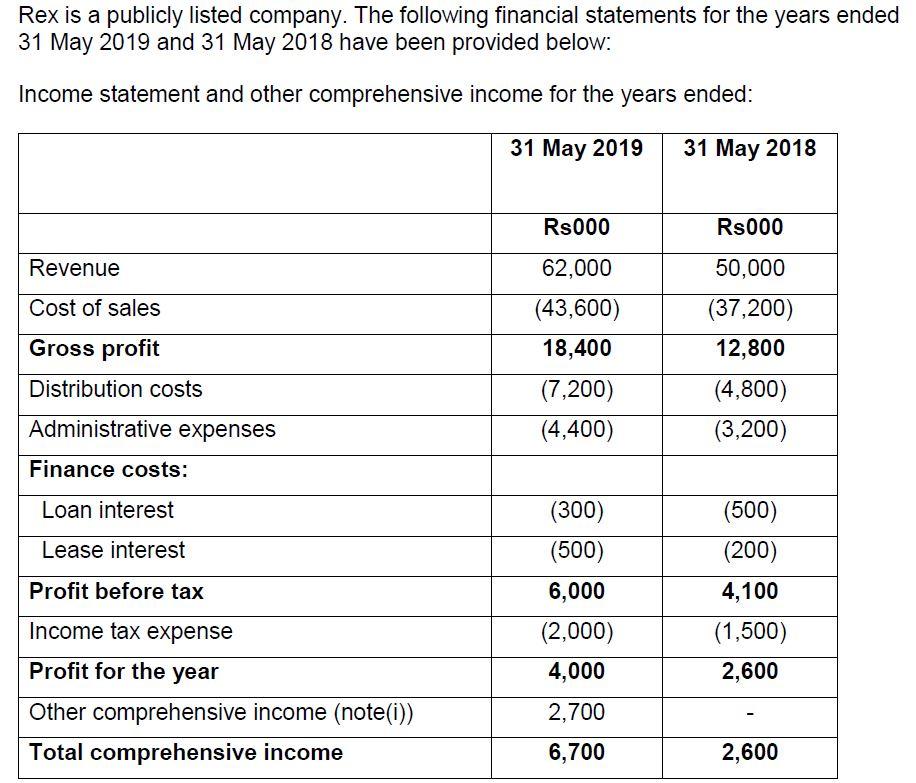

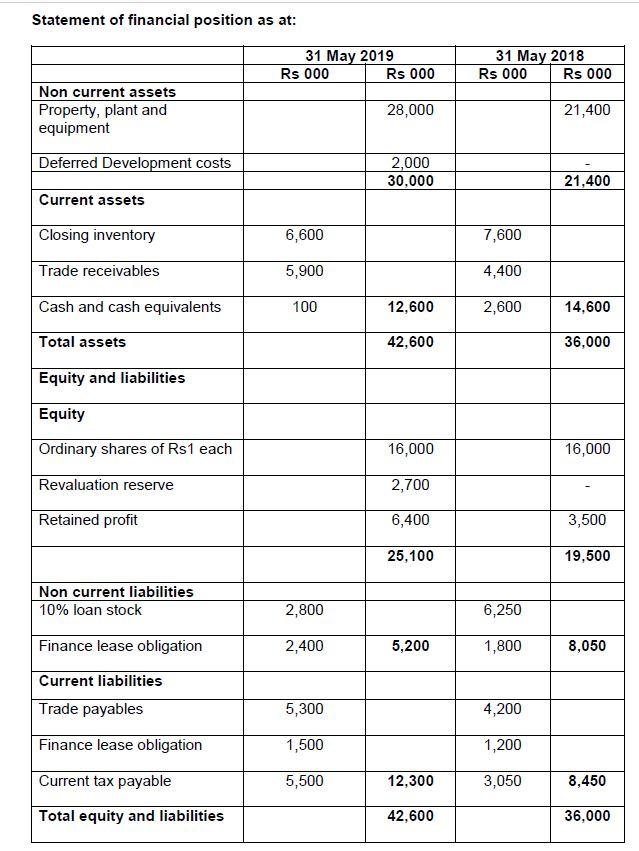

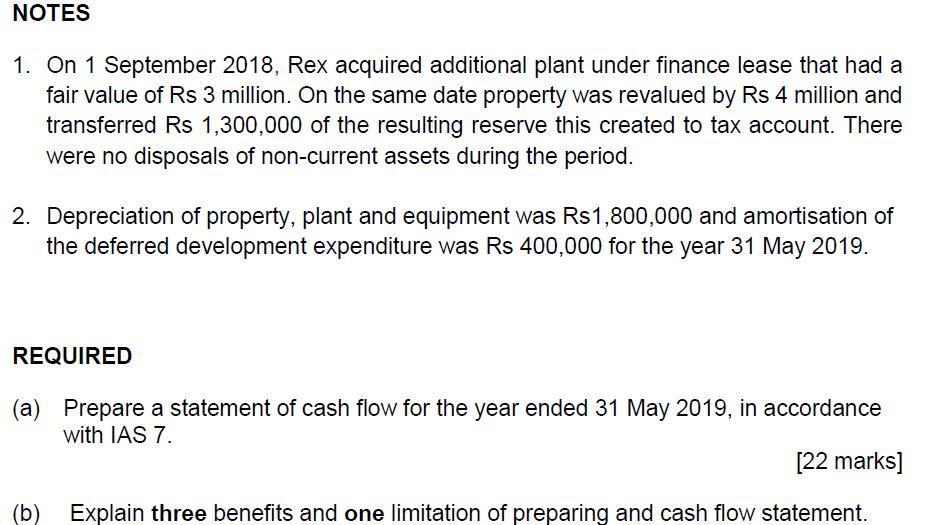

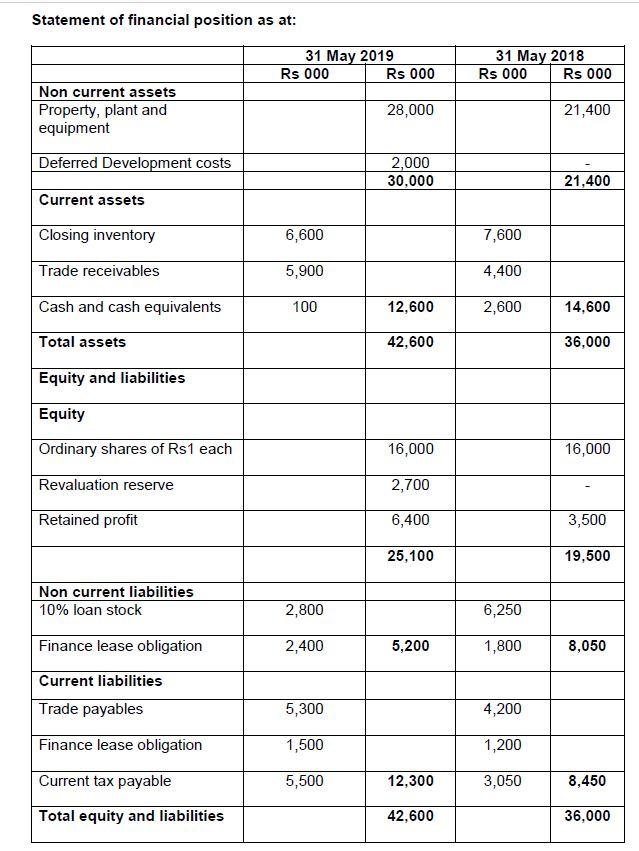

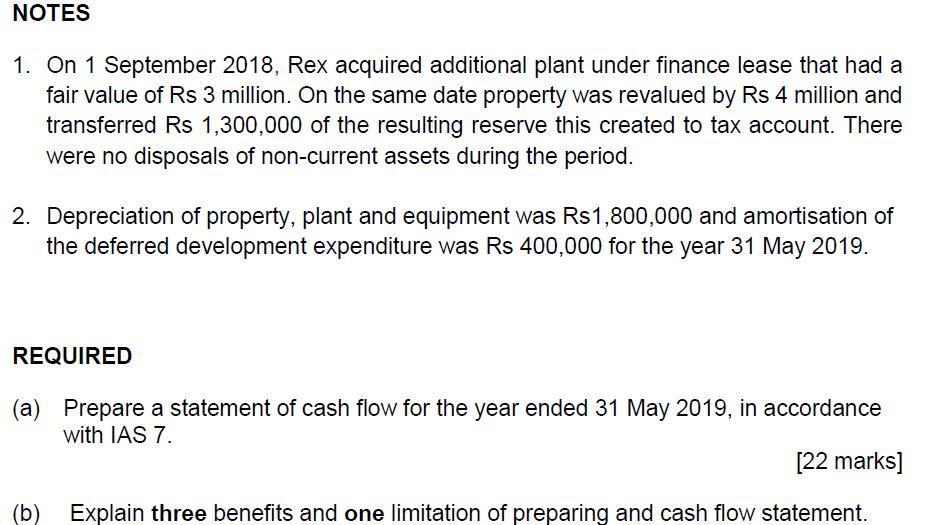

Rex is a publicly listed company. The following financial statements for the years ended 31 May 2019 and 31 May 2018 have been provided below: Income statement and other comprehensive income for the years ended: 31 May 2019 31 May 2018 Rs000 Rs000 Revenue 62,000 Cost of sales Gross profit (43,600) 18,400 (7,200) (4,400) 50,000 (37,200) 12,800 (4,800) (3,200) Distribution costs Administrative expenses Finance costs: Loan interest Lease interest Profit before tax (300) (500) 6,000 (2,000) 4,000 (500) (200) 4,100 (1,500) 2,600 Income tax expense Profit for the year Other comprehensive income (note(i)) Total comprehensive income 2,700 6,700 2,600 Statement of financial position as at: 31 May 2019 Rs 000 Rs 000 31 May 2018 Rs 000 Rs 000 Non current assets Property, plant and equipment 28,000 21,400 Deferred Development costs 2,000 30,000 21,400 Current assets Closing inventory 6,600 7,600 Trade receivables 5,900 4,400 Cash and cash equivalents 100 12,600 2,600 14,600 Total assets 42,600 36,000 Equity and liabilities Equity Ordinary shares of Rs1 each 16,000 16,000 Revaluation reserve 2,700 Retained profit 6,400 3,500 25,100 19,500 Non current liabilities 10% loan stock 2,800 6,250 Finance lease obligation 2,400 5,200 1,800 8,050 Current liabilities Trade payables 5,300 4,200 Finance lease obligation 1,500 1,200 Current tax payable 5,500 12,300 3,050 8,450 Total equity and liabilities 42,600 36,000 NOTES 1. On 1 September 2018, Rex acquired additional plant under finance lease that had a fair value of Rs 3 million. On the same date property was revalued by Rs 4 million and transferred Rs 1,300,000 of the resulting reserve this created to tax account. There were no disposals of non-current assets during the period. 2. Depreciation of property, plant and equipment was Rs1,800,000 and amortisation of the deferred development expenditure was Rs 400,000 for the year 31 May 2019. REQUIRED (a) Prepare a statement of cash flow for the year ended 31 May 2019, in accordance with IAS 7. [22 marks] (b) Explain three benefits and one limitation of preparing and cash flow statement