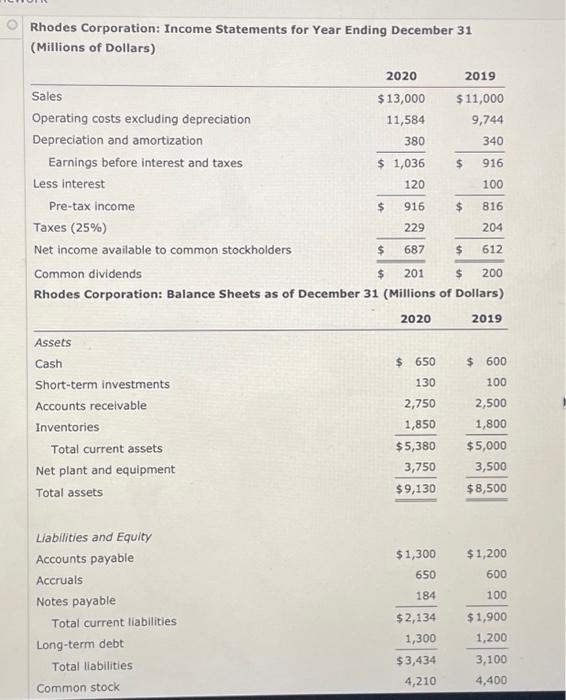

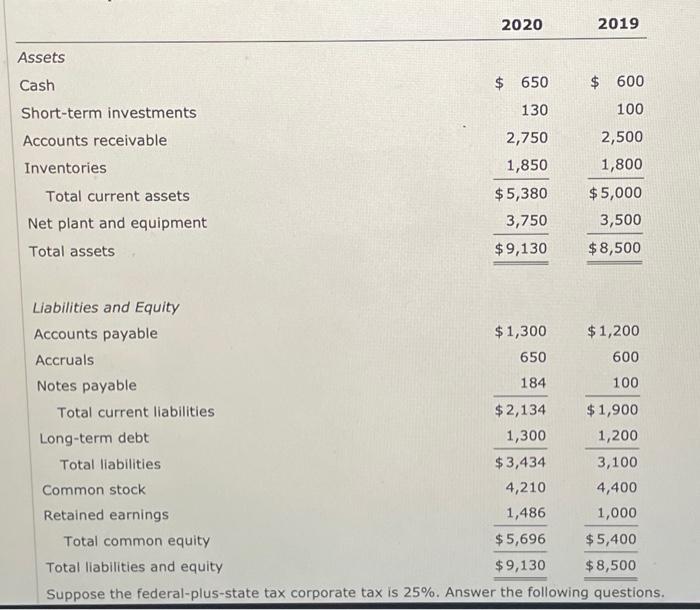

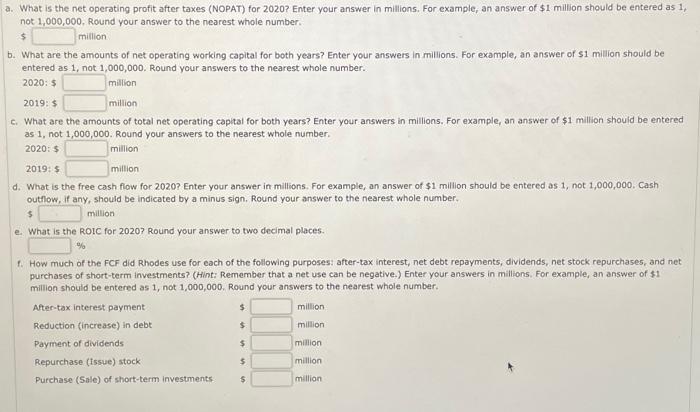

Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) \begin{tabular}{lrrr} & 2020 & 2019 \\ \hline Assets & & \\ Cash & $650 & $600 \\ Short-term investments & 130 & 100 \\ Accounts receivable & 2,750 & 2,500 \\ Inventories & 1,850 & 1,800 \\ Total current assets & $5,380 & $5,000 \\ Net plant and equipment & 3,750 & $8,5003,500 \\ Total assets & $9,130 & 10 & \end{tabular} Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity \begin{tabular}{rr} $1,300 & $1,200 \\ 650 & 600 \\ 184 & 100 \\ \hline$2,134 & $1,900 \\ 1,300 & 1,200 \\ \hline$3,434 & 3,100 \\ 4,210 & 4,400 \\ 1,486 & 1,000 \\ \hline$5,696 & $5,400 \\ \hline$9,130 & $8,500 \\ \hline \end{tabular} Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? Enter your answer in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000, Round your answer to the nearest whole number. $ million b. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. 2020:52019:5millionmillion milion million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers to the nearest whole number. 2020:52019:5millionmillion d. What is the free cash flow for 2020? Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Cash outliow. If any, should be indicated by a minus sign. Round your answer to the nearest whole number. s. million s. million e. What is the ROIC for 2020 ? Round your answer to two decimal places. % 1. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions, For example, an answer of \$1 million should be entered as 1 , not 1,000,000. Round your answers to the nearest whole number