Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reyes Manufacturing Company uses a job order cost system. At the beginning of January, the company had one job in process (Job 201) and one

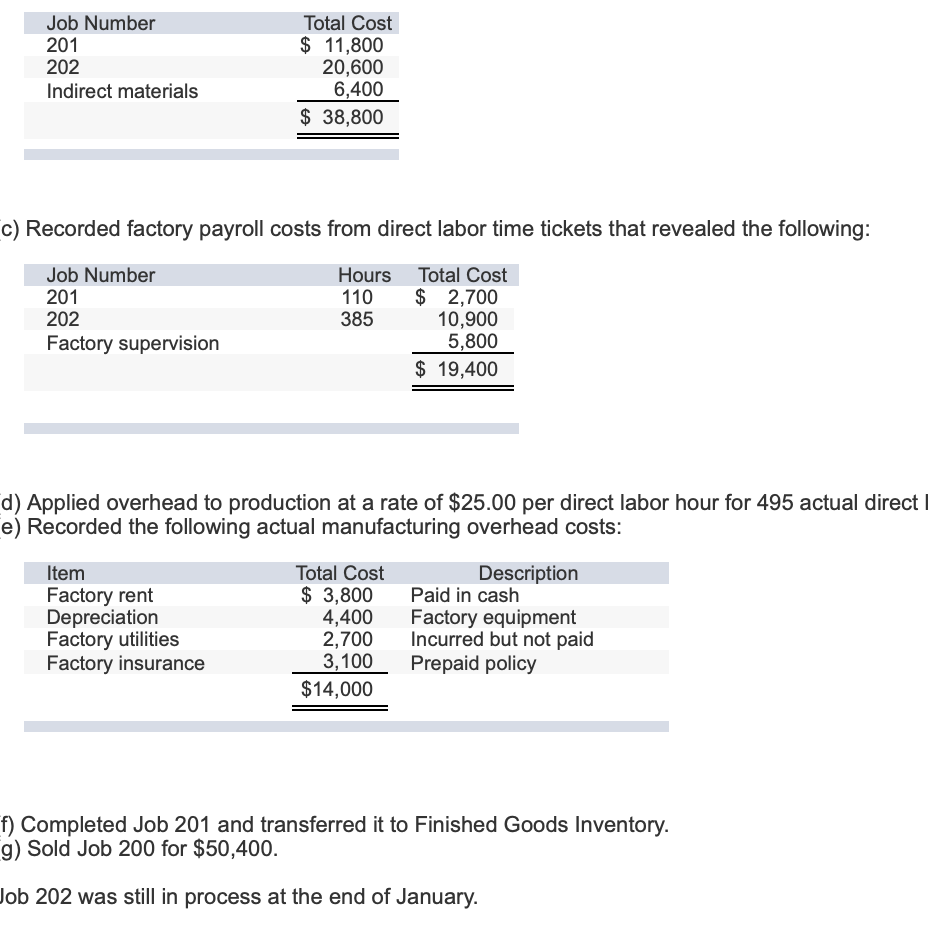

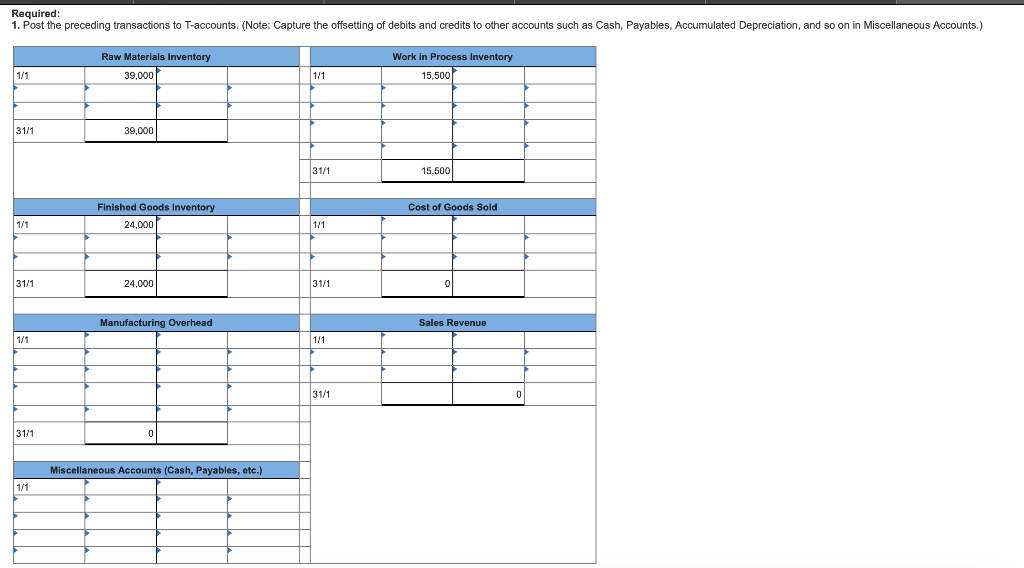

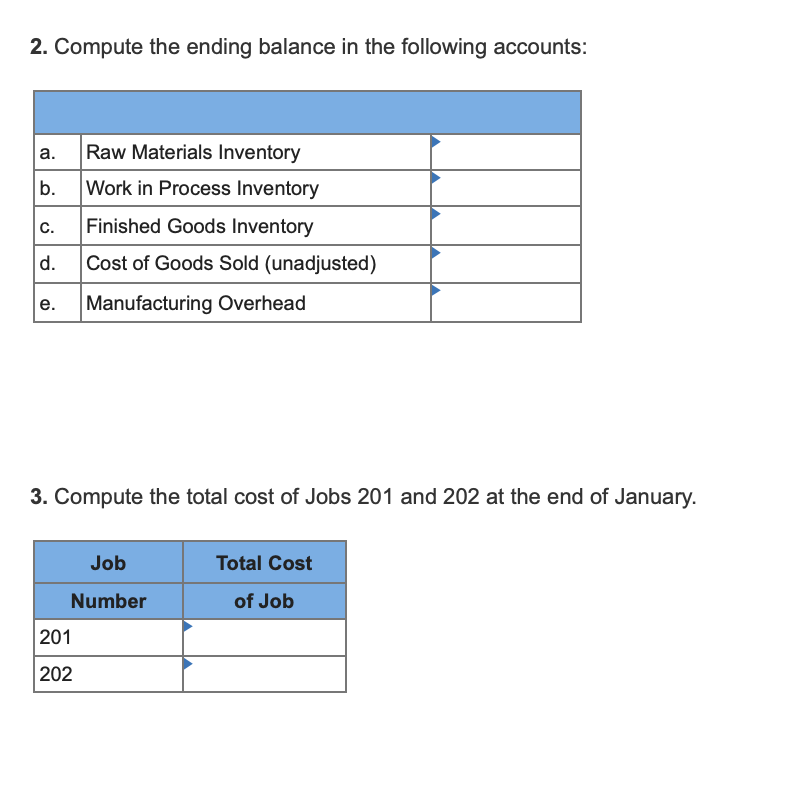

Reyes Manufacturing Company uses a job order cost system. At the beginning of January, the company had one job in process (Job 201) and one job completed but not yet sold (Job 200). Job 202 was started during January. Other select account balances follow (ignore any accounts that are not listed). During January, the company had the following transactions: (a) Purchased $65,000 worth of materials on account. (b) Recorded materials issued to production as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started