Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reynaldo and Sonya, a married couple, had flood damage in their home due to a dam break near their home in 2021, which was declared

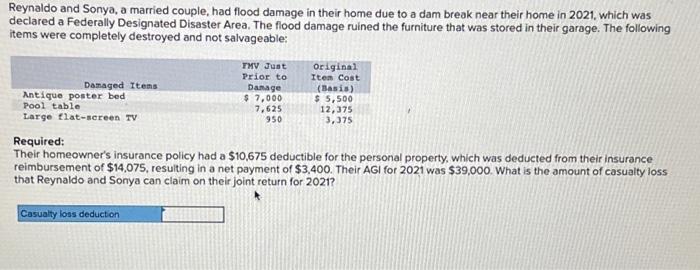

Reynaldo and Sonya, a married couple, had flood damage in their home due to a dam break near their home in 2021, which was declared a Federally Designated Disaster Area. The flood damage ruined the furniture that was stored in their garage. The following items were completely destroyed and not salvageable: Damaged Items Antique poster bed Pool table Large flat-screen TV FMV Just Prior to Damage $ 7,000 7,625 950 Casualty loss deduction Original Item Cost (Basis) $ 5,500 12,375 3,375 Required: Their homeowner's insurance policy had a $10,675 deductible for the personal property, which was deducted from their insurance reimbursement of $14,075, resulting in a net payment of $3,400. Their AGI for 2021 was $39,000. What is the amount of casualty loss that Reynaldo and Sonya can claim on their joint return for 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started