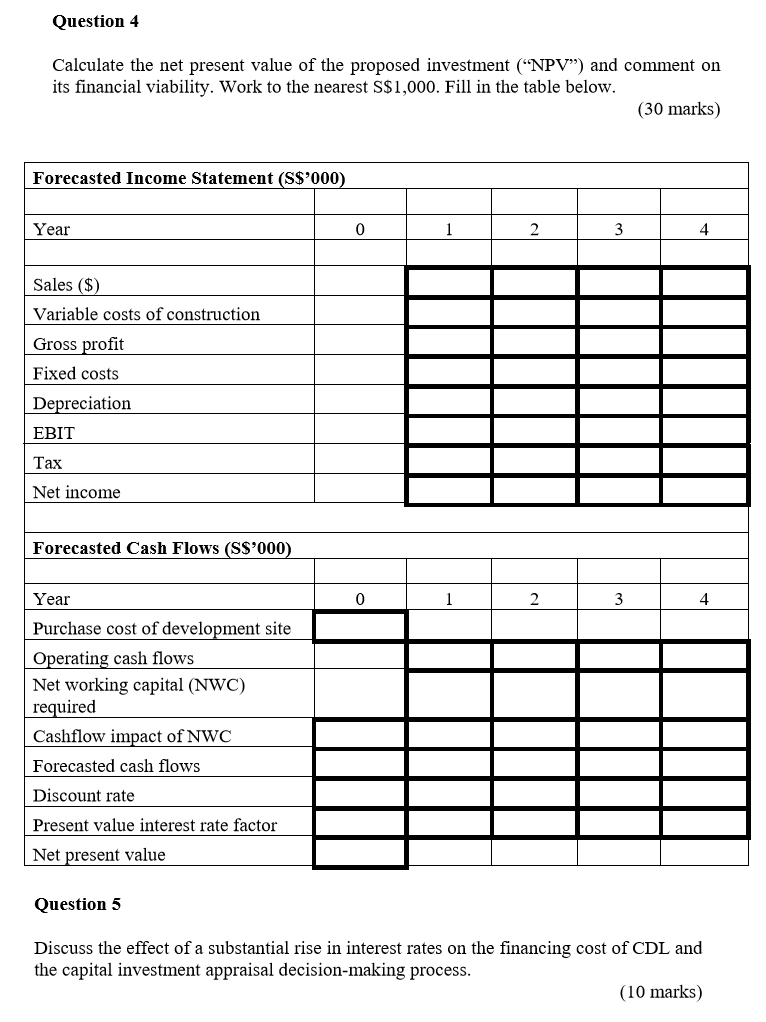

Question 4 Calculate the net present value of the proposed investment (NPV) and comment on its financial viability. Work to the nearest S$1,000. Fill in the table below. (30 marks)

Question 5 Discuss the effect of a substantial rise in interest rates on the financing cost of CDL and the capital investment appraisal decision-making process. (10 marks)

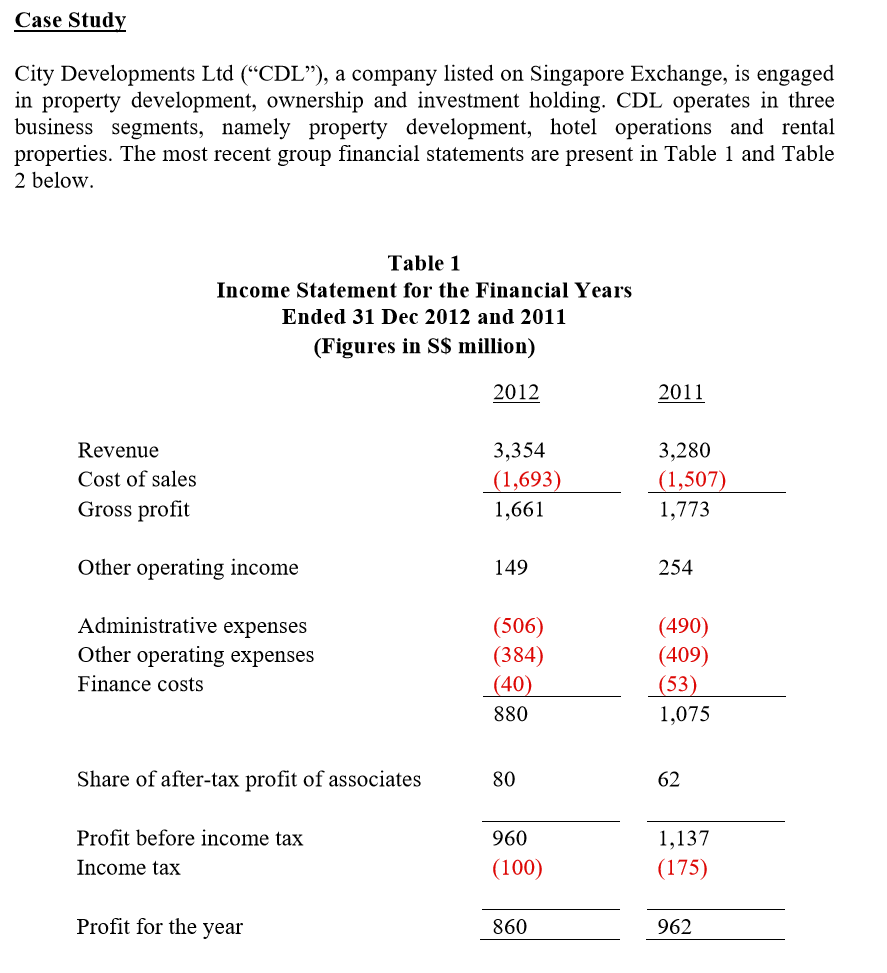

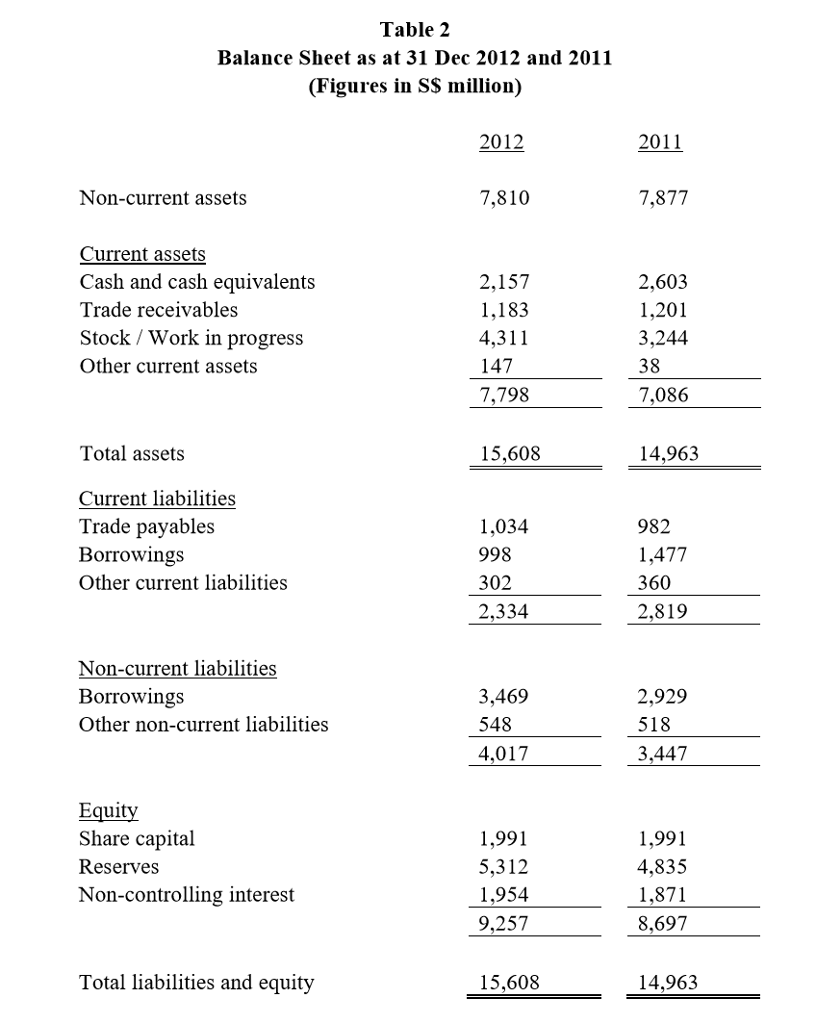

Case Study City Developments Ltd ("CDL"), a company listed on Singapore Exchange, is engaged in property development, ownership and investment holding. CDL operates in three business segments, namely property development, hotel operations and rental properties. The most recent group financial statements are present in Table 1 and Table 2 below Table 1 Income Statement for the Financial Years Ended 31 Dec 2012 and 2011 (Figures in SS million) 2012 2011 3,354 3,280 Revenue 1,507) Cost of sales (1,693) 1,661 1,773 Gross profit Other operating income 149 254 (506) (490) Administrative expenses (409) Other operating expenses (384) (40) (53) Finance costs 880 1,075 Share of after-tax profit of associates 80 62 Profit before income tax 960 1,137 (100) (175) Income tax 860 962 Profit for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started