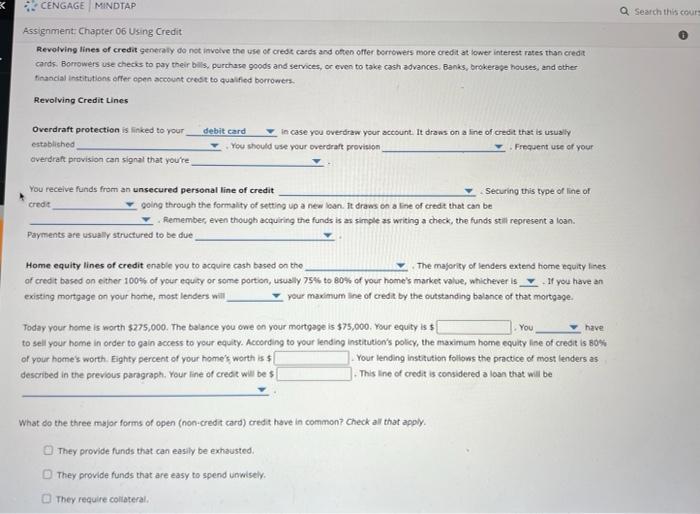

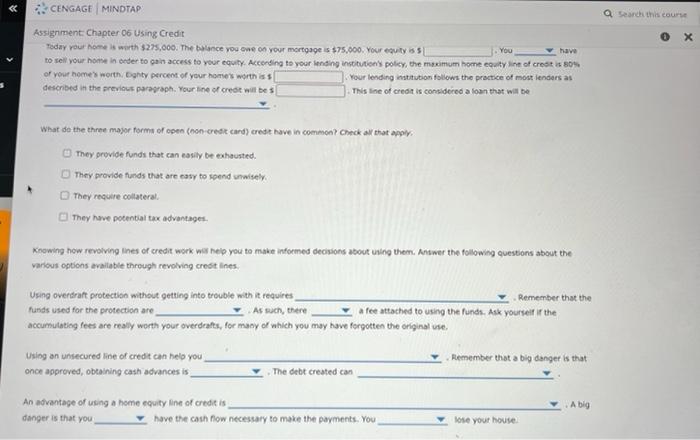

Revolving lines of credit generaly do not invotve the wie of credt cards and ofted offer berrowets mote credit at lower interest rates than credit cards. Bonowers use checks to pay their bills, purchase goods and services, or even to take cash advances, Banks, orvikerase houses, and other finandal inetitutions offer open acoount orest to qualfied borrowers. Revolving Credit Lines What do the three mujor forms of open (non-credit card) credit have in common? check all that apply. They provide funds that can easily be exhausted. They provide funds that are easy to spend unwisely. They require coliateral, Assignment Chapter 06 Using Credit of yout homes worth, Gighty percent of your homes with is 1 . Vour lending institution followt the proctice of most lenders as described it the crevious parastaph. Yourline of orede ait be 3 . This line of credt is concidered a fosen that will be What do the three mayor forma of open (non-crest card) credt have in common? Check ay that appiy. They provide funds that can essily be exhausted. They provide funds that are easy to soend sowisely. They recuire collateral. They have pocential tux advantages. Knowing how revolving lnes of credit work wit help you to make informed decisions about using them. Antwer the following questions about the various opbons available through revolving credt lines. Using overdraft protectisn without getting into trouble with it requires - funds used for the protection are accumulatiog fees are realy worth your overdratts. for maay of which you may have fergotten the original use. Using an unsecured line of credit can helo you once aoproved, obeaining cash advances is - The debt created can An advantage of using a home equity line of credit is danger is that you have the cash flow necessary to make the payments. You lose yout house. Revolving lines of credit generaly do not invotve the wie of credt cards and ofted offer berrowets mote credit at lower interest rates than credit cards. Bonowers use checks to pay their bills, purchase goods and services, or even to take cash advances, Banks, orvikerase houses, and other finandal inetitutions offer open acoount orest to qualfied borrowers. Revolving Credit Lines What do the three mujor forms of open (non-credit card) credit have in common? check all that apply. They provide funds that can easily be exhausted. They provide funds that are easy to spend unwisely. They require coliateral, Assignment Chapter 06 Using Credit of yout homes worth, Gighty percent of your homes with is 1 . Vour lending institution followt the proctice of most lenders as described it the crevious parastaph. Yourline of orede ait be 3 . This line of credt is concidered a fosen that will be What do the three mayor forma of open (non-crest card) credt have in common? Check ay that appiy. They provide funds that can essily be exhausted. They provide funds that are easy to soend sowisely. They recuire collateral. They have pocential tux advantages. Knowing how revolving lnes of credit work wit help you to make informed decisions about using them. Antwer the following questions about the various opbons available through revolving credt lines. Using overdraft protectisn without getting into trouble with it requires - funds used for the protection are accumulatiog fees are realy worth your overdratts. for maay of which you may have fergotten the original use. Using an unsecured line of credit can helo you once aoproved, obeaining cash advances is - The debt created can An advantage of using a home equity line of credit is danger is that you have the cash flow necessary to make the payments. You lose yout house