Question

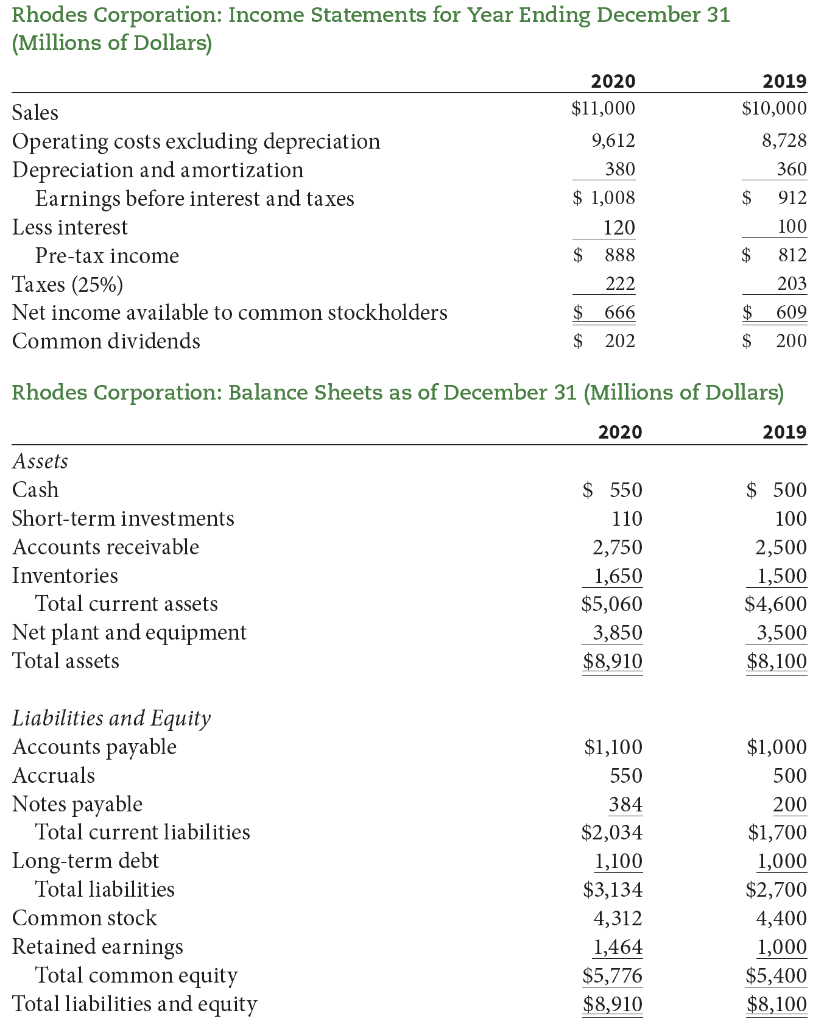

Rhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the

Rhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2020? e. What is the ROIC for 2020? f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started