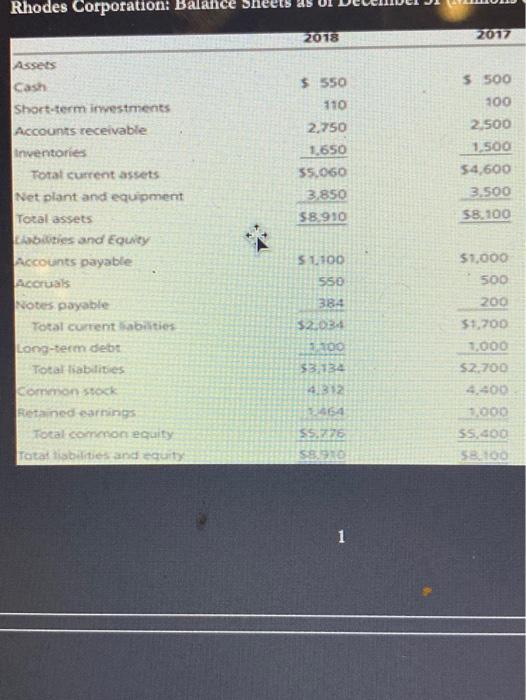

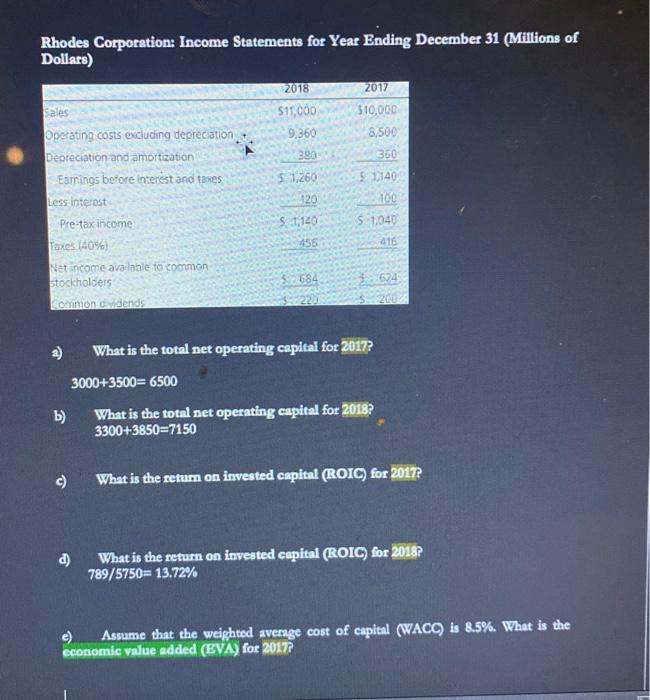

Rhodes Corporation: Balance She 2018 2017 Assets $ 550 310 2.750 1.650 55.060 3.850 58.910 $ 500 100 2.500 1,500 54.600 3.500 58.100 51100 Cash Short-term investments Accounts receivable Inventories Totat current assets Net plant and equipment Total assets Lities and Equity Accounts payable Accruals Notes payable Total current abilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Totattibilities and equity 550 $1,000 500 200 384 52.03 100 53,134 4.312 1664 55,776 59910 51.700 1.000 52.700 4.300 1,000 35.400 58.100 1 Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2018 2017 $11,000 9,360 $10,000 8,500 Sales Operating costs excluding depreciation Depreciation and amortization Earrings before interest and taxes 380 360 531,260 Less interest 120 5 1140 100 5 1.040 416 $ 1,120 455 Pre-tax income Taxes (40%) Net income available to common stockholders 684 624 Lommon vidends a) What is the total net operating capital for 2017? 3000+3500= 6500 b) What is the total net operating capital for 2018? 3300+3850=7150 What is the return on invested capital (ROIC) for 2017? d) What is the return on invested capital (ROIC) for 2018? 789/5750= 13.72% c) Assume that the weighted average cost of capital (WACC) is 8.5%. What is the economic value added (EVA) for 2017 c) Assume that the weighted average cost of capital (WACC) is 8.5%. What is the economic value added (EVA) for 2017? 2 1) Assume that the weighted average cost of capital (WACC) is 8.5%. What is the economic value added (EVA) for 2018? Assume that there are 100 million shares of common stock outstanding. The current stock price per share is $85 per share. What is the macket value added (MVA) for equity in 2018? Rhodes Corporation: Balance She 2018 2017 Assets $ 550 310 2.750 1.650 55.060 3.850 58.910 $ 500 100 2.500 1,500 54.600 3.500 58.100 51100 Cash Short-term investments Accounts receivable Inventories Totat current assets Net plant and equipment Total assets Lities and Equity Accounts payable Accruals Notes payable Total current abilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Totattibilities and equity 550 $1,000 500 200 384 52.03 100 53,134 4.312 1664 55,776 59910 51.700 1.000 52.700 4.300 1,000 35.400 58.100 1 Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2018 2017 $11,000 9,360 $10,000 8,500 Sales Operating costs excluding depreciation Depreciation and amortization Earrings before interest and taxes 380 360 531,260 Less interest 120 5 1140 100 5 1.040 416 $ 1,120 455 Pre-tax income Taxes (40%) Net income available to common stockholders 684 624 Lommon vidends a) What is the total net operating capital for 2017? 3000+3500= 6500 b) What is the total net operating capital for 2018? 3300+3850=7150 What is the return on invested capital (ROIC) for 2017? d) What is the return on invested capital (ROIC) for 2018? 789/5750= 13.72% c) Assume that the weighted average cost of capital (WACC) is 8.5%. What is the economic value added (EVA) for 2017 c) Assume that the weighted average cost of capital (WACC) is 8.5%. What is the economic value added (EVA) for 2017? 2 1) Assume that the weighted average cost of capital (WACC) is 8.5%. What is the economic value added (EVA) for 2018? Assume that there are 100 million shares of common stock outstanding. The current stock price per share is $85 per share. What is the macket value added (MVA) for equity in 2018