Answered step by step

Verified Expert Solution

Question

1 Approved Answer

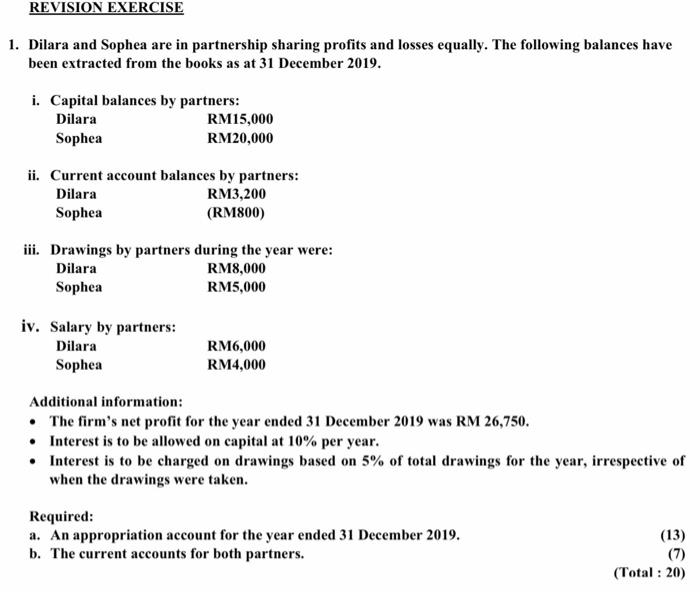

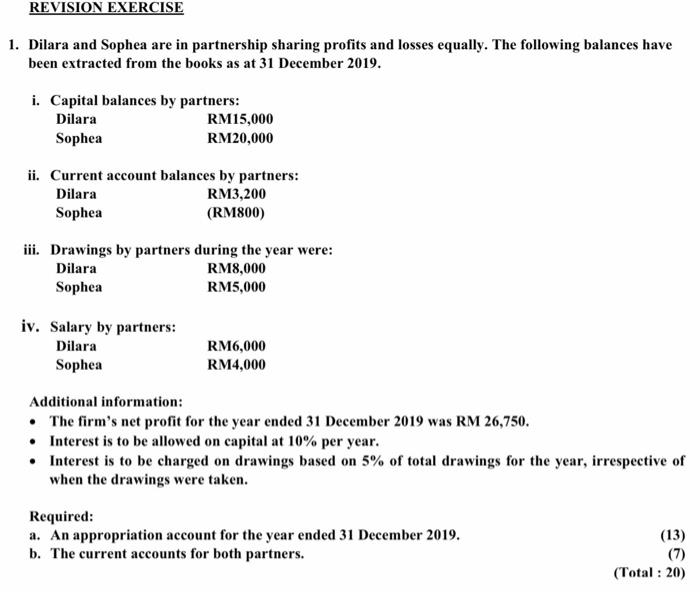

REVISION EXERCISE 1. Dilara and Sophea are in partnership sharing profits and losses equally. The following balances have been extracted from the books as at

REVISION EXERCISE 1. Dilara and Sophea are in partnership sharing profits and losses equally. The following balances have been extracted from the books as at 31 December 2019. i. Capital balances by partners: Dilara RM15,000 Sophea RM20,000 ii. Current account balances by partners: Dilara RM3,200 Sophea (RM800) iii. Drawings by partners during the year were: Dilara RM8,000 Sophea RM5,000 iv. Salary by partners: Dilara Sophea RM6,000 RM4,000 Additional information: The firm's net profit for the year ended 31 December 2019 was RM 26,750. Interest is to be allowed on capital at 10% per year. Interest is to be charged on drawings based on 5% of total drawings for the year, irrespective of when the drawings were taken. Required: a. An appropriation account for the year ended 31 December 2019. b. The current accounts for both partners. (13) (7) (Total : 20)

REVISION EXERCISE 1. Dilara and Sophea are in partnership sharing profits and losses equally. The following balances have been extracted from the books as at 31 December 2019. i. Capital balances by partners: Dilara RM15,000 Sophea RM20,000 ii. Current account balances by partners: Dilara RM3,200 Sophea (RM800) iii. Drawings by partners during the year were: Dilara RM8,000 Sophea RM5,000 iv. Salary by partners: Dilara Sophea RM6,000 RM4,000 Additional information: The firm's net profit for the year ended 31 December 2019 was RM 26,750. Interest is to be allowed on capital at 10% per year. Interest is to be charged on drawings based on 5% of total drawings for the year, irrespective of when the drawings were taken. Required: a. An appropriation account for the year ended 31 December 2019. b. The current accounts for both partners. (13) (7) (Total : 20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started