Answered step by step

Verified Expert Solution

Question

1 Approved Answer

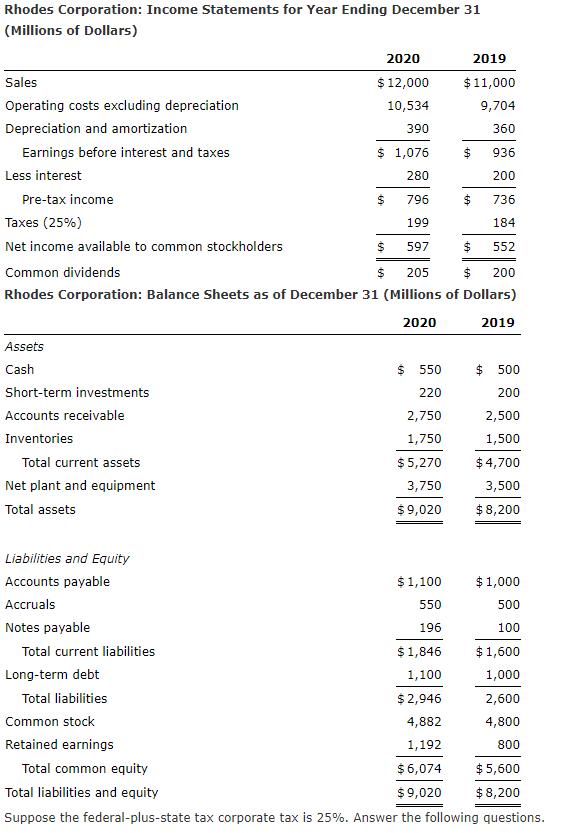

Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2020 2019 Sales $12,000 $11,000 Operating costs excluding depreciation 10,534 9,704 Depreciation

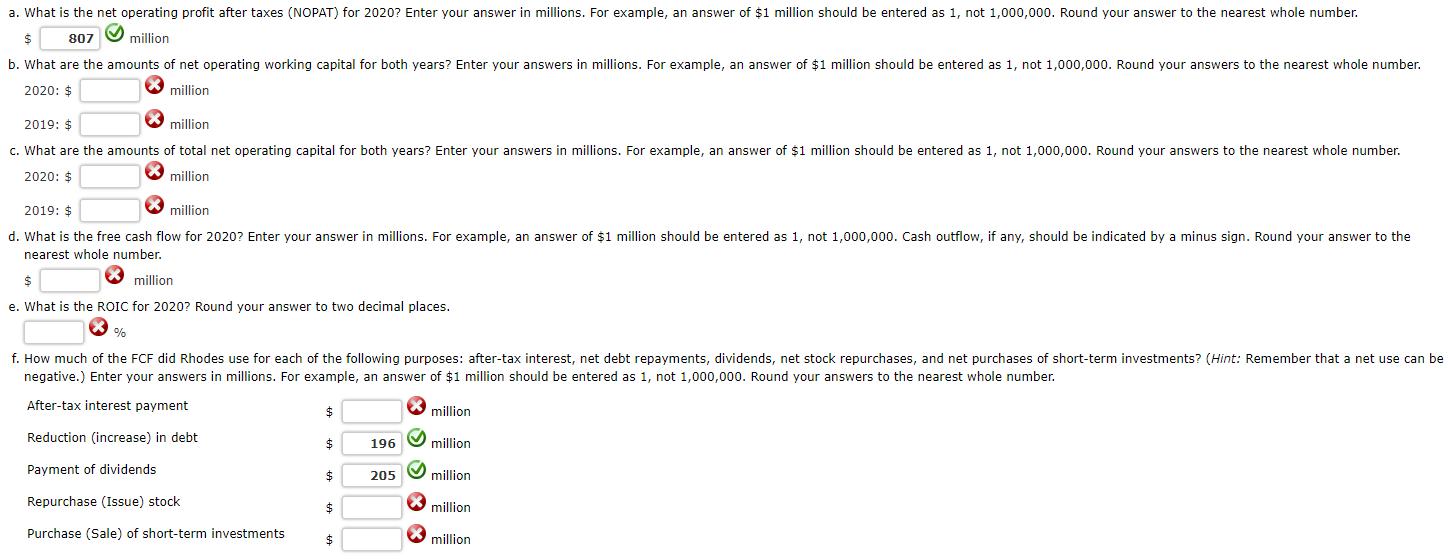

Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2020 2019 Sales $12,000 $11,000 Operating costs excluding depreciation 10,534 9,704 Depreciation and amortization 390 360 Earnings before interest and taxes $ 1,076 $ 936 Less interest 280 200 Pre-tax income $ 796 $ 736 Taxes (25%) 199 184 Net income available to common stockholders $ 597 $ 552 Common dividends 205 $ 200 Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2020 2019 Assets Cash $ 550 $ 500 Short-term investments 220 200 Accounts receivable 2,750 2,500 Inventories 1,750 1,500 Total current assets $5,270 $4,700 Net plant and equipment 3,750 3,500 Total assets $9,020 $ 8,200 Liabilities and Equity Accounts payable $1,100 $1,000 Accruals 550 500 Notes payable 196 100 Total current liabilities $1,846 $1,600 Long-term debt 1,100 1,000 Total liabilities $2,946 2,600 Common stock 4,882 4,800 Retained earnings Total common equity Total liabilities and equity 1,192 800 $6,074 $5,600 $9,020 $8,200 Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to the nearest whole number. million 807 b. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. 2020: $ 2019: $ million million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. 2020: $ 2019: $ million million d. What is the free cash flow for 2020? Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Cash outflow, if any, should be indicated by a minus sign. Round your answer to the nearest whole number. $ million e. What is the ROIC for 2020? Round your answer to two decimal places. % f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answers to the nearest whole number. After-tax interest payment Reduction (increase) in debt Payment of dividends Repurchase (Issue) stock Purchase (Sale) of short-term investments $ million $ 196 million $ 205 million million million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started