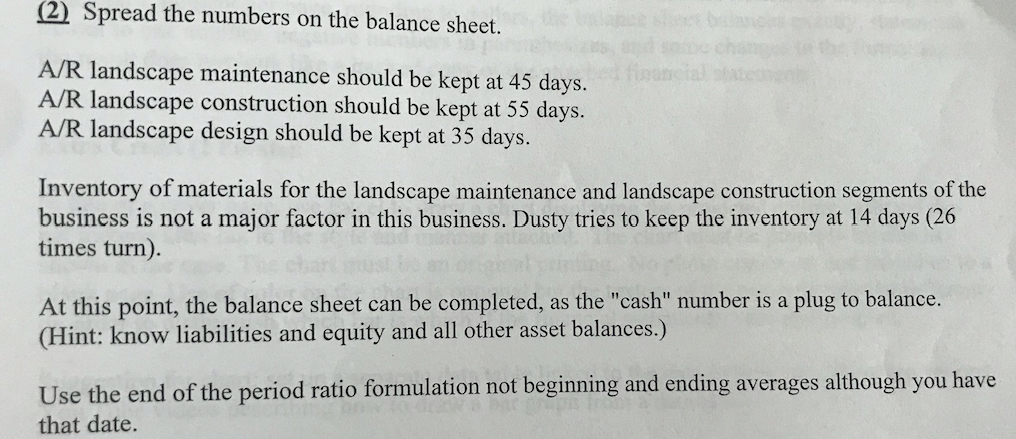

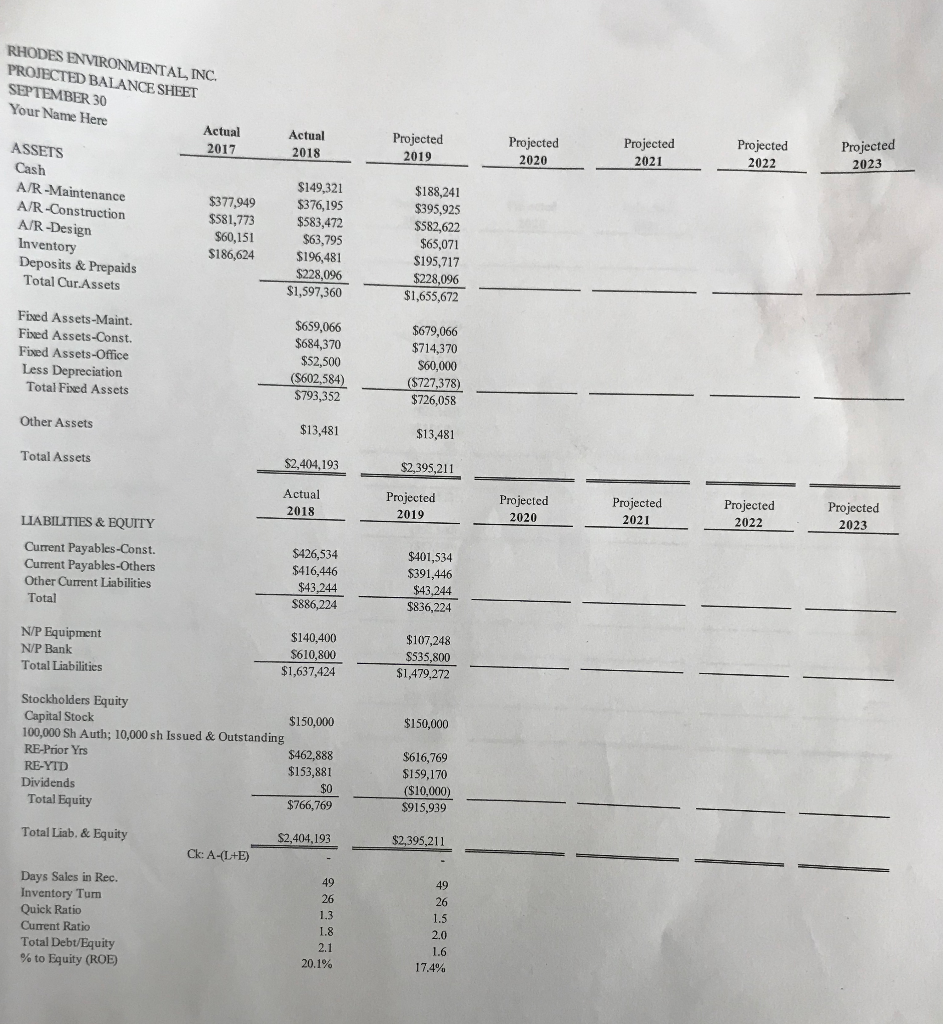

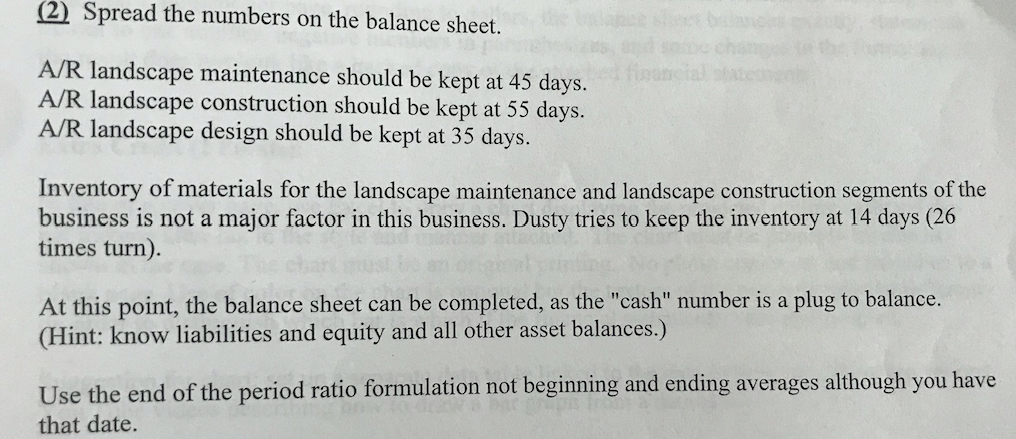

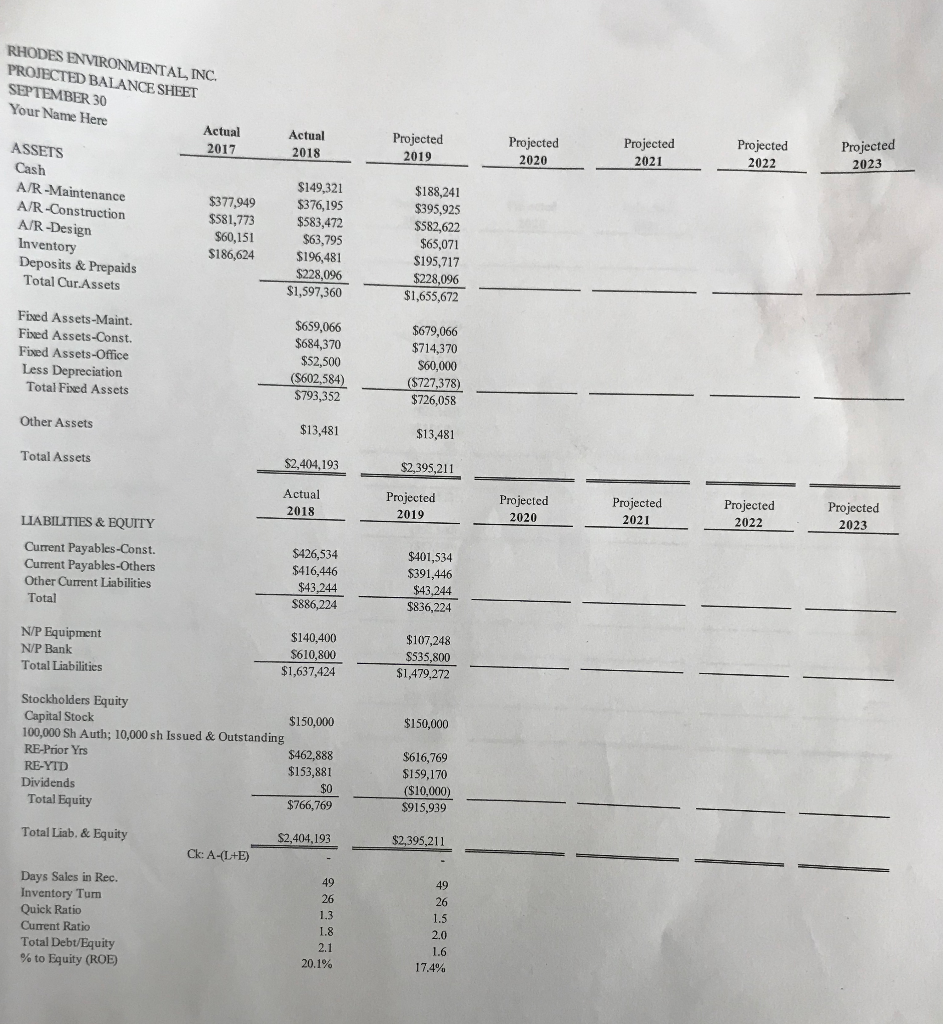

RHODES ENVIRONMENTAL, INC Revised March 2019 Teaching Objectives 1) Develop a better working knowledge of financial statements by forecasting an integrated set of income b and cash now statements over several periods using a computer software spreadsheet 2) Practice constructing and interpreting ratios. statements, balance sheets 3Improve experience working with spreadsheet software Rhodes Environmental, Inc. was started in 1978 by Darrel ("Dusty") and Sandra ("Sandy") Rhodes. They first met at a rock concert in 1967 and traveled together for many years in search of perfect peace. When their first child Michael "Muddy") was born in the late 1975, they found that changing diapers in the back of a VW van left a lot to be desired. Consequently, they settled down in a small house out in the backcountry of Orange County called Cooke's Comer Dusty needed to provide food for his growing family Richard ("Rocky") Rhodes was born in 1976 and little Steven ("Snowy") Rhodes followed a year later. As a result of Dusty's love for the outdoors, Dusty took a job with a small landscape outfit doing fieldwork. In 1978, Dusty started off on his own as a landscape designer figuring that he had been handling and inhaling plants for most of his life so why not do what he knew best (aka "core competence" in the strategy and marketing classes ) Dusty soon found that many of his clients asked him to actually build what he had designed. Still others asked him to do the maintenance on many of the designs he had built. Thus, in 2019 some 40+ years after he started out, Rhodes Environmental was now a significant player in the South Orange County landscape industry. Dusty and Sandy now live in a large house in Cote de Gaza next to General William Lyon and worry that Muddy, Rocky, and Snowy seem too fascinated by computers and video games. To make matters worse, none of the three kids can find Vietnam on a map or think a VW van is even remotely cool compared to a new Jeep Grand Cherokee. In the ultimate sign that "the times they are a changing", Cooke's Corner has been gentrified by the BMW set. The bikers now are both male and female, over 40 and ride Kawasaki and Yamaha bikes as well as the all-American Harley "Hog". Someone was seen recently wearing a "Fire Your Therapist, Ride a Motorcycle" tee shirt. Although no extra credit will be given, as part of 'your Orange County cultural experience you might want to actually visit Cooke's Corner by going east on Chapman Ave until it turns inteo Santiago Canyon Road (Hwy 18). Go through Santiago Canyon (hence the name). Cooke's Corner will be at the intersection of E Santiago Canyon Road and Live Oak Canyon Road Address for GPS is 19152 Santiago Canyon Road, Trabuco, CA, Total distance from Chapman is about 18.3 miles So Dusty and Sandy with their kids grown and gone and with a significant business at hand, realize they are having a mid life crisis and are not sure where they are going. Moreover, the Cooke's Corner National Bank is in the process of its annual review of its loan to Rhodes Environmental and would like some updated projections done to support the present bank loan. RHODES ENVIRONMENTAL, INC Revised March 2019 Dusty and Sandy got your name through a friend of a friend. Dusty has been assured that although you are studying for your business admin degree, you are not a "suit. So they are willing to talk to you. You visit Dusty and Sandy. They give you their September 30, 2018 financial statements. You ask a series of questions and learn the following Landscape maintenance revenue is projected to grow @ 5.0 per year. Landscape construction revenue is very lumpy so Dusty wants to be conservative an Landscape design work will grow at 5% per year as well. No change in margin is expected. d keep it flat. Sales and marketing expense, engineering, and general and administrative (S,G&A) expenses are all expected to grow at 3% per year. Field salespeople are paid on straight commission at 5% of job revenue Depreciation on the fixed assets on hand now runs about $115,152 per year (depreciate over the next five years). Dusty expcts to buy about $20K per year in new equipment for the maintenance business, $30K per year in new equipment for the construction business, and $7.5K per year in new office equipment per year. The new maintenance and construction equipment will be depreciated per books over 7 years. The new office equipment will be depreciated per books over 3 years. The new equipment will be funded out of current cash flow. Dusty is tired of people from the equipment leasing company constantly looking over his shoulder. The current equipment loans require fixed payments the total of which is $50K per year. implied interest rate on the equipment leases is 12%. The The current bank loan requires fixed monthly principle payments totaling $75K per year plus accrued interest @) 9.75% The state income tax rates6% and the Federal tax rate is 25% Fed tax calculations.) (State taxes are deductible for Due to the recent changes in the tax law, Dusty and Sandy (who own all the stock) will have Rhodes start paying a dividend of SI per share per year Deposits, long term assets and current liabilities are all flat. Current payables construction and other are to be paid down $25K per year each year. (2) Spread the numbers on the balance sheet. A/R landscape maintenance should be kept at 45 days. A/R landscape construction should be kept at 55 days. A/R landscape design should be kept at 35 days. Inventory of materials for the landscape maintenance and landscape construction segments of the business is not a major factor in this business. Dusty tries to keep the inventory at 14 days (26 times turn). At this point, the balance sheet can be completed, as the "cash" number is a plug to balance. (Hint: know liabilities and equity and all other asset balances.) Use the end of the period ratio formulation not beginning and ending averages although you have that date. RHODES PROJECTED BALANCE SHEET SEPTEMBER 30 Your Name Here ENVIRONMENTAL, INC Projected 2021 Projected 2022 Projected 2023 Actual Projected 2019 Projected 2020 Cash A/R-Maintenance A/R-Construction A/R-Design Inventory Deposits & Prepaids Total Cur.Assets $149,321 $377,949 $376,195 $81,773 $583,472 $188,241 $395,925 $582,622 $65,071 S195,717 $60,151 $186,624 $196,481 $228,096 $1,597,360 1,655,672 Fixed Assets-Maint. Fixed Assets-Const. Fixed Assets-Office $659,066 $714,370 $52,500 $793,352$727.378 $726,058 (S602,584)(5727,378) Total Fixed Assets Other Assets Total Assets $13,481 $2,404,193 $2,395.211 Projected 2020 Projected 2021 Projected 2022 Projected 2023 Projected 2018 2019 LIABILITIES & EQUITY Current Payables-Const Current Payables-Others Other Current Liabilities $426,534 416,446 $43,244 $886,224 $401,534 $391,446 $43,244 $836,224 N/P Equipment N/P Bank Total Liabilities $140,400 $610,800 $1,637,424 $107,248 $535,800 $1,479,272 Stockholders Equity Capital Stock 100,000 Sh Auth; 10,000 sh Issued& Outstanding $150,000 $150,000 $462,888 $153,881 $0 $766,769 $616,769 $159,170 (S10,000) $915,939 RE-YTD Dividends Total Equity Total Liab. & Equity $2,404,193 $2,395,211 Ck: A-(L+E) Days Sales in Rec. Inventory Turn Quick Ratio Current Ratio Total Debt/Equity % to Equity (ROE) 26 1.3 1.8 26 1.5 RHODES ENVIRONMENTAL, INC Revised March 2019 Teaching Objectives 1) Develop a better working knowledge of financial statements by forecasting an integrated set of income b and cash now statements over several periods using a computer software spreadsheet 2) Practice constructing and interpreting ratios. statements, balance sheets 3Improve experience working with spreadsheet software Rhodes Environmental, Inc. was started in 1978 by Darrel ("Dusty") and Sandra ("Sandy") Rhodes. They first met at a rock concert in 1967 and traveled together for many years in search of perfect peace. When their first child Michael "Muddy") was born in the late 1975, they found that changing diapers in the back of a VW van left a lot to be desired. Consequently, they settled down in a small house out in the backcountry of Orange County called Cooke's Comer Dusty needed to provide food for his growing family Richard ("Rocky") Rhodes was born in 1976 and little Steven ("Snowy") Rhodes followed a year later. As a result of Dusty's love for the outdoors, Dusty took a job with a small landscape outfit doing fieldwork. In 1978, Dusty started off on his own as a landscape designer figuring that he had been handling and inhaling plants for most of his life so why not do what he knew best (aka "core competence" in the strategy and marketing classes ) Dusty soon found that many of his clients asked him to actually build what he had designed. Still others asked him to do the maintenance on many of the designs he had built. Thus, in 2019 some 40+ years after he started out, Rhodes Environmental was now a significant player in the South Orange County landscape industry. Dusty and Sandy now live in a large house in Cote de Gaza next to General William Lyon and worry that Muddy, Rocky, and Snowy seem too fascinated by computers and video games. To make matters worse, none of the three kids can find Vietnam on a map or think a VW van is even remotely cool compared to a new Jeep Grand Cherokee. In the ultimate sign that "the times they are a changing", Cooke's Corner has been gentrified by the BMW set. The bikers now are both male and female, over 40 and ride Kawasaki and Yamaha bikes as well as the all-American Harley "Hog". Someone was seen recently wearing a "Fire Your Therapist, Ride a Motorcycle" tee shirt. Although no extra credit will be given, as part of 'your Orange County cultural experience you might want to actually visit Cooke's Corner by going east on Chapman Ave until it turns inteo Santiago Canyon Road (Hwy 18). Go through Santiago Canyon (hence the name). Cooke's Corner will be at the intersection of E Santiago Canyon Road and Live Oak Canyon Road Address for GPS is 19152 Santiago Canyon Road, Trabuco, CA, Total distance from Chapman is about 18.3 miles So Dusty and Sandy with their kids grown and gone and with a significant business at hand, realize they are having a mid life crisis and are not sure where they are going. Moreover, the Cooke's Corner National Bank is in the process of its annual review of its loan to Rhodes Environmental and would like some updated projections done to support the present bank loan. RHODES ENVIRONMENTAL, INC Revised March 2019 Dusty and Sandy got your name through a friend of a friend. Dusty has been assured that although you are studying for your business admin degree, you are not a "suit. So they are willing to talk to you. You visit Dusty and Sandy. They give you their September 30, 2018 financial statements. You ask a series of questions and learn the following Landscape maintenance revenue is projected to grow @ 5.0 per year. Landscape construction revenue is very lumpy so Dusty wants to be conservative an Landscape design work will grow at 5% per year as well. No change in margin is expected. d keep it flat. Sales and marketing expense, engineering, and general and administrative (S,G&A) expenses are all expected to grow at 3% per year. Field salespeople are paid on straight commission at 5% of job revenue Depreciation on the fixed assets on hand now runs about $115,152 per year (depreciate over the next five years). Dusty expcts to buy about $20K per year in new equipment for the maintenance business, $30K per year in new equipment for the construction business, and $7.5K per year in new office equipment per year. The new maintenance and construction equipment will be depreciated per books over 7 years. The new office equipment will be depreciated per books over 3 years. The new equipment will be funded out of current cash flow. Dusty is tired of people from the equipment leasing company constantly looking over his shoulder. The current equipment loans require fixed payments the total of which is $50K per year. implied interest rate on the equipment leases is 12%. The The current bank loan requires fixed monthly principle payments totaling $75K per year plus accrued interest @) 9.75% The state income tax rates6% and the Federal tax rate is 25% Fed tax calculations.) (State taxes are deductible for Due to the recent changes in the tax law, Dusty and Sandy (who own all the stock) will have Rhodes start paying a dividend of SI per share per year Deposits, long term assets and current liabilities are all flat. Current payables construction and other are to be paid down $25K per year each year. (2) Spread the numbers on the balance sheet. A/R landscape maintenance should be kept at 45 days. A/R landscape construction should be kept at 55 days. A/R landscape design should be kept at 35 days. Inventory of materials for the landscape maintenance and landscape construction segments of the business is not a major factor in this business. Dusty tries to keep the inventory at 14 days (26 times turn). At this point, the balance sheet can be completed, as the "cash" number is a plug to balance. (Hint: know liabilities and equity and all other asset balances.) Use the end of the period ratio formulation not beginning and ending averages although you have that date. RHODES PROJECTED BALANCE SHEET SEPTEMBER 30 Your Name Here ENVIRONMENTAL, INC Projected 2021 Projected 2022 Projected 2023 Actual Projected 2019 Projected 2020 Cash A/R-Maintenance A/R-Construction A/R-Design Inventory Deposits & Prepaids Total Cur.Assets $149,321 $377,949 $376,195 $81,773 $583,472 $188,241 $395,925 $582,622 $65,071 S195,717 $60,151 $186,624 $196,481 $228,096 $1,597,360 1,655,672 Fixed Assets-Maint. Fixed Assets-Const. Fixed Assets-Office $659,066 $714,370 $52,500 $793,352$727.378 $726,058 (S602,584)(5727,378) Total Fixed Assets Other Assets Total Assets $13,481 $2,404,193 $2,395.211 Projected 2020 Projected 2021 Projected 2022 Projected 2023 Projected 2018 2019 LIABILITIES & EQUITY Current Payables-Const Current Payables-Others Other Current Liabilities $426,534 416,446 $43,244 $886,224 $401,534 $391,446 $43,244 $836,224 N/P Equipment N/P Bank Total Liabilities $140,400 $610,800 $1,637,424 $107,248 $535,800 $1,479,272 Stockholders Equity Capital Stock 100,000 Sh Auth; 10,000 sh Issued& Outstanding $150,000 $150,000 $462,888 $153,881 $0 $766,769 $616,769 $159,170 (S10,000) $915,939 RE-YTD Dividends Total Equity Total Liab. & Equity $2,404,193 $2,395,211 Ck: A-(L+E) Days Sales in Rec. Inventory Turn Quick Ratio Current Ratio Total Debt/Equity % to Equity (ROE) 26 1.3 1.8 26 1.5