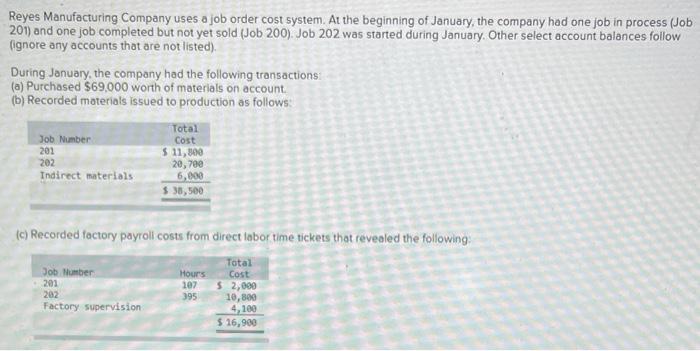

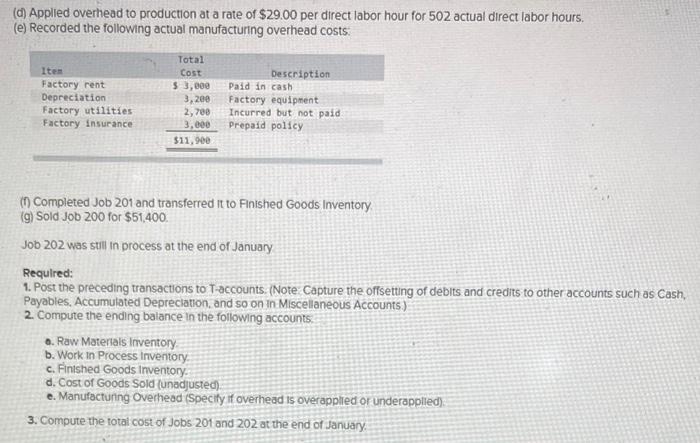

Reyes Manufacturing Company uses a job order cost system. At the beginning of January, the company had one job in process (Job 201) and one job completed but not yet sold (Job 200) Job 202 was started during January. Other select account balances follow [ignore any accounts that are not listed). During January, the company had the following transactions (a) Purchased $69,000 worth of materials on account (6) Recorded materials issued to production as follows Total Job Number Cost 201 $ 11,940 202 20,700 Indirect materials 6.200 $ 38,500 (c) Recorded factory payroll costs from direct labor time tickets that revealed the following Job Number 201 202 Factory supervision Hours 107 395 Total Cost 5 2,000 10,890 4,100 $ 16,900 (d) Applied overhead to production at a rate of $29.00 per direct labor hour for 502 actual direct labor hours. (e) Recorded the following actual manufacturing overhead costs. Item Factory rent Depreciation Factory utilities Factory insurance Total Cost $ 3,200 3,200 2,700 3,000 $11,900 Description Paid in cash Factory equipment Incurred but not paid Prepaid policy in Completed Job 201 and transferred it to Finished Goods Inventory (g) Sold Job 200 for $51.400. Job 202 was still in process at the end of January Required: 1. Post the preceding transactions to T-accounts. (Note Capture the offsetting of debits and credits to other accounts such as Cash Payables. Accumulated Depreciation, and so on in Miscellaneous Accounts) 2. Compute the ending balance in the following accounts. a. Raw Materials inventory b. Work in Process Inventory c. Finished Goods Inventory. d. Cost of Goods Sold (unadjusted). e. Manufacturing Overhead (Specify if overhead is overapplied or underapplied) 3. Compute the total cost of Jobs 201 and 202 at the end of January Reyes Manufacturing Company uses a job order cost system. At the beginning of January, the company had one job in process (Job 201) and one job completed but not yet sold (Job 200) Job 202 was started during January. Other select account balances follow [ignore any accounts that are not listed). During January, the company had the following transactions (a) Purchased $69,000 worth of materials on account (6) Recorded materials issued to production as follows Total Job Number Cost 201 $ 11,940 202 20,700 Indirect materials 6.200 $ 38,500 (c) Recorded factory payroll costs from direct labor time tickets that revealed the following Job Number 201 202 Factory supervision Hours 107 395 Total Cost 5 2,000 10,890 4,100 $ 16,900 (d) Applied overhead to production at a rate of $29.00 per direct labor hour for 502 actual direct labor hours. (e) Recorded the following actual manufacturing overhead costs. Item Factory rent Depreciation Factory utilities Factory insurance Total Cost $ 3,200 3,200 2,700 3,000 $11,900 Description Paid in cash Factory equipment Incurred but not paid Prepaid policy in Completed Job 201 and transferred it to Finished Goods Inventory (g) Sold Job 200 for $51.400. Job 202 was still in process at the end of January Required: 1. Post the preceding transactions to T-accounts. (Note Capture the offsetting of debits and credits to other accounts such as Cash Payables. Accumulated Depreciation, and so on in Miscellaneous Accounts) 2. Compute the ending balance in the following accounts. a. Raw Materials inventory b. Work in Process Inventory c. Finished Goods Inventory. d. Cost of Goods Sold (unadjusted). e. Manufacturing Overhead (Specify if overhead is overapplied or underapplied) 3. Compute the total cost of Jobs 201 and 202 at the end of January