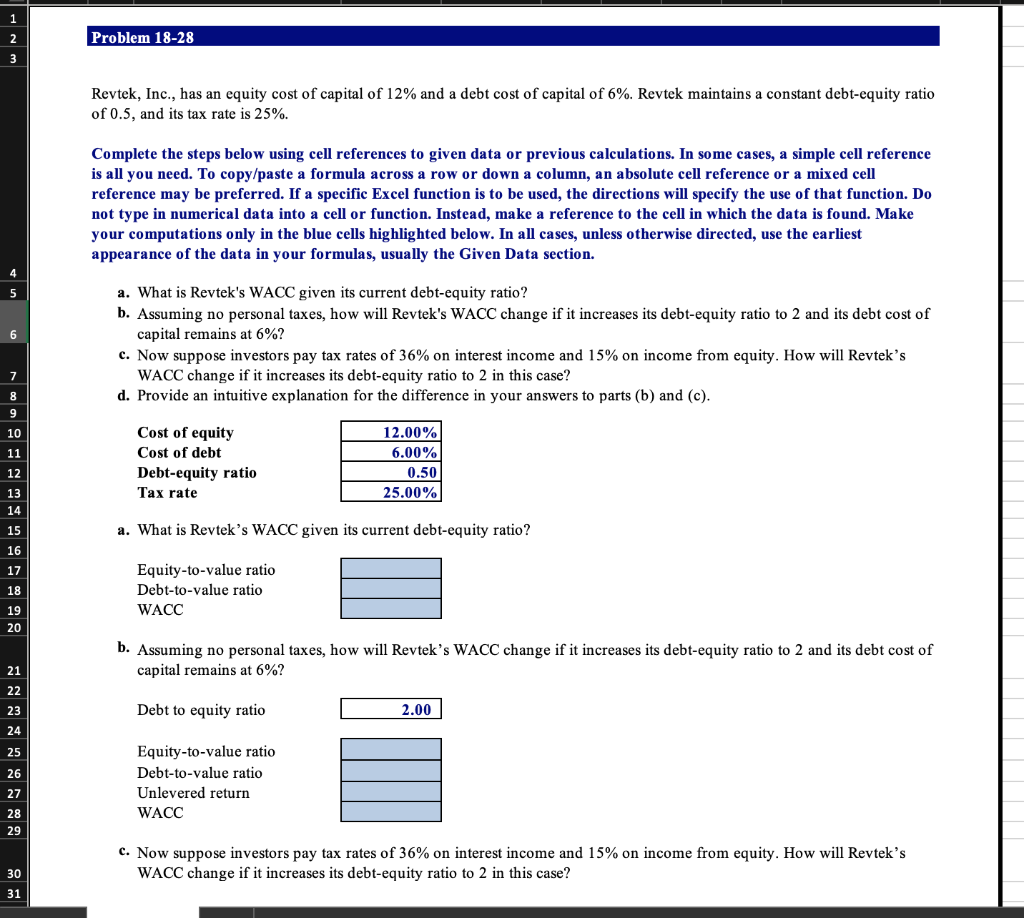

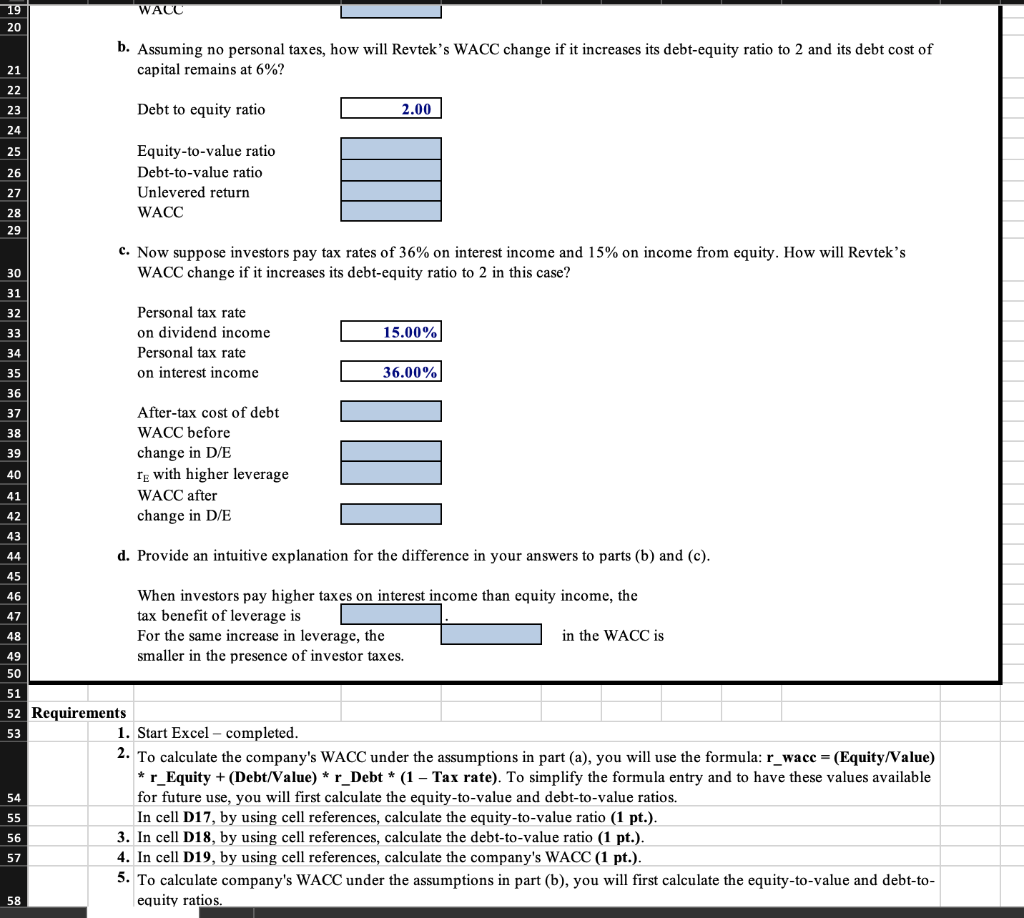

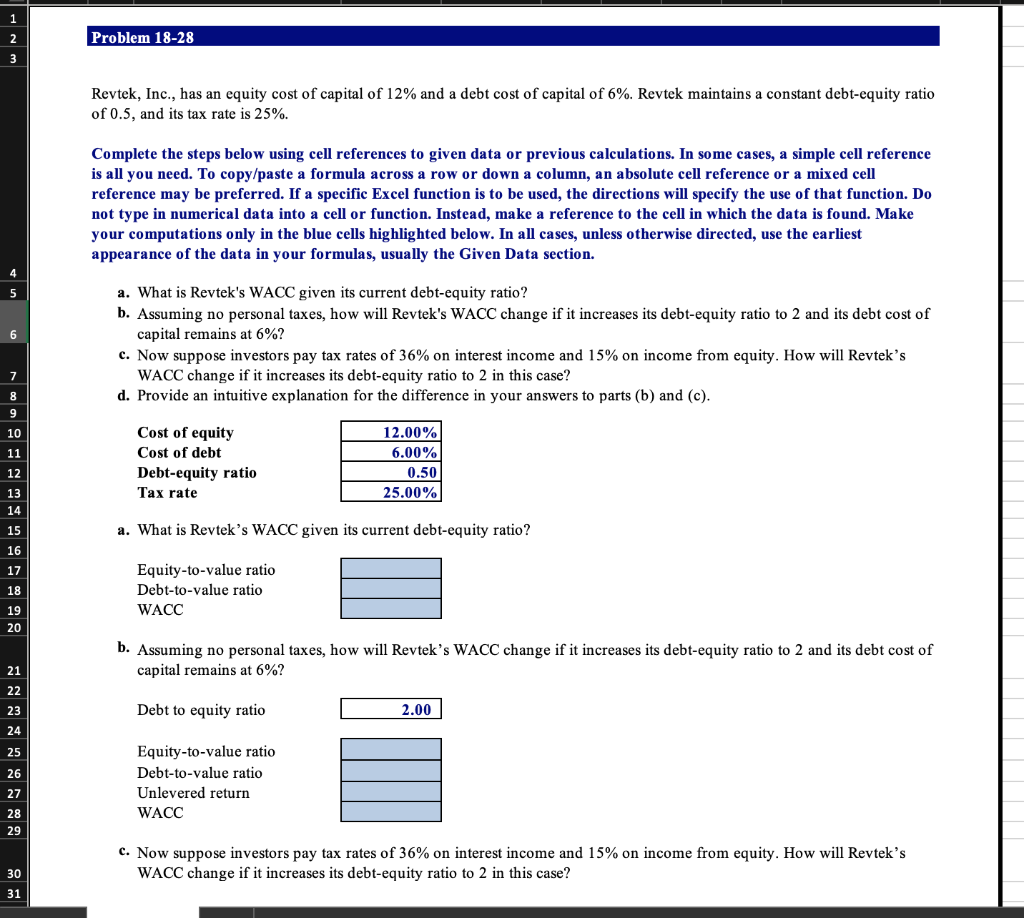

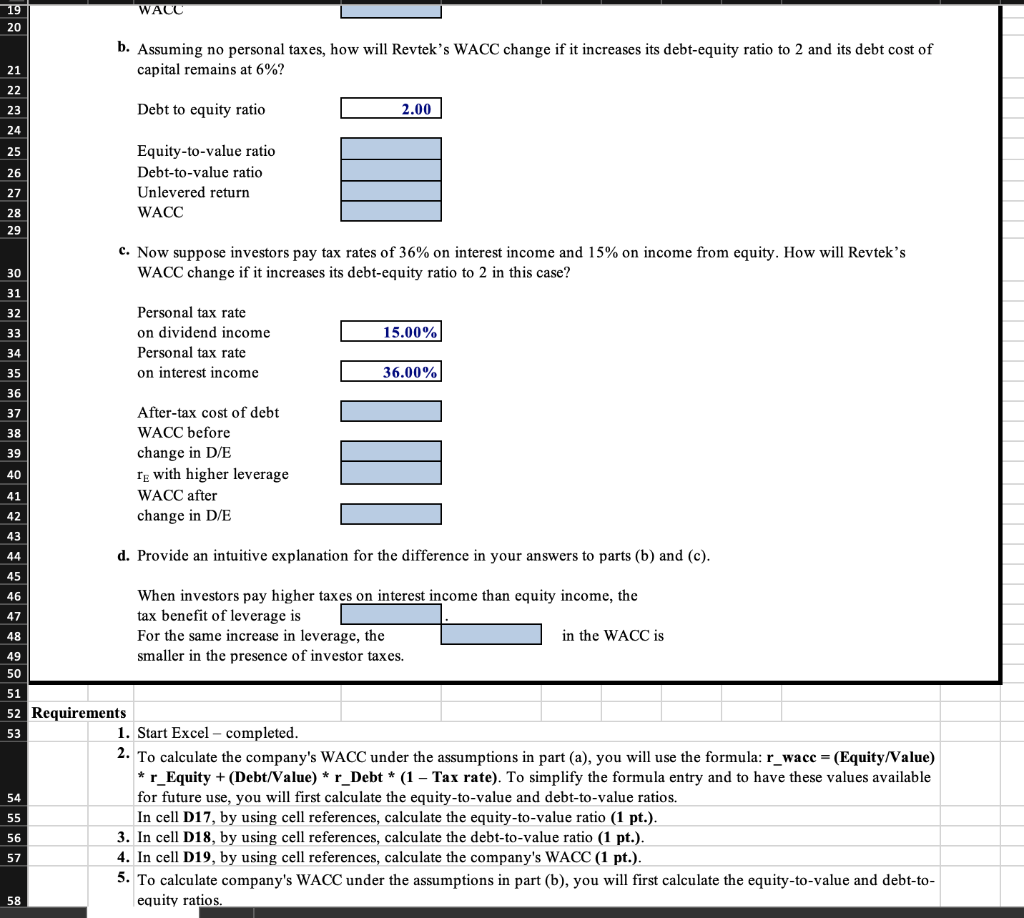

Revtek, Inc., has an equity cost of capital of 12% and a debt cost of capital of 6%. Revtek maintains a constant debt-equity ratio of 0.5, and its tax rate is 25%. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. What is Revtek's WACC given its current debt-equity ratio? b. Assuming no personal taxes, how will Revtek's WACC change if it increases its debt-equity ratio to 2 and its debt cost of capital remains at 6%? c. Now suppose investors pay tax rates of 36% on interest income and 15% on income from equity. How will Revtek's WACC change if it increases its debt-equity ratio to 2 in this case? d. Provide an intuitive explanation for the difference in your answers to parts (b) and (c). a. What is Revtek's WACC given its current debt-equity ratio? b. Assuming no personal taxes, how will Revtek's WACC change if it increases its debt-equity ratio to 2 and its debt cost of capital remains at 6% ? c. Now suppose investors pay tax rates of 36% on interest income and 15% on income from equity. How will Revtek's WACC change if it increases its debt-equity ratio to 2 in this case? b. Assuming no personal taxes, how will Revtek's WACC change if it increases its debt-equity ratio to 2 and its debt cost of capital remains at 6% c. Now suppose investors pay tax rates of 36% on interest income and 15% on income from equity. How will Revtek's WACC change if it increases its debt-equity ratio to 2 in this case? d. Provide an intuitive explanation for the difference in your answers to parts (b) and (c). When investors pay higher taxes on interest income than equity income, the tax benefit of leverage is For the same increase in leverage, the in the WACC is smaller in the presence of investor taxes. 1. Start excel-completed. 2. To calculate the company's WACC under the assumptions in part (a), you will use the formula: rwacc =(Equity/Value) rEquity + (Debt/Value) * rDebt * (1 - Tax rate). To simplify the formula entry and to have these values available for future use, you will first calculate the equity-to-value and debt-to-value ratios. In cell D17, by using cell references, calculate the equity-to-value ratio (1 pt.). 3. In cell D18, by using cell references, calculate the debt-to-value ratio (1 pt.). 4. In cell D19, by using cell references, calculate the company's WACC (1 pt.). 5. To calculate company's WACC under the assumptions in part (b), you will first calculate the equity-to-value and debt-toequity ratios