Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RHIM 4322 * Homework 7 * Cost of Capital Please complete and show work in an excel spreadsheet following the Demo Exercise. Do transfer the

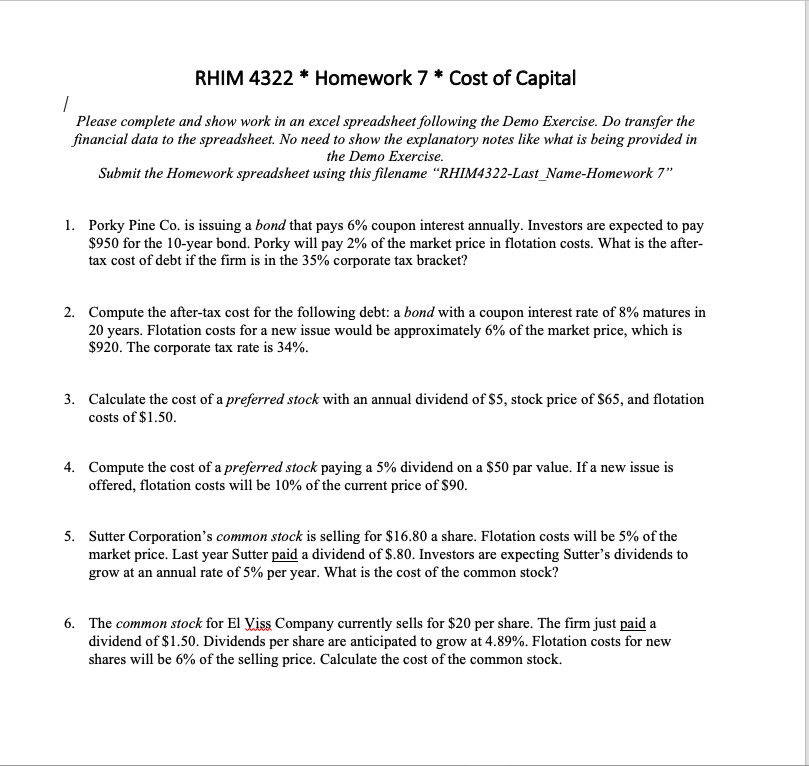

RHIM 4322 * Homework 7 * Cost of Capital

Please complete and show work in an excel spreadsheet following the Demo Exercise. Do transfer the financial data to the spreadsheet. No need to show the explanatory notes like what is being provided in the Demo Exercise.

I have posted the demo sheet answered on the excel spreadsheet! the last picture of HW 7 is what needs to be anwsered!

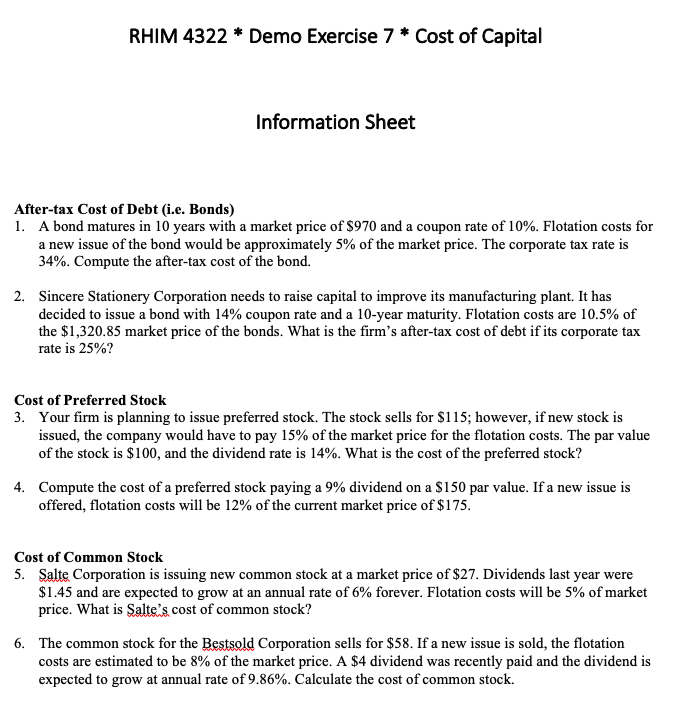

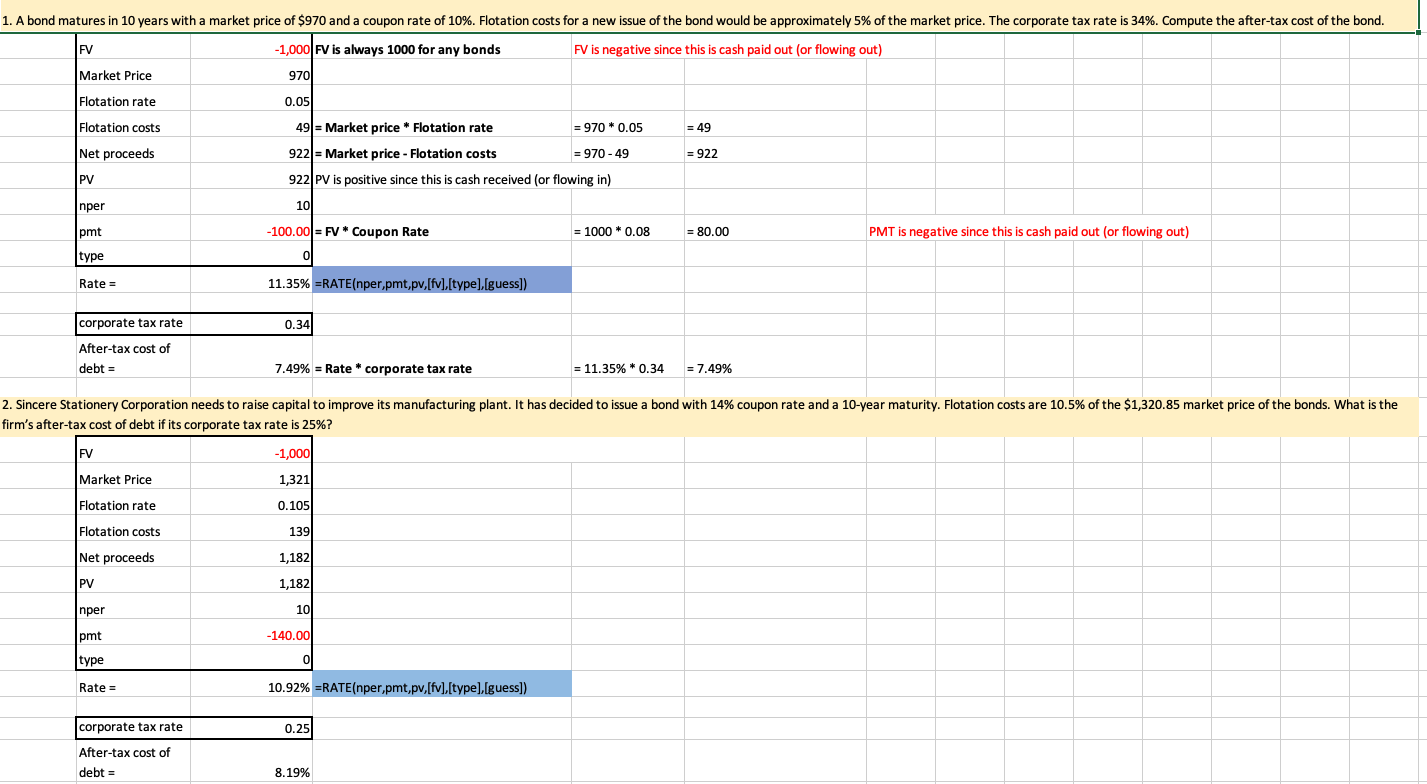

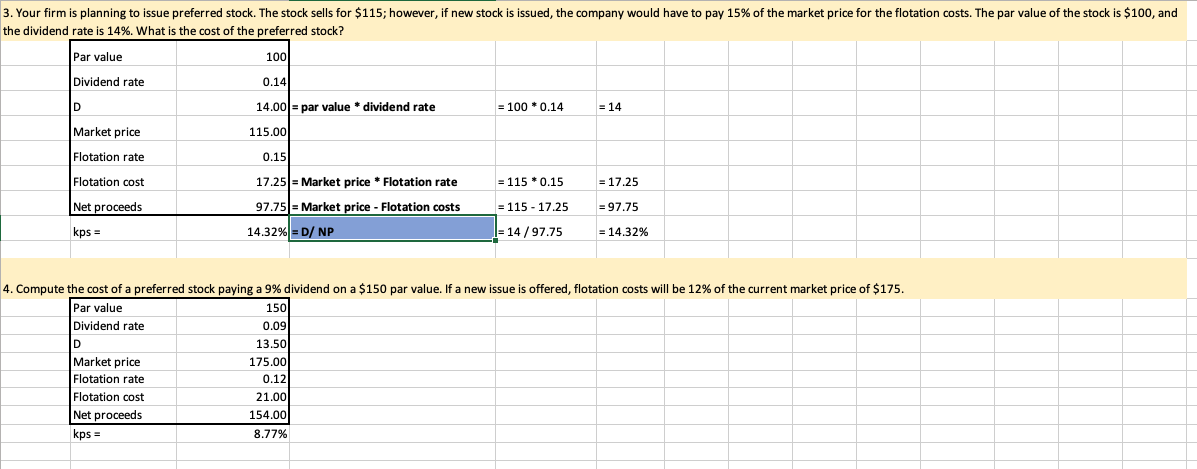

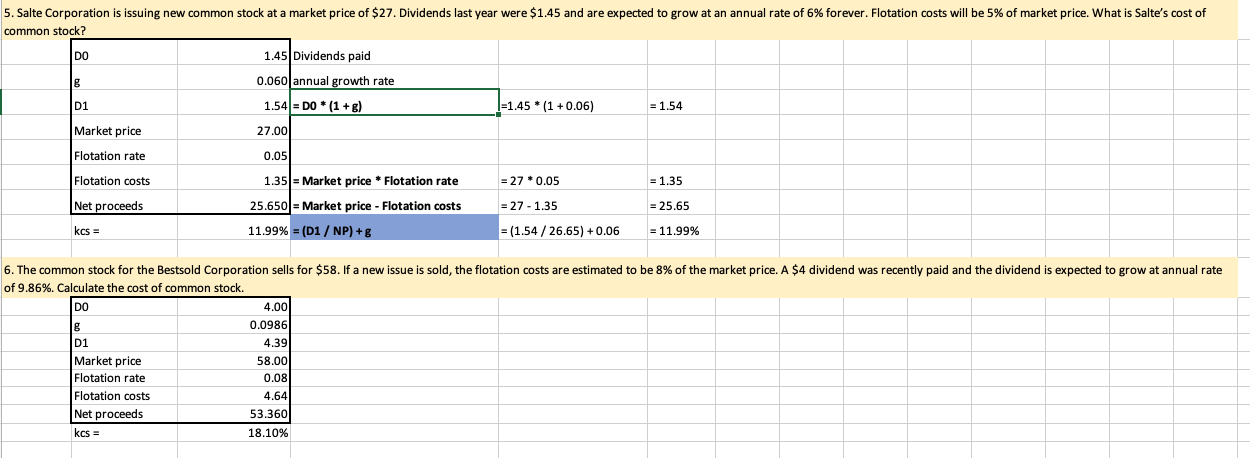

RHIM 4322 * Demo Exercise 7 * Cost of Capital Information Sheet After-tax Cost of Debt (i.e. Bonds) 1. A bond matures in 10 years with a market price of $970 and a coupon rate of 10%. Flotation costs for a new issue of the bond would be approximately 5% of the market price. The corporate tax rate is 34%. Compute the after-tax cost of the bond. 2. Sincere Stationery Corporation needs to raise capital to improve its manufacturing plant. It has decided to issue a bond with 14% coupon rate and a 10-year maturity. Flotation costs are 10.5% of the $1,320.85 market price of the bonds. What is the firm's after-tax cost of debt if its corporate tax rate is 25%? Cost of Preferred Stock 3. Your firm is planning to issue preferred stock. The stock sells for $115; however, if new stock is issued, the company would have to pay 15% of the market price for the flotation costs. The par value of the stock is $100, and the dividend rate is 14%. What is the cost of the preferred stock? 4. Compute the cost of a preferred stock paying a 9% dividend on a $150 par value. If a new issue is offered, flotation costs will be 12% of the current market price of $175. Cost of Common Stock 5. Salte Corporation is issuing new common stock at a market price of $27. Dividends last year were $1.45 and are expected to grow at an annual rate of 6% forever. Flotation costs will be 5% of market price. What is Salte's cost of common stock? 6. The common stock for the Bestsold Corporation sells for $58. If a new issue is sold, the flotation costs are estimated to be 8% of the market price. A $4 dividend was recently paid and the dividend is expected to grow at annual rate of 9.86%. Calculate the cost of common stock. 970 1. A bond matures in 10 years with a market price of $970 and a coupon rate of 10%. Flotation costs for a new issue of the bond would be approximately 5% of the market price. The corporate tax rate is 34%. Compute the after-tax cost of the bond. FV -1,000 FV is always 1000 for any bonds FV is negative since this is cash paid out (or flowing out) Market Price Flotation rate 0.05 Flotation costs 49 = Market price * Flotation rate = 970 * 0.05 = 49 Net proceeds 922 = Market price - Flotation costs = 970 - 49 = 922 PV 922 PV is positive since this is cash received (or flowing in) nper 10 pmt -100.00 = FV * Coupon Rate = 1000 * 0.08 = 80.00 PMT is negative since this is cash paid out (or flowing out) type 0 Rate = 11.35% =RATE(nper,pmt,pv, [fv],[type],[guess]) 0.34 corporate tax rate After-tax cost of debt = 7.49% = Rate * corporate tax rate = 11.35% * 0.34 = 7.49% 2. Sincere Stationery Corporation needs to raise capital to improve its manufacturing plant. It has decided to issue a bond with 14% coupon rate and a 10-year maturity. Flotation costs are 10.5% of the $1,320.85 market price of the bonds. What is the firm's after-tax cost of debt if its corporate tax rate is 25%? FV -1,000 Market Price 1,321 Flotation rate 0.105 139 Flotation costs Net proceeds 1,182 PV 1,182 nper 10 pmt -140.00 type Rate = 10.92% =RATE(nper,pmt,pv,[fv],[type],[guess]) corporate tax rate 0.25 After-tax cost of debt = 8.19% 3. Your firm is planning to issue preferred stock. The stock sells for $115; however, if new stock is issued, the company would have to pay 15% of the market price for the flotation costs. The par value of the stock is $100, and the dividend rate is 14%. What is the cost of the preferred stock? Par value 100 Dividend rate 0.14 D 14.00 = par value * dividend rate = 100 * 0.14 = 14 Market price 115.00 0.15 Flotation rate Flotation cost = 115 * 0.15 = 17.25 17.25 = Market price * Flotation rate 97.75 = Market price - Flotation costs Net proceeds = 115 - 17.25 = 97.75 Kps = 14.32% = D NP I= 14/97.75 = 14.32% 4. Compute the cost of a preferred stock paying a 9% dividend on a $150 par value. If a new issue is offered, flotation costs will be 12% of the current market price of $175. Par value 150 Dividend rate 0.09 D 13.50 Market price 175.00 Flotation rate 0.12 Flotation cost 21.00 Net proceeds 154.00 kps = 8.77% 5. Salte Corporation is issuing new common stock at a market price of $27. Dividends last year were $1.45 and are expected to grow at an annual rate of 6% forever. Flotation costs will be 5% of market price. What is Salte's cost of common stock? DO 8 1.45 Dividends paid 0.060 annual growth rate 1.54 = DO *(1 + g) D1 |=1.45 *(1 +0.06) = 1.54 Market price 27.00 Flotation rate 0.051 Flotation costs 1.35 = Market price * Flotation rate = 27 * 0.05 = 1.35 Net proceeds 25.650 = Market price - Flotation costs = 27 - 1.35 = 25.65 kcs = 11.99% = (D1/ NP) +g = (1.54 / 26.65)+0.06 = 11.99% D1 6. The common stock for the Bestsold Corporation sells for $58. If a new issue is sold, the flotation costs are estimated to be 8% of the market price. A $4 dividend was recently paid and the dividend is expected to grow at annual rate of 9.86%. Calculate the cost of common stock. DO 4.00 g 0.0986 4.391 Market price 58.00 Flotation rate 0.08 Flotation costs 4.641 Net proceeds 53.360 kcs 18.10% RHIM 4322 * Homework 7 * Cost of Capital / Please complete and show work in an excel spreadsheet following the Demo Exercise. Do transfer the financial data to the spreadsheet. No need to show the explanatory notes like what is being provided in the Demo Exercise. Submit the Homework spreadsheet using this filename "RHIM4322-Last_Name-Homework 7" 1. Porky Pine Co. is issuing a bond that pays 6% coupon interest annually. Investors are expected to pay $950 for the 10-year bond. Porky will pay 2% of the market price in flotation costs. What is the after- tax cost of debt if the firm is in the 35% corporate tax bracket? 2. Compute the after-tax cost for the following debt: a bond with a coupon interest rate of 8% matures in 20 years. Flotation costs for a new issue would be approximately 6% of the market price, which is $920. The corporate tax rate is 34%. 3. Calculate the cost of a preferred stock with an annual dividend of $5, stock price of $65, and flotation costs of $1.50. 4. Compute the cost of a preferred stock paying a 5% dividend on a $50 par value. If a new issue is offered, flotation costs will be 10% of the current price of $90. 5. Sutter Corporation's common stock is selling for $16.80 a share. Flotation costs will be 5% of the market price. Last year Sutter paid a dividend of $.80. Investors are expecting Sutter's dividends to grow at an annual rate of 5% per year. What is the cost of the common stock? 6. The common stock for El Viss Company currently sells for $20 per share. The firm just paid a dividend of $1.50. Dividends per share are anticipated to grow at 4.89%. Flotation costs for new shares will be 6% of the selling price. Calculate the cost of the common stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started