Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REWORD THE ANSWER TO QUESTION 7. ( IGNORE THE RED INC ) 7. The Capital Asset Pricing Model (CAPM) relies upon beta as a measure

REWORD THE ANSWER TO QUESTION 7. ( IGNORE THE RED INC )

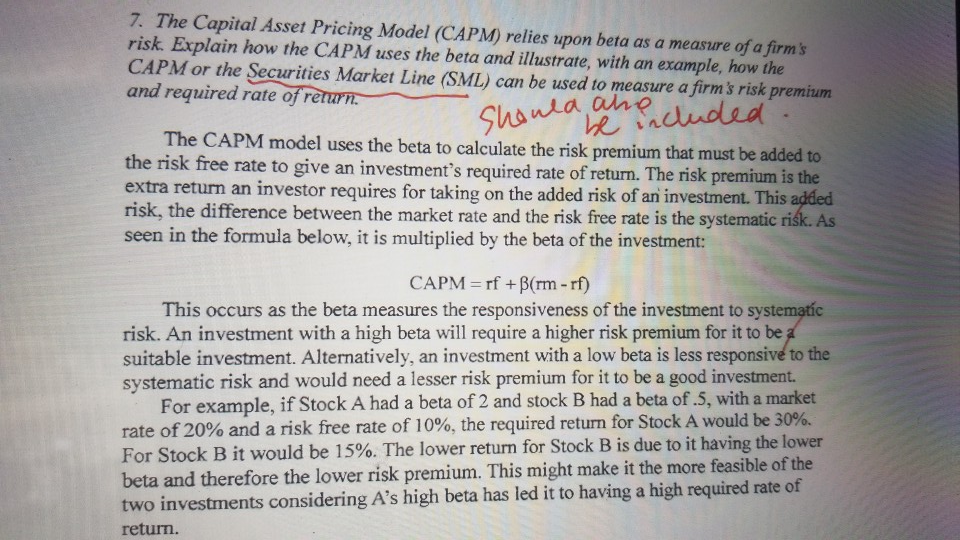

7. The Capital Asset Pricing Model (CAPM) relies upon beta as a measure of a firm's risk. Explain how the CAPM uses the beta and illustrate, with an example, how the CAPM or the Securities Market Line (SML) can be used to measure a firm's risk premium and required rate of return. should ale be included. The CAPM model uses the beta to calculate the risk premium that must be added to the risk free rate to give an investment's required rate of return. The risk premium is the extra return an investor requires for taking on the added risk of an investment. This added risk, the difference between the market rate and the risk free rate is the systematic risk. As seen in the formula below, it is multiplied by the beta of the investment: CAPM = rf +B(rm - rf) This occurs as the beta measures the responsiveness of the investment to systematic risk. An investment with a high beta will require a higher risk premium for it to be a suitable investment. Alternatively, an investment with a low beta is less responsive to the systematic risk and would need a lesser risk premium for it to be a good investment. For example, if Stock A had a beta of 2 and stock B had a beta of.5, with a market rate of 20% and a risk free rate of 10%, the required return for Stock A would be 30%. For Stock B it would be 15%. The lower return for Stock B is due to it having the lower beta and therefore the lower risk premium. This might make it the more feasible of the two investments considering A's high beta has led it to having a high required rate of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started