Answered step by step

Verified Expert Solution

Question

1 Approved Answer

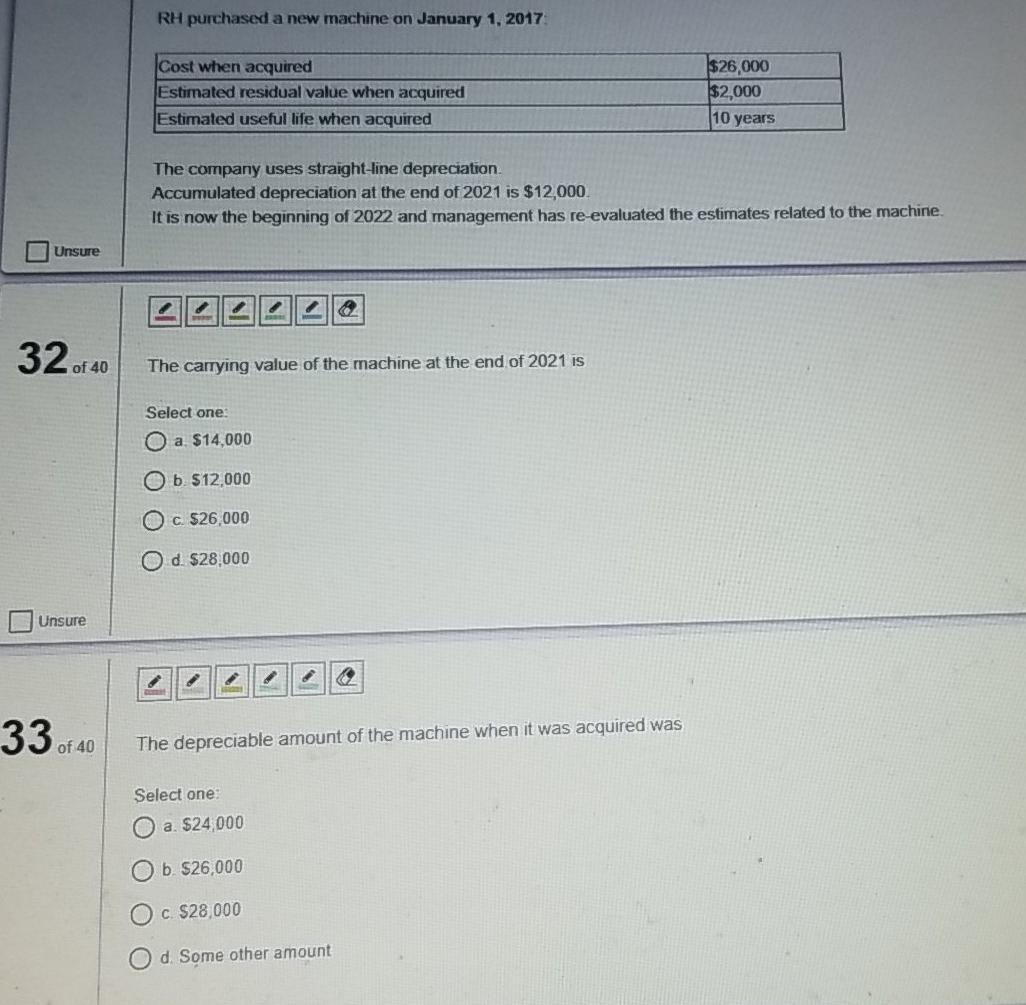

RH purchased a new machine on January 1, 2017 Cost when acquired Estimated residual value when acquired Estimated useful life when acquired $26.000 $2,000 10

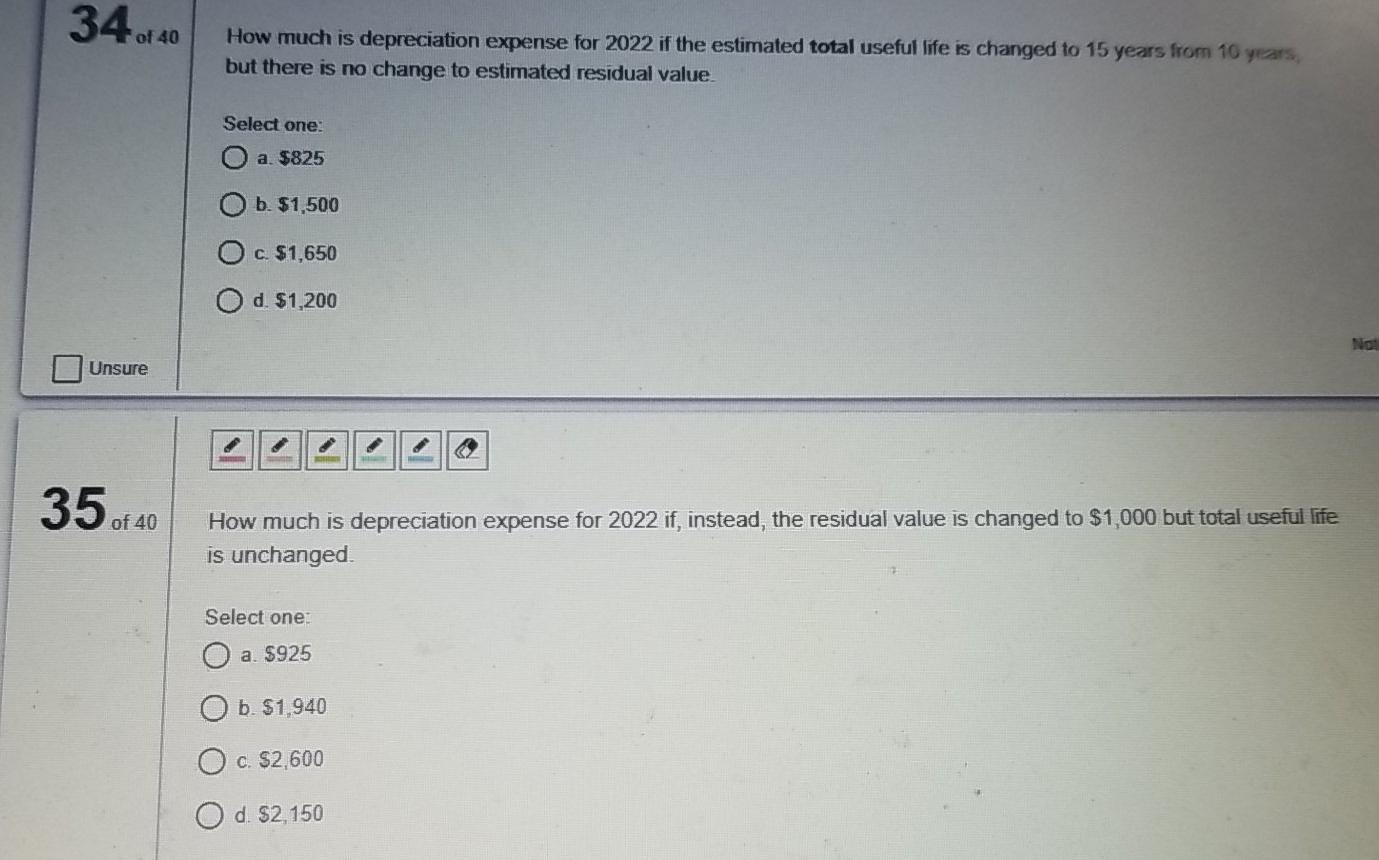

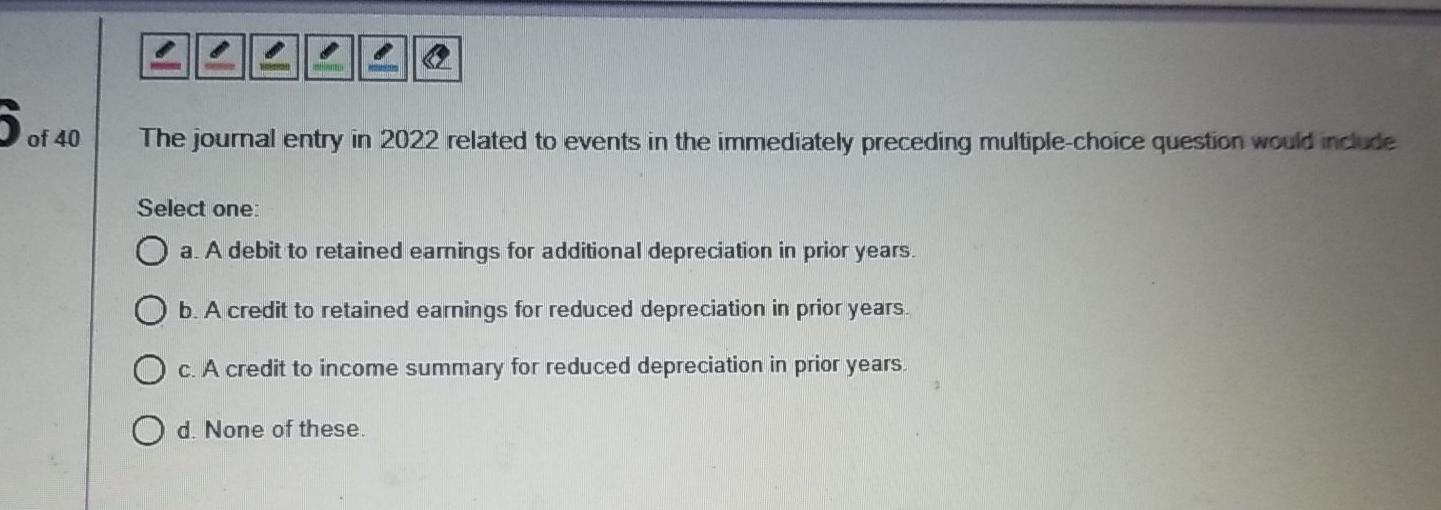

RH purchased a new machine on January 1, 2017 Cost when acquired Estimated residual value when acquired Estimated useful life when acquired $26.000 $2,000 10 years The company uses straight-line depreciation Accumulated depreciation at the end of 2021 is $12,000 It is now the beginning of 2022 and management has re-evaluated the estimates related to the machine Unsure ||| lle 32 of 4 of 40 The carrying value of the machine at the end of 2021 is Select one: a $14,000 O b. $12,000 c. $26.000 Od $28.000 Unsure 33 of 40 The depreciable amount of the machine when it was acquired was Select one a. $24,000 b. $26,000 c. $28,000 O d. Some other amount 34 of of 40 How much is depreciation expense for 2022 if the estimated total useful life is changed to 15 years from 10 years, but there is no change to estimated residual value Select one: a $825 b. $1,500 O c $1,650 Od $1,200 No Unsure 35 of 40 How much is depreciation expense for 2022 if, instead, the residual value is changed to $1,000 but total useful life is unchanged Select one: O a $925 O b. $1,940 O c. $2,600 O d. $2,150 |||| of 40 The journal entry in 2022 related to events in the immediately preceding multiple-choice question would include Select one: O a. A debit to retained eamings for additional depreciation in prior years. O b. A credit to retained earnings for reduced depreciation in prior years. O c. A credit to income summary for reduced depreciation in prior years. O d. None of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started