Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rhonda, who is married filing a joint return, is employed as a full-time high school teacher. The school district where she works recently instituted

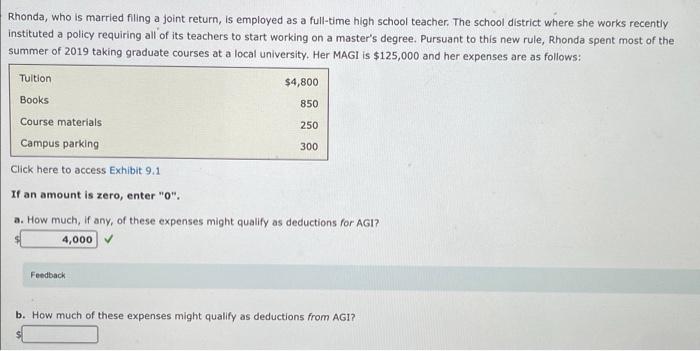

Rhonda, who is married filing a joint return, is employed as a full-time high school teacher. The school district where she works recently instituted a policy requiring all of its teachers to start working on a master's degree. Pursuant to this new rule, Rhonda spent most of the summer of 2019 taking graduate courses at a local university. Her MAGI is $125,000 and her expenses are as follows: Tultion $4,800 Books 850 Course materials 250 Campus parking 300 Click here to access Exhibit 9.1 If an amount is zero, enter "0". a. How much, if any, of these expenses might qualify as deductions for AGI? 4,000 Feedback b. How much of these expenses might qualify as deductions from AGI?

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a At most 4000 of the tuition could be a deduction for AGI This assumes that the AGI limit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started