Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rex and Felix are the cole shareholders of Dogs and Cat Corporation (DCC). After several years of operations using the accrual method, they dedded to

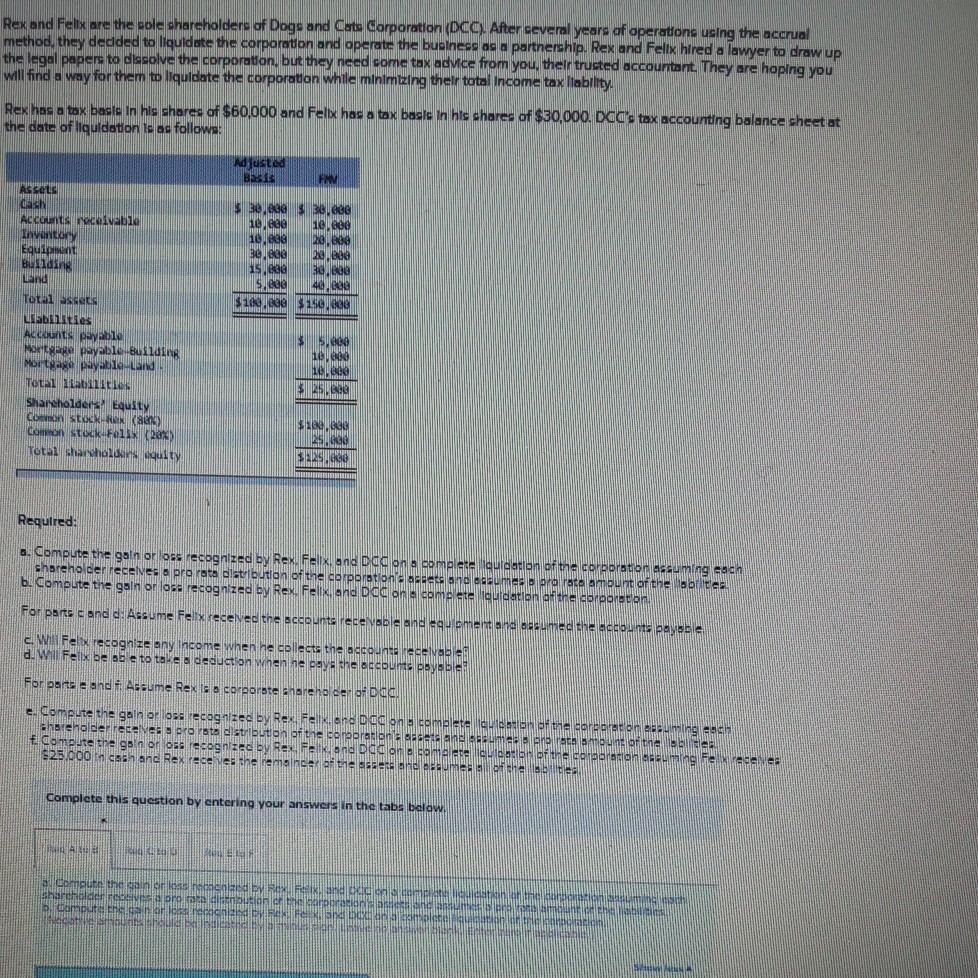

Rex and Felix are the cole shareholders of Dogs and Cat Corporation (DCC). After several years of operations using the accrual method, they dedded to liquidate the corporation and operate the buelnesc as a partnership. Rex and Felix hired a lawyer to draw up the legal papers to dissolve the corporation, but they need come tax advice from you, their trusted accountant. They are hoping you will find a way for them to liquidate the corporation while minimizing their total income tax liability Rexhas a tax basis in his shares of $60.000 and Felix has a tox basis in his chares of $30,000. Ddae tax accounting balance sheet at the date of liquidation is as follows: Adjusted Basis FM $30.60 $ 38,800 10. Bee 10.800 10.a 20.68 30. 15. 30.09 S.BG 40. $180.com 152.ee 20.800 Assets GEN Accounts receivable Inventory Equipment Bulding Land Total assets Liabilities Accounts payable Mortgage payable Build Mortgage payable and Total liabilities Shareholders Equity Con Stock RON () common stock Felix (2015 Tots Shareholders sulty 10.000 10.000 $ 25,00 31. .600 29.80 Required: a. Compute the galn or loss recognized by Rex, Felix, and Dad on a complete quidation of the corporation assuming each shareholder receives a pro rata distribution of the corporation Beet and suma pral rate amount of the abilities b. Compute the galn or lose recognized by Rex, Felix, and Ddd on a come eta outdation of the corporation For parte e and d: Assume Felix receved the accounts recevable and equipment and acumed the accounts payable c. Will Felix recognize any income when he collects the accounts receivable d. Will Felix bese to take a deduction when he pay the accounts payable For parte and Assume Rex sa corporate shareholder af Ddal e. Compute the gain or loss recognized by Rex Feland Dad one complete con of the correon coeuning och shareholder recens pra rata distribution of the corporatione case and bums enlace amount of the be compute the gonor oss recognized by Re, Fekend Dad one come ate ter of the corporation coming fe redene: $25.000 coth and Rex receive the remainder of the second baumes of the team Complete this question by entering your answers in the tabs below! ANA FR a. Compute the gain or a necalized by land oddelementer Shareholder eve a probution to carporation and communicate . Computer en ganar les recognised and been moderneneca ecated LAIN Rex and Felix are the cole shareholders of Dogs and Cat Corporation (DCC). After several years of operations using the accrual method, they dedded to liquidate the corporation and operate the buelnesc as a partnership. Rex and Felix hired a lawyer to draw up the legal papers to dissolve the corporation, but they need come tax advice from you, their trusted accountant. They are hoping you will find a way for them to liquidate the corporation while minimizing their total income tax liability Rexhas a tax basis in his shares of $60.000 and Felix has a tox basis in his chares of $30,000. Ddae tax accounting balance sheet at the date of liquidation is as follows: Adjusted Basis FM $30.60 $ 38,800 10. Bee 10.800 10.a 20.68 30. 15. 30.09 S.BG 40. $180.com 152.ee 20.800 Assets GEN Accounts receivable Inventory Equipment Bulding Land Total assets Liabilities Accounts payable Mortgage payable Build Mortgage payable and Total liabilities Shareholders Equity Con Stock RON () common stock Felix (2015 Tots Shareholders sulty 10.000 10.000 $ 25,00 31. .600 29.80 Required: a. Compute the galn or loss recognized by Rex, Felix, and Dad on a complete quidation of the corporation assuming each shareholder receives a pro rata distribution of the corporation Beet and suma pral rate amount of the abilities b. Compute the galn or lose recognized by Rex, Felix, and Ddd on a come eta outdation of the corporation For parte e and d: Assume Felix receved the accounts recevable and equipment and acumed the accounts payable c. Will Felix recognize any income when he collects the accounts receivable d. Will Felix bese to take a deduction when he pay the accounts payable For parte and Assume Rex sa corporate shareholder af Ddal e. Compute the gain or loss recognized by Rex Feland Dad one complete con of the correon coeuning och shareholder recens pra rata distribution of the corporatione case and bums enlace amount of the be compute the gonor oss recognized by Re, Fekend Dad one come ate ter of the corporation coming fe redene: $25.000 coth and Rex receive the remainder of the second baumes of the team Complete this question by entering your answers in the tabs below! ANA FR a. Compute the gain or a necalized by land oddelementer Shareholder eve a probution to carporation and communicate . Computer en ganar les recognised and been moderneneca ecated LAIN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started