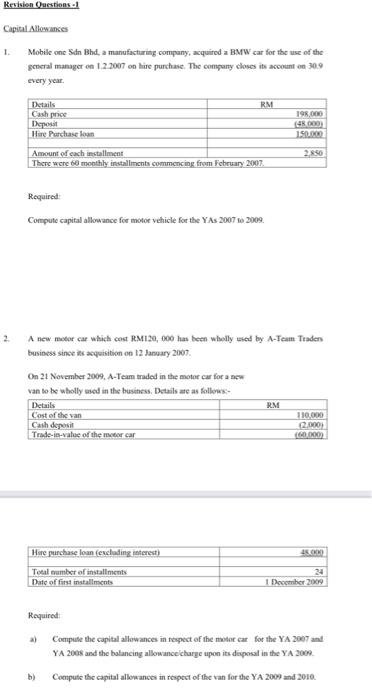

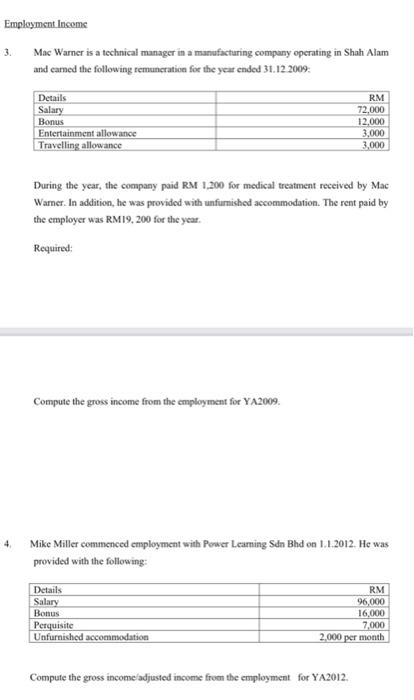

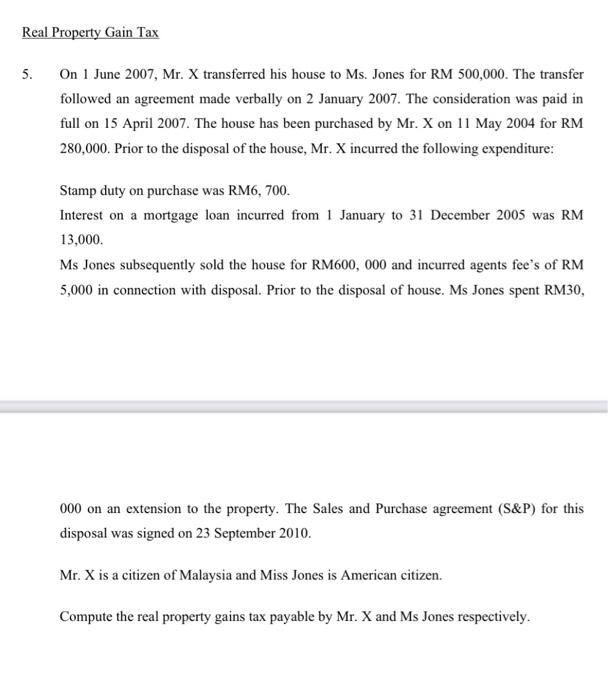

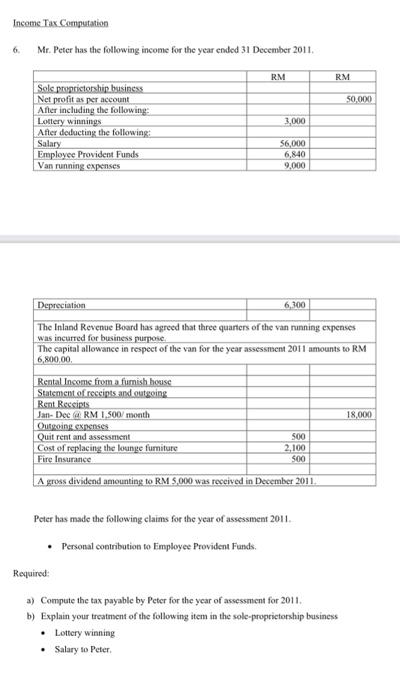

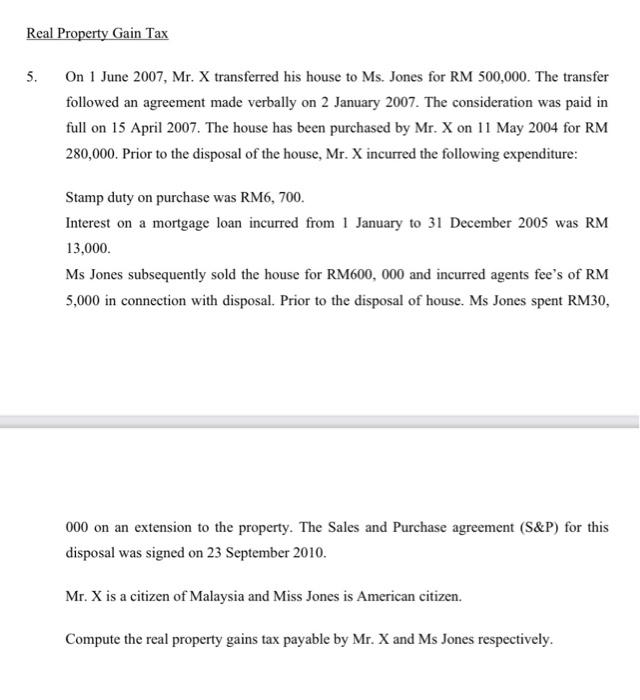

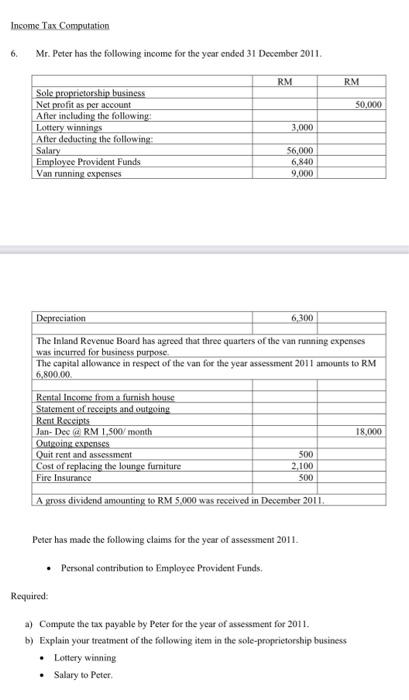

Revision Questions: Capital Allowances Mobile one Sdn Bhd. a manufacturing company, acquired a BMW car for the use of the general manager on 1.2.2007 on hire purchase. The company closes its account 30.9 every year RM Details Cash price Deposit Hire Purchase lo 1980 (48000 15 Amount of each installment There were 60 monthly installments commencing from February 2007 2.850 Required Compute capital allowance for motor vehicle for the YAS 2007 16 2009. A new motor car which cost RM120,000 has been wholly used by A-Team Traden business since its acquisition on 12 January 2007 On 21 November 2009. A-Team truded in the motor car for a new van to be wholly used in the business Details are as follows: Details Cost of the van 110 000 Cash deposit 2.000 Trade-is-value of the motor car (60.000 RM Hare purchase loan (excluding interest) Total number of installments Date of first installments 24 1 December 2009 Required Compute the capital allowances in respect of the motor car for the YA 2007 and YA 2005 and the balancing allowance charge upon its disposal in the YA 2008 Compute the capital allowances in respect of the van for the YA 2009 and 2010. b) Employment Income 3. Mac Warner is a technical manager in a manufacturing company operating in Shah Alam and earned the following remuneration for the year ended 31.12.2009 Details Salary Bonus Entertainment allowance Travelling allowance RM 72.000 12.000 3,000 3,000 During the year, the company paid RM 1,200 for medical treatment received by Mac Wamer. In addition, he was provided with unfurmished accommodation. The rent paid by the employer was RM 19.200 for the year. Required: Compute the gross income from the employment for Y 2009 4 Mike Miller commenced employment with Power Leaming Sdn Bhd on 1.1.2012. He was provided with the following: Details Salary Bonus Perquisite Unfurnished accommodation RM 96,000 16,000 7.000 2.000 per month Compute the gross income adjusted income from the employment for YA2012. Real Property Gain Tax 5. On 1 June 2007, Mr. X transferred his house to Ms. Jones for RM 500,000. The transfer followed an agreement made verbally on 2 January 2007. The consideration was paid in full on 15 April 2007. The house has been purchased by Mr. X on 11 May 2004 for RM 280,000. Prior to the disposal of the house, Mr.X incurred the following expenditure: Stamp duty on purchase was RM6, 700. Interest on a mortgage loan incurred from 1 January to 31 December 2005 was RM 13,000. Ms Jones subsequently sold the house for RM600, 000 and incurred agents fee's of RM 5,000 in connection with disposal. Prior to the disposal of house. Ms Jones spent RM30, 000 on an extension to the property. The Sales and Purchase agreement (S&P) for this disposal was signed on 23 September 2010. Mr.X is a citizen of Malaysia and Miss Jones is American citizen. Compute the real property gains tax payable by Mr. X and Ms Jones respectively. Income Tax Computation Mr. Peter has the following income for the year ended 31 December 2011 6. RM RM 50.000 3,000 Sole proprietorship business Net profit as per account After including the following Lottery winnings After deducting the following: Salary Employee Provident Funds Van running expenses 56,000 6,840 9,000 Depreciation 6.100 The Inland Revenue Board has agreed that three quarters of the van running expenses was incurred for business purpose The capital allowance in respect of the van for the year assessment 2011 amounts to RM 6,800,00 18.000 Rental Income from a furnish house Statement of receipts and outcoing Rent Receipts Jan-Dec RM 1.500/month Outgoing expenses Quit rent and assessment Cost of replacing the lounge furniture Fire Insurance 500 2,100 500 A gross dividend amounting to RM 5,000 was received in December 2011. Peter has made the following claims for the year of assessment 2011 Personal contribution to Employee Provident Funds Required: a) Compute the tax payable by Peter for the year of assessment for 2011 b) Explain your treatment of the following item in the sole-proprietorship business Lottery winning Salary to Peter Real Property Gain Tax 5. On 1 June 2007, Mr. X transferred his house to Ms. Jones for RM 500,000. The transfer followed an agreement made verbally on 2 January 2007. The consideration was paid in full on 15 April 2007. The house has been purchased by Mr. X on 11 May 2004 for RM 280,000. Prior to the disposal of the house, Mr.X incurred the following expenditure: Stamp duty on purchase was RM6, 700. Interest on a mortgage loan incurred from 1 January to 31 December 2005 was RM 13,000. Ms Jones subsequently sold the house for RM600,000 and incurred agents fee's of RM 5,000 in connection with disposal. Prior to the disposal of house. Ms Jones spent RM30, 000 on an extension to the property. The Sales and Purchase agreement (S&P) for this disposal was signed on 23 September 2010. Mr.X is a citizen of Malaysia and Miss Jones is American citizen. Compute the real property gains tax payable by Mr. X and Ms Jones respectively. Income Tax Computation 6. Mr. Peter has the following income for the year ended 31 December 2011 RM RM 50.000 3,000 Sole proprietorship business Net profit as per account After including the following Lottery winnings After deducting the following: Salary Employee Provident Funds Van running expenses 56,000 6,840 9,000 Depreciation 6.300 The Inland Revenue Board has agreed that three quarters of the van running expenses was incurred for business purpose The capital allowance in respect of the van for the year assessment 2011 amounts to RM 6,800.00 18,000 Rental Income from a furnish house Statement of receipts and outgoing Rent Receipts Jan-Dee @ RM 1,500/month Outgoing expenses Ouit rent and assessment Cost of replacing the lounge furniture Fire Insurance 500 2,100 500 A gross dividend amounting to RM 5,000 was received in December 2011 Peter has made the following claims for the year of assessment 2011 Personal contribution to Employee Provident Funds Required: a) Compute the tax payable by Peter for the year of assessment for 2011. b) Explain your treatment of the following item in the sole-proprietorship business Lottery winning Salary to Peter Revision Questions: Capital Allowances Mobile one Sdn Bhd. a manufacturing company, acquired a BMW car for the use of the general manager on 1.2.2007 on hire purchase. The company closes its account 30.9 every year RM Details Cash price Deposit Hire Purchase lo 1980 (48000 15 Amount of each installment There were 60 monthly installments commencing from February 2007 2.850 Required Compute capital allowance for motor vehicle for the YAS 2007 16 2009. A new motor car which cost RM120,000 has been wholly used by A-Team Traden business since its acquisition on 12 January 2007 On 21 November 2009. A-Team truded in the motor car for a new van to be wholly used in the business Details are as follows: Details Cost of the van 110 000 Cash deposit 2.000 Trade-is-value of the motor car (60.000 RM Hare purchase loan (excluding interest) Total number of installments Date of first installments 24 1 December 2009 Required Compute the capital allowances in respect of the motor car for the YA 2007 and YA 2005 and the balancing allowance charge upon its disposal in the YA 2008 Compute the capital allowances in respect of the van for the YA 2009 and 2010. b) Employment Income 3. Mac Warner is a technical manager in a manufacturing company operating in Shah Alam and earned the following remuneration for the year ended 31.12.2009 Details Salary Bonus Entertainment allowance Travelling allowance RM 72.000 12.000 3,000 3,000 During the year, the company paid RM 1,200 for medical treatment received by Mac Wamer. In addition, he was provided with unfurmished accommodation. The rent paid by the employer was RM 19.200 for the year. Required: Compute the gross income from the employment for Y 2009 4 Mike Miller commenced employment with Power Leaming Sdn Bhd on 1.1.2012. He was provided with the following: Details Salary Bonus Perquisite Unfurnished accommodation RM 96,000 16,000 7.000 2.000 per month Compute the gross income adjusted income from the employment for YA2012. Real Property Gain Tax 5. On 1 June 2007, Mr. X transferred his house to Ms. Jones for RM 500,000. The transfer followed an agreement made verbally on 2 January 2007. The consideration was paid in full on 15 April 2007. The house has been purchased by Mr. X on 11 May 2004 for RM 280,000. Prior to the disposal of the house, Mr.X incurred the following expenditure: Stamp duty on purchase was RM6, 700. Interest on a mortgage loan incurred from 1 January to 31 December 2005 was RM 13,000. Ms Jones subsequently sold the house for RM600, 000 and incurred agents fee's of RM 5,000 in connection with disposal. Prior to the disposal of house. Ms Jones spent RM30, 000 on an extension to the property. The Sales and Purchase agreement (S&P) for this disposal was signed on 23 September 2010. Mr.X is a citizen of Malaysia and Miss Jones is American citizen. Compute the real property gains tax payable by Mr. X and Ms Jones respectively. Income Tax Computation Mr. Peter has the following income for the year ended 31 December 2011 6. RM RM 50.000 3,000 Sole proprietorship business Net profit as per account After including the following Lottery winnings After deducting the following: Salary Employee Provident Funds Van running expenses 56,000 6,840 9,000 Depreciation 6.100 The Inland Revenue Board has agreed that three quarters of the van running expenses was incurred for business purpose The capital allowance in respect of the van for the year assessment 2011 amounts to RM 6,800,00 18.000 Rental Income from a furnish house Statement of receipts and outcoing Rent Receipts Jan-Dec RM 1.500/month Outgoing expenses Quit rent and assessment Cost of replacing the lounge furniture Fire Insurance 500 2,100 500 A gross dividend amounting to RM 5,000 was received in December 2011. Peter has made the following claims for the year of assessment 2011 Personal contribution to Employee Provident Funds Required: a) Compute the tax payable by Peter for the year of assessment for 2011 b) Explain your treatment of the following item in the sole-proprietorship business Lottery winning Salary to Peter Real Property Gain Tax 5. On 1 June 2007, Mr. X transferred his house to Ms. Jones for RM 500,000. The transfer followed an agreement made verbally on 2 January 2007. The consideration was paid in full on 15 April 2007. The house has been purchased by Mr. X on 11 May 2004 for RM 280,000. Prior to the disposal of the house, Mr.X incurred the following expenditure: Stamp duty on purchase was RM6, 700. Interest on a mortgage loan incurred from 1 January to 31 December 2005 was RM 13,000. Ms Jones subsequently sold the house for RM600,000 and incurred agents fee's of RM 5,000 in connection with disposal. Prior to the disposal of house. Ms Jones spent RM30, 000 on an extension to the property. The Sales and Purchase agreement (S&P) for this disposal was signed on 23 September 2010. Mr.X is a citizen of Malaysia and Miss Jones is American citizen. Compute the real property gains tax payable by Mr. X and Ms Jones respectively. Income Tax Computation 6. Mr. Peter has the following income for the year ended 31 December 2011 RM RM 50.000 3,000 Sole proprietorship business Net profit as per account After including the following Lottery winnings After deducting the following: Salary Employee Provident Funds Van running expenses 56,000 6,840 9,000 Depreciation 6.300 The Inland Revenue Board has agreed that three quarters of the van running expenses was incurred for business purpose The capital allowance in respect of the van for the year assessment 2011 amounts to RM 6,800.00 18,000 Rental Income from a furnish house Statement of receipts and outgoing Rent Receipts Jan-Dee @ RM 1,500/month Outgoing expenses Ouit rent and assessment Cost of replacing the lounge furniture Fire Insurance 500 2,100 500 A gross dividend amounting to RM 5,000 was received in December 2011 Peter has made the following claims for the year of assessment 2011 Personal contribution to Employee Provident Funds Required: a) Compute the tax payable by Peter for the year of assessment for 2011. b) Explain your treatment of the following item in the sole-proprietorship business Lottery winning Salary to Peter