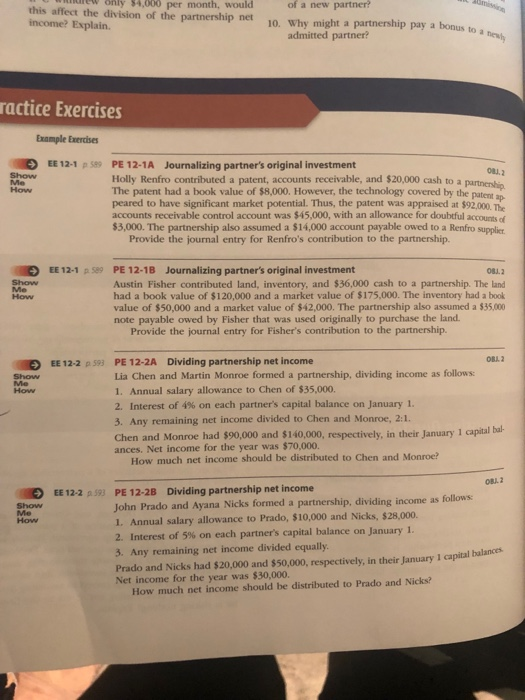

rew only $4,000 per month, would of a new partner this affect the division of the partnership net income? Explain. 1o. Why might a partnership pay a bonus to a admitted partner? ractice Exercises Example Exercises EE 12-1 p S89 PE 12-1A Journalizing partner's original investment ORJ2 Show Holly Renfro contributed a patent, accounts receivable, and $20,000 cash to a The patent had a book value of $8,000. However, the technology covered by the patent an peared to have significant market potential. Thus, the patent was appraised at $92,000. The accounts receivable control account was $45,000, with an allowance for doubtful accounts of $3,000. The partnership also assumed a $14,000 account payable owed to a Renfro supplicr How Provide the journal entry for Renfro's contribution to the partnership. EE12-1 p 589 PE 12-18 Journalizing partner's original investment O8J.2 Austin Fisher contributed land, inventory, and $36,000 cash to a partnership. The land had a book value of $120,000 and a market value of $175,000. The inventory had a book value of $50,000 and a market value of $42,000. The partnership also assumed a $35,000 note payable owed by Fisher that was used originally to purchase the land. Show Me Provide the journal entry for Fisher's contribution to the partnership. 2 EE 12-2 p593 PE 12-2A Dividing partnership net income Lia Chen and Martin Monroe formed a partnership, dividing income as follows 1. Annual salary allowance to Chen of $35,000. 2. Interest of 4% on each partner's capital balance on January 1. 3. Any remaining net income divided to Chen and Monroe, 2:1. Chen and Monroe had $90,000 and $140,000, respectively, in their January 1 capital bal- ances. Net income for the year was $70,000. How How much net income should be distributed to Chen and Monroe? OBL2 PE 12-2B Dividing partnership net income John Prado and Ayana Nicks formed a partnership, dividing income as follows 1. Annual salary allowance to Prado, $10,000 and Nicks, $28,000. 2. Interest of 5% on each partner's capital balance on January i 3. Any remaining net income divided equally. Prado and Nicks had $20,000 and $50,000, respectively, in their January I capital balances Net income for the year was $30,000. EE 12-2 Show Me How How much net income should be distributed to Prado and Nicks