Revision

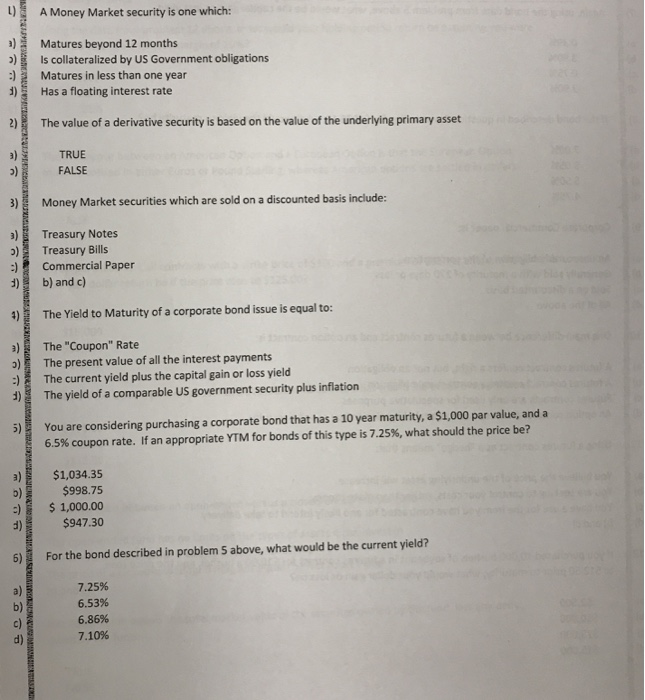

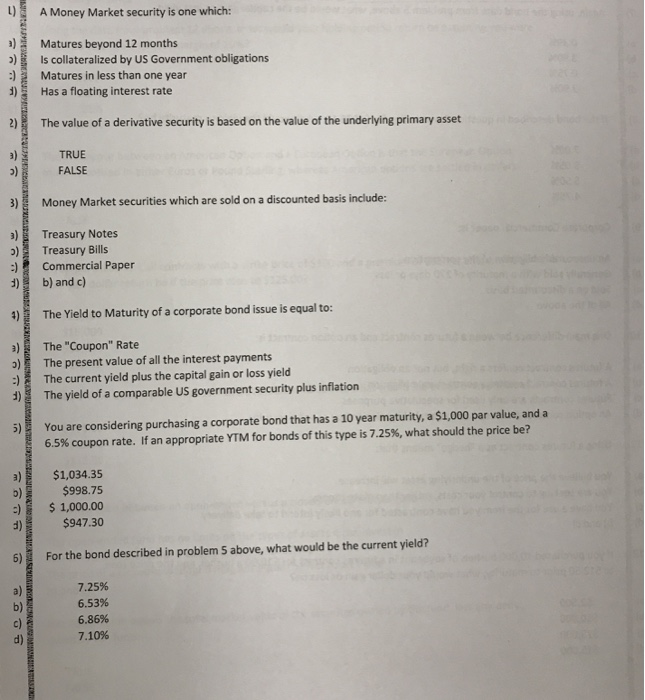

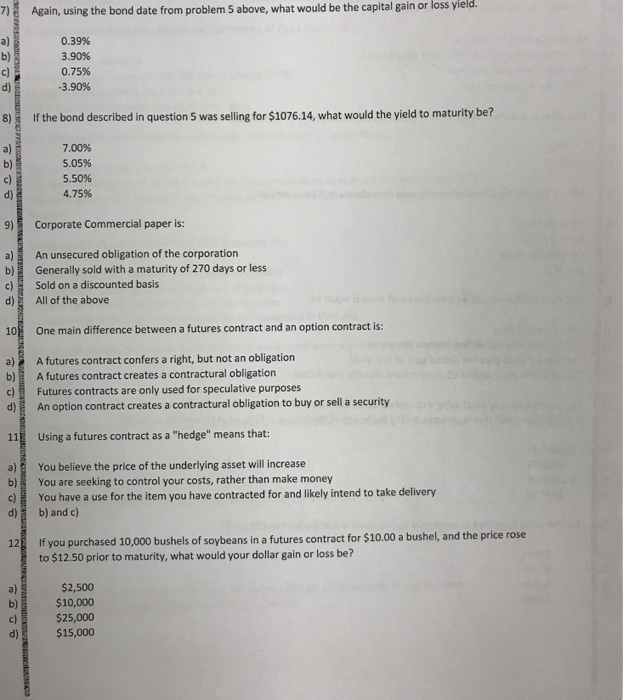

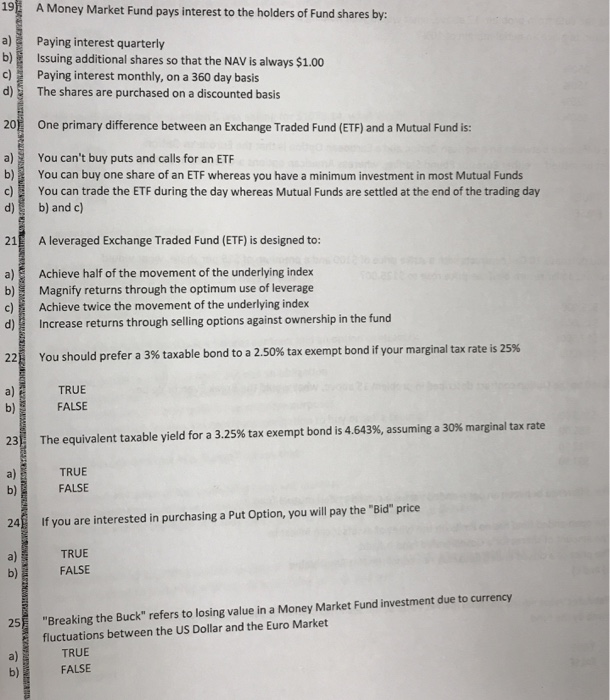

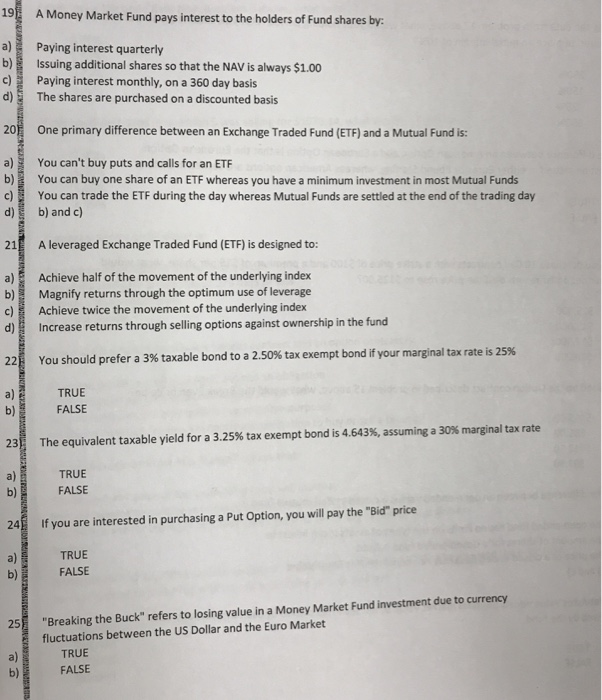

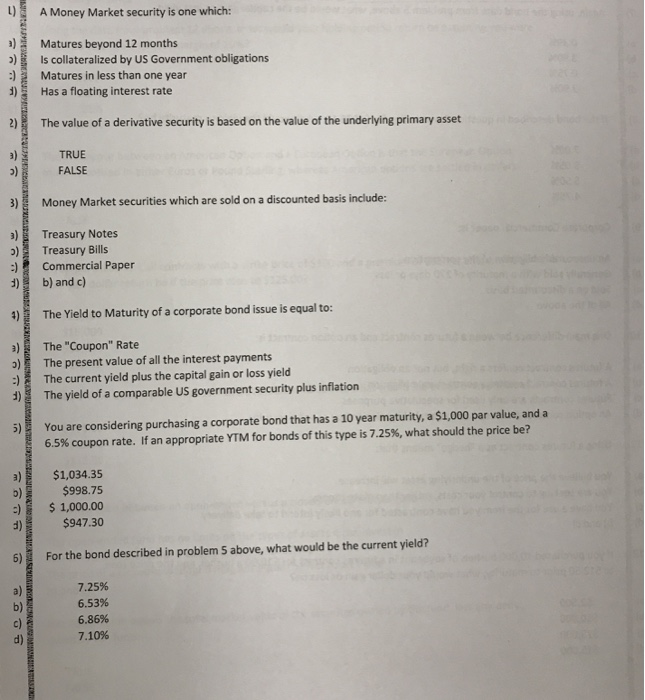

A Money Market security is one which: Matures beyond 12 months Matures in less than one year Is collateralized by US Government obligations Has a floating interest rate 2) The value of a derivative security is based on the value of the underlying primary asset TRUE FALSE 3) Money Market securities which are sold on a discounted basis include: aTreasury Notes oTreasury Bills Commercial Paper b) and c) The Yield to Maturity of a corporate bond issue is equal to: ) The "Coupon" Rate a) ) The present value of all the interest payments The current yield plus the capital gain or loss yield dThe yield of a comparable US government security plus inflation 5) You are considering purchasing a corporate bond that has a 10 year maturity, a $1,000 par value, and a 6.5% coupon rate. If an appropriate YTM for bonds of this type is 7.25%, what should the price be? a)$1,034.35 o) d) 6) $998.75 1,000.00 $947.30 For the bond described in problem 5 above, what would be the current yield? 7.25% 6.53% 6.86% 7.10% a) b) d) )Again, using the bond date from problem 5 above, what would be the capital gain or loss yield. 0.39% 3.90% 0.75% -3.90% b) d) 8) If the bond described in question 5 was selling for $1076.14, what would the yield to maturity be? a) b) c) d) 5.05% 5.50% 4.75% 9) Corporate Commercial paper is: a) An unsecured obligation of the corporation b c) Generally sold with a maturity of 270 days or less Sold on a discounted basis All of the above 10 One main difference between a futures contract and an option contract is: a) A futures contract confers a right, but not an obligation b)A futures contract creates a contractural obligation c)Futures contracts are only used for speculative purposes d) An option contract creates a contractural obligation to buy or sell a security 11 Using a futures contract as a "hedge" means that: a) You believe the price of the underlying asset will increase b) You are seeking to control your costs, rather than make money cYou have a use for the item you have contracted for and likely intend to take delivery d) b) and c) If you purchased 10,000 bushels of soybeans in a futures contract for $10.00 a bushel, and the price rose to $12.50 prior to maturity, what would your dollar gain or loss be? 12 a) b) c) d) $2,500 $10,000 $25,000 $15,000 E Using the data from problem 12 above, what would your holding period return be assuming you were required to place an initial margin of 10%? 250% 150% 25% 350% The difference between an American Option and a European Option is that the European Option must be settled in either Euros or Pound Sterling, whereas American options are settled in dollars 4 TRUE FALSE lf you purchase 10 Call contracts with a strike price of $100 and a premium of $15 per share, what would your net dollar return be if the price rose to $125.00? a) b) c) d) $25,000 $15,000 $12,500 $10,000 16 Based on the Option contract described in problem 15 above, what would the Break Even price be? a) b) c) d) 115.00 $85.00 $112.50 $97.50 17 The difference between an open-ended versus a closed-ended mutual fund is: a) b) The open-ended fund has no limits on the types of assets it can invest in The amount of shares for a closed-ended fund is fixed The price of a closed-ended fund may not equal the Net Asset Value d)b) and c) Net Asset Value equals the total market value of the securites owned by the fund, less any debt owed by the fund. 18 TRUE a) b) FALSE 19 A Money Market Fund pays interest to the holders of Fund shares by: a) Paying interest quarterly b)Issuing additional shares so that the NAV is always $1.00 c)Paying interest monthly, on a 360 day basis d) The shares are purchased on a discounted basis 2 One primary difference between an Exchange Traded Fund (ETF) and a Mutual Fund is: a) You can't buy puts and calls for an ETF b) You can buy one share of an ETF whereas you have a minimum investment in most Mutual Funds c)You can trade the ETF during the day whereas Mutual Funds are settled at the end of the trading day d) b) and c) 21 A leveraged Exchange Traded Fund (ETF) is designed to: a) Achieve half of the movement of the underlying index b) Magnify returns through the optimum use of leverage c)Achieve twice the movement of the underlying index d) Increase returns through selling options against ownership in the fund 22 You should prefer a 3% taxable bond to a 2.50% tax exempt bond if your marginal tax rate is 25% TRUE FALSE a) b) 23 a) The equivalent taxable yield for a 3.25% tax exempt bond is 4.643%, assuming a 30% marginal tax rate TRUE FALSE b) 24 If you are interested in purchasing a Put Option, you will pay the "Bid" price a) b) TRUE FALSE "Breaking the Buck" refers to losing value in a Money Market Fund investment due to currency fluctuations between the US Dollar and the Euro Market 25 a) b) TRUE FALSE 19 A Money Market Fund pays interest to the holders of Fund shares by: a) Paying interest quarterly b)Issuing additional shares so that the NAV is always $1.00 c)Paying interest monthly, on a 360 day basis d) The shares are purchased on a discounted basis 20 One primary difference between an Exchange Traded Fund (ETF) and a Mutual Fund is: a) You can't buy puts and calls for an ETF b) You can buy one share of an ETF whereas you have a minimum investment in most Mutual Funds c)You can trade the ETF during the day whereas Mutual Funds are settled at the end of the trading day d) b) and c) 21 A leveraged Exchange Traded Fund (ETF) is designed to: a) E Achieve half of the movement of the underlying index b) Magnify returns through the optimum use of leverage d) Increase returns through selling options against ownership in the fund 221 You should prefer a 3% taxable bond to a 2.50% tax exempt bond if your marginal tax rate is 2 a) Achieve twice the movement of the underlying index TRUE FALSE b) 23 The equivalent taxable yield for a 3.25% tax exempt bond is 4.643%, assunning a 30% marginal tax rate TRUE FALSE a) b) 4If you are interested in purchasing a Put Option, you will pay the "Bid" price a) TRUE FALSE b) "Breaking the Buck" refers to losing value in a Money Market Fund investment due to currency fluctuations between the US Dollar and the Euro Market 25 a) b) TRUE FALSE