Answered step by step

Verified Expert Solution

Question

1 Approved Answer

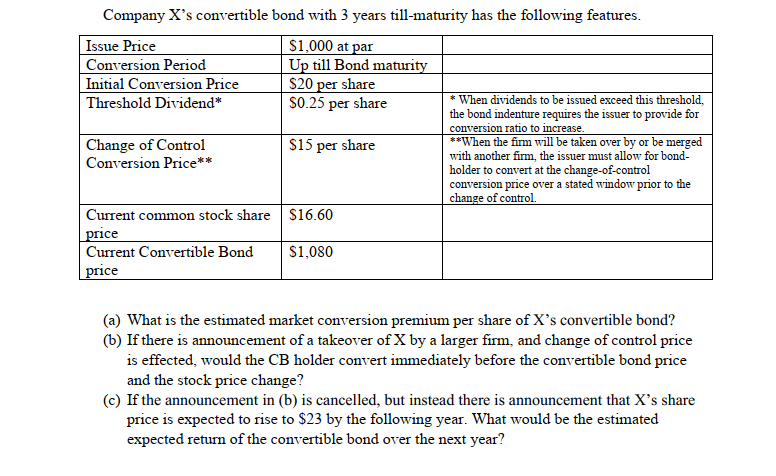

Company X's convertible bond with 3 years till-maturity has the following features. Issue Price $1,000 at par Conversion Period Initial Conversion Price Threshold Dividend*

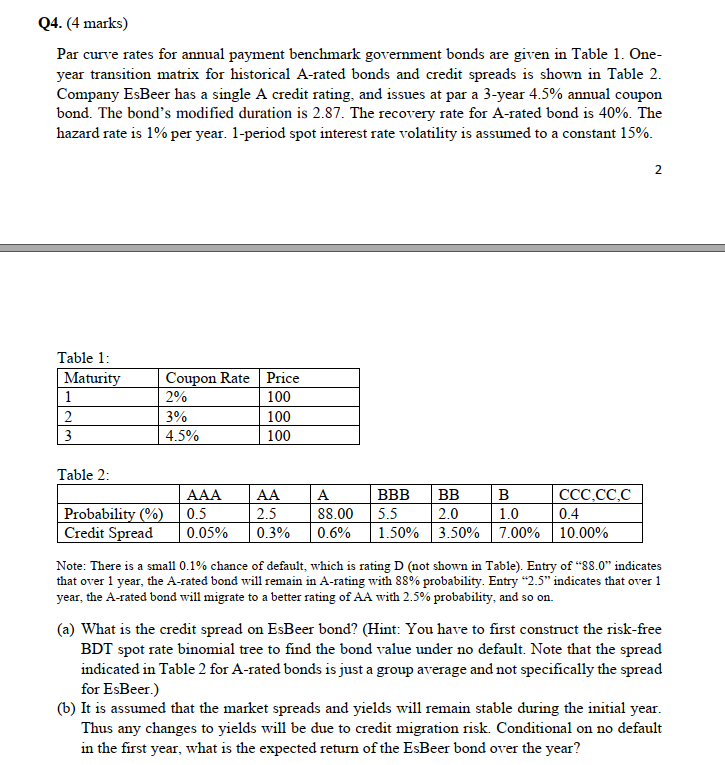

Company X's convertible bond with 3 years till-maturity has the following features. Issue Price $1,000 at par Conversion Period Initial Conversion Price Threshold Dividend* Up till Bond maturity $20 per share $0.25 per share $15 per share Change of Control Conversion Price** Current common stock share price Current Convertible Bond price $16.60 $1,080 * When dividends to be issued exceed this threshold, the bond indenture requires the issuer to provide for conversion ratio to increase. **When the firm will be taken over by or be merged with another firm, the issuer must allow for bond- holder to convert at the change-of-control conversion price over a stated window prior to the change of control. (a) What is the estimated market conversion premium per share of X's convertible bond? (b) If there is announcement of a takeover of X by a larger firm, and change of control price is effected, would the CB holder convert immediately before the convertible bond price and the stock price change? (c) If the announcement in (b) is cancelled, but instead there is announcement that X's share price is expected to rise to $23 by the following year. What would be the estimated expected return of the convertible bond over the next year? Q4. (4 marks) Par curve rates for annual payment benchmark government bonds are given in Table 1. One- year transition matrix for historical A-rated bonds and credit spreads is shown in Table 2. Company EsBeer has a single A credit rating, and issues at par a 3-year 4.5% annual coupon bond. The bond's modified duration is 2.87. The recovery rate for A-rated bond is 40%. The hazard rate is 1% per year. 1-period spot interest rate volatility is assumed to a constant 15%. Table 1: Maturity 1 2 3 Table 2: Probability (%) Credit Spread Coupon Rate Price 100 2% 3% 4.5% AAA 0.5 0.05% 100 100 AA 2.5 A 88.00 0.3% 0.6% B BBB BB 5.5 2.0 1.50% 3.50% 7.00% 1.0 CCC,CC,C 0.4 10.00% 2 Note: There is a small 0.1% chance of default, which is rating D (not shown in Table). Entry of "88.0" indicates that over 1 year, the A-rated bond will remain in A-rating with 88% probability. Entry "2.5" indicates that over 1 year, the A-rated bond will migrate to a better rating of AA with 2.5% probability, and so on. (a) What is the credit spread on EsBeer bond? (Hint: You have to first construct the risk-free BDT spot rate binomial tree to find the bond value under no default. Note that the spread indicated in Table 2 for A-rated bonds is just a group average and not specifically the spread for EsBeer.) (b) It is assumed that the market spreads and yields will remain stable during the initial year. Thus any changes to yields will be due to credit migration risk. Conditional on no default in the first year, what is the expected return of the EsBeer bond over the year?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Convertible Bond Analysis Company X a Market Conversion Premium Conversion price CP 025 assumed threshold not met Current common stock price S 1660 Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started