Question

RG pic has decided to undertake a rights issue to raise 150 million. The company's shares are trading at 3.00 and it is proposed

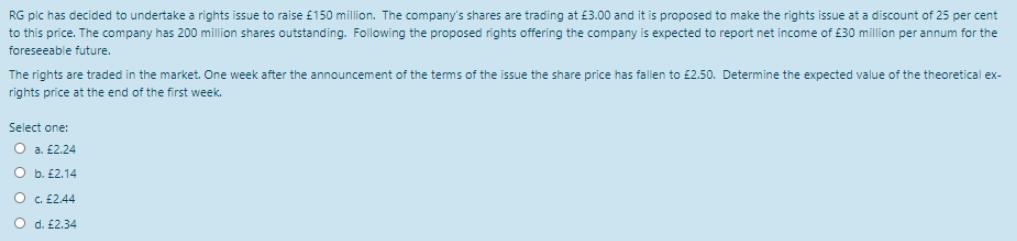

RG pic has decided to undertake a rights issue to raise 150 million. The company's shares are trading at 3.00 and it is proposed to make the rights issue at a discount of 25 per cent to this price. The company has 200 million shares outstanding. Following the proposed rights offering the company is expected to report net income of 30 million per annum for the foreseeable future. The rights are traded in the market. One week after the announcement of the terms of the issue the share price has fallen to 2.50. Determine the expected value of the theoretical ex- rights price at the end of the first week. Select one: O a. 2.24 O b. 2.14 O c 2.44 O d. 2.34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below the expected value of the theoretical ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting and Analysis

Authors: David Alexander, Anne Britton, Ann Jorissen

5th edition

978-1408032282, 1408032287, 978-1408075012

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App